- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Waste Management Market Size & Share, Report, 2030GVR Report cover

![U.S. Waste Management Market Size, Share & Trends Report]()

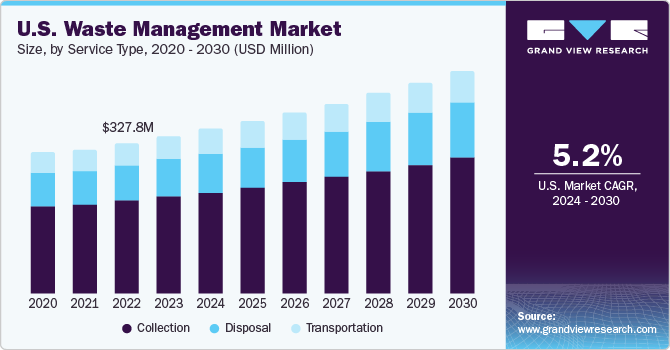

U.S. Waste Management Market Size, Share & Trends Analysis Report By Service Type (Collection, Transportation, Disposal), By Waste Type ( Municipal Waste, Medical Waste, Industrial Waste, E-waste) And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-204-7

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

U.S. Waste Management Market Trends

The U.S. waste management market size was estimated at USD 342.7 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. The growth of the US waste management market is driven by several factors. The expanding population and increased globalization have led to an increase in waste volume. This, coupled with rising environmental concerns and the adoption of sustainable waste management practices, has propelled the industry forward. Unlawful dumping and increased pollution have also contributed to the strong growth of the market. Furthermore, lifestyle changes and the increase in the adoption of technologically advanced waste management solutions such as e-waste management are driving the market growth. Improvements in government measures for solid waste management in developing regions also play a significant role.

The U.S. waste management market is expected to grow steadily over the forecast period, mainly driven by regulations, technological advancement, and environmental awareness. The US government is actively focusing on waste management through various policies, programs, and initiatives to address challenges and opportunities in managing waste.

The Resource Conservation and Recovery Act (RCRA) is the primary federal law that governs the management of hazardous and non-hazardous solid waste. It aims to establish a cradle-to-grave system for waste management. Environmental Protection Agency (EPA) announced a bold National Recycling Policy in 2021, intending to increase the national recycling rate to 50% by 2030. Such policies are benefiting the U.S. waste management market.

The integration of Environmental, Social, and Governance (ESG) standards into the investment decision-making process of institutional investors has become increasingly common. This trend is driven by both voluntary commitments and regulatory pressures. For instance, ESG regulations have increased by 155% globally in the past decade with 1,255 ESG regulations introduced since 2011, including significant increase in U.S. market as well. These regulations and standards are reshaping the investment landscape by encouraging sustainable and responsible investment practices. This creates a positive loop for the waste management market, as it encourages more and more corporations to incorporate more sustainable practices, including waste management.

The Sustainability Accounting Standards Board (SASB) is a non-profit organization that establishes industry-specific standards for disclosing financial material sustainability information to investors. These standards are closely linked with ESG. In the context of the waste management market, SASB provides industry-specific waste management standards. This standard addresses environmental issues associated with hazardous and non-hazardous waste generated by companies. Companies in the waste management industry, such as Waste Management Inc., use the SASB reporting framework for their sustainability disclosures. This shift towards sustainable practices is transforming the waste management industry and creating new opportunities for innovation and growth.

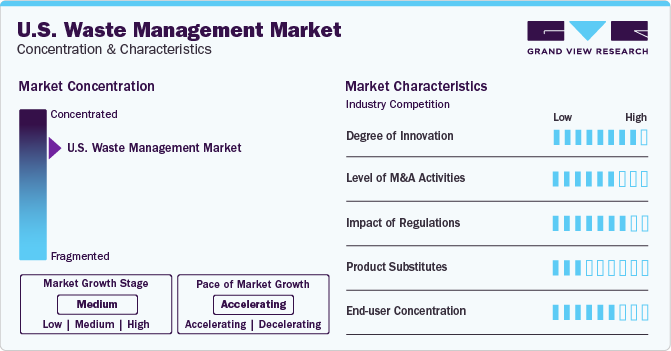

Market Concentration & Characteristics

The waste management industry in the US has seen a solid year of mergers and acquisitions. This suggests that companies are actively seeking strategic partnerships to expand their capabilities and market reach. This shows the further concentration of the already consolidated market.

Regulations such as the Resource Conservation and Recovery Act (RCRA) by the Environmental Protection Agency (EPA) have a significant impact on the waste management market. These regulations aim to protect the environment from the hazards of waste disposal, conserve energy and natural resources by recycling and recovery, reduce or eliminate waste, and clean up improperly disposed waste.

There are no direct substitutes for waste management services, as waste disposal is a necessity. However, the traditional methods are often insufficient and polluting. Therefore, waste management companies are adopting smart technologies like AI-powered waste sorting robots, IoT-enabled waste bins and trucks, blockchain-based material tracking, and decomposition technologies that reduce landfill waste.

The industrial segment is the largest end-user in the waste management market, generating a significant amount of waste daily. The US waste management market is in the growth stage, with the industry experiencing healthy growth over the last few years.

Service Type Insights

The collection segment dominated the U.S. market in 2023 with around 61.5% revenue share. This is due to the high demand for efficient and reliable waste collection services from various waste generators such as households, industries, and municipalities.

The disposal segment, on the other hand, was the second largest but is expected to be the fastest-growing segment with a CAGR of 5.7% from 2024-2030. This is attributed to the rising need for safe and sanitary disposal of waste, especially hazardous and infectious waste, as well as advancement in waste disposal technologies like waste-to-energy.

The transportation segment is also expected to grow steadily over the forecast period. With the growing market, the need for efficient and sustainable transportation services connecting the collection points to disposal and recycling stations is also going to surge further.

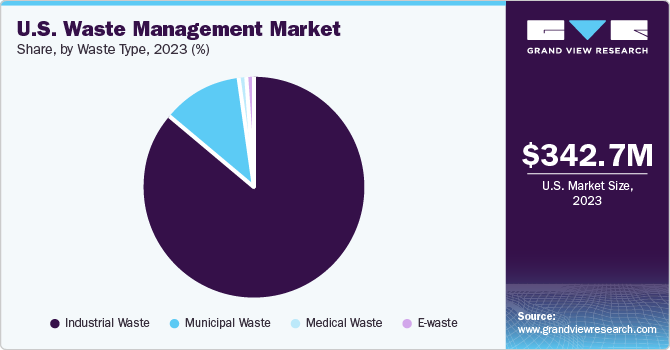

Waste Type Insights

The industrial waste segment dominated the U.S. market revenue share in 2023. This is due to the high volume and variety of industrial waste generated by various sectors such as manufacturing, construction, mining, and agriculture.

The E-waste segment, on the other hand, was the smallest but is expected to be the fastest-growing segment from 2024-2030.This is attributed to the rapid increase in consumption and disposal of electronic appliances such as mobile phones, computers, TVs, and other appliances.

The municipal waste was the second largest segment in 2023, followed by the medical waste. Both these segments are expected to grow steadily over the forecast period, owing to the rising population, urbanization, and consumerism in the US.

Key U.S. Waste Management Company Insights

The US waste management market is dominated by a few major players, such as Waste Management Inc., Republic Services, Inc., and Clean Harbors, Inc. This indicates a high level of market concentration. The waste management industry is witnessing significant innovation. Emerging trends include the use of AI and robotics for waste sorting, blockchain-powered solutions for tracking material lifecycle, and innovative composting and advanced recycling.

For example, Pello, a product of Recycle Track Systems, employs artificial intelligence, ultrasonic sensors, and a multispectral camera to accurately detect and quantify the contents of waste bins in any setting. It can identify impurities and determine fill levels with high accuracy. The sensors, which are designed to withstand all weather conditions, are linked to AI software hosted on the cloud. This software can be fully integrated with third-party systems, providing customers with a comprehensive view of their bin data and asset tracking.

Key U.S. Waste Management Companies:

- Waste Management Inc

- Republic Services Inc

- Waste Connections Inc

- Clean Harbors Inc

- Casella Waste Systems

- Stericycle

- Covanta Holding Corporation

- US Ecology Inc

- Heritage Crystal Clear Inc

- Recycle Track Systems

Recent Developments

-

Republic Services Inc. completed its acquisition of all outstanding shares of US Ecology, Inc. in May 2022. This acquisition is expected to expand the Republic’s portfolio of environmental solutions across U.S. and strengthen its position in waste management industry.

-

In October 2023, Heritage-Crystal Clean, Inc. was acquired by J.F. Lehman & Company for $1.2 billion. Heritage-Crystal Clean, Inc. is a one of leading provider of hazardous and non-hazardous waste disposal services.

U.S. Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 358.4 million

Revenue forecast in 2030

USD 484.8 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Service type, waste type

Key companies profiled

Waste Management Inc, Republic Services Inc, Waste Connections Inc, Clean Harbors Inc, Casella Waste Systems, Stericycle, Covanta Holding Corporation, US Ecology Inc, Heritage Crystal Clear Inc, Recycle Track Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Waste Management Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the US waste management market based on service type, and waste type:

-

Service Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Collection

-

Transportation

-

Disposal

-

-

Waste Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Municipal Waste

-

Medical Waste

-

Industrial Waste

-

E-waste

-

Frequently Asked Questions About This Report

b. The U.S. waste management market size was estimated at USD 342.7 million in 2023 and is expected to be USD 358.4 million in 2024.

b. The U.S. waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 484.8 million by 2030.

b. Collection segment of service type dominated the U.S. waste management market with a revenue share of 61.5% in 2023. The highest cost spending nature of the collection services comprising of transporting waste from origin to transportation station attributable for high revenue share.

b. Some of the key players operating in the U.S. waste management market include Waste Management Inc, Republic Services Inc, Waste Connections Inc, Clean Harbors Inc, Casella Waste Systems, Stericycle, Covanta Holding Corporation, US Ecology Inc, Heritage Crystal Clear Inc, and Recycle Track Systems.

b. The key factors that are driving the U.S. waste management market include the rising regulatory compliance, flourishing industrial activities, increasing consumer disposable income, and advancements in the recycling advancement.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."