- Home

- »

- Plastics, Polymers & Resins

- »

-

Southeast Asia Modified Polypropylene Market, Industry Report 2030GVR Report cover

![Southeast Asia Modified Polypropylene Market Size, Share & Trends Report]()

Southeast Asia Modified Polypropylene Market Size, Share & Trends Analysis By End-use (Automotive, Building & Construction, Packaging, Medical, Electrical & Electronics), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-183-8

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Market Size & Trends

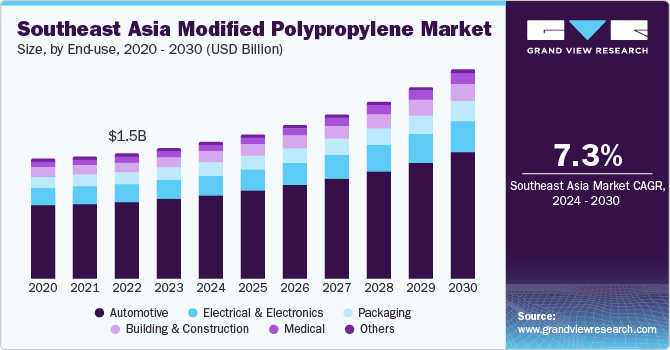

The Southeast Asia modified polypropylene market size was estimated at USD 1,608.82 million in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. Demand for modified polypropylene (PP) is being driven by the rising e-commerce sector and changing customer expectations for sustainable and lightweight packaging solutions. Furthermore, the Southeast Asian construction industry, which is undergoing fast urbanization and infrastructure development, contributes to the product demand in applications, such as pipes, fittings, and insulating materials. The market in Indonesia is characterized by various manufacturing industries, as a result of the increased emphasis on R&D combined with favorable government initiatives to attract investments. This, in turn, is likely to result in country market expansion.

The agriculture sector has been a significant source of income for domestic households in Indonesia while also facilitating much-needed export revenue. As per the Food and Agriculture Organization (FAO), the agriculture sector is considered the most important part of the economy, accounting for 12.40% of the GDP in 2022. Moreover, the construction sector significantly contributes to the product demand. The material's versatility and durability make it suitable for various construction applications including pipes, fittings, and insulation materials. The country's rapid urbanization and infrastructure development have further fueled the demand for materials that can withstand a range of environmental conditions while ensuring the durability of structures.

This is expected to drive the product adoption in the construction industry. Furthermore, product adoption in countries, such as Thailand and Malaysia, is being driven by the focus of these countries on sustainable practices and environmental responsibility. The increasing awareness of environmental concerns among industries in Indonesia has led to a search for materials that align with sustainability goals. Modified PP meets the rising demand for eco-friendly solutions in the country and contributes to the growth of the overall market in the region.

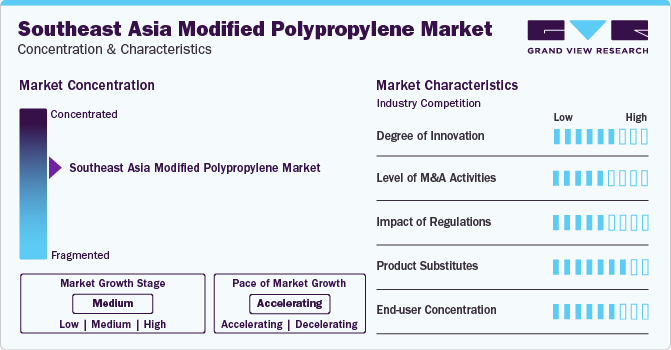

Market Concentration & Characteristics

Market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors, such as advancements in the production of modified PP, availability of raw materials, and increasing plastic resins consumption across several applications including packaging, building & construction, and automotive, among others. Subsequently, innovative modified PP applications are constantly emerging, disrupting existing industries and creating new ones.

The market is also characterized by a high level of M&A activities by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, the need to consolidate in a rapidly growing market, and increasing strategic initiatives of modified PP.

The market is also subject to increasing regulatory scrutiny. The market is subject to numerous regulations, guidelines, and restrictions regarding PP production and its applications owing to the toxic nature of raw materials, such as crude oil, coupled with certain health hazards of improperly disposed products and over-exposure to chemicals contained in these resins.

There are a limited number of direct product substitutes for modified PP. However, there are a number of technologies that can be used to achieve sustainable outcomes for modified PP, such as bio-based plastics, and fiberglass. These substitutes can be used in certain applications, but they typically do not offer the same level of performance or flexibility as modified PP.

End-user concentration is a significant factor in this market. Since there are a number of end-user industries that are driving product demand. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing polymer foam PP solutions for several end-use industries. However, it also creates challenges for companies that are trying to compete in a crowded market.

End-use Insights

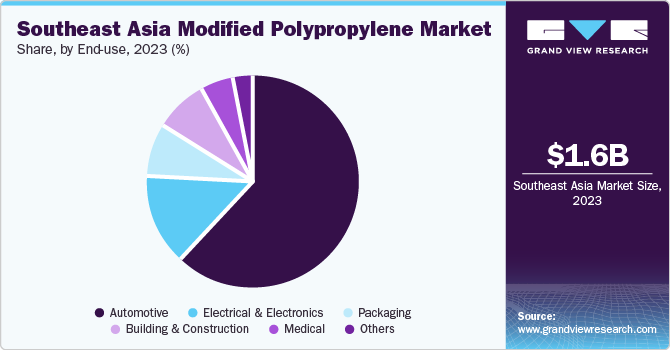

The automotive segment dominated the market in 2023. The material's resistance to various chemicals, moisture, and corrosion significantly enhances its suitability for a diverse range of automotive applications. The durability and resistance properties of modified PP in Southeast Asia's tropical climate and varying environmental conditions contribute significantly to the reliability and longevity of automotive components. This resilience is particularly crucial in ensuring the longevity of vehicles and reducing the frequency of replacements, thereby lowering overall maintenance costs for both manufacturers and consumers. The medical end-use segment is projected to grow at the fastest CAGR over the forecast period.

The increasing demand for single-use devices and disposable medical products is driving the market growth in Southeast Asia. Modified PP maintains necessary properties even after sterilization, and it is used in the production of various medical items, such as syringes, containers, and surgical instruments. Modified PP is a key material in the healthcare sector as it ensures hygiene and prevents cross-contamination, thus supporting the development of safe and disposable medical solutions. The electrical & electronics segment is also anticipated to witness a substantial upsurge in product adoption.

The increasing emphasis on environmental sustainability and regulatory compliance contributes to the increased product usage in the electrical & electronics segment. The material's eco-friendly characteristics and recyclability align with the region's growing awareness of environmental issues and the push toward greener manufacturing practices. As the electrical & electronics industry continues to expand, driven by the proliferation of smart devices and connectivity, modified PP has emerged as a key enabler, balancing cost-effectiveness, performance, and environmental considerations.

Country Insights

Indonesia Modified Polypropylene Market Trends

The Indonesia modified polypropylene market dominated the overall industry and accounted for a share of 25.29 % share in 2023. The increasing product demand from end-use industries, such as automotive, packaging, construction, and consumer goods, is expected to drive market growth in Indonesia. Modified PP offers advantages, such as improved strength, durability, and chemical resistance, making it a preferred material in the aforementioned applications. The adoption of modified PP in Indonesia is driven by the country's emphasis on technological advancements and innovation. Modified PP's versatility in processing, molding, and integration into advanced manufacturing technologies positions it as a material that aligns with Indonesia's technological aspirations.

Singapore Modified Polypropylene Market Trends

The Modified Polypropylene market in Singapore is expected to witness substantial growth from 2024 to 2030. Singapore's focus on advanced manufacturing and innovation has led to increased product adoption. The country strongly emphasizes high-tech industries and precision manufacturing, which generates a consistent demand for materials that offer a combination of durability, flexibility, and design versatility - all attributes that can be found in modified PP. This material finds its applications in a variety of sectors, such as electronics, aerospace, and medical manufacturing, which aligns with the country's advanced manufacturing landscape.

Thailand Modified Polypropylene Market Trends

The Thailand modified polypropylene market is anticipated to witness significant growth at a CAGR of 6.8% from 2024 to 2030. Thailand's role as a major trade partner in Southeast Asia contributes to product demand. The country's position as a regional economic hub facilitates the movement of goods and materials across borders, enhancing product accessibility and distribution; thereby boosting its market presence in the region. Thailand is a significant production and export base for numerous industries including automobiles, computer components, IT, and others. Thailand's position as a key trading partner has strengthened its ties with other countries, solidifying its reputation as a reliable and trustworthy business partner, thus contributing significantly to the growth and development of the region's economy.

Key Southeast Asia Modified Polypropylene Company Insights

Some of the key players operating in the market include SABIC and LG Chem.

-

SABIC operates through five business segments: culture of continuous improvement, petrochemicals, specialties, agri-nutrients, and metals. The products manufactured under these segments cater to agriculture, building & construction, automotive, consumer goods, electrical & electronics, healthcare, and packaging industries.

-

LG Chem deals in basic materials, information technology & electronic materials, advanced materials, and energy solutions. It provides an extensive array of products in every category, such as ethylene, propylene, polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polarizers, ITO films, photo resins, rechargeable battery materials, lithium-ion cylindrical batteries, and automotive batteries.

PolyPacific and China XD Plastics Co., Ltd. are among the emerging participants in the Southeast Asia modified polypropylene market.

-

PolyPacific manufactures reinforced and modified polyolefin compounds for use in the industrial sector in Southeast Asia. The company's offering includes thermoplastic elastomers, thermoplastic polymers, polyolefin, materials for insulation and sheathing applications, and masterbatches, allowing it to provide products to industries while also providing technical and application development support.

-

China XD Plastics Co., Ltd. manufactures engineering plastic resins. The company focuses on the R&D of polymer composite materials for the automotive industry.

Key Southeast Asia Modified Polypropylene Companies:

- SABIC

- LG Chem

- Polyplastics Asia Pacific Sdn Bhd

- HMC Polymers

- Dow Thailand Group

- PT Mitsui Chemicals

- PolyPacific

- China XD Plastics Co., Ltd.

Recent Developments

-

In May 2023, Maire Tecnimont was awarded a contract to design a USD 1.5 billion PP facility in Vietnam. The factory will begin commercial operations in the fourth quarter of 2026, producing 600,000 tons of PP per year for producers of home appliances, autos, electronics, and medical equipment

-

In September 2022, W. R. Grace & Co., a supplier of PP and polyolefin catalyst technology, announced their new licensee in Indonesia: PT Kilang Pertamina International (PT KPI). This project will improve PT KPI's polyolefin and refinery capacity

-

In January 2022, LyondellBasell announced that LyondellBasell Spheripol technology will be used by PT Polytama Propindo to expand its existing operation. The process method will be used for a 300 KTA PP plant to be built in Balongan, West Java, Indonesia, and is projected to be finished in 2024

Southeast Asia Modified Polypropylene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.69 Billion

Revenue forecast in 2030

USD 2.57 Billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, country

Regional scope

Southeast Asia

Country scope

Thailand; Indonesia; Singapore; Vietnam; Philippines; Malaysia

Key companies profiled

SABIC; LG Chem; Polyplastics Asia Pacific Sdn Bhd; HMC Polymers; Dow Thailand Group; PT Mitsui Chemicals; PolyPacific; China XD Plastics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Modified Polypropylene Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia modified polypropylene market report based on end-use and country:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Packaging

-

Medical

-

Electrical & Electronics

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thailand

-

Indonesia

-

Singapore

-

Vietnam

-

Philippines

-

Malaysia

-

Frequently Asked Questions About This Report

b. The Southeast Asia modified polypropylene market size was estimated at USD 1.61 billion in 2023 and is expected to reach USD 1.69 billion in 2024.

b. The Southeast Asia-modified polypropylene market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 2.57 billion by 2030.

b. Indonesia dominated the Southeast Asia modified polypropylene market with a share of over 25% in 2023. The increasing product demand from end-use industries, such as automotive, packaging, construction, and consumer goods, is expected to drive the market in Indonesia.

b. Some of the key players operating in Southeast Asia modified polypropylene include SABIC; LG Chem; Polyplastics Asia Pacific Sdn Bhd; HMC Polymers; Dow Thailand Group; PT Mitsui Chemicals; and PolyPacific.

b. Key factors driving the Southeast Asia modified polypropylene market growth include a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production of modified polypropylene, the availability of raw materials, and increasing plastic resins consumptions across several applications including packaging, building & construction, automotive, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."