- Home

- »

- Medical Devices

- »

-

U.S. Continuous Glucose Monitoring Devices Market, Industry Report, 2030GVR Report cover

![U.S. Continuous Glucose Monitoring Devices Market Size, Share, & Trends Report]()

U.S. Continuous Glucose Monitoring Devices Market Size, Share, & Trends Analysis Report By Component (Transmitters, Sensors, Receivers), By End-use (Hospitals, Homecare), By Connectivity (Bluetooth, 4G), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-235-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

The U.S. continuous glucose monitoring devices market size was estimated at USD 1.51 billion in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 6.68% from 2024 to 2030.Major factors contributing to the growth of this market include the growing prevalence of diabetes, the development of advanced CGM devices, and the rising geriatric population who are more susceptible to develop diabetes. Moreover, the dominance of obesity among individuals is likely to increase the growth of this market over the forecast period.

The U.S. continuous glucose monitoring (CGM) devices market accounted for a 33% revenue share of the global market in 2023. Obesity, improper lifestyle patterns, and aging are the potential factors leading to diabetes, thereby contributing to diabetes. The CDC reports that in the U.S., approximately 34.2 million people, or 10.5% of the population, have diabetes. This includes both diagnosed and undiagnosed cases. According to CDC, 37.3 million people are suffering from diabetes, out of which 28.7 million people are diagnosed and around 8.5 million people have undiagnosed diabetes. Furthermore, there are a large number of people who are undiagnosed or have prediabetes, which is a condition where blood glucose levels are higher than normal but not yet high enough to be classified as diabetes. For instance, according to CDC, 122.4 million people have prediabetes, among which 96 million people are 18 years and above and 26.4 million people are aged 65 & above. The rise in the prevalence of obesity and diabetes can be attributed to various factors such as unhealthy diet, sedentary lifestyle, and heredity. These conditions can increase the risk of several other health problems, including heart disease, stroke, and certain types of cancer.

The increasing incidence of prediabetes is also fueling market growth. Prediabetes is a condition in which sugar levels in blood are higher than normal but not high enough to be classified as type 2 diabetes. It is a serious health condition that can increase the risk of developing type 2 diabetes, heart disease, and stroke. Unfortunately, the number of people diagnosed with prediabetes is rapidly growing. The main reason for the increase in prediabetes cases is the rise in obesity rates. The increasing incidence of prediabetes is also fueling market growth. Prediabetes is a critical condition that poses a high risk of type 2 diabetes among people. With the surge in obesity, the incidences of prediabetes are rapidly increasing. According to the CDC and the U.S. Department of Health & Human Services, it is estimated that 97.6 million adults in the U.S. 18 years or above had prediabetes in 2021. According to crude estimates for the years 2017 to 2020, around 38% of all adults in the U.S. had prediabetes based on their A1C level or fasting glucose. Only 19% of adults with prediabetes had been informed by a health professional of their condition.

The advent of CGM devices is significantly impacting diabetes management. Furthermore, real-time monitoring features, glucose level alerts, and lifestyle suggestions offered by these devices contribute to the high demand for CGM devices among individuals. This demand in turn accelerates the growth opportunities in the market. Several companies are actively involved in developing innovative CGM devices to sustain their position in the market. Moreover, regulatory approvals for these devices boost the market growth. For instance, in March 2024, Stelo, the first glucose biosensor manufactured by US-based Dexcom, Inc received US FDA approval. Such technological advances will likely accelerate the demand for CGM devices in the market over the forecast period.

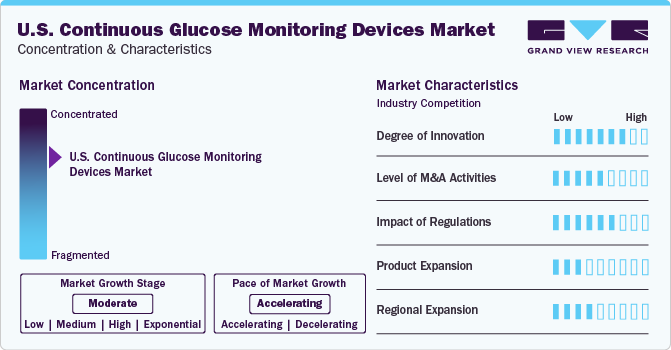

Market Concentration & Characteristics

The U.S. continuous glucose monitoring devices industry is highly concentrated due to the presence of a few companies accounting for dominating market shares. The industry growth is projected to increase at an accelerating pace in the coming years.

Degree of Innovation: Key companies are introducing a variety of products to enhance their product portfolios, a strategy that helps them expand their customer base, diversify their product offerings, and enhance the quality of their products. For instance, in November 2022 , Intuity Medical, Inc. partnered with Embecta Corp. to promote Intuity Medical’s innovative POGO Automatic Blood Glucose Monitoring System to healthcare professionals within the U.S.

Merger and Acquisition: Key companies are engaging in partnerships and collaborations to foster growth, innovation, and enhance competitiveness by leveraging the expertise and resources of diverse organizations. For instance, in September 2023, Abbott announced the acquisition of Bigfoot Biomedical to enhance diabetes care in patients. This would escalate Abbott's presence in diabetes care, accelerate FreeStyle Libre portfolio of continuous glucose monitoring technology, and the company's efforts to develop connected solutions for diabetes management.

Regional/Product Expansion: Key companies are constantly making efforts to establish a robust market position involving efficiently operating by introducing diverse products and facilities across multiple locations to expand their global presence and secure a larger market share. For instance, in February 2023, Dexcom, Inc. launched the Dexcom G6 CGM System in Singapore for diabetic patients aged 2 years and older.

Impact of Regulations: Several companies participate in trials, clinical studies, and approvals from the regulatory bodies to make advancements in the market. For instance, in September 2023, Senseonics Holdings, Inc. announced the completion of the ENHANCE Pivotal Clinical Study, demonstrating the accurate and safe performance of Eversense to facilitate effective and lasting diabetes management.

Component Insights

Based on components, sensors of CGM devices dominated market with a share of 41.04% in 2023. Sensors are a significant component of CGM devices and play an important role in glucose monitoring. The technology used in the sensor helps in generating electrical signals following glucose-oxidase reaction, thereby monitoring glucose levels at particular intervals of time. Moreover, the sensor has a chemical covering at its surface which keeps it functional even inside a human body. Thus, higher efficiency and applications of these components boost the growth of this segment.

The transmitters segment is anticipated to expand at the fastest CAGR from 2024 to 2030. These components can be placed at the body surface and transmit signals to the sensors inside the body, which further monitor glucose levels. These transmitters send data recorded by sensors to the receivers such as smartphones, or any other sensing device thereby contributing to continuous glucose monitoring. Radiofrequency transmitters are preferred for CGM. Hence, the efficient mechanism of working of transmitters and technological advancements will likely increase market growth over the forecast years.

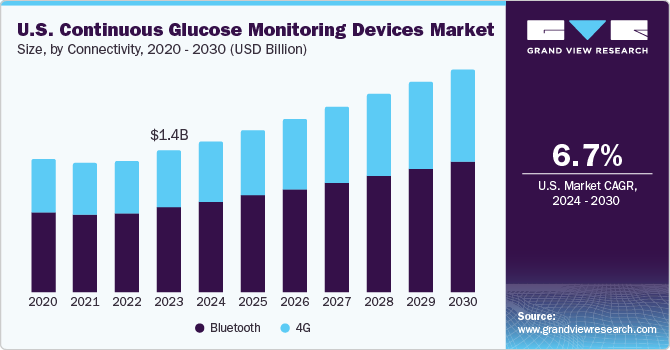

Connectivity Insights

Bluetooth connectivity held the largest market share in 2023. The feature of quick connectivity for data transmission is driving the growth of bluetooth in the market. CGM sensors generally use Bluetooth chips that provide real-time glucose level readings and alerts on smartphones or other Bluetooth-enabled devices. Thus, the applications of bluetooth connectivity in diabetic patients create growth opportunities for this segment. CGM devices with Bluetooth connectivity can benefit people with diabetes by providing real-time glucose level readings and alerts to their smartphones or other Bluetooth-enabled devices. This can help individuals with diabetes to better manage their blood sugar levels and avoid dangerous highs & lows. For instance, the Dexcom G6 CGM system features Bluetooth connectivity, allowing it to wirelessly transmit glucose data to a compatible device every 5 minutes. The system also includes customizable alerts and alarms that notify users of high or low glucose levels, even when asleep.

The 4G segment is projected to increase at the fastest CAGR of 6.48% during the forecast period from 2024 to 2030. Sensors with 4G connectivity, allow real-time data transmission to healthcare providers along with prompt feedback on glucose levels. This innovation enables patients to make necessary adjustments to their insulin dosage or diet plan based on the received information. Such trends are expected to enhance market growth over the forecast years. 4G connectivity CGM sensors are the latest innovation in the diabetes management industry that provides CGM to patients. It allows real-time data transmission to the patient's healthcare provider, allowing patients to receive prompt feedback on their glucose levels. This helps them make essential adjustments to their insulin dosage or diet plan. Thus, preventing life-threatening conditions such as hypoglycemia or hyperglycemia.

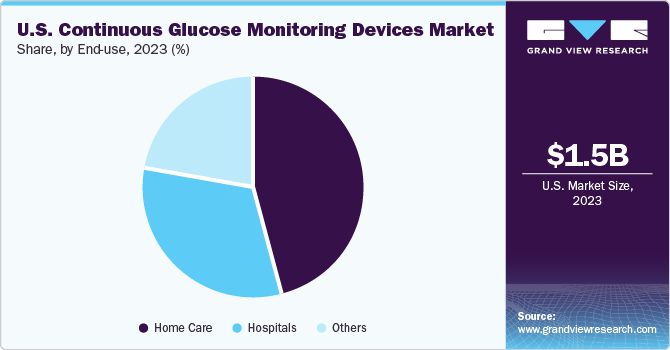

End-use Insights

Based on end-use, homecare dominated the market with a share of over 45% in 2023 and is projected to grow at the fastest CAGR over the forecast period. The growth of this segment can be attributed to the availability of advanced remote CGM devices and the benefits offered by them. CGM devices are easy-to-use for glucose monitoring in adults and children thereby increasing their demand in the market. Thus, a surge in demand is expected to drive the segment’s growth.

The hospitals segment is anticipated to expand with a significant CAGR from 2024 to 2030 owing growing preference of healthcare professionals for CGM devices in hospitals. Many hospitals and healthcare settings have increased the use of CGM devices to identify blood sugar levels in patients suffering from diabetes mellitus due to its real-time monitoring and continuous recording features. Many hospitals and healthcare settings have increased the use of CGM devices to identify blood sugar levels in patients suffering from diabetes mellitus. CGM devices have been shown to perform considerably better compared to Self-monitoring Blood Glucose (SMBG) devices during clinical studies involving gestational diabetes mellitus, according to the National Center for Biotechnology Information (NCBI). The adoption of blood glucose monitoring devices is expected to increase in hospitals owing to the introduction of technologically advanced devices for the management of diabetes mellitus.

Key U.S. Continuous Glucose Monitoring Devices Company Insights

Prominent companies in the U.S. CGM device market include Abbott Laboratories, Dexcom, and Senseonics Holdings, among others.

The competition is high due to the presence of numerous key players who are constantly competing to expand their market share and improve their product offerings. Moreover, these key companies are focusing on strategic initiatives such as innovative product launches, Mergers and acquisition activities, and partnerships to expand their company portfolios.

Key U.S. Continuous Glucose Monitoring Devices Companies:

- Dexcom, Inc.

- Abbott

- Medtronic

- Ypsomed AG

- Senseonics Holdings, Inc.

- A. Menarini Diagnostics S.r.l.

- Signos, Inc.

- Phillips-Medisize

Recent Developments

-

In February 2024, DexCom announced the launch of a unique CGM device, DexCom ONE+ in Europe. This device would allow real-time monitoring of blood glucose to users through a smartphone app.

-

In January 2024, Abbott and Tandem Diabetes Care, Inc. recently announced that their t:slim X2 insulin pump, which uses Control-IQ technology, has become the first Automated Insulin Delivery (AID) system to integrate with Abbott's latest Continuous Glucose Monitoring (CGM) technology, the FreeStyle Libre 2 Plus sensor. This development has enabled users of FreeStyle Libre technology in the U.S. to experience the benefits of a hybrid closed-loop system. With this system, users can predict and prevent high & low blood sugar levels

-

In October 2023, Phillips-Medisize announced the collaboration with GlucoModicum to present a non-invasive CGM wearable device to provide better patient outcomes.

-

In February 2023, Dexcom launched the Dexcom G7 CGM System in the U.S. It introduced the CGM system through a Super Bowl commercial starring Nick Jonas, who has diabetes. The commercial was expected to be watched by over 4.8 million diabetic U.S. individuals, of which 3.3 million were not using CGM and 2.3 million had CGM coverage. Hence, the ad was expected to create awareness about diabetes and have an influential product launch.

U.S. Continuous Glucose Monitoring Devices Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 1.62 billion

The revenue forecast for 2030

USD 2.39 billion

Growth Rate

CAGR of 6.68% from 2024 to 2030

Actual estimates

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, connectivity, end-use

Country Scope

U.S.

Key companies profiled

Dexcom, Inc.; Abbott; Medtronic; Ypsomed AG; Senseonics Holdings, Inc.; Phillips-Medisize; A. Menarini Diagnostics S.r.l., and Signos, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Continuous Glucose Monitoring Devices Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. continuous glucose monitoring devices marketbased on component, connectivity, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmitters

-

Sensors

-

Receivers

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

4G

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare Settings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. continuous glucose monitoring devices market size was estimated at USD 1.51 billion in 2023 and is expected to reach USD 1.62 billion in 2024.

b. The U.S. continuous glucose monitoring devices market is expected to grow at a compound annual growth rate of 6.68% from 2024 to 2030 to reach USD 2.39 billion by 2030.

b. Homecare segment dominated the U.S. continuous glucose monitoring devices market with a share of over 45.0% in 2023. The growth of this segment can be attributed to the availability of advanced remote CGM devices and the benefits offered by them. CGM devices are easy-to-use for glucose monitoring in adults and children thereby increasing their demand in the market. Thus, a surge in demand is expected to drive the segment’s growth.

b. Some key players operating in the U.S. CGM devices market include TDexcom, Inc.; Abbott; Medtronic; Ypsomed AG; Senseonics Holdings, Inc.; Phillips-Medisize; A. Menarini Diagnostics S.r.l., and Signos, Inc.

b. Key factors that are driving the market growth include growing prevalence of diabetes, the development of advanced CGM devices, and the rising geriatric population who are more susceptible to develop diabetes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."