- Home

- »

- Electronic Devices

- »

-

Wearable Camera Market Size, Share & Growth Report 2030GVR Report cover

![Wearable Camera Market Size, Share & Trend Report]()

Wearable Camera Market Size, Share & Trend Analysis Report By Product, By Application (Sports & Adventure, Security, Healthcare, Industrial), By Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-510-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Wearable Camera Market Size & Trends

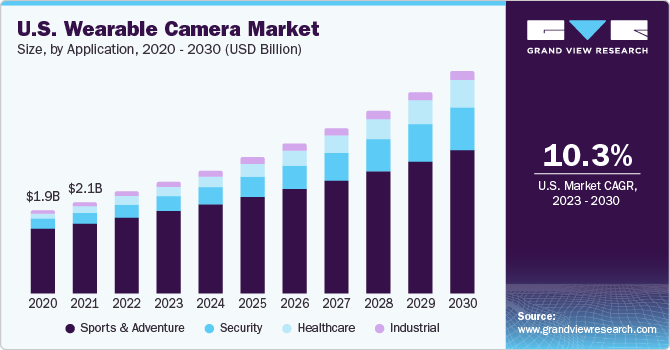

The global wearable camera market size was valued at USD 8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.4% from 2023 to 2030,owing to its rapid adoption across residential and commercial applications. The increasing demand for features such as the convenience of hands-free operation and the exceptional experience of wearable cameras will likely propel global market growth over the forecast period.

The market for wearable cameras is expected to increase in share owing to the growing adoption of these cameras in several applications, such as sports and adventure, security, healthcare, consumer, enterprise, and industrial. This technology has evolved with impressive features that let users record their experiences from a unique and first-person perspective.

The growing popularity of sharing experiences through photos and videos on social media platforms presents a significant market growth opportunity. The technology offers better low-light performance and enables users to shoot high-quality videos with sophisticated image stabilization.

Moreover, the advancement of Internet accessibility and usage of different social media sites and apps have encouraged users to adopt wearable camera technology, thereby driving market growth. The main aspects leading to the growth of this technology are convenience, responsiveness, and security.

Type Insights

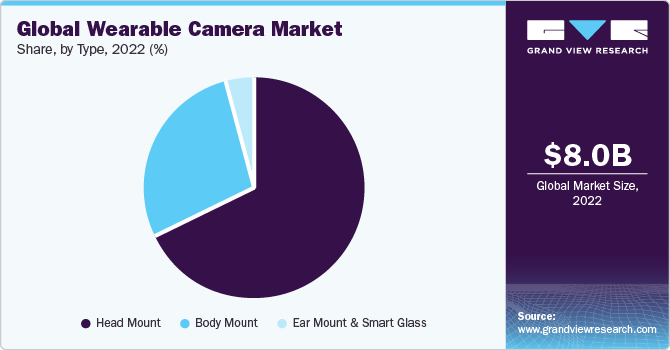

Based on types, the market has been segmented into head mount, body mount, and ear mount & smart glass. The head mount segment dominated the market with the highest revenue share of 67.8% in 2022. The head mount offers a hands-free experience, allowing users to capture moments and record videos without holding a camera. This convenience is especially attractive for sports, outdoor adventures, and vlogging activities, where users need their hands for other tasks.

On the other hand, the body mount segment is expected to grow at the highest CAGR of 19.0% over the forecast period, owing to the high demand for security applications. Body-mount cameras are gaining popularity in security applications. For instance, body-worn cameras utilized by law enforcement help record interactions with the public, gather video evidence at crime scenes and capture other assaults or offenses. The rising awareness among consumers regarding the advancements of wearable cameras is further expected to drive market growth.

Regional Insights

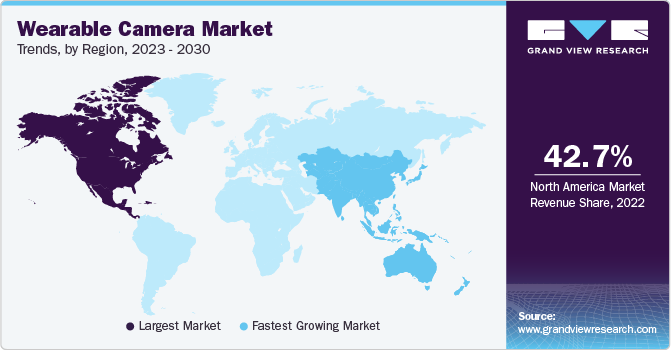

North America dominated the wearable camera market with the largest revenue share of 42.7% in 2022, owing to well-established manufacturers and a large consumer base. North America is known for its outdoor activities and adventure sports culture. Wearable cameras, such as action cameras and body-worn cameras, provide a hands-free way to capture and share experiences during activities like skiing, snowboarding, mountain biking, and surfing. The popularity of these sports and the desire to document and share exciting moments’ drive the demand for wearable cameras.

The Asia Pacific is expected to grow at the fastest CAGR of 23.9% during the forecast period. The Asia Pacific region is experiencing healthy growth in disposable income owing to lower commodity prices and macroeconomic stimulus, which is anticipated to drive market growth. Innovative technologies and growing leisure spending are the key factors driving the wearable camera industry demand over the projected period.

The French market is expected to witness significant developments in various sports and adventure applications owing to a large tourist attraction in the country. The ability to shoot and share real-time life experiences has increased the adoption of wearable cameras.

Product Insights

The product segment is categorized into accessories and camera. The camera held the largest market share of 87.6% in 2022. International vendors dominate the global wearable camera device market. Operational efficiencies associated with a wearable camera device, such as embedding GPS and enhancing video stabilization, are expected to drive market growth.

The ability of wearable cameras to capture life experiences while offering an improved user experience is expected to improve product demand. Furthermore, the increasing demand for connectivity between devices to share information and data online and store them on the cloud has also led to the growth of wearable camera technology in the segment.

The accessories segment is projected to register the fastest CAGR of 15.4% over the forecast period. Accessories provide additional features and capabilities to enhance the functionality of wearable cameras. They can include mounts, straps, grips, and stabilizers that improve the user experience, allowing for more versatile and stable footage capture.

Application Insights

Based on applications, the market has been segmented into sports & adventure, security, healthcare, and industrial. The sports & adventure segment dominated the market with the highest revenue share of 75.9% in 2022. Wearable cameras can be used during surgeries to record procedures from the surgeon's perspective. This footage can be invaluable for surgical training, education, and research. Medical students, residents, and surgeons can review and analyze the recordings to enhance their skills, improve techniques, and learn from real-life cases.

The healthcare segment is expected to witness significant growth of CAGR of 21.4% over the forecast period. The increasing need for consumers to track fitness and digitize medical records has increased demand for medical wearable camera devices. For instance, wearable cameras embedded with other software and hardware can determine nutrition facts and categorize food types through image processing techniques. These features offered by the device are expected to influence the industry positively.

Key Companies & Market Share Insights

Key players are indulged in undertaking strategic initiatives such as new product developments to offer avenues for increased profitability through better customer relationships. For instance, in September 2021, GoPro launched the HERO10 Black, flagship camera designed to offer smooth performance and exceptional video stabilization. This wearable camera has a powerful GP2 processor and a high-resolution 23-megapixel sensor. Additionally, it boasts HyperSmooth 4.0 video stabilization technology, further enhancing the quality and stability of captured footage.

Key Wearable Camera Companies:

- JVCKENWOOD USA Corporation

- Contour

- Sony Corporation

- Xiaomi

- VIEVU LLC

- Axon Enterprise, Inc.

- Pinnacle Response Ltd.

- Narrative AB

- Garmin Ltd.

- DRIFT

- GoPro Inc.

Recent Developments

-

In June 2023, Realme, a smartphone manufacturer, announced the launch of its 2023 camera flagship. The highlight of this upcoming device is its impressive 200-megapixel shooter, a significant advancement in smartphone camera technology. Including Optical Image Stabilization (OIS) further enhances the camera's capabilities, ensuring stable and blur-free images even in challenging shooting conditions.

-

In June 2023, Insta360 announced that it would be launching a "revolutionary" new camera. The company hints that this upcoming product will be significantly smaller. Despite its size, it boasts the impressive capability to capture precious moments from the unique perspectives of family members, friends, or even pets. Insta360 aims to ignite a "tiny revolution" with this innovative camera, suggesting that it will offer a fresh and exciting way to document and share experiences.

-

In October 2022, Axis Communications introduced the AXIS W101, a body-worn camera designed to cater to various sectors and markets. This camera enhances audio and image quality, delivering sharp images in every frame while effectively suppressing noise. Moreover, it offers additional features such as GPS, Galileo, Glonass, and improved location tracking capabilities.

-

In September 2022, GoPro unveiled its flagship action camera, the Hero11 Black, along with two new additions to its lineup; the Hero11 Black Creator Edition and Hero11 Black Mini. With these latest releases, GoPro will expand its range of action cameras for the fall of 2022. The lineup comprises three models: the standard Hero11 Black, a compact Mini version, and a model specifically designed for creators. By introducing these new options, GoPro aims to cater to a broader audience with varying needs and preferences, further solidifying its position as a leading provider of action cameras.

-

In April 2022, Noyafa introduced the A18, a wearable camera capable of shooting videos in 1080p resolution. The camera is equipped with a CMOS image sensor for capturing high-quality footage. The A18 wearable camera from Noyafa provides a versatile solution for various professional use cases, ensuring efficient and reliable video documentation.

Wearable Camera Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.92 billion

Revenue forecast 2030

USD 22.83 billion

Growth rate

CAGR of 14.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

JVCKENWOOD USA Corporation; Contour; Sony Corporation; Xiaomi; VIEVU LLC; Axon Enterprise, Inc.; Pinnacle Response Ltd.; Narrative AB; Garmin Ltd.; DRIFT; GoPro Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Camera Market Report Segmentation

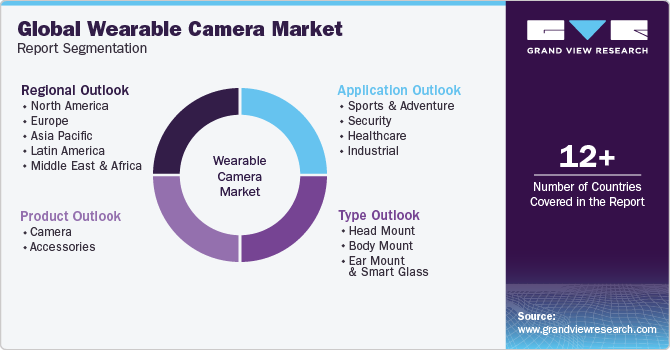

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wearable camera market on the basis of product, type, application, and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Camera

-

Accessories

-

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Head Mount

-

Body Mount

-

Ear Mount & Smart Glass

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Sports & Adventure

-

Security

-

Healthcare

-

Industrial

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wearable camera market size was estimated at USD 8.0 billion in 2022 and is expected to reach USD 8.92 billion in 2023.

b. The global wearable camera market is expected to grow at a compound annual growth rate of 18.2% from 2023 to 2030 to reach USD 22.83 billion by 2030.

b. North America dominated the wearable camera market with a share of 42.7% in 2022. This is attributable to growing leisure spending and growing popularity of sharing experiences through photos and videos on social media sites. North America is known for its outdoor activities and adventure sports culture. Wearable cameras, such as action cameras and body-worn cameras, provide a hands-free way to capture and share experiences during activities like skiing, snowboarding, mountain biking, and surfing.

b. Some key players operating in the wearable camera market include JVCKENWOOD USA Corporation, Contour, Sony Corporation, Xiaomi, VIEVU LLC, Axon Enterprise, Inc., Pinnacle Response Ltd., Narrative AB, Garmin Ltd., DRIFT, and GoPro Inc. among others.

b. Key factors that are driving the market growth include the growing popularity of social networking sites and high demand for adventure tourism and public safety. The increasing demand for features such as the convenience of hands-free operation and the exceptional experience of wearable cameras will likely propel global market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."