- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Tempered Glass Market Size, Share & Growth Report, 2030GVR Report cover

![Tempered Glass Market Size, Share & Trends Report]()

Tempered Glass Market Size, Share & Trends Analysis Report By Type (Plain Glass, Colored Glass), End-use (Automotive, Construction, Consumer Electronics, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-704-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Tempered Glass Market Size & Trends

The global tempered glass market size was valued at USD 50.08 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. Rising demand from the automotive sector and increasing awareness regarding tempered glass benefits in the automotive and electronic industries among consumers in developing regions are expected to propel industry growth over the forecast period. Tempered glass is manufactured by chemical treatment or controlled thermal processes to increase its strength as compared to annealed glass. The product is employed in numerous applications including shower doors, passenger vehicle windows, refrigerator trays, and architectural doors and tables. Moreover, it is used as a component in the manufacturing of bulletproof products, mobile screen protectors, cookware, and diving masks on account of superior properties including high strength and safety features.

Rising construction spending in various regions including North America, Europe, Asia-Pacific, and MEA, coupled with rising need for durable building materials, is expected to fuel product demand over the next few years. Moreover, growing architectural trend toward the use of glass in building façades is expected to positively impact the demand for tempered glass during the forecast period.

Growing automobile industry, particularly in emerging economies of Asia Pacific including India and China, is another factor driving the market. However, rising use of laminated glass for automobile manufacturing on account of properties such as lightweight and anti-breakage is expected to challenge industry growth over the next few years.

Tempered glass is particularly employed when safety, thermal resistance, and strength are the key considerations. Over the past few years, screen protectors have been developed and introduced in the market for mobiles. They serve as an additional protection cover for cell phones as compared to the traditional plastic type screen protector. Growth of the global smart phone industry is expected to boost the product consumption over the forecast period.

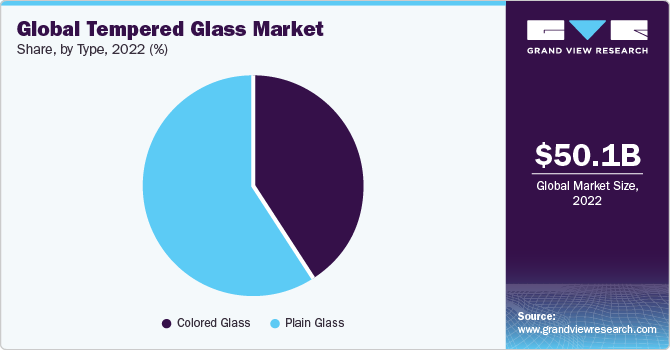

Type Insights

The plain glass segment accounted for the largest revenue share of 59.4 % in 2022.Growing demand from the automotive and electronic sector, and the penetration of glass architecture in residential and non-residential constructions are expected to drive market growth over the forecast period.

The colored glass segment is expected to grow at the fastest CAGR of 8.0% during the forecast period. Factors such as growing demand in the automotive and architectural industries for colored glass products, the increasing popularity of windows with stained glass in homes and other commercial and industrial buildings along with the growing need in the hospitality industry for decorative glass products are anticipated to fuel the market growth. Additionally, technological advancements are making it possible to produce more colorful and intricate designs in colored glass products.

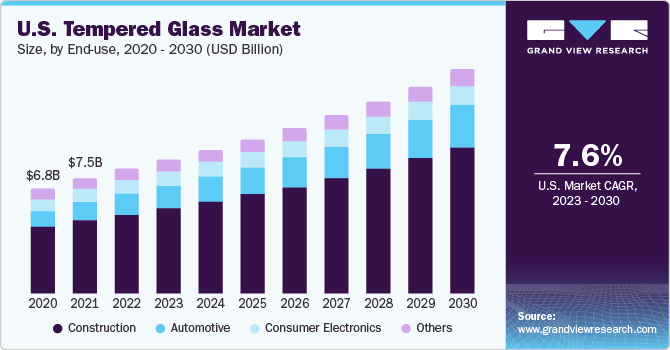

End-use Insights

The construction segment accounted for the largest revenue share of 66.0 % in 2022. The product finds application in both exterior and interior elements of a structure in order to improve its aesthetic value and avoid fragility. Increasing government expenditure on infrastructural development and rapid urbanization in emerging economies like India are expected to augment product demand over the next few years.

The automotive segment is expected to grow at the fastest CAGR of 9.2% during the forecast period. Increasing use of tempered glass in the manufacturing of backlights and windows is expected to propel its demand over the forecast period. Although, it faces competitive disadvantage as compared to laminated glass as it is more resilient to breakage and comprises greater capabilities in terms of pressure resistance.

Increasing product use in niche applications including as a component of ovens in the baking and cooking sector, electrical and electronics, and solar industry is expected to positively impact industry growth over the forecast period. The solar module industry is anticipated to have a positive impact on the product demand during the forecast period.

Regional Insights

Asia Pacific dominated the global market and accounted for the largest revenue share of 40.0% in 2022 and is expected to grow at the fastest CAGR of 8.2% during the forecast period. The region is expected to witness significant growth in the automobile industry on account of rising vehicle manufacturing in India, China, and Malaysia. Various manufacturers use tempered class in car windows due to its tendency of not breaking into small parts as compared to basic glass that breaks into sharp pieces, which can cause injuries.

The market in North America is relatively mature and is characterized by new product developments. As of 2022, the region held the second-largest share in revenue. The U.S. is a predominant market in the region due to rising tempered glass application in architectural projects. Europe held a significant revenue share in 2022. Substantial growth of the automobile industry generated a healthy demand in the region. Western European countries, particularly the UK, France, and Germany, are the largest applicants of tempered glass.

Key Companies & Market Share Insights

The companies through mergers & acquisitions, capacity expansion, partnerships, and others are trying to increase their sales to facilitate the respective market across the globe.

Key Tempered Glass Companies:

- Saint-Gobain

- AGC Inc.

- Nippon Sheet Glass Co., Ltd

- Guardian Industries

- GSC GLASS LTD

- CARDINAL GLASS INDUSTRIES, INC

Recent Developments

-

In June 2023, Oldcastle BuildingEnvelope, completed the acquisition of Syracuse Glass Company that provides independent fabrication and distribution of architectural glass to glass merchants throughout Eastern Pennsylvania, Upstate New York, and New England. According to the company representatives, Oldcastle BuildingEnvelope purchased Syracuse Glass Company to increase its footprint in the Northeastern U.S.

-

In January 2023, AGC Inc. developed a digital twin technology, the Optimization Assistant (COCOA) and CADTANK Online Computation, for the glass melting process. This combines an online simulator with a digital prototype tool. With the help of this technology, it is now possible to quickly and thoroughly comprehend the glass melting process as well as conduct a preliminary analysis of the production environment, both of which were previously challenging tasks.

-

In January 2023, Guardian Glass announced an agreement for the acquisition of Vortex Glass, a fabrication business based in Miami, Florida. By combining its cutting-edge operations and products with Vortex's manufacturing capabilities, Guardian is better positioned to assist clients in adhering to changing building safety and energy-saving laws.

-

In May 2022, Nippon Sheet Glass Co., Ltd announced its plan to integrate their China-ased automotive glass business with a major Chinese automotive glass manufacturer, SYP Kangqiao Autoglass Co., Ltd., a Chinese producer of automobile glass. The aim of the integration into SYP Automotive was to consolidate their ability to meet the rising needs of automakers in China.

-

In August 2021, AGC Inc. declared that Cardinal Glass Industries, Inc had successfully acquired its architectural glass business in North America. Cardinal Glass Industries, Inc acquired the assets of AGC Glass in Tennessee, Virginia, Abingdon, and Spring Hill, Churchill, Kansas.

-

In April 2021, Aircel Inc. finished the acquisition of Cleer Vision Windows Inc., a tempered and specialty glass manufacturer. This enhanced its product line and clientele.

-

In August 2020, TOMAKK GLASS PARTNERS LLC, with an investment of USD 195 million, expanded the company's operations and product line by opening a tempered glass manufacturing facility in Shreveport, Louisiana, in the U.S.

-

SATINAL, an Italian safety glass manufacturer, introduced the first chemically tempered glass made by a third party specifically for the marine industry.

Tempered Glass Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 53.83 billion

Revenue forecast in 2030

USD 91.66 billion

Growth rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Million Sq. Meters, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, End-use , Region

Regional scope

North America; Europe; Asia Pacific; Latin America; & MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Mexico; Saudi Arabia; South Africa; UAE; Oman; Qatar

Key companies profiled

Saint-Gobain; AGC Inc.; Nippon Sheet Glass Co., Ltd; Guardian Industries; GSC GLASS LTD; CARDINAL GLASS INDUSTRIES, INC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

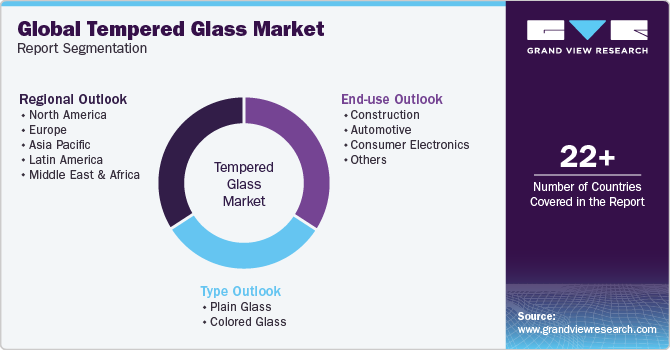

Global Tempered Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global tempered glass market on the basis of type, end-use and region:

-

Type Outlook (Volume, Million Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Plain Glass

-

Colored Glass

-

-

End-use Outlook (Volume, Million Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Residential Construction

-

Commercial Construction

-

Industrial Construction

-

-

Automotive

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Volume, Million Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Malaysia

-

Indonesia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global tempered glass market size was estimated at USD 53.83 billion and is expected to reach USD 57.92 billion in 2023.

b. The global tempered glass market is expected to grow at a compound annual growth rate of 7.9% from 2022 to 2030 to reach USD 91.66 billion by 2030.

b. Construction dominated the tempered glass market with a share of 65.9 % in 2022. This is attributable to rising demand from the infrastucture sector on account of growing investments from different governments to boost the economy.

b. Some key players operating in the tempered glass market include Guardian Industries, AGC Group, NSG Group, Saint-Gobain, Dillmeier Glass Company, Trulite, and Interpane Glas Industrie AG.

b. Key factors that are driving the market growth include increasing awareness regarding tempered glass benefits in the automotive and electronic industries among consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."