- Home

- »

- Consumer F&B

- »

-

Whipping Cream Powder Market Size & Share Report, 2030GVR Report cover

![Whipping Cream Powder Market Size, Share & Trends Report]()

Whipping Cream Powder Market Size, Share & Trends Analysis Report By Source (Dairy, Non-dairy), By Type (Sweetened, Unsweetened), By Application (Bakery & Confectionery, Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-077-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

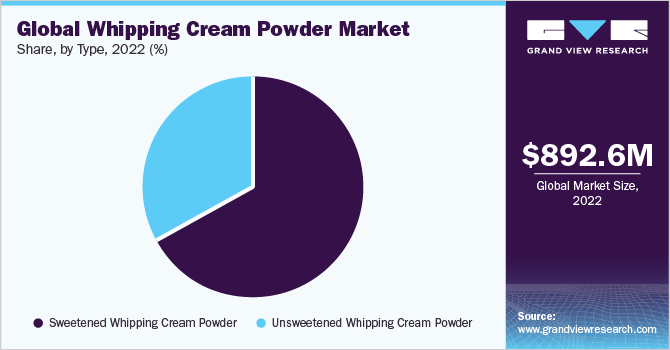

The global whipping cream powder market size was valued at USD 892.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The growth factors, such as the increasing popularity of baking and pastry-making, the growing demand for dairy-based products in emerging markets, and the increasing adoption of whipping cream powder in various applications, such as in bakery products, confectionery, and frozen desserts are being projected to augment demand over the forecast period. Furthermore, there has been a growing trend towards health-conscious food consumption, which has led to the development of low-fat and sugar-free versions of dairy-based products, including whipping cream powder.

This trend has contributed to the growth of the global market. Whipping cream powder finds application in a wide range of food products, including bakery items, confectionery, and frozen desserts. It is used as a key ingredient in cake mixes, pastries, cookies, mousses, ice creams, and other desserts. The versatility of whipping cream powder makes it popular among food manufacturers and professional chefs, as it provides convenience, extended shelf life, and consistent quality. The increasing adoption of whipping cream powder in these various applications is expected to contribute to the market's expansion. Baking and pastry-making have gained significant popularity worldwide, driven by factors, such as the increasing number of cooking shows, rising social media influence, and the growing interest in homemade & artisanal food products.

Whipping cream powder is a convenient and versatile ingredient used in various baking and pastry recipes, as it provides stability, texture, and creaminess to desserts, cakes, pastries, and other confections. The increasing demand for whipping cream powder from both professional bakers and home cooks is expected to boost the market growth.Emerging markets, particularly in regions like AsiaPacific, Latin America, and Africa, are experiencing a rise in disposable income, rapid urbanization, and changing dietary habits. This has led to increased consumption of dairy-based products, including whipping cream powder. Whipping cream powder offers a convenient and shelf-stable alternative to fresh cream, making it attractive to consumers in areas where access to fresh dairy products may be limited.

The growing demand for dairy-based products in these emerging markets is projected to drive market growth. With a rising focus on health and wellness, there is a growing demand for healthier versions of dairy-based products. This has led to the development of low-fat and sugar-free alternatives, including whipping cream powder. Manufacturers are introducing whipping cream powder formulations that cater to health-conscious consumers, offering reduced fat and sugar content while maintaining the desired taste and texture. The development of such healthier versions aligns with the evolving consumer preferences and dietary choices, driving the growth of the global market.

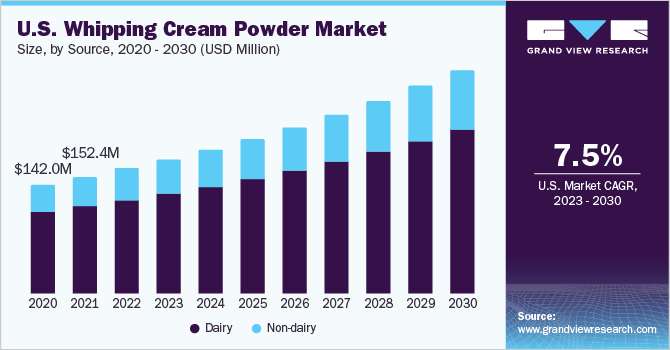

Source Insights

The dairy source segment dominated the market with a share of 74.7% in 2022. Dairy-based whipping cream powder offers a familiar and desirable taste profile that many consumers prefer. It provides a rich, creamy flavor that is associated with traditional dairy products. In addition, the existing dairy industry has established a strong infrastructure for dairy production, processing, and distribution, making dairy-based whipping cream powder readily available in the market. Dairy has a long history of being a primary source of whipping cream, and cultural preferences and culinary traditions further contribute to its dominance.Non-dairy sources are expected to grow at the fastest CAGR of 8.3% from 2023 to 2030 owing to the changing dietary preferences of consumers.

Increasing dietary preferences, such as lactose intolerance, dairy allergies, veganism, and health-consciousness, have driven the demand for non-dairy alternatives. Non-dairy whipping cream powders, often made from plant-based ingredients, offer lower saturated fat content and cater to these evolving consumer preferences. Culinary innovation and the development of high-quality non-dairy options have expanded their application possibilities, further fueling consumer interest. Moreover, sustainability concerns and the lower environmental impact of non-dairy sources have contributed to their popularity. The market has responded with a broader range of non-dairy whipping cream powder products, meeting the growing demand for these alternatives.

Type Insights

The sweetened whipping cream powder segment dominated the market with a revenue share of 66.6% in 2022 owing to consumer preference and shelf stability. It caters to the taste preferences of many consumers who enjoy the added sweetness in their whipped cream. The inclusion of sugar or sweeteners enhances the flavor profile, making it a desirable choice for topping desserts, beverages, and other sweet treats. The convenience it offers by combining the cream and sweetener in a single product saves time and effort for consumers, particularly in busy or professional settings. In addition, the shelf stability of sweetened whipping cream powder is an advantage.

It has a longer shelf life compared to unsweetened whipping cream, as the sugar or sweeteners act as preservatives. The consistency and stability of sweetened whipping cream powder when whipped also contribute to its popularity. The sugar or sweeteners incorporated into the powder help stabilize the whipped cream, ensuring a fluffy texture and preventing deflation or separation. The unsweetened whipping cream powder is expected to grow at a CAGR of 8.1% from 2023 to 2030.

The rising demand for dietary flexibility and health consciousness has fueled the need for alternatives that allow individuals to control the sweetness of their dishes. Unsweetened whipping cream powder provides a versatile option for both sweet and savory recipes, allowing the flavors of other ingredients to shine. It offers customization possibilities, empowering consumers to adjust the sweetness level according to their preferences. Moreover, unsweetened whipping cream powder caters to those with specific dietary restrictions, such as ketogenic or sugar-free diets, providing a creamy option without compromising on taste.

Application Insights

The bakery & confectionery segment dominated the market with a share of 45.5% in 2022 due to the versatility, convenience, stability, cost-effectiveness, and longer shelf life of whipping cream powder. Whipping cream powder is a versatile ingredient used in various bakery and confectionery products, such as cakes, pastries, desserts, and toppings. Its ability to provide texture, stability, and creamy flavor makes it highly desirable in these applications.

Beverages are expected to grow at the fastest CAGR of 8.2% from 2023 to 2030 owing to the increasing consumer demand for creamy drinks, customization possibilities, and convenience. There is a growing consumer demand for indulgent and creamy beverages across the globe. Whipping cream powder offers a convenient way to achieve a rich and creamy texture in beverages, such as milkshakes, hot chocolates, and specialty coffees. This demand is driving the adoption of whipping cream powder in the beverage sector.

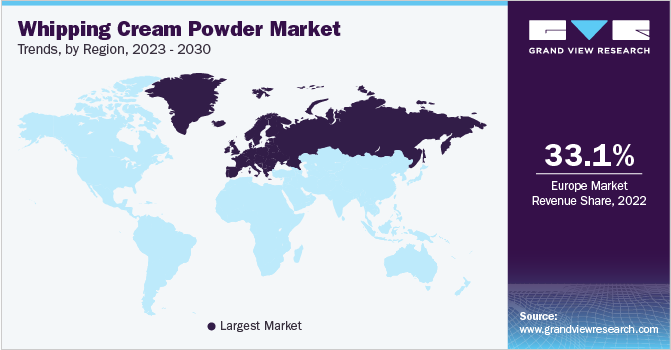

Regional Insights

The Europe region dominated the market with a revenue share of 33.1% in 2022 due to its strong dairy tradition, culinary culture, quality products, efficient distribution networks, and continuous product innovation. The market in Germany was dominant with a revenue share of 17.0% in 2022.The Asia Pacific region is expected to grow at a CAGR of 8.1% from 2023 to 2030. The changing consumer preferences and the adoption of Western food trends have increased the demand for whipping cream powder in the region, especially in convenience foods, desserts, and bakery products.

Furthermore, the Asia Pacific region has witnessed significant growth in its food and beverage industry, fueled by rising disposable incomes and a growing middle-class population. This has contributed to the increased use of whipping cream powder in various culinary applications. China dominated the Asia Pacific market with a share of 23.5% in 2022.The North America region is expected to grow at a CAGR of 7.1% from 2023 to 2030 driven by changing consumer preferences, increased home baking and cooking activities, a thriving foodservice industry, the popularity of dessert and bakery products, and the efforts of manufacturers and suppliers to meet market demand.

Key Companies & Market Share Insights

The global industry is expected to witness moderate competition among companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, many companies are expanding their product portfolio to gain a competitive edge in the market. Some of the key market players in the market are Kraft Heinz; Wilton Brands LLC; Weikfield; Betty Crocker; AussieBlends; Dr. Oetker; Swiss Bake Ingredients Pvt. Manufacturers are increasingly engaged in R&D activities related to whipping cream powder.

They are also expanding their product lines through product launches, mergers, acquisitions, and partnerships to meet the growing demand for whipping cream powder. For instance, in May 2022, PT Lautan Natural Krimerindo (LNK), a European-based food & beverage company, introduced a new addition to its product lineup, the RichCreme Whip Creme Powder. This product is designed specifically for bakers and individuals with a penchant for sweet treats.Some of the prominent players in the global whipping cream powder market include:

-

Kraft Heinz

-

Wilton Brands LLC

-

Weikfield

-

Betty Crocker

-

AussieBlends

-

Dr. Oetker

-

Well & Good

-

Hoosier Hill Farm

-

Adams Food Ingredients Ltd.

-

Swiss Bake Ingredients Pvt.

Whipping Cream Powder Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 957.1 million

Revenue forecast in 2030

USD 1,598.2 million

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in metric tons, Revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

Kraft Heinz; Wilton Brands LLC; Weikfield; Betty Crocker; AussieBlends; Dr Oetker; Well & Good; Hoosier Hill Farm; Adams Food Ingredients Ltd; Swiss Bake Ingredients Pvt.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whipping Cream Powder Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global whipping cream powder market based on source, type, application, and region:

-

Source Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Dairy

-

Non-dairy

-

-

Type Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Sweetened Whipping Cream Powder

-

Unsweetened Whipping Cream Powder

-

-

Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Bakery & Confectionery

-

Icecream & frozen desserts

-

Beverages

-

Others

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global whipping cream powder market size was estimated at USD 892.6 million in 2022 and is expected to reach USD 957.1 million in 2023.

b. The Whipping cream powder market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 1,598.9 million by 2030.

b. The Europe region dominated the market with a revenue share of 33.1% in 2022, due to its strong dairy tradition, culinary culture, quality products, efficient distribution networks, and continuous product innovation.

b. Some of the key market players in the whipping cream powder market are Kraft Heinz; Wilton Brands LLC; Weikfield; Betty Crocker; AussieBlends; Dr Oetker; Well & Good; Hoosier Hill Farm; Adams Food Ingredients Ltd; Swiss Bake Ingredients Pvt., among others.

b. The growth factors such as increasing popularity of baking and pastry-making, the growing demand for dairy-based products in emerging markets, and the increasing adoption of whipping cream powder in various applications, such as in bakery products, confectionery, and frozen desserts are being projected to augment demand over the forecast period. Furthermore, there has been a growing trend towards health-conscious food consumption, which has led to the development of low-fat and sugar-free versions of dairy-based products, including whipping cream powder. This trend has contributed to the growth of the global whipping cream powder market.

b. The China whipping cream powder market dominated the Asia Pacific market with a revenue share of 23.5% in 2022. The rapid growth of the foodservice sector, including restaurants, cafes, and bakeries, in China has boosted the demand for whipping cream powder. These establishments often use whipping cream powder in various applications such as dessert toppings, beverages, and pastry fillings, further driving market growth.

b. The Germany whipping cream powder market dominated the Europe market with a revenue share of 17.0% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."