- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Cleanroom Film And Bags Market Size Report, 2030GVR Report cover

![U.S. Cleanroom Film And Bags Market Size, Share & Trends Report]()

U.S. Cleanroom Film And Bags Market Size, Share & Trends Analysis Report By Product (Bags, Pouches, Tape, Boxes, Films & Wraps), By Material, By End-use, By States, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-122-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

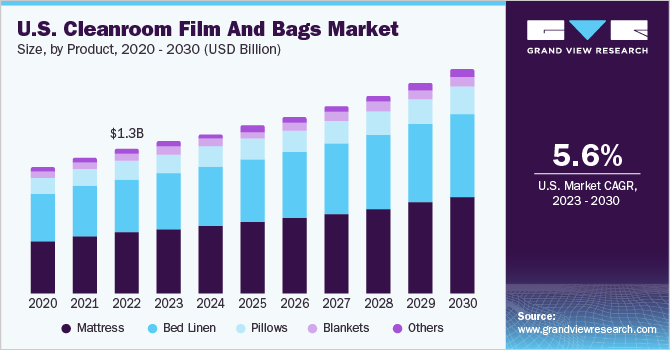

The U.S. cleanroom film and bags market size was estimated at USD 1.29 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The expanding end-use industries such as food& beverage, pharmaceuticals, and microelectronics are anticipated to drive the demand for the product over the forecast period. Moreover, the rising demand for convenient and efficient packaging solutions is expected to stimulate market growth.

The food & beverage industry is one of the largest end users of cleanroom films and bags. Products such as pouches, bags, and films, among others, are extensively utilized in the food & beverage industry for the packaging of ready-to-eat convenient products, ready-to-eat meals, snack foods, carbonated & non-carbonated beverages, and frozen meals. Contamination free packaging products are lightweight, transparent, and less expensive. Besides, it offers robust barrier properties along with high aesthetic appeal. These prominent factors are increasing the product demand in the food & beverage industry, hence, driving the product demand in the country.

Furthermore, the growth in the pharmaceutical industry is expected to drive the demand for cleanroom films and bags. For instance, according to The Observatory of Economic Complexity (OEC), in 2020, the export value of pharmaceutical products from the U.S. was USD 60.5 billion, which increased to USD 81.6 billion in 2021. These film and bags as a barrier and prevent the entry of any foreign elements that may contaminate the pharmaceutical compositions.

Moreover, the technological advancement in packaging products such as the employment of advanced polymers and the application of nano-coatings is playing a crucial role in increasing the product demand across the country. Furthermore, the customizations and features such as UV-resistant films and heat-sealable & peelable films, are expected to create new opportunities for cleanroom film and bags players in the country.

Product Insights

Based on product, the market is segmented into bags, pouches, tape, boxes, and film & wraps. The films & wraps segment recorded the largest market share of over 42.0% in 2022. Stringent regulations for packaging and the growth of end-use industries such as pharmaceuticals, electronics, biotechnology, and healthcare are expected to increase product demand over the forecast period.

Cleanroom bags are specialized bags that safeguard cleanroom environments from contamination. These bags are manufactured to minimize the release of particles and other contaminants. The growing focus on contamination control and stringent regulations for cleanroom packaging in various industries is expected to increase the demand for cleanroom bags over the forecast period.

Cleanroom pouches are used to protect delicate equipment and products from contamination in controlled environments such as manufacturing facilities in the FMCG, electronics, and pharmaceutical sectors. The wide application scope of cleanroom pouches in various industries is expected to fuel demand for pouches in the country over the forecast period.

Material Insights

Based on type, the market is segmented into plastic and paper & paperboard. The plastic segment accounted for the largest market share of over 84.0% in 2022. This positive outlook is due to the better barrier properties, reduced outgassing, and improved sealing capabilities. Furthermore, the expansion of medical and healthcare industry has led to an increase in demand for medical devices and pharmaceutical product packaging solutions, driving the demand for plastic-based cleanroom packaging.

Paper & paperboard are used for labeling and record-keeping purposes. These materials are chosen for their convenience and ease of use in recording information. Specialized paper materials known as "cleanroom wipes" are used for cleaning surfaces and equipment in cleanrooms. These wipes are designed to minimize particle generation and are treated to be compatible with cleanroom standards.

End-use Insights

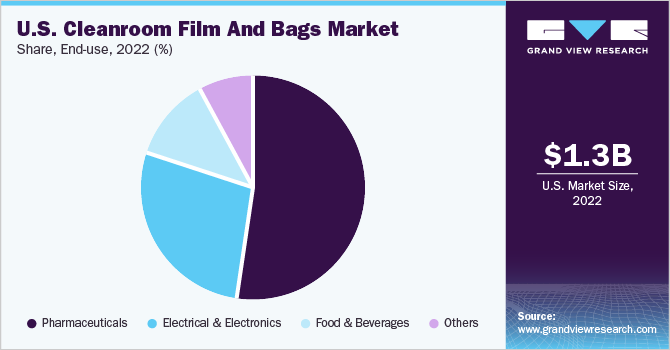

Based on end-use, the U.S. cleanroom films & bags market is segmented into food & beverages, pharmaceuticals, electrical & electronics, and others. The pharmaceuticals segment recorded the largest market share of over 52.0% in 2022. The rising population and the growing prevalence of chronic diseases in the country, due to changing lifestyles are generating significant demand for pharmaceutical products, which, in turn, is expected to drive the demand for pharmaceutical cleanroom film and bags in the end-use segment.

Cleanroom film and bags have a wide range of critical applications in the electronics manufacturing industry, where contamination control, protection, and precision are of utmost importance. Increasing demand for electronics products and investments in the electronics industry is expected to boost the demand for cleanroom films and bags over the forecast period.

States Insights

The California state accounted for the largest market share of over 11.0% in 2022. The demand for cleanroom films and bags in California is driven by the growth of the medical industry in the state. Various healthcare and medical programs, such as Medi-Cal, are being launched by the government of California that offer healthcare services and facilities at a low price in the state. Cleanroom packaging such as bags and films is widely used in the healthcare industry, resulting in the launch and opening of several new cleanroom facilities in the Californian market.

The Washington state is expected to grow at a fast CAGR of 6.8% over the forecast period. Washington is a major aerospace hub with the presence of companies like Boeing, MIT Lincoln Laboratory, Draper, General Electric Aviation, and others. Cleanroom films & bags find valuable application in the aerospace industry due to the industry's demanding requirements for precision, cleanliness, and protection. Cleanroom film and bags are used to protect sensitive aerospace components, electronics, and equipment from contaminants.

Key Companies & Market Share Insights

The key players operating in the market include CFB Cleanroom Film and Bags (C-P Flexible Packaging), Tekni-Plex, Inc., Fruth Custom Packaging, Nelipak Corporation, PPC Flexible Packaging LLC, and others.

Major players operating in the market are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansion. For instance, in February 2023, PPC Flexible Packaging LLC announced the acquisition of StePac, a packaging manufacturer. This acquisition aided PPC Flexible Packaging LLC in expanding its cleanroom packaging production facilities in the U.S. market. Some of the prominent players operating in the U.S. cleanroom film and bags market are:

-

CFB Cleanroom Film and Bags (C-P Flexible Packaging)

-

Tekni-Plex, Inc.

-

AeroPackaging, Inc.

-

Fruth Custom Packaging

-

Pristine Clean Bags

-

Nelipak Corporation

-

PPC Flexible Packaging LLC

-

Degage Corp.

-

Plitek

-

Production Automation Corporation

U.S. Cleanroom Film and Bags Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,989.9 million

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, states

States scope

California, Ohio, Colorado, Connecticut, Maine, Maryland, New Jersey, New York, Oregon, Pennsylvania, Rhode Island, Vermont, Washington, Massachusetts

Key companies profiled

CFB Cleanroom Film and Bags (C-P Flexible Packaging), Tekni-Plex, Inc., AeroPackaging, Inc., Fruth Custom Packaging, Pristine Clean Bags, Nelipak Corporation, PPC Flexible Packaging LLC, Degage Corp., Plitek, Production Automation Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cleanroom Film and Bags Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cleanroom film and bags market report based on product, material, end-use, and states:

-

Product Outlook (Revenue, USD Million 2018 - 2030)

-

Bags

-

Pouches

-

Tape

-

Boxes

-

Films & Wraps

-

-

Material Outlook (Revenue, USD Million 2018 - 2030)

-

Plastic

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Others (PS, PVC, EVA)

-

-

Paper & Paperboard

-

-

End-use Outlook (Revenue, USD Million 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Electrical & Electronics

-

Others

-

-

States Outlook (Revenue, USD Million 2018 - 2030)

-

California

-

Ohio

-

Colorado

-

Connecticut

-

Maine

-

Maryland

-

New Jersey

-

New York

-

Oregon

-

Pennsylvania

-

Rhode Island

-

Vermont

-

Washington

-

Massachusetts

-

Frequently Asked Questions About This Report

b. The U.S. cleanroom film and bags market was estimated at around USD 1.29 billion in the year 2022 and is expected to reach around USD 1,360.0 million in 2023.

b. The U.S. cleanroom film and bags market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach around USD 1,989.9 million by 2030.

b. Pharmaceuticals emerged as a dominating end-use industry with a value share of around 52.3% in the year 2022 owing to the continuous development and manufacturing of pharmaceutical drugs and biologics is fueling the demand for cleanroom packaging.

b. The key market player in the U.S. cleanroom film and bags market includes CFB Cleanroom Film and Bags (C-P Flexible Packaging), Tekni-Plex, Inc., AeroPackaging, Inc., Fruth Custom Packaging, Pristine Clean Bags, Nelipak Corporation, PPC Flexible Packaging LLC, Degage Corp., Plitek, Production Automation Corporation.

b. The rising demand for convenient & efficient packaging solution in end-use industries such as food & beverage, pharmaceuticals, and microelectronics is expected to drive the U.S. cleanroom films and bags Market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."