- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Sports Composites Market Size, Share, Growth Report, 2030GVR Report cover

![Sports Composites Market Size, Share & Trends Report]()

Sports Composites Market Size, Share & Trends Analysis Report By Reinforcement Material, By Resin Type, By Process Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-893-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Sports Composites Market Size & Trends

The global sports composites market size was valued at USD 3.82 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The increasing popularity of sports and rising sports participation to stay fit and healthy has led to the growing need for lightweight materials in sports and recreation. This is a significant factor driving market growth. In addition, with the rising popularity of golf across the world, the demand for durable materials in the production of skis, rackets, and the increasing use of carbon fiber in the form of textile and prepreg in various sports applications is estimated to augment demand of such materials.

The globalization and growing popularity of sports have enabled the exchange of sporting culture and promoted indigenous games to worldwide audiences, and this has propelled the demand for accessories and advanced sports equipment made from high-performance composites. For instance, in July 2023, the PGA of America partnered with Aivot Golf & Sports Management Private Limited and expanded its scope of golf culture in India. Similarly, in February 2024, the Hurricane Junior Golf Tour announced its expanding operations/tournaments in India after China. Such developments are likely to drive market growth.

Health and fitness trends continue to support participation in sports and activities, thereby driving market growth. For instance, according to a survey by ARRIS Composites, Inc., 78% of Americans planned to exercise more in 2023. The rise in fitness activities is likely to increase the demand for sports equipment and drive market growth.

Other alternatives, such as carbon, glass, and flax fiber-reinforced composites are used for their best technical performance and economic value, respectively. The lighter components, such as frames and wheels in bicycles, can boost speed endurance and superior bike ride quality. For instance, in November 2023, Velos Advancement, a New Zealand-based company, built its new Holocene road bike from recycled Toray carbon fiber.

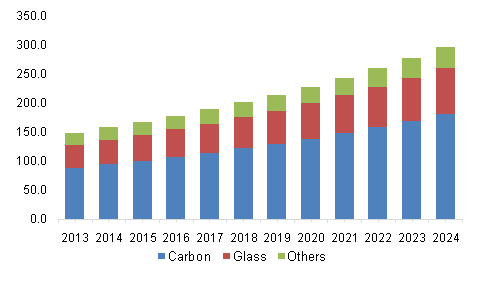

Reinforcement Material Insights

Carbon fiber dominated the market and accounted for a market share of 51.0% in 2023. It can be attributed to the availability of raw materials, with advancements in manufacturing techniques to produce carbon composite, which is used in bicycle frames, golf clubs, and rackets. In addition, it provides durability in equipment to avoid repetitive stresses and ensure power transfer and accuracy of shots for professional and amateur athletes. Various organizations have been established for the sporting goods industry which utilize carbon fiber for its lightweight sports equipment. Thereby boosting market growth. For instance, the World Sailing Trust the Carbon Fibre Circular Alliance (CFCA), a collaborative initiative that aims at creating awareness and solutions within sectors of the sporting goods industry for carbon fiber composite recycling in early 2022.

The glass fiber segment is expected to grow at a significant CAGR over the forecast period. It can be attributed to the increasing use of glass fiber composites in snowboards and skis and its ability to improve sliding properties and provide additional strength during landing. To reduce friction and improve gliding, manufacturers of SkiMo racing skis use glass fiber to ensure the durability, stiffness, and lightness of the equipment. Furthermore, the popularity of this sport has increased in recent times and would be included in the Winter Olympics. Thereby fueling the market growth. For instance, according to the Canada Ski Council, skier visits have increased to over 21 million for the 2022/23 season.

Resin Type Insights

Epoxy resin dominated the market and accounted for a market share of 40.3% in 2023. It can be attributed to the superior adhesion and durability, high performance in applications, and superior strength and high impact resistance qualities of epoxy resin, making it a preferred choice in applications such as carbon fiber reinforced composites for bicycles, golf sticks & clubs, and tennis rackets. Market players aim to increase their market revenue share with their promotional strategies, thereby boosting market growth. For instance, in January 2021, Huntsman Advanced Materials announced the acquisition of Gabriel Performance Products, which is expected to help boost the manufacturing of epoxy curing agents and specialty additives.

The polyamide segment is expected to grow at a significant CAGR over the forecast period. The inherent corrosion resistance of polyamide makes it suitable for outdoor sports equipment exposed to varying environmental conditions. This enhances the longevity of products, driving its market demand. The growing popularity of sports such as ice hockey, where polyamide is commonly used for stick blades due to its lightweight and robust nature, is contributing to the increased demand for polyamide composites.

Application Insights

Golf equipment dominated the market and accounted for a market share of 30.3% in 2023. It can be attributed to the increasing popularity of the sport among people worldwide. For instance- according to the Global Golf Participation Report 2023, there are 8.0 million registered golfers, 61.2 million adults engaged with golf, and 21,431 golf courses in the R&A affiliated nations worldwide. In addition, the high demand for performance enhancement, sustainability trends, and flexibility in design allows for the incorporation of various performance-enhancing features, such as adjustable weights and optimized aerodynamics. This has led to the usage of composites in golf equipment, thereby boosting market growth.

The bicycle parts segment is expected to grow at a significant CAGR during the forecast period. It can be attributed to the increasing demand for lightweight bicycles for recreational activities and competitive sports. In addition companies have focused on improving their production and thereby boosting the market growth with various strategies. For instance, in 2023, Bianchi planned to build new headquarters of over 30,000 sqm, 17,000 sqm, and a production facility to produce carbon fiber bicycle frames.

Process Type Insights

Prepreg layup dominated the market and accounted for a market share of 35.1% in 2023 owing to the consistent quality, performance, and improvement in manufacturing efficiency offered by it. In addition, the prepreg process allows for greater design flexibility, enables manufacturers to create complex shapes and structures that can optimize performance and aesthetics in sports equipment. Thus the adoption rate for such products in sports equipment have boosted the market growth over the forecast period.

The filament winding segment is expected to grow at a significant CAGR during the forecast period. It is used to manufacture high-performance composite materials for fishing rods, golf clubs, and other sporting goods. In addition, filament winding is versatile and can be applied to various sporting goods, including bicycles, skis, and protective gear. Its adaptability to different designs and specifications makes it the preferred choice for manufacturers. Thereby fueling market growth over the forecast period.

Regional Insights

The North America Sports Composites market was identified as a lucrative region in 2023. It can be attributed to the increasing use of composites for various sports equipment such as lacrosse sticks and polo sticks. The increased participation in sports such as skiing has also boosted the market growth in this region; for instance, according to the information released by Statistics Canada in October 2023, as per the Survey Series on People and their Communities (SSPC), more than half (55%) of people aged 15 years and above reported participating in sports such as soccer, ice hockey, swimming and running.

U.S. Sports Composites Market Trends

The U.S. sports composites market is expected to grow significantly over the forecast period, attributed to technological advancements, cutting-edge sporting equipment, and the presence of a robust sports culture, contributing to the demand for sports composites. The rise in the adoption of lightweight materials in sports such as cycling, golf, and winter sports has contributed to the market growth. In addition, several companies have adopted promotional strategies such as mergers & acquisitions, which will impact market growth positively over the forecast period. For instance, in February 2022, Celanese Company acquired DuPont’s mobility & materials business.

Asia Pacific Sports Composites Market Trends

Asia Pacific sports composites market dominated the global market with the revenue share of 33.1% in 2023 and is expected to grow at the fastest CAGR over the forecast period. It can be attributed to the burgeoning sports culture in this region, raising the need for high-performance sports equipment, notably composites. In addition, rapid economic development, increased participation in sports, and rising standards of living have boosted the demand for high-performance gear across countries such as India, China, Japan, and South Korea. Thereby fueling sports composites market growth.

The China sports composites market accounted for a share of 12.4% in the global market in 2023. The increasing participation in sports in China is a major contributing factor for the market growth. Various government initiatives such as the National Fitness Plan, and the Healthy China 2030 have boosted the spirit of Chinese people to increase sports participation and improve population health by imparting fitness and exercise-related programs. Furthermore, participation in sports such as golf, SkiMo, and bicycling have also raised in recent times in China. For instance, China had a total number of 500,000 registered golfers in 2022, of which 100,00 are adult registered female golfers, and 605 golf courses.

Europe Sports Composites Market Trends

Europe sports composites market is anticipated to witness significant growth in the sports composites market. The region is driven by the presence of a large number of sports composites manufacturers, thus increasing the widespread availability of the product at a competitive price. In addition, increasing participation in hockey and tennis in European countries such as Germany and France is expected to drive growth over the forecast period.

Central & South America Sports Composites Market Trends

Central & South America sports composites market is anticipated to witness significant growth in the sports composites market. This can be attributed to the rising awareness regarding fitness and exercise and the rising sports culture in this region. In addition, sports such as golf, hockey, and skiing have boosted the participation spirit among the people, thereby fueling the sports composites market. For instance- Argentina had a total number of 58,000 registered golfers in 2022, of which 1,300 are junior registered golfers, 8,100 adult female registered golfers, and 352 golf courses.

MEA Sports Composites Market Trends

MEA sports composites market is anticipated to witness significant growth in the sports composites market. The countries in this region are investing heavily in international tournaments, events, and sports infrastructure to establish themselves as global centers for sports, culture, and tourism. The hosting of significant sporting events such as the 2022 FIFA World Cup in Qatar, has helped drive interest and participation in sports across the region. For instance, Saudi Arabia had the most significant number of registered golfers 2,680 in 2022 in the Middle East region. Similarly, South Africa had 472 golf courses in 2022, with 145,510 registered golfers in the Africa region.

Key Sports Composites Company Insights

Some of the key companies in the sports composites market include Mitsubishi Chemical Group Corp., TORAY INDUSTRIES, INC., TEIJIN LIMITED., SGL Carbon and others. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

Mitsubishi Chemical Group Corp company is engaged in developing a wide range of proprietary materials and processes, creating high-quality golf shafts to help enhance performance for golfers. The company specializes in carbon fiber technology, which allows it to manufacture shafts that meet the demands of both amateur and professional players.

-

TORAY INDUSTRIES, INC. offers a wide range of composite materials, including carbon fiber and carbon fiber reinforced polymers. These materials are essential for producing lightweight, durable sports equipment, such as bicycles, golf clubs, and various athletic gear. Toray employs advanced manufacturing techniques to produce composite materials that meet the specific needs of the sports industry. This includes the development of prepregs and other intermediate materials that facilitate the production of complex shapes and structures in sports equipment.

Key Sports Composites Companies:

The following are the leading companies in the sports composites market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Chemical Group Corp.

- TORAY INDUSTRIES, INC.

- TEIJIN LIMITED.

- SGL Carbon

- Arvind Composite

- Epsilon Composite

- Advanced Composites, Inc.

- Rockman Advanced Composites

- New Era Materials

- ACP COMPOSITES,INC.

- ARRIS Composites, Inc.

Recent Developments

-

In March 2023, SGL Carbon introduced a carbon fiber called the SIGRAFIL C T50-4.9/235, which is applicable in sports that require high strength and fiber elongation.

-

In February 2021, TEIJIN LIMITED. launched carbon fiber intermediate materials such as Tenax PW and Tenax BM brands for sports applications.

Sports Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.04 billion

Revenue forecast in 2030

USD 5.67 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030, Volume in Kilotons

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Reinforcement Material, resin type, process type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, KSA, UAE.

Key companies profiled

Mitsubishi Chemical Group Corp., TORAY INDUSTRIES, INC., TEIJIN LIMITED. , SGL Carbon, Arvind Composite, Epsilon Composite, Advanced Composites, Inc., Rockman Advanced Composites, New Era Materials, ACP COMPOSITES,INC., ARRIS Composites, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports composites market report based on reinforcement material, resin type, process type, application, and region:

-

Reinforcement Material Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Carbon Fiber

-

Glass Fiber

-

Others

-

-

Resin Type Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Epoxy Resin

-

Polyamide

-

Others

-

-

Process Type Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Prepeg Layup

-

Infusion

-

Filament Winding

-

Wet Layup

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Skis & Snowboards

-

Bicycle Parts

-

Rackets & Bats

-

Golf Equipment

-

Hockey Sticks

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."