- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Sludge Management And Dewatering Market Report 2030GVR Report cover

![U.S. Sludge Management And Dewatering Market Size, Share & Trends Report]()

U.S. Sludge Management And Dewatering Market Size, Share & Trends Analysis Report By Category (CWT, Onsite Facilities), By Source (Municipal, Industrial), By Services, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-026-2

- Number of Pages: 156

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

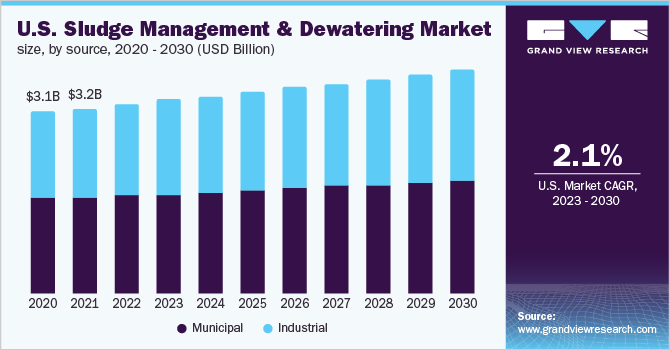

The U.S. sludge management and dewatering market size was estimated at USD 3.29 billion in 2022 and is expected to expand at a compounded annual growth rate (CAGR) of 2.1% from 2023 to 2030. The growth is attributed to the increasing industrial output driven by the expansion of various manufacturing facilities. The outbreak of COVID-19 negatively impacted the market. The industrial sector was significantly affected by the COVID-19 restriction and lockdowns, resulting in reduced wastewater and sludge production. Over the forecast period, the market is expected to recover, bouncing back due to the resumption of production activities.

The wastewater management industry is continuously growing owing to the increasing industrial activities across the U.S., such as pulp & paper, textile, pharmaceuticals, etc. Due to the rising industrial production, wastewater generation and demand for treatment is also rising. This results in the increasing production of sludge and drives the demand for sludge management.

Moreover, rising treatment and transportation facilities in the U.S. are expected to augment the growth of the sludge management and dewatering market. Various companies are investing in expanding product portfolios and geographical expansion which is expected to enhance the availability of sludge hauling and treatment over the forecast period.

The U.S. government is actively focusing on growing sludge management infrastructure across the country. For instance, the U.S. government launched an initiative in August 2020, which provides proper sanitation facilities for 11 rural communities across the country. This is likely to drive the sludge collection and further management.

Rising concerns over the environmental impact of the improper disposal of sludge from municipal and industrial wastewater are expected to drive sludge management. Due to the rising awareness among the masses, proper sludge treatment and disposal techniques are being increasingly followed by facility owners, which is expected to drive the growth of the market over the forecast period.

Source Insights

The municipal source segment led the U.S. sludge management and dewatering market with the largest revenue share of 51.8% in 2022. This is attributed to the high amount of wastewater and high rate of sludge generation per person in the U.S. The activities producing wastewater containing bio-solids include bathing, washing, flushing, and cooking.

The industrial segment is anticipated to witness strong growth, registering a CAGR of 2.3% over the forecast period. This is significantly attributed to the growth in the industrial output of the country. The rising private, public, and government investments to strengthen the supply chain of the country and to reduce dependency on foreign goods are contributing to the growth of the segment.

New stringent regulations are also expected to boost the growth of the sludge management and dewatering market in the U.S. For instance, in 2021, EPA announced new wastewater regulations with new effluent limitations for poultry, metal finishing, and the plastics & fibers industry. This is likely to encourage the manufacturer to implement a more advanced treatment system giving rise to increased sludge management over the forecast period.

The textile industry is also a significant source of sludge generation during the production at the mills. The industry requires a vast amount of water and various chemicals during the process and generated huge wastewater. Textile sludge primarily consists of organic and inorganic complexes along with heavy metals such as iron, copper, zinc, cadmium, and chromium.

Category Insights

The CWT, centralized waste treatment facilities held a majority of the market share, accounting for a 93.5% revenue share in 2022. Centralized wastewater treatment facilities treat millions of gallons of wastewater every day, which produces a huge amount of sludge as a by-product. This sludge is treated at a centralized location with aeration tanks for thickening.

These centralized treatment facilities carry out treatment for municipal and industrial sludge by various techniques. These techniques primarily consist of activated sludge treatment, sludge stabilization, chemical treatment, dewatering, thermal treatment, etc.

The onsite facilities segment is expected to witness a significant CAGR of 4.0% over the forecast period. Onsite treatment technology is gaining momentum due to increasing awareness about the treatment method among the masses, especially those who are not connected to centralized facilities. Moreover, increasing product development is also expected to drive segment growth.

Industrial facilities implementing onsite treatment technique is also likely to drive the growth of the segment. To minimize the cost of hauling and treatment many industrial players are showing interest to install systems that can treat the majority of the wastewater and sludge on-site or near the production facility. This is anticipated to drive the growth of the segment over the forecast period.

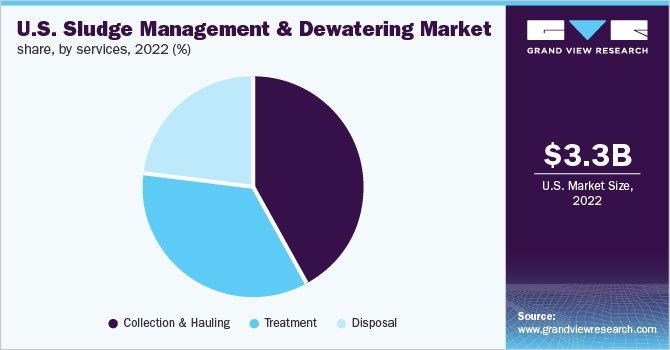

Services Insights

The collection & hauling segment led the market with a revenue share of 41.6% in 2022. The segment is also expected to witness a significant CAGR over the forecast period owing to the increasing collection and hauling services.

Sludge collection and hauling consists of the removal & collection of sludge from the wastewater treatment facilities and transporting it to the treatment facilities. The tanker trucks with proper sealing mostly do the hauling of the sludge to the treatment facilities. These haulers and handlers of sludge require certifications from the authorities that inspect the system properly for safe sludge transportation.

The disposal segment is estimated to witness steady growth, with a CAGR of 2.4% over the forecast period. Disposal of sludge in the U.S. consists of incineration, land application, and agriculture dumping. The predominantly sludge disposal is done as a fertilizer which is expected to minimize in the future due to the emerging multifaceted and integrated approach for final sludge disposal.

Treatment of sludge is done by a number of techniques, which includes sludge thickening, sludge stabilization, dewatering, and UV disinfection. Sometimes additional chemicals are also used to treat the sludge. New sludge treatment technology is being actively studied such as harnessing renewable energy from sludge incineration in the U.S.

Key Companies & Market Share Insights

The U.S. sludge management & dewatering industry is fragmented with the presence of several players accounting majority of the market share. The key players are actively focusing on several strategies, including geographical expansion, partnership, merger & acquisition, and joint venture. Key players aim to target new end-use industries and increase market penetration.

For instance, in August 2022, Veolia Group announced the merger of Vigie SA, formerly known as Suez SA into Veolia. The merger is expected to benefit the companies with the combined strength of industry-leading technologies and expertise in the sludge management market as well. Some prominent players in the U.S. sludge management and dewatering market include:

-

Wastewater Transport Services

-

J.P. Mascaro & Sons

-

Franc Environmental, Inc.

-

Veolia Group

-

Sheridan Environmental

-

Aqua Zyme

-

U.S. Ecology, Inc.

-

Waterleau

-

Evoqua Water Technologies LLC

-

Texas Sludge Disposal Inc.

U.S. Sludge Management And Dewatering Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.35 billion

Revenue forecast in 2030

USD 3.88 billion

Growth Rate

CAGR of 2.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Category, source, services

Country scope

U.S.

Key companies profiled

Wastewater Transport Services; J.P. Mascaro & Sons; Franc Environmental, Inc.; Veolia Group; Sheridan Environmental; Aqua Zyme; U.S. Ecology, Inc.; Waterleau; Evoqua; Water Technologies LLC, and Texas Sludge Disposal Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sludge Management And Dewatering Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sludge management and dewatering market report based on category, source, and services:

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

CWT

-

Onsite Facilities

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Collection & Hauling

-

Treatment

-

Disposal

-

Frequently Asked Questions About This Report

b. U.S. sludge management & dewatering market size was estimated at USD 3.29 billion in 2022 and is expected to be USD 3.35 billion in 2023

b. The U.S. sludge management & dewatering market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.1% from 2023 to 2030 to reach USD 3.88 billion by 2030

b. Some of the key players operating in the U.S. sludge management & dewatering market include: Veolia Group, Suez Group, U.S. Ecology, Inc., Wastewater Transport Services, Sheridan Environmental, Waterleau, and Evoqua Water Technologies LLC

b. Key factors driving the U.S. sludge management & dewatering market is rising awareness about onsite management technologies among the end users, increasing sludge generation from wastewater treatment plants and development in treatment & disposal techniques

b. CWT segment dominated the U.S. sludge management & dewatering market with a revenue share of 93.5% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."