- Home

- »

- Plastics, Polymers & Resins

- »

-

Sustainable Plastic Packaging Market Size Report, 2030GVR Report cover

![Sustainable Plastic Packaging Market Size, Share & Trends Report]()

Sustainable Plastic Packaging Market Size, Share & Trends Analysis Report By Material (PE, PP, PET, PVC, Bioplastics), By Type, By Packaging Format, By Process, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-259-8

- Number of Pages: 220

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Sustainable Plastic Packaging Market Trends

The global sustainable plastic packaging market size was estimated at USD 100.49 million in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. Increased awareness of environmental issues, such as plastic pollution, has led to a growing demand for sustainable alternatives. In addition, consumer demand for sustainability and stringent regulations & policies for reducing plastic waste is triggering demand for sustainable plastic packaging solutions across the world.

According to the Environmental Protection Agency (EPA), In 2021, the United States generated approximately 40 million tons of plastic waste, of which only 5% to 6% (about two million tons) was recycled. This recycling rate signifies a significant challenge in plastic waste management. Plastics take hundreds of years to decompose in landfills. More plastic waste means more landfill space being used up more quickly. Recycling reduces plastic landfill waste. Hence, increasing plastic waste is expected to positively influence the U.S. market.

In addition, consumer preferences are also playing a pivotal role in driving the market growth. There has been a noticeable shift in consumer behavior, with an increasing number of individuals opting for products that are packaged in an environmentally responsible manner. This demand for sustainable packaging is driving companies to incorporate eco-friendly materials and practices into their supply chains to enhance their brand image and meet consumer expectations. As consumers become more informed and environmentally conscious, they are likely to continue influencing market trends by favouring products that align with their values.

Furthermore, stringent regulations and policies aimed at curbing single-use plastics are pushing companies to adopt sustainable practices. Governments around the world are implementing measures to reduce the use of traditional plastics and encourage the adoption of recyclable, biodegradable, or compostable alternatives. As a result, businesses are compelled to invest in sustainable packaging solutions to comply with evolving regulatory landscapes. This regulatory push is acting as a catalyst for the adoption of environmentally friendly materials and is reshaping the competitive landscape of the sustainable plastic packaging industry.

Moreover, the collaboration between stakeholders, including plastic packaging manufacturers, raw material suppliers, and recycling facilities, is benefiting the overall sustainable plastic packaging ecosystem. For instance, in November 2023, Amcor Plc, a renowned global company known for its development and production of environmentally conscious packaging solutions, revealed a Memorandum of Understanding (MOU) with NOVA Chemicals Corporate, a leading producer of sustainable polyethylene. The agreement includes the procurement of mechanically recycled polyethylene resin (rPE) from NOVA Chemicals Corporate, which will be utilized in the production of flexible packaging films. This initiative aligns with Amcor's dedication to promoting packaging circularity by increasing the utilization of rPE in flexible packaging applications.

Market Concentration & Characteristics

Prominent sustainable plastic packaging companies operating in the market include Amcor plc, Sealed Air, Sonoco Products Company, Smurfit Kappa, Berry Global Inc.; Tetra Pak, Elevate Packaging, Huhtamaki Oyj, Mondi, DS Smith, Elopak AS, UFlex Limited, Constantia Flexibles, Genpak, Reynolds Packaging, Crown Holdings, Inc.; Gerresheimer AG, Novamont S.p.A., EPL Limited, Ernest Packaging Solutions, NEFAB GROUP, TIPA LTD, Farnell Packaging, Greiner Packaging, and Greendot Biopak.

Companies are increasingly focusing on the introduction of sustainable packaging products in the global market. For instance, in November 2023, Yara introduced sustainable packaging to reduce its environmental impact. The company aims to reduce the carbon footprint of its packaging materials by 40% by 2030 compared to 2021. Yara is using recycled plastic in its packaging materials, with at least 30% recycled plastic in big and small bags which were rolled out all over Europe during 2023. This initiative is part of Yara's ambition to grow a nature-positive food future and deliver a more sustainable food value chain.

In May 2023, Constantia Flexibles, Premji Invest, and SB Packagings formed the joint venture, which aims to establish a significant sustainable packaging platform in India and South Asia. This collaboration has received regulatory approval from the Competition Commission of India. The joint venture forged together two prominent leaders in the flexible packaging industry, with Premji Invest as a shareholder. By leveraging the distinctive strengths and resources of each company, the joint venture seeks to achieve greater success in the Indian market.

Material Insights

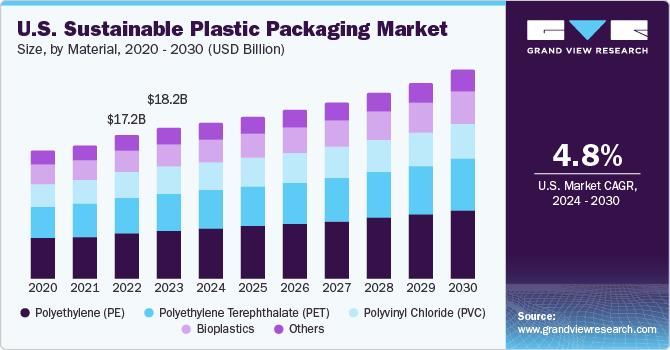

Based on material, the global market has been segmented into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), Bioplastics, and other materials. The polyethylene (PE) segment led the market with the largest revenue share of over 27.0% in 2023. PE is known for its durability and strength, which contributes to the longevity of the packaging. This can help protect the contents and reduce the likelihood of damage during transportation and handling.

The bioplastics material segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. This material is designed to be biodegradable or compostable, hence they can break down into natural components over time. This reduces the persistence of plastic waste in the environment and helps address the issue of plastic pollution.

Application Insights

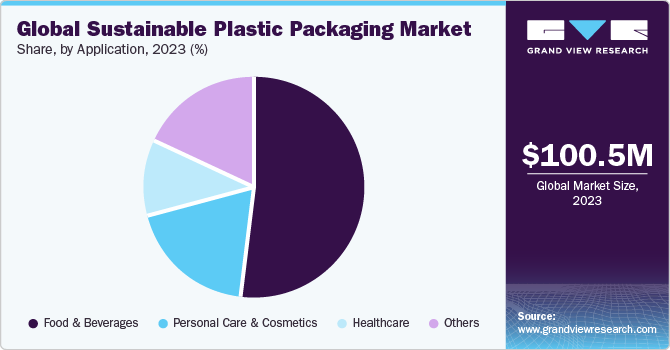

Based on application, the market is segmented into food & beverages, personal care & cosmetics, healthcare, and other applications. The food & beverages segment led the market with the largest revenue share of 51.7% in 2023. Many food & beverage companies recognize the importance of aligning their business practices with social and environmental responsibility. Adopting sustainable packaging is a visible way for companies to demonstrate their commitment to CSR.

The healthcare application segment is projected to grow at the fastest CAGR of 5.9% over the forecast period. Sustainable packaging materials are often designed to be free from harmful chemicals and additives. This is particularly crucial in the healthcare applications, where patient safety is a top priority. Using eco-friendly packaging materials can help ensure that products remain uncontaminated and safe for use.

Type Insights

Based on the type, the market is segmented into rigid and flexible packaging. The flexible type segment led the market with the largest revenue share of 68.1% in 2023. Flexible packaging typically requires less material than rigid packaging options. This results in less usage of plastic to create the packaging, resulting in a lower environmental impact.

The rigid plastic packaging provides excellent protection for products. It can withstand external pressures, impacts, and other environmental factors, ensuring that the contents remain intact and undamaged. This is particularly important for fragile or sensitive packaged items.

Packaging Format Insights

Based on packaging format, the market is segmented into primary, secondary, and tertiary packaging. The primary packaging segment held the market with the largest revenue share of 46.0% in 2023. Primary packaging helps in preserving the freshness, flavor, and overall quality of the product. It prevents exposure to elements that could lead to spoilage, contamination, or degradation of the product's sensory attributes.

Besides, secondary packaging shields the primary packaging and the product from external factors such as impacts, vibrations, and environmental conditions. This helps ensure that the product reaches its destination in optimal condition. Moreover, primary and secondary packaging is necessary for protecting individual products, however, tertiary packaging helps in minimizing overall packaging waste by consolidating multiple units into larger, more efficient loads. This can contribute to sustainability goals by optimizing the use of materials and reducing the environmental impact of packaging.

Process Insights

Based on process, the market is segmented into recyclable, reusable, and biodegradable. The biodegradable process segment led the market with the largest revenue share of 46.7% in 2023. Biodegradable materials decompose more easily, posing fewer risks to wildlife and ecosystems compared to non-biodegradable counterparts. Besides, many biodegradable packaging materials are derived from renewable resources, such as plant-based sources, which helps reduce dependence on finite fossil fuels.

The recyclable process segment is anticipated to grow at the fastest CAGR of 5.6% from 2024 to 2030. The adoption of a recyclable packaging process helps in reducing the overall volume of plastic waste generated. This is particularly important in addressing the global plastic pollution crisis and the challenges associated with managing and disposing of non-recyclable plastics.

Regional Insights

The sustainable plastic packaging market in North America is expected to grow at the fastest CAGR over the forecast period. The North America market is characterized by extensive research and development for developing innovative technologies and processes for manufacturing sustainable plastic packaging solutions. Many North American based big brands and retailers have made public commitments to use 100% reusable, recyclable or compostable packaging by 2025 - 2030. Companies such as Unilever, Nestle, Walmart, Target, and PepsiCo are redesigning packaging to reduce plastic waste.

U.S. Sustainable Plastic Packaging Market Trends

The sustainable plastic packaging market in U.S. is one of the largest packaged food industries in world owing to presence of a large population with high disposable income. Food companies are launching sustainable plastic packaging products for their food products to achieve their sustainability goals. For instance, Kellanova launched Cheez-It Snap'd, Cheez-It Puff'd, and Club Crisps with reduced plastic packaging, optimizing designs to reduce material weight by 672,000 pounds annually. This initiative aligns with Kellanova's Better Days Promise commitment to achieve 100% reusable, recyclable, or compostable packaging by 2030. Hence, this type of sustainable product launch is anticipated to positively influence the market in the U.S.

The Canada sustainable plastic packaging market held a significant revenue share in 2023, due to its pursuit of a circular economy with zero plastic waste agenda. The willingness of Canadians to pay premiums for sustainable food packaging showcases the awareness among consumers and the changing market dynamic.

Asia Pacific Sustainable Plastic Packaging Market Trends

Asia Pacific dominated the sustainable plastic packaging market with the largest revenue share of 43.67% in 2023. Rapid economic growth in countries such as China, India, and Southeast Asia is driving demand for consumer goods and packaged foods & beverages, which requires more sustainable packaging. In December 2023, SABIC and CJ Cheiljedang collaborated on sustainable packaging initiatives in Asia Pacific, aligning with CJ's 'Nature to Nature' sustainability roadmap. This partnership marks the launch of ISCC PLUS certified food packaging, emphasizing a commitment to environmentally friendly practices. Therefore, this type of strategic initiative is expected to benefit the Asia Pacific market.

The sustainable plastic packaging market in India is expected to grow at the fastest CAGR over the forecast period.In October 2023, Pakka Limited, a manufacturer specializing in compostable packaging solutions, has introduced India's first compostable flexible packaging in collaboration with Brawny Bear, a nutrition company. This initiative marks a significant milestone in India's packaging industry, aiming to address environmental concerns associated with conventional non-biodegradable plastic-based flexible packaging. This initiative establishes Pakka Limited as an industry’s prominent player in providing sustainable packaging solutions. This can create a ripple effect, encouraging other companies in the packaging industry to explore and invest in eco-friendly alternatives.

Europe Sustainable Plastic Packaging Market Trends

The sustainable plastic packaging market in Europe held a major revenue share in 2023, owing to the continuous innovations for promoting sustainable packaging. For instance, in November 2023, Nokia, a Finland-based company, took a significant step towards sustainability by transitioning to 100% recyclable packaging for its Fixed Networks Lightspan portfolio. This move aims to reduce packaging waste for its broadband access products. The new packaging is not only environmentally friendly but also more efficient, being 60% smaller and 44% lighter, which results in a reduction of CO2 emissions by up to 60%. Hence, this type of strategic decisions is estimated to accelerate the market growth in Europe.

The UK sustainable plastic packaging market is primarily driven by the increasing efforts made by the UK Government and manufacturers of food packaging products to reduce plastic pollution, and simultaneously develop environmentally friendly packaging products. For instance, in September 2023, the Reconomy Group, a Telford, UK-based resource management company, launched a sustainable food and drink container service for businesses throughout the UK. This service aims to help businesses switch to a reuse solution that is practical, commercially viable, and environmentally friendly.

Central & South America Sustainable Plastic Packaging Market Trends

The sustainable plastic packaging market in Central & South America is projected to grow at a significant CAGR from 2024 to 2030, due to the increasing demand for flexible packaging in the region. This increasing demand is attributed to the expansion of industries such as e-commerce and digital printing. Moreover, customers in the region are eager to pay more for specific product attributes boosted by sustainable plastic based flexible packaging.

The Brazil sustainable plastic packaging market is expected to register at the fastest CAGR over the forecast period. Research conducted in Brazil revealed concerning findings about greenwashing practices in supermarkets. A study led by researchers from the Federal University of Sao Paulo found that many products claiming to be biodegradable were not meeting the necessary requirements. These products, including plates, cutlery, cups, and straws, were priced higher but did not biodegrade as claimed, highlighting the challenges in the sustainability of plastic products. These developments underscore the growing importance of sustainable practices in the packaging industry and the need for genuine efforts to reduce plastic pollution and promote environmentally friendly alternatives.

Middle East & Africa Sustainable Plastic Packaging Market Trends

The sustainable plastic packaging market in Middle East & Africa is influenced by a growing population and government regulations related to plastic packaging. Countries in MEA have implemented strict regulations around packaging waste and single-use plastics. This has pushed companies to adopt more eco-friendly packaging such as bioplastics or compostable plastics.

The UAE sustainable plastic packaging market growth can be ascribed to initiatives taken by UAE government to achieve its sustainability goals and curb the usage of single use plastic in packaging. For instance, in December 2023, Dubai Municipality launched a comprehensive initiative to boost recycling efforts and reduce waste impact on the environment. This initiative involves distributing smart plastic packaging containers, setting up collection centers, and installing recovery devices at public facilities. The goal is to collect and recycle 3 million plastic packaging units, equivalent to around 60 tons of PET plastic commonly used in soft drink and food packaging.

Key Sustainable Plastic Packaging Company Insights

The market is fragmented with the presence of a significant number of companies. Sustainable plastic packaging industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

-

In December 2023, Melodea Ltd. launched a sustainable barrier coating product called MelOx NGen, designed to enhance the recyclability of plastic food packaging. The MelOx NGen coating serves as an eco-friendly alternative to petroleum-based Ethyl Vinyl Alcohol copolymers commonly used in packaging. This high-performance barrier coating is plant-sourced and approved by the Food and Drug Administration (FDA) for food contact. It is applied as a transparent layer inside various plastic packaging forms such as films, pouches, bags, lidding, and blister packs used for snacks, confectionery, nutrition bars, meats, dairy products, and pharmaceuticals

-

In September 2023, Sidel introduced StarLITE R, a novel 100% rPET bottle specifically designed for carbonated soft drinks. This innovative bottle aims to assist carbonated soft drinks packaging producers in adopting material circularity by offering a sustainable packaging solution. StarLITE R provides carbonated soft drink manufacturers with the opportunity to embrace rPET, contributing to eco-conscious bottle manufacturing and reducing plastic waste in the beverage industry

Key Sustainable Plastic Packaging Companies:

The following are the leading companies in the sustainable plastic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sealed Air

- Sonoco Products Company

- Smurfit Kappa

- Berry Global Inc.

- Tetra Pak

- Elevate Packaging

- Huhtamaki Oyj

- Mondi

- DS Smith

- Elopak AS

- UFlex Limited

- Constantia Flexibles

- Genpak

- Reynolds Packaging

- Crown Holdings, Inc.

- Gerresheimer AG

- Novamont S.p.A.

- EPL Limited

- Ernest Packaging Solutions

- NEFAB GROUP

- TIPA LTD

- Farnell Packaging

- Greiner Packaging

- Greendot Biopak

Sustainable Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 104.63 million

Revenue forecast in 2030

USD 148.38 million

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, packaging format, process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; Sealed Air; Sonoco Products Company; Smurfit Kappa; Berry Global Inc.; Tetra Pak; Elevate Packaging; Huhtamaki Oyj, Mondi; DS Smith; Elopak AS; UFlex Limited; Constantia Flexibles

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Plastic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sustainable plastic packaging market report based on material, type, packaging format, process, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polyvinyl Chloride (PVC)

-

Bioplastics

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Packaging Format Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Primary Packaging

-

Secondary Packaging

-

Tertiary Packaging

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Recyclable

-

Reusable

-

Biodegradable

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sustainable plastic packaging market size was estimated at USD 100.49 million in 2023 and is expected to reach USD 104.63 million in 2024.

b. The global sustainable plastic packaging market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 148.68 million by 2030.

b. Asia Pacific dominated the sustainable plastic packaging market with a share of 43.0% in 2023. This is attributable to rising demand for consumer goods and packaged foods & beverages, which requires more sustainable packaging.

b. Some key players operating in the sustainable plastic packaging market include TAmcor plc, Sealed Air, Sonoco Products Company, Smurfit Kappa, Berry Global Inc., Tetra Pak, Elevate Packaging, Huhtamaki Oyj, Mondi, DS Smith, Elopak AS, UFlex Limited, and Constantia Flexibles.

b. Key factors that are driving the market growth include increasing awareness of environmental issues, such as plastic pollution, has led to a growing demand for sustainable alternatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."