- Home

- »

- Renewable Chemicals

- »

-

U.S. Specialty Oleochemicals Market Size Report, 2030GVR Report cover

![U.S. Specialty Oleochemicals Market Size, Share & Trends Report]()

U.S. Specialty Oleochemicals Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Food processing, Textiles, Paints & Inks, Industrial), By Product, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-404-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Report Overview

The U.S. specialty oleochemicals market was valued at USD 3.83 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. The market growth is due to rising demand for eco-friendly solutions and bio-degradable products and rising focus on sustainability by the government and major companies. Growth in automotive, textile, construction, food processing, and more industries has increased the country's demand for specialty oleochemicals products. Furthermore, rising demand for cosmetics and personal care products that are chemical-free and manufactured with natural ingredients has also been attributed to the market growth. Therefore, these factors are responsible for the market growth of the specialty oleochemicals market in the U.S.

Rising demand for sustainable packaging has also contributed to the market growth. According to McKinsey and Company, more than half of the U.S. population is willing to pay extra for sustainable packaging. Oleochemicals are green chemicals that are natural, safe, renewable, and biodegradable. The raw materials required to manufacture oleochemicals are also easily available. Hence, companies are adopting the usage of oleochemicals to promote sustainability.

Moreover, rising rubber production has also led to market growth. Oleochemicals improve the rubber extraction process. The rising use of rubber in the manufacturing of products such as footwear, seals, tires, and more has led to increased demand for oleochemicals.

Increased usage of oleochemicals in the food and beverage industry has also aided market growth. Oleochemicals are used as food thickeners, additives, or emulsifiers in food items such as breads, cakes, and other items. Furthermore, various types of customized oils are produced with the help of oleochemicals. Using oleochemicals to produce food additives in processed food products also aids market growth.

Product Insights

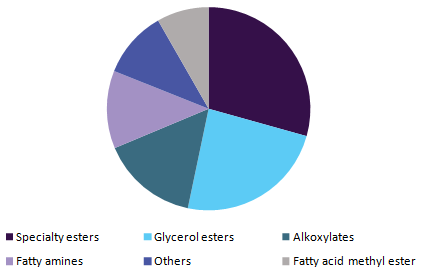

The specialty esters segment dominated the market in 2023 with a share of 24.7%. The market growth is due to the rising adoption of esters instead of petroleum-based chemicals. Specialty esters are a sustainable alternative derived from vegetable fats and oils. The market growth is also attributed to the rising adoption of specialty esters in food and beverages, pharmaceuticals, and other industries. Furthermore, rising awareness regarding the health benefits of esters has led to increased usage in the processed food sector. Therefore, these factors are responsible for the market growth of this segment.

The fatty acid methyl ester (FAME) segment is expected to grow at a CAGR of 10.3% during the forecast period. The market growth is attributed to the demand for FAME in biodiesel manufacturing. Increased biodiesel adoption to reduce fossil fuel dependency aids in market growth. FAME also produces lubricants, additives, feedstock, and more. Furthermore, government initiatives and funding to promote renewable energy resources have increased FAME usage.

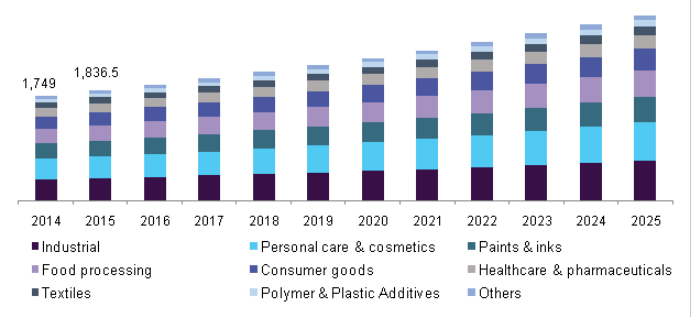

Application Insights

The industrial segment dominated the market in 2023 with a share of 20.9%. The market growth is due to rising demand for sustainable and biodegradable products. Oleochemicals act as an alternative to traditional petrochemical products. Hence, companies are increasingly adopting the usage of oleochemicals to promote sustainability. Furthermore, favorable government regulations, incentives, and the cost-effectiveness of oleochemicals further aid in the market growth of this segment.

The personal care and cosmetics segment is expected to grow at a CAGR of 8.7% during the forecast period. The market growth is attributed to the rising demand for organic and natural products. Major cosmetics and personal care companies are adopting the usage of oleochemicals as they provide properties such as sun protection, better moisturization, and more. Increased emphasis on research and development and technological advancements has allowed companies to enhance the efficacy of products with the help of the integration of oleochemicals. Hence, these factors aid in the market growth of this sector.

Key Company Share & Insights

Some of the major companies in the U.S. specialty oleochemicals market are Vantage Specialty Chemicals, Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd, and others. Companies are focusing on developing bio-based chemicals to promote sustainability, with heavy investments in research and development, collaborations, and technological advancements.

-

Vantage Specialty Chemicals is a company specializing in the production of naturally derived specialty ingredients and chemical products. The company deals with products such as bio-based surfactant chemistries, plant-derived raw materials, process cleaning solutions, and more.

-

Emery Oleochemicals is a company that deals with the development and supply of natural-based chemicals. The company caters to industries such as automotive, construction, pharmaceutical, medical, electrical, electronics, and more. the company produces products such as bio-lubricants, eco-friendly polyols, green polymer additives, and more.

Key U.S. Specialty Oleochemicals Companies:

The following are the leading companies in the U.S. specialty oleochemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Vantage Specialty Chemicals

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd

- Kao Chemicals

- PT. Ecogreen Oleochemicals

- Cargill, Incorporated.

- Oleon NV

- IOI Oleochemical

- Twin Rivers Technologies, Inc.

Recent Developments

- In June 2023, Oleon NV announced the opening of its oleochemistry plant in Europe. The plant was opened to promote the production of sustainable oleochemicals and reduce CO2 emissions from the production of enzymatic esters for the food and cosmetics industries.

U.S. Specialty Oleochemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.13 billion

Revenue forecast in 2030

USD 6.55 billion

Growth Rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Vantage Specialty Chemicals; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd; Kao Chemicals; PT. Ecogreen Oleochemicals; Cargill, Incorporated.; Oleon NV; IOI Oleochemical; Twin Rivers Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global U.S. specialty oleochemicals market report based on products, application.

-

Product Outlook (Revenue, USD Million, Volume in Kilotons 2018 - 2030)

-

Specialty Esters

-

Fatty acid Methyl Ester

-

Glycerol Esters

-

Alkoxylates

-

Fatty Amines

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume in Kilotons 2018 - 2030)

-

Personal Care & Cosmetics

-

Consumer Goods

-

Food Processing

-

Textiles

-

Paints & Inks

-

Industrial

-

Healthcare & Pharmaceuticals

-

Polymer & Plastic Additives

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."