- Home

- »

- Biotechnology

- »

-

U.S. Cord Blood Banking Services Market Size Report, 2030GVR Report cover

![U.S. Cord Blood Banking Services Market Size, Share & Trends Report]()

U.S. Cord Blood Banking Services Market Size, Share & Trends Analysis Report By Bank Type, By Component (Cord Blood, Tissue, Placenta), By States (Texas, Arizona, California, Florida, Kentucky, New Jersey), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-054-5

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

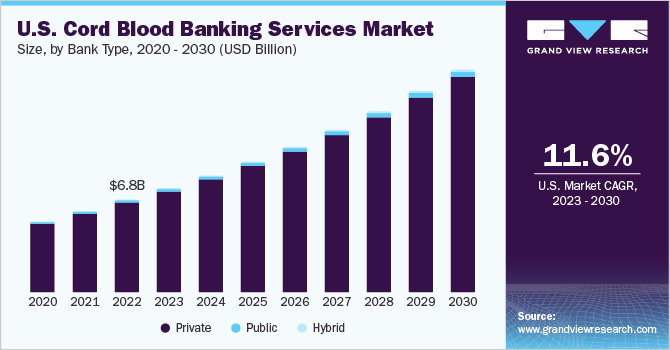

The U.S. cord blood banking services market size was valued at USD 6.83 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.56% from 2023 to 2030. The growing use of Cord Blood (CB) & stem cells in hereditary disease treatment is propelling the industry's growth. Furthermore, the rising awareness about the benefits, a wide range of service providers, and health coverage are among the factors driving requirements for CB banking services. The COVID-19 pandemic has caused a global economic downturn, affecting many medical services. As a result of the pandemic, approximately 20% of CB services as well as blood component suppliers have seen a swift drop in subscriptions.

Therefore, infections associated with blood transfusions, as well as movement restrictions, have stifled the expansion of the industry. In comparison to the global industry, the CB banking services market in the U.S. is relatively mature. The factors driving the demand for CB banking services include rising per capita consumer spending and industry participants offering services at competitive prices. The growing number of CB applications in the treatment of numerous chronic diseases is also anticipated to be one of the primary drivers of the market.

CB stem cells are currently used to treat approximately 80 diseases. Bone marrow disorders, cancers, blood illnesses, hepatic conditions, and immunodeficiency syndromes are examples of these diseases. The rising prevalence of these diseases, combined with a lack of effective alternative treatments, is expected to increase the total number of cases, and further boost industry growth. According to the American Cancer Society, around 16.9 million patients were suffering from cancer in 2020 while more than 1.8 million new cases were diagnosed in the same year. Hence, a rise in the number of cancer cases being diagnosed is anticipated to drive industry growth.

Bank Type Insights

The private bank type segment accounted for the maximum share of more than 97.30% in 2022. This can be attributed to the large customer base of private banks, owing to their more appealing marketing strategies over public banks. Furthermore, higher costs per CB unit collected and retained at private banks are contributing to the higher revenue generated by this segment.

The hybrid bank segment, on the other hand, is expected to register the fastest CAGR of 12.03% during 2023-2030. A hybrid CB banking system combines aspects of both public & private banking systems and is expected to grow considerably over the forecast period. A hybrid model is shifting beyond the traditional division of public & private CB banking, as the former offers both options of donating CB and family banking. Many of the private banks, including StemCyte, Celebration Stem Cell Centre, Core 23 BioBank, and New Jersey Cord Blood Bank, prefer a hybrid model for operations. Furthermore, the inclination of end-users toward hybrid banking due to the advantages associated with it is fueling the demand for hybrid banks. The hybrid banking model improves access to global CB transplants and personalized banking. Thus, driving the market for hybrid banks and further boosting industry growth.

Component Insights

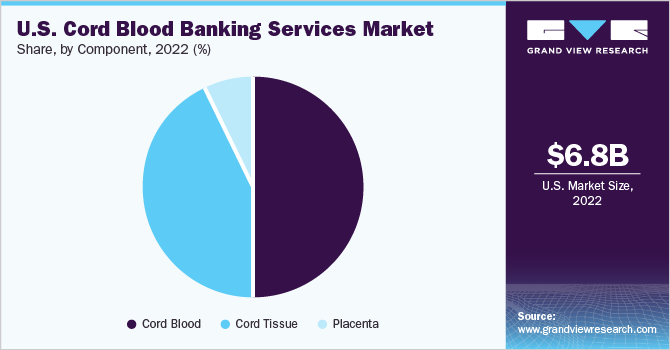

In 2022, CB dominated the industry and accounted for the maximum share of more than 50% of the overall revenue. The segment is likely to expand further at a steady growth rate retaining its dominant position throughout the forecast period. An increase in the prevalence of chronic diseases is boosting the demand for cord plantation applications, regenerative medical treatments, and the overall number of CB providers, all of which are driving market growth. Furthermore, an increasing number of births occurring in the U.S. is a major contributing factor to the growth of this segment.

On the other hand, the cord tissue component segment is expected to register the fastest growth rate during the forecast period. The ongoing study of different applications of cord tissues indicates that the segment has high growth potential. Parkinson’s disease, multiple sclerosis, Type 1 diabetes, rheumatoid arthritis, and cerebral palsy are among the currently approved applications. Furthermore, rising awareness about the benefits of tissue storage is expected to drive segment growth.

States Insights

On the basis of states, the market has been further categorized into Arizona, California, Florida, Kentucky, New Jersey, Texas, Massachusetts, and the rest of the U.S. California dominated the overall market and accounted for the maximum share of more than 18.4% of the overall revenue in 2022. The segment is likely to expand further at a steady growth rate maintaining its dominant industry position throughout the forecast period.

The high share can be attributed to a significant number of CB banks present in public and private domains. Furthermore, the state is highly ethnically diverse, which makes it suitable for a more diverse collection of cord blood donations from its population. In addition, several government initiatives, such as the Umbilical Cord Blood Community Awareness Campaign, are undertaken in the state, which is likely to boost the market growth in California.

Key Companies & Market Share Insights

Key players are implementing various strategies including partnerships through mergers & acquisitions, geographical expansions, and strategic collaborations to expand their industry presence. For instance, in March 2022, Cryo-Cell International, Inc. signed a purchase agreement for a newly constructed 56,000-square-foot facility in Durham, North Carolina’s Regional Commerce Center. The facility will help Cryo-Cell expand its cryopreservation and cold-storage operations. Launch of new services, new market entrants, and the presence of existing & matured key players intensify market competition and boost growth. Some of the key players in the U.S. cord blood banking services market include:

-

California Cryobank

-

StemCyte Inc.

-

Cryo-Cell International Inc.

-

Lifeforce Cryobank Sciences Inc.

-

Stem Cell Cryobank Inc.

-

Norton Healthcare

-

Viacord

-

MiracleCord Inc.

-

New Jersey Cord Blood Bank

-

Carter BloodCare

-

CryoCyte LLC

-

Americord Registry LLC

-

Maze Cord Blood

U.S. Cord Blood Banking Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.59 billion

Growth rate

CAGR of 11.56% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Bank Type, Component, States

States scope

Arizona, California, Florida, Kentucky, New Jersey, Texas, Massachusetts

Key companies profiled

California Cryobank, StemCyte Inc., Cryo-Cell International Inc., Lifeforce Cryobank Sciences Inc., Stem Cell Cryobank Inc., Norton Healthcare Viacord, MiracleCord Inc., New Jersey Cord Blood Bank, Carter BloodCare.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

U.S. Cord Blood Banking Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. cord blood banking services market report based on bank type, component, and states:

-

Bank Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

Hybrid

-

-

Component Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Cord Blood

-

Cord Tissue

-

Placenta

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Arizona

-

California

-

Florida

-

Kentucky

-

New Jersey

-

Texas

-

Massachusetts

-

Frequently Asked Questions About This Report

b. The U.S. cord blood banking services market size was estimated at USD 6.83 billion in 2022.

b. The U.S. cord blood banking services market is expected to grow at a compound annual growth rate of 11.56% from 2023 to 2030 to reach USD 16.59 billion by 2030.

b. Private cord blood banking dominated the U.S. cord blood banking services market with a share of 97.30% in 2022. This is attributable to the presence of a substantial number of private banks in the space and their large customer base.

b. Some key players operating in the U.S. cord blood banking services market include Cord Blood America, Inc.; California Cryobank Stem Cell Services LLC, StemCyte, Inc, Cryo-Cell International, Inc.; Norton Healthcare, Inc.; Lifeforce Cryobank Sciences Inc., and others.

b. Key factors that are driving the U.S. cord blood banking services market growth include increasing popularity biobanking services and rising application of cord blood in treatment of chronic conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."