- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Underwater Concrete Market Size Report, 2030GVR Report cover

![Underwater Concrete Market Size, Share & Trends Report]()

Underwater Concrete Market Size, Share & Trends Analysis Report By Raw Material (Admixtures, Aggregates), By Application (Hydro Projects, Marine, Tunnels, Shore Protection), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-350-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Report Overview

The global underwater concrete market size was valued at USD 159.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030. The underwater concrete market is experiencing significant growth driven by the increasing demand for marine construction projects, such as bulk terminals, oil platforms, and wind farms, as well as the growing emphasis on environmental sustainability and advancements in underwater building technologies and techniques.

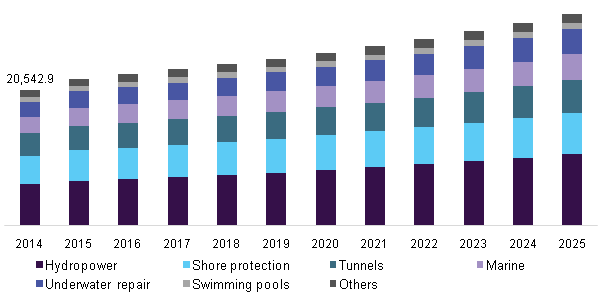

U.S. underwater concrete market revenue, by application, 2014 - 2025 (USD Million)

The underwater concrete market is experiencing significant growth driven by the increasing demand for specialized concrete mixes for constructing and maintaining underwater structures. This growth is primarily attributed to the rising marine infrastructure projects, such as port construction, harbor development, and offshore wind farms. The unique properties of underwater concrete, including its durability, resistance to water penetration, and ability to set and cure effectively while submerged, make it an ideal solution for these projects.

The Indian Government’s recent initiatives to improve port infrastructure, promote eco-friendly methods, and support global partnerships have also contributed to the growth of the underwater concrete market. The “Amrit Kaal Vision 2047” for the Indian maritime blue economy aims to drive sustainable development and promote environmentally friendly practices. As a result, manufacturers are focusing on creating new concrete mixtures that have lower CO2 emissions, reduced energy consumption, and higher durability to meet consumers’ demands for eco-sustainable products.

In addition, technological advancements in the development of new and advanced materials, such as geopolymer and self-healing concrete, are also driving the growth of the underwater concrete market. These innovative materials have better environmental characteristics and significantly enhance the service life of underwater infrastructure, making them an attractive option for manufacturers and consumers alike. As a result, the market is poised for continued growth as demand for eco-friendly and sustainable products continues to increase.

Raw Material Insights

Aggregate segment dominated the market and accounted for a share of 56.2% in 2023, driven by the need for robust, long-lasting, and stable marine structures. The addition of gravel, sand, and crushed stones enhances the concrete’s resistance to water and chemical damage, making it an essential component for marine construction projects.

Admixture segment is expected to register the fastest CAGR of 3.8% during the forecast period. The incorporation of high-performance admixtures in underwater concrete is crucial for enhancing fluidity, facilitating placement and compaction, and ensuring structural integrity. Regulatory bodies are enforcing stricter quality standards to guarantee the safety and durability of underwater constructions, driving the demand for advanced admixtures in the marine construction industry.

Application Insights

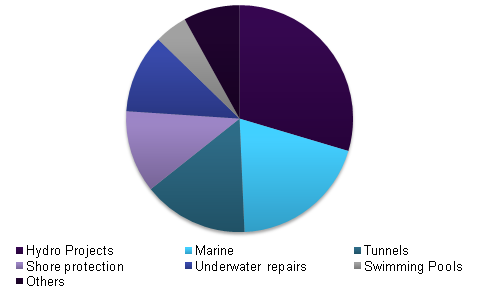

Hydro projects accounted for the largest market revenue share of 33.4% in 2023. The widespread use of underwater concrete in hydropower projects, including dams, reservoirs, and power facilities, demands high-quality, durable, and trustworthy materials. The importance of structural integrity and longevity necessitates the use of specialized underwater concrete, which can withstand extreme water pressure and environmental conditions.

Marine segment is expected to register the second-fastest CAGR of 3.6% over the forecast period, owing to the demand for strong and durable structures in marine environments, fueled by projects such as coastal infrastructure development, offshore energy installations, and underwater transportation infrastructure. Government funding and initiatives in maritime infrastructure also contribute to the market’s growth and expansion.

Regional Insights

Asia Pacific underwater concrete market dominated the global underwater concrete market in 2023 with a revenue share of 56.7%. The rapid growth of urban centers in Asia, particularly India, Japan, and China, is driving the demand for new harbors, ports, and coastal infrastructure. Underwater concrete’s durability and reliability make it an ideal material for challenging underwater construction projects. Technological advancements, government initiatives, and infrastructure investments are fueling market growth.

China Underwater Concrete Market Trends

The underwater concrete market in China dominated the Asia Pacific underwater concrete market with a share of 64.4% in 2023. China’s expanding global trade requires larger and deeper ports, increasing demand for underwater concrete. The country’s energy plan is driving the development of offshore wind farms, necessitating massive underwater concrete foundations. Moreover, coastal erosion and rising sea levels are prompting significant investments in seawalls and breakwaters, further boosting demand.

North America Underwater Concrete Market Trends

North America underwater concrete market was identified as a lucrative region in 2023 due to substantial investments in marine infrastructure, port expansions, and building maintenance. For instance, in April 2024, the U.S. government revealed a significant USD 20 billion initiative to rejuvenate the nation’s maritime infrastructure. This funding will upgrade shipyards, enhance domestic crane production, and modernize port facilities, solidifying the region’s position in global maritime trade. Advanced technology and strict environmental regulations are driving innovation in concrete mixtures, prioritizing durability and sustainability.

The underwater concrete market in the U.S. is expected to grow rapidly in the coming years. The demand for underwater concrete is expected to surge as advanced materials and techniques are adopted in underwater construction methods. The growth of marine infrastructure projects, such as renewable energy initiatives and offshore wind turbines, is expected to create opportunities for suppliers in the U.S.

Europe Underwater Concrete Market Trends

Europe underwater concrete market is anticipated to witness significant growth in the global underwater concrete market. The aging marine infrastructure in coastal nations, including ports, harbors, and offshore structures, necessitates regular maintenance, repair, and rehabilitation to ensure safe and efficient operations. Moreover, Europe’s stringent environmental regulations to protect marine ecosystems and reduce pollution are driving the demand for underwater concrete, presenting a significant business opportunity.

The underwater concrete market in the UK held a substantial market share in 2023. The UK’s aging marine infrastructure demands continuous maintenance, repair, and rehabilitation to ensure safe and efficient operations. Strict environmental regulations are driving the need for underwater concrete, while substantial investments in upgrading marine infrastructure create opportunities for stakeholders.

Key Companies & Market Share Insights

Some key companies in the underwater concrete market include Cemex, S.A.B. de C.V.; Heidelberg Materials; Sika AG; Conmix; Don Construction Products Ltd.; and others. Market players are developing advanced data integration and analytics capabilities to expand commercial applications, and partnering with startups to create innovative solutions.

-

Cemex, S.A.B. de C.V. is a producer of construction materials, offering a diversified portfolio of products including cement, ready-mix concrete, aggregates, and clinker. The company’s comprehensive range of offerings includes asphalt, concrete blocks, pipes, and precast products for various infrastructure applications, such as bridges, roads, and buildings.

-

MUHU (China) Construction Materials Co., Ltd is a specialized producer of concrete admixtures, focusing on research, development, and distribution of chemical additives. The company’s product portfolio includes construction chemicals, water reducers, accelerators, retarders, anti-freeze products, coatings, adhesives, and waterproofing materials, catering to the demands of the construction industry.

Key Underwater Concrete Companies:

The following are the leading companies in the underwater concrete market. These companies collectively hold the largest market share and dictate industry trends.

- Cemex, S.A.B. de C.V.

- Heidelberg Materials

- Sika AG

- Conmix

- Don Construction Products Ltd.

- Titan America LLC

- MUHU (China) Construction Materials Co., Ltd

- Buzzi S.p.A.

- Ashland

- Rockbond SCP

Recent Developments

-

In July 2024, Cemex supplied concrete for the reconstruction of the NASA Causeway Bridge, enhancing access for rocket transportation to the Kennedy Space Center. The company delivered over 60,000 cubic yards of high-strength concrete for the project.

-

In June 2024, Heidelberg Materials Spain ceased clinker production at the Añorga facility, refocusing on low-carbon cement to enhance sustainability and align with its global climate plan. The move aimed to reduce CO2 emissions by 47% by 2030 and achieve 50% sustainable revenue.

Underwater Concrete Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 164.7 billion

Revenue forecast in 2030

USD 202.9 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Thailand, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, Oman, Kuwait, Qatar

Key companies profiled

Cemex, S.A.B. de C.V.; Heidelberg Materials; Sika AG; Conmix; Don Construction Products Ltd.; Titan America LLC; MUHU (China) Construction Materials Co., Ltd; Buzzi S.p.A.; Ashland; Rockbond SCP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Underwater Concrete Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global underwater concrete market report based on raw material, application, and region.

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Admixture

-

Cement

-

Aggregates

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hydro Power

-

Marine

-

Shore Protection

-

Underwater Repairs

-

Tunnels

-

Swimming Pools

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."