Ultrasound Devices Market Size, Share & Trends Analysis Report By Application (Cardiology, Radiology), By Portability (Handheld, Compact), By End-use (Hospitals, Imaging Centers), By Product (Therapeutic, Diagnostic), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-814-5

- Number of Report Pages: 190

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Ultrasound Devices Market Size & Trends

The global ultrasound devices market size was estimated at USD 9.79 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.24% from 2024 to 2030. The market growth is poised to be driven by the rising usage of ultrasound equipment for diagnostic imaging and treatment, along with the increasing prevalence of chronic and lifestyle disorders. Other factors influencing market growth include increased demand for minimally invasive surgeries and frequent developments in ultrasound imaging technology. Ultrasound is a leading diagnostic tool in medical imaging, compared to other diagnostic imaging systems, since it is less expensive and faster. Moreover, as it does not utilize ionizing radiation or magnetic fields, it is safer than other imaging technologies.

Both diagnostic and therapeutic uses for the ultrasonic medical device are extensive. Specific therapeutic applications of ultrasound, from oncology to cardiology, have grown in popularity. The development of wireless transducers, app-based ultrasound technology, fusion with CT/MR, laparoscopic ultrasound, and the expansion of ultrasound device applications in 3D imaging and shear wave elastography are expected to support market growth. For instance, in March 2023, KronosMD, INC., a division of Kronos Advanced Technologies Inc., confirmed its acquisition of all current and future properties and patents related to its planned breakthrough 3D ultrasonic dentistry imaging and diagnostic equipment.

As the transaction approaches completion, it aims to boost the industrialization of the S-WAVETM system and S-WAVETM ultrasonic imaging equipment. Currently, manufacturers are focusing on expanding product applications in radiology. Radiologists still utilize 2-D ultrasound imaging for examinations even though 3-D/4-D volume imaging in obstetrics and gynecology and 4DUS imaging are used to visualize heart wall movements. Manufacturers and scientists have driven interest in the market due to improved imaging quality and workflow and growing awareness about radiation dose issues with other imaging modalities. Real-time ultrasound imaging can be very important in the emerging field of fusion imaging.

Due to radiologists' predilection for modalities, such as CT and MRI, ultrasound fusion imaging needs to be more well-established in the radiology industry. Radiologists are concentrating more on the market due to recent developments in ultrasound imaging technology and growing radiation exposure concerns. The COVID-19 pandemic has led the healthcare sector to face many difficulties. As installations were delayed and manufacturers had to concentrate on producing COVID-critical devices, there was an uneven demand for ultrasound devices during the pandemic. However, handheld ultrasound devices were in high demand due to their effectiveness, portability, speed, and usability in treating patients needing critical care in crowded hospitals.

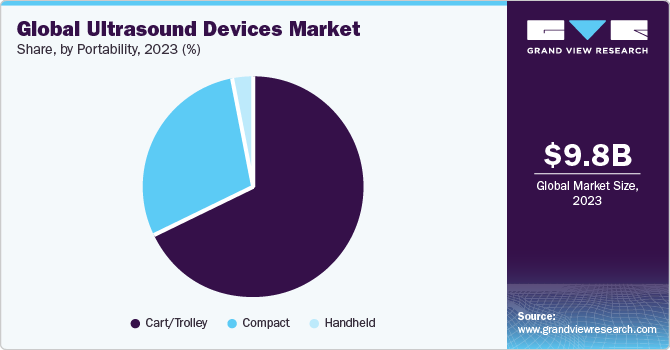

Portability Insights

The cart/trolley-based ultrasound devices segment accounted for the largest revenue share of over 67.75% in 2023. By transporting the device to the patient's location, whether it is an Intensive Care Unit (ICU) or an emergency department, cart/trolley ultrasounds completely avoid the issue of transferring critical patients. Furthermore, it aids in rapid diagnosis, treatment decision-making, and administration, contributing to increased patient recovery and satisfaction. The handheld ultrasound devices segment is anticipated to register the fastest growth rate of 5.73% from 2024 to 2030. Handheld devices are in high demand due to the growing trend of home healthcare and remote patient monitoring.

During the COVID-19 pandemic, handheld ultrasound devices have proven efficient in monitoring critically ill patients. Thus, since the pandemic, the demand for handheld ultrasound devices has only been accelerating. Technological advancements are further expected to boost market growth. For instance, in January 2023, a novel cordless handheld ultrasonic device called the PocketPro H2 was introduced by Konica Minolta Healthcare Americas, Inc. for application in point-of-care settings for general screening. With the PocketPro H2, offering an entirely novel form of versatility and cost in ultrasound imaging, Konica Minolta Healthcare teamed up with Healcerion to offer it across the U.S. for use in human and animal purposes.

Market Dynamics

The rising use of ultrasound equipment for diagnostic imaging & therapy and the rising prevalence of chronic and lifestyle-related illnesses are the key factors anticipated to drive market growth. Ultrasound technology is used in various application areas, such as cardiology, obstetrics/gynecology, vascular, orthopedic, & general imaging. The rising prevalence of cardiac disorders is expected to boost overall market growth. According to the WHO, Cardiovascular Diseases (CVDs) are the major cause of death globally, taking approximately 17.9 million lives annually. In addition, as per the CDC, in the U.S., every year, about 805,000 people have a heart attack and about one in 20 adults (about 5%) aged 20 years & older have coronary artery disease.

Furthermore, a comprehensive report by the WHO states that around 17.5% of adults, or around one in six globally, face infertility issues, resulting in an urgent demand for high-quality & affordable fertility care. As per the American Society of Clinical Oncology (ASCO), around 66,200 inhabitants in the United States are projected to be diagnosed with uterine or endometrial cancer in 2023. Annually, the amount of people diagnosed with uterine cancer in the country is growing by almost 2% in women aged 49 years & below, and by 1% in women older than this age group. Ultrasound devices are used to assess the pelvic anatomy of the uterus, including the uterine lining & bilateral ovaries. These factors are aiding in driving the market growth.

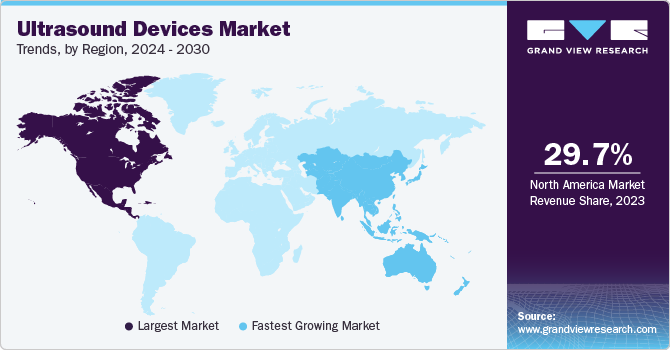

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 29.75% in 2023. The region is expected to grow at a significant rate from 2024 to 2030. The presence of a significant number of competitors in the region and an increasing number of cancer cases are key factors contributing to regional market growth. Increasing expenditure on healthcare, a greater understanding of various methods of diagnosis, and favorable policies for reimbursement are projected to drive regional market growth.

Asia Pacific is estimated to register the fastest CAGR of 4.90% from 2024 to 2030 owing to the increased demand for better imaging devices. Furthermore, key players are adopting different strategies to strengthen their presence in this region. Factors, such as low research costs, less stringent regulatory guidelines, increased government funding for the R&D sector’s development in the respective countries, are making the region attractive for research studies. Moreover, rapidly developing economies and improving healthcare services in Southeast Asian countries, such as China, Japan, and India, are expected to propel growth.

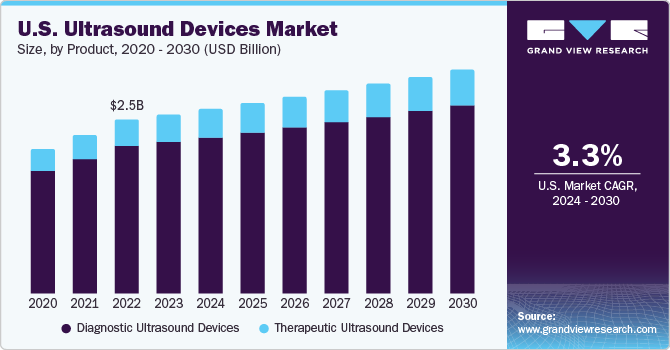

Product Insights

The diagnostic ultrasound devices segment accounted for the largest revenue share of more than 84.27% in 2023 owing to the wide range of applications in obstetrics, cardiology, and oncology. The demand for diagnostic ultrasound devices is also anticipated to increase due to technological improvements and rising prevalence of various lifestyle-related diseases. The regulatory approvals of ultrasound devices are the main driver of the segment's growth. For instance, in September 2022, Koninklijke Philips N.V. declared that the Food & Drug Administration (FDA) 510(k) approval was successfully awarded for its cutting-edge 5000 Compact Series, the company's most recent tiny ultrasonic system.

This most recent authorization enhances ultrasound accessibility efficiency by utilizing the latest advances in Philips ultrasound technology generated to provide cart-based high-quality images in small format, involving an array of ultrasound diagnosis remedies that cater to the requirements of many medical areas of expertise, such as medical care, obstetrics, general imaging, cardiology, and gynecology. The rising need for advanced diagnostic instruments, such as miniaturized 2D and 3D/4D, is also expected to fuel the market growth for diagnostic ultrasound devices. The segment is further divided into 2D, 3D/4D, and Doppler.

The therapeutic ultrasound devices segment is estimated to register the fastest CAGR of 4.90% from 2024 to 2030. This segment is further divided into high-intensity focused ultrasound and extracorporeal shockwave lithotripsy. The high-intensity focused ultrasound segment held the largest revenue share in 2023 and is expected to grow significantly over the forecast period since these devices are highly effective in treating cancers and other related disorders. For instance, according to the American Cancer Society Journals, in 2023, 1,958,310 new cancer cases and 609,820 cancer deaths are projected to occur in the U.S.

Application Insights

The radiology segment held the largest revenue share of over 22.33% in 2023. The increasing application of artificial intelligence (AI) in radiology boosts the segment growth. Moreover, rising merger & acquisition activities among key players for expanding the product portfolio drive the market growth. For instance, in February 2023, GE HealthCare disclosed the execution of a contract to purchase Caption Health, Inc. This privately held AI health services company develops medical devices that help in early disease diagnosis, including the application of AI to assist in scanning for ultrasounds.

Ultrasonic investigations can be made simpler and quicker with Caption AI tools, allowing more medical professionals to undergo basic echocardiography evaluations. This device can identify indications of diseases, such as cardiac failure, in at-risk patients throughout healthcare facilities, the home, and alternate care places, thereby saving hospitalizations and enabling better medical results. The obstetrics/gynecology segment is anticipated to grow at the fastest rate of over 4.92% from 2024 to 2030. Obstetrics and gynecology have been transformed by ultrasound technology.

During pregnancy, obstetric ultrasonography is used to monitor fetal development and check maternal health. Gynecological ultrasound is used to identify problems, such as ovarian cysts, uterine fibroids, and endometriosis. For instance, in June 2022, Mindray launched the ultrasonic machine Imagyn I9 was created to cater to the special needs of busy OB/GYN settings. This device was developed to meet the rigorous standards set by OB/GYN facilities. The recently released system includes a completely free-floating interface for users, enhanced transducer ports, and unique E-Ink keys, emphasizing accessibility and ergonomics in the OB/GYN arena.

End-use Insights

The hospitals segment held the largest revenue share of over 40.45% in 2023 and is expected to maintain its lead over the forecast period. The segment growth can be attributed to the extensive use of ultrasound devices in hospital settings and an increased number of patients visiting hospitals with various lifestyle-related disorders. Introducing portable systems is expected to fuel the demand for ultrasound devices in OPD and in-patient departments.

Furthermore, a rise in the adoption of technologically advanced imaging systems and increasing merger & acquisition activities between hospitals and market players are likely to boost the demand for new installations in the coming years. For instance, in 2020, Philips signed a multi-year contract to support the expansion and improvement of Zhejiang University's First Affiliated Hospital, one of China's leading hospitals. This contract comprises Ultrasound, Image-Guided Therapy, Monitoring Analytics, and therapeutic Care systems, which combine clinical research and education.

Key Companies & Market Share Insights

Major players are working to improve their product offerings by upgrading their products, taking advantage of important cooperation activities, and exploring acquisitions and government clearances to expand their customer base and gain a larger market share. For instance, in March 2023, Siemens Healthineers announced the evolution of the Acuson Sequoia Flagship series of ultrasound devices at the European Congress of Radiology (ECR), 2023, in Vienna. With an estimated growth rate of 6.3% to reach a value of USD 9.0 billion by 2026, Ultrasound is one of the fastest-growing global markets.

In addition, in February 2023, Boston Imaging launched the Hera W10 Elite, the exclusive model of the Hera platform for obstetrics and gynecology, providing clinicians with powerful AI tools and clinical applications to enhance the diagnostic experience. Boston Imaging is the U.S. headquarters for marketing, sales, and distribution of all Samsung digital radiography and ultrasound systems.

Key Ultrasound Devices Companies:

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- FUJIFILM SonoSite, Inc.,

- Konica Minolta Inc.

- Esaote

Ultrasound Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.19 billion |

|

Revenue forecast in 2030 |

USD 13.07 billion |

|

Growth rate |

CAGR of 4.24% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, portability, applications, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ultrasound Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrasound devices market report on the basis of product, portability, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Ultrasound Devices

-

2D

-

3D/4D

-

Doppler

-

-

Therapeutic Ultrasound Devices

-

High-intensity Focused Ultrasound

-

Extracorporeal Shockwave Lithotripsy

-

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Compact

-

Cart/Trolley

-

Point-of-Care Cart/Trolley Based Ultrasound

-

Higher-end Cart/Trolley Based Ultrasound

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Obstetrics/Gynaecology

-

Radiology

-

Orthopaedic

-

Anaesthesia

-

Emergency Medicine

-

Primary Care

-

Critical Care

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centres

-

Research Centres

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ultrasound devices market size was estimated at USD 9.79 billion in 2023 and is expected to reach USD 10.19 billion in 2024.

b. The global ultrasound devices market is expected to grow at a compound annual growth rate of 4.24% from 2024 to 2030 to reach USD 13.07 billion by 2030.

b. North America dominated the ultrasound device market with a share of 29.75% in 2023. This is attributable to the presence of a significant number of market competitors in the region and the increasing number of cancer cases.

b. Some key players operating in the ultrasound devices market include Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, Canon Medical Systems, Mindray Medical International Limited, Samsung Medison Co., Ltd., FUJIFILM SonoSite, Inc., Konica Minolta Inc., and Esaote

b. Key factors that are driving the ultrasound device market growth include an increase in the adoption of ultrasound devices for diagnosis and treatment, rising demand for minimally invasive procedures, and technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."