- Home

- »

- Clothing, Footwear & Accessories

- »

-

Apparel Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Apparel Market Size, Share & Trends Report]()

Apparel Market Size, Share & Trends Analysis Report By Category (Mass, Premium, Luxury), By End-user (Men, Women, Children), By Distribution Channel (Online, Offline) By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-264-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Consumer Goods

Apparel Market Size & Trends

The global apparel market size was estimated at USD 1,709.76 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. The high spending on apparel by consumers is a key factor driving the market growth. For instance, according to the data published by Bureau of Labor Statistics, in 2022, the average monthly expenditure on apparel and related services among Americans was $162 or $1,945 over the year, an increase of 11% since 2021.

In addition, the increasing disposable income among consumers in emerging economies is significantly driving the global market. Emerging economies like China, India, Brazil, and others are experiencing rapid urbanization, industrialization, and economic growth, leading to a burgeoning middle class with higher purchasing power. This demographic shift is fueling a surge in demand for clothing and accessories as consumers seek to upgrade their wardrobes, follow fashion trends, and improve their lifestyles.

There is a growing consumer demand for sustainable and environmentally friendly products, including apparel. Consumers are becoming increasingly conscious of the environmental and social ramifications of the apparel industry. As a result, they are actively seeking out clothing that is sustainably and ethically produced, utilizing eco-friendly materials such as organic cotton, recycled fabrics, and other innovative alternatives. Consumers are urging brands to adopt transparent supply chains, minimize waste, and enforce fair labor practices to meet this demand. Embracing sustainability in processes is essential for both individuals and businesses to lessen their environmental footprint and contribute to a more sustainable future. Sustainable practices aim to mitigate negative environmental, social, and economic impacts while promoting long-term well-being and resilience.

The apparel industry has witnessed a significant trend in the emergence of Direct-to-Consumer (D2C) brands over the past decade. These brands operate by selling their products directly to consumers, bypassing traditional intermediaries such as wholesalers, retailers, or distributors. With the increasing digitalization and prevalence of e-commerce, D2C brands have found favorable conditions to thrive and reshape the apparel industry. Offering competitive pricing, enhanced customer experiences, and customized products and services tailored to individual preferences, D2C brands have garnered significant attention and consumer loyalty.

Social media has greatly influenced fashion preferences, shaping the clothing choices of both women and men. Through platforms like Instagram and Facebook, consumers across the globe have easy access to a wide range of fashion content posted by influencers, bloggers, and celebrities. This accessibility has sparked a growing interest in exploring various styles and experimenting with new looks among consumers. Influencers use social media to showcase a wide range of fashion trends, offering inspiration and guidance on incorporating these styles into everyday or special occasion attire. In addition, through endorsements, numerous celebrities are popularizing the trend of wearing traditional ethnic attire for weddings and other events.

Market Concentration & Characteristics

The market demonstrates a high degree of innovation. Emerging technologies like 3D printing and artificial intelligence are anticipated to transform the apparel industry significantly. These advancements hold the potential to revolutionize various aspects of apparel creation, including design, manufacturing, and distribution processes.

The market navigates a complex regulatory landscape, including safety standards, environmental regulations, and labor laws. For instance, clothing items imported, produced, and marketed in the United States must adhere to a range of labeling, flammability, substance, testing, and certification regulations.

The threat of substitutes in the apparel industry is relatively low due to the essential nature of clothing in everyday life. This factor holds minimal significance within the apparel and fashion industry, as there is no alternative to replace clothing.

Category Insights

Based on category, the mass segment led the market with the largest revenue share of 68.2% in 2023. Mass apparels are constantly produced in new designs and patterns that encourage customers to visit stores more frequently, leading to increased purchases. Rather than restocking inventory, retailers swap sold-out items with new arrivals.Fast fashion ensures that shoppers can access desired clothing items promptly and conveniently. Moreover, it has made fashionable clothing more accessible, offering innovative, imaginative, and stylish options. Mass apparel is affordable and provides easy access to trendy clothing, making trendy garments accessible to a broader range of consumers.

The luxury segment is expected to grow at the fastest CAGR of 5.5% from 2024 to 2030. The luxury apparel industry is growing, owing to the growing population of high-net-worth individuals. Increased sales of fashionable luxury apparel and rising interaction between consumers and industry players through social media platforms and online retail channels are pivotal factors driving market expansion. The increasing popularity of luxury apparel among millennials presents a lucrative factor for industry growth, given their heightened susceptibility to the latest fashion trends. In addition, advancements in digital marketing strategies, coupled with the rising prevalence of social media as a marketing platform in emerging markets, have opened up numerous new business prospects for industry participants.

End-user Insights

Based on end-user, the women segment led the market with the largest revenue share of 52.2% in 2023. The female fashion industry is experiencing a surge in demand for new trends and a diverse range of options. Women's fashion represents higher demand compared to men's due to the extensive variety available, including dresses, skirts, blouses, and accessories. This increased demand prompts designers and retailers to prioritize female fashion, catering to the evolving preferences of consumers. As a significant segment of the consumer market, women contribute substantially to global fashion industry trends through their spending habits. Their tendency to invest more in clothing and accessories makes women's fashion a lucrative sector for businesses. Moreover, the vast diversity within women's fashion, spanning from casual wear to haute couture, fosters continuous innovation and adaptation to evolving tastes and preferences.

The children segment is expected to grow at the fastest CAGR of 5.9% from 2024 to 2030. In the children's apparel industry, emphasis is given to fashion-ability as the primary consideration. In addition, multi-pack options are csommon offering by many industry players, providing added convenience for shoppers. Larger retailers are also increasingly incorporating sustainable options, such as organic cotton, into their children's clothing collections at prices comparable to their core offerings, thereby stimulating market growth. Moreover, the premium kids wear segment is capitalizing on several long-term trends, including a shift towards more thoughtful purchasing decisions and the increasing age of new parents. With greater disposable income, today's consumers are gravitating towards higher-end brands that prioritize quality and durability.

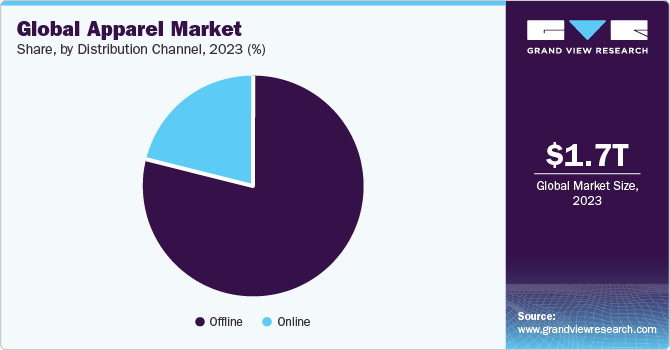

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 79.3% in 2023. Face-to-face interactions in offline stores allow for personalized customer. Sales associates can provide tailored assistance, offering styling advice, suggesting complementary items, and addressing any concerns or questions customers may have. This personalized attention enhances the overall shopping experience and fosters a sense of loyalty and trust between the customer and the brand. In addition, the ability to physically see, touch, and try on products in offline stores instills confidence in their quality and fit. Customers can inspect the fabric, examine the craftsmanship, and assess how the garment looks and feels on their body. This hands-on experience helps to ease concerns about purchasing clothing and reduces the likelihood of returns or exchanges due to incorrect sizing or dissatisfaction with the product.

The online segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. Online shopping provides customers with convenience, enabling them to effortlessly browse, compare, and purchase products or services from the comfort of their homes at any time of the day. Moreover, online channels provide with competitive price, coupons, and discounts owing to which their adoption is increasing among consumers thus driving the segment’s growth. Online sales channels grant easy access to global brands, eliminating geographical constraints and expanding consumer choices.

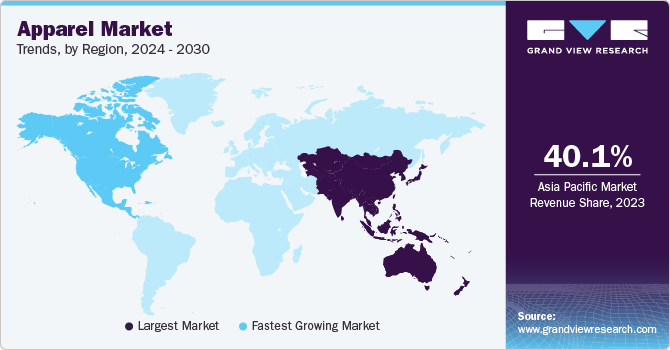

Regional Insights

The apparel market in North America is expected to grow at the fastest CAGR of 3.2% from 2024 to 2030. The emergence of the 'athleisure' trend has significantly impacted the market particularly in North America, where it has encouraged accelerated growth in sales of both sports-inspired and performance apparel. The evolution of athleisure has seen consumers increasingly opting to incorporate sportswear into their everyday attire. This shift in consumer behavior has created a new demand for versatile and stylish active-wear pieces that seamlessly transition from gym sessions to daily activities and has become a driving force behind the market growth in North America. As more individuals embrace active and healthy lifestyles, there is a greater emphasis on comfort, functionality, and style in clothing choices.

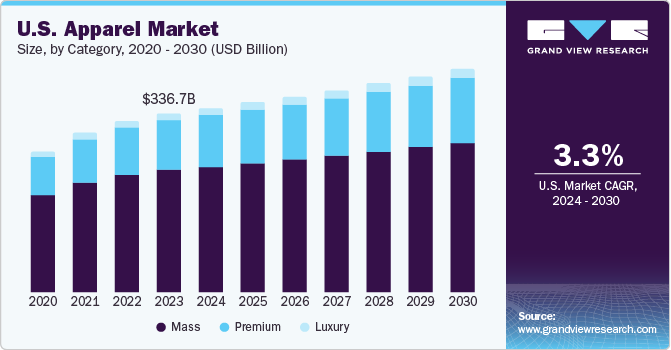

U.S. Apparel Market Trends

The apparel market in U.S. is expected to grow at the fastest CAGR of 3.3% from 2024 to 2030. The U.S. market is characterized by its dynamic nature and diverse offerings resulting in evolving consumer preferences, fashion trends, and economic influences. A notable trend within this market is the growing demand for sustainable and ethically sourced clothing. Consumers are increasingly mindful of the environmental and social consequences of their fashion decisions, driving a surge in demand for eco-friendly materials, ethical production methods, and transparent supply chains. Brands such as Patagonia and Eileen Fisher have garnered recognition for their dedication to sustainability within the apparel sector.

Asia Pacific Apparel Market Trends

Asia Pacific dominated the apparel market with a revenue share of 40.11% in 2023. Consumer spending on clothing is experiencing significant growth in Asia Pacific, Digital solutions are rapidly gaining traction in the region. A considerable number of young people in the region are embracing e-commerce platforms, leading to a substantial increase in apparel sales for giants like Lazada, Shopee, and Tokopedia. This surge underscores the evolving consumer behavior and highlights the crucial role of technology in shaping the market landscape. The diverse nature of the Asian market, influenced by various cultures and styles, presents opportunities for experimentation and innovation. While there is a growing trend towards minimalist fashion in the region, this creates an opening for Nordic fashion brands renowned for their simple yet elegant designs to enter the market successfully.

Europe Apparel Market Trends

The apparel market in Europe is expected to grow at the fastest CAGR of 3.4% from 2024 to 2030. The European market is experiencing growth driven by several factors, including shifting fashion trends, a focus on sustainability within the industry, the expansion of e-commerce, and ongoing innovation in design and manufacturing techniques.

Key Apparel Company Insights

Adidas, Nike, Inc., and Puma SE are some of the dominant players operating in global market.

-

Adidas has established a significant global presence, serving athletes and fashion-conscious consumers across Europe, North America, Asia, and beyond, and is renowned for its commitment to innovation, sustainability, and superior quality

-

Nike, Inc. is a global corporation specializing in the creation, production, and global distribution of apparel, footwear, accessories, and equipment. Nike has a significant footprint and has established its presence in regions like the Americas, Asia Pacific, Europe, the Middle East, and Africa

-

Puma SE is a manufacturer of sporting goods and equipment. It specializes in crafting and promoting footwear, apparel, and accessories suitable for all genders and age groups.. Its global footprint spans Europe, the Americas, Asia Pacific, the Middle East, and Africa

Key Apparel Companies:

The following are the leading companies in the apparel market. These companies collectively hold the largest market share and dictate industry trends.

- VF Corporation

- Burberry Group plc

- Puma SE

- Adidas AG

- Nike Inc.

- H&M Hennes & Mauritz AB

- LVMH

- KERING

- PVH Corp.

- Inditex

Recent Developments

-

In March 2024, PUMA and PLEASURES announced they are continuing their collaborative partnership with a new collection set to launch in 2024. This upcoming release follows their initial seasonal offering from 2023 including graphic shirts, accessories, and more, as well as their previous sneaker collaborations, the Suede XL and Velophasis

-

In February 2023, Adidas has introduced a new label, SPORTSWEAR, in collaboration with actress, producer, advocate, and style icon Jenna Ortega. The label is debuting with the Tiro Suit Collection featuring tracksuits, the Express Dress, the Avryn shoe, the Coach Jacket, and the Express Jersey

-

In June 2023, Nike has introduced Aerogami, its latest performance-apparel technology designed to enhance breathability precisely when athletes require it

Apparel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,774.56 billion

Revenue forecast in 2030

USD 2,263.98 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

VF Corporation; Burberry Group plc; Puma; Adidas AG; Nike Inc.; H&M Hennes & Mauritz AB; LVMH; KERING; PVH Corp.; Inditex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the apparel market report based on category, end-user, distribution channel, and region.

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

Luxury

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Casual Wear

-

Formal Wear

-

Sportswear

-

Night Wear

-

Inner Wear

-

Ethnic Wear

-

Others

-

-

Women

-

Casual Wear

-

Formal Wear

-

Sportswear

-

Night Wear

-

Inner Wear

-

Ethnic Wear

-

Others

-

-

Children

-

Casual Wear

-

Formal Wear

-

Sportswear

-

Night Wear

-

Inner Wear

-

Ethnic Wear

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Clothing Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global apparel market size was estimated at USD 1,709.76 billion in 2023 and is expected to reach USD 1,774.56 billion in 2024.

b. The global apparel market is expected to grow at a compounded growth rate of 4.1% from 2024 to 2030 to reach USD 2,263.98 billion by 2030.

b. Women apparel dominated the apparel market with a share of 52.2% in 2023. The female fashion industry is experiencing a surge in demand for new trends and a diverse range of options.

b. Some key players operating in the apparel market include VF Corporation; Burberry Group plc; Puma; Adidas AG; Nike Inc.; H&M Hennes & Mauritz AB; LVMH; KERING; PVH Corp.; and Inditex

b. The global market is driven by the high spending on apparel by consumers is a key factor driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."