- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Solar Control Glass Market Size Report, 2030GVR Report cover

![Solar Control Glass Market Size, Share & Trends Report]()

Solar Control Glass Market Size, Share & Trends Analysis Report By Type (Hard Coating, Soft Coating), By Application (Residential Buildings, Commercial Buildings, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-116-0

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Report Overview

The global solar control glass market size was valued at 7.11 USD billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2030. The growth is primarily driven by increasing demand for energy-efficient buildings, growing favorable government initiatives regarding sustainable energy, and rising concerns about climate change and carbon emissions. Multiple commercial building projects and renovation plans of existing infrastructural facilities have been focusing on using solar control glass, which efficiently reduces solar heat gains and assists in the energy efficiency of the entire building. This results in lower utility bills and reduced carbon emissions due to decreased, lessened use of numerous systems such as commercial air conditioners.

Increasing growth experienced by the commercial construction industry in various countries has increased demand for solar control glass. In addition, residential buildings have also started preferring solar control glass to attain energy efficiency through reduced use of power-driven products such as air conditioners. The ability of solar control glasses to decrease the heat gained inside the premises has provided unparalleled benefits to the users. The product applies to windows and facades, which provide thermal and vision comfort inside the building. Excessive emphasis on energy savings and using natural resources may lead to problematic climates in indoor environments. However, the invention of solar control glass and solar control films has resulted in the availability of practical solutions for this problem in recent years.

Moreover, rising favorable government regulations and incentives are also driving market growth. With growing concerns for climate change and carbon emissions, governments are increasingly seeking ways to reduce their carbon footprint through numerous ways. For instance, the United Nations Net Zero Initiative is signed by more than 140 countries to reduce emissions by 45% by 2030 and achieve net zero by 2050. This includes countries such as India, China, the U.S., and the European Union, which account for a large share of overall carbon emissions worldwide.

Type Insights

The soft coating solar control glass segment dominated the global industry and accounted for revenue share of 69.3% in 2023. The projected growth of this segment is primarily driven by increasing demand for energy-efficient buildings and sustainable solutions. Soft-coated solar control glass is usually preferred in locations where the atmosphere is characterized by extreme to mid-level heat and completely lacks cold weather. Soft-coated solar control glass is more effective than hard-coated solar control glass at reducing heat gains from the sun. This product is extensively used in commercial buildings in countries such as India, Saudi Arabia, China, the U.K., and certain parts of the U.S.

Hard Coating solar control glass is expected to experience a significant CAGR over the forecast period. The durability and scratch resistance capabilities have made this product a preferred choice for high-traffic areas and harsh environments. The growing demand for high-performance glass, intelligent glass applications, and innovative uses like energy-generating glass also contribute to the growth of hard coatings. Hard coatings offer excellent energy efficiency, UV protection, and low maintenance, aligning with global sustainability goals and driving demand among various residential sectors. The product is commonly used where the indoor climate requires a controlled amount of heat owing to extreme cold temperatures outside.

Application Insights

The residential buildings segment held the largest revenue share of the global industry in 2023. The segment growth is driven by the increasing population worldwide and rising demand for residential buildings. Solar control glass offers several benefits in residential buildings, such as reducing solar heat, lesser energy consumption, and cooler interiors, which help to reduce reliance on cooling systems such as air conditioners. It also helps to prevent UV rays that can cause skin problems and may hamper the quality of carpet, fabrics, and furniture over time. For instance, the world population is around 7.6 billion and is projected to reach 9.8 billion by 2050. This rapidly increasing population and urbanization are expected to generate greater growth for the residential building segment in the coming years.

The commercial buildings segment is anticipated to witness the fastest CAGR during the forecast period. The segment's growth is attributed to increasing industrialization, growing population, and worldwide urbanization. The segment growth is driven by increasing infrastructural developments in developing economies such as China, India, Japan, and others, leading to the construction of commercial spaces, including business offices, malls, industrial facilities, and others. Furthermore, commercial builders and developers increasingly seek energy-efficient solutions such as solar control glass, which helps reduce energy consumption and costs. Moreover, rising trends toward green building and sustainability are expected to drive further demand for solar control glass.

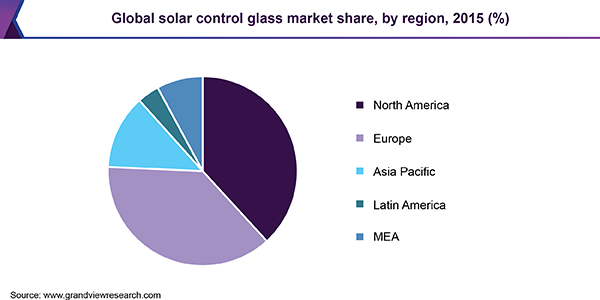

Regional Insights

North America solar control glass market held a significant share in 2023. The growth is attributed to established infrastructural development and favorable government initiatives to reduce carbon emissions. Growing awareness of energy efficiency and sustainability drives the region's demand for solar control glass. Stringent government regulations and initiatives encourage using energy-efficient solutions such as solar control glass. For instance, the Energy Star Program, a mutual initiative between the U.S. Department of Energy and the Environmental Protection Agency, provides tax benefits to consumers, industries, and businesses for using energy-efficient materials such as solar control glass.

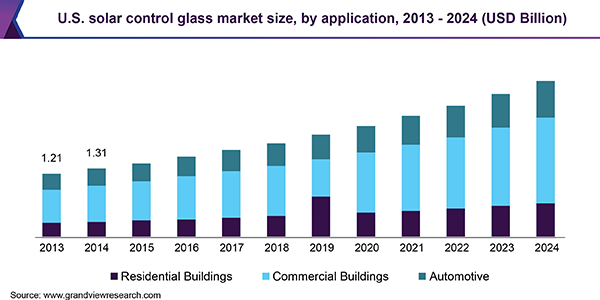

U.S. Solar Control Glass Market Trends

The U.S. solar control glass market is expected to experience noteworthy growth during the forecast period. This is attributed to regulatory frameworks related to the use of heat shielding glass and reduction of carbon emissions, growing consumer demand driven by the increasing constructions in the commercial domain of the industry, technological advancements in product development, and availability of multiple product alternatives in the market. According to the U.S. Census Bureau, construction spending in the country for June 2024 was estimated at USD 2,148.4 billion with a Seasonally Adjusted Annual Rate (SAAR).

Europe Solar Control Glass Market Trends

Europe solar control glass market is expected to witness the fastest CAGR during the forecast period. Increasing adoption of solar control glass, expanding construction sector, and stringent government regulation are key factors driving region growth. Furthermore, the increasing demand for energy-efficient solutions and rising automotive sectors in the region further propel region growth. In addition, increasing the renovation of existing buildings in the European region to save energy and achieve zero-emission and decarbonized buildings by 2050 is likely to drive demand for solar-controlled glass.

The UK solar control glass market dominated in 2023. This market's growth is mainly driven by factors such as the increasing frequency of heatwaves, the growing need for energy efficiency solutions, a set of regulations aimed at reducing overheating, energy performance standard requirements, and more. The commonly used glass types in this market are float glass, tempered glass, laminated glass, and heat-strengthened glass. Increasing focus on innovation and new product launches has also contributed to the growth of this industry in recent years.

Asia Pacific Solar Control Glass Market Trends

Asia Pacific solar control glass dominated the global industry in 2023 and accounted for a share of 38.9% in 2023. The dominance in the region is driven by positive economic growth experienced by multiple countries, rising urbanization, infrastructural developments, and entry of numerous global businesses, resulting in a growing need for commercial spaces equipped with enhanced energy efficiency solutions. The changing climatic conditions, increasing consumer awareness about energy efficiency, and rising regional green building trends are expected to generate greater demand for solar control glass in Asia. In addition, countries such as China and India significantly contribute to greenhouse gas emissions. [KA1] With stringent government regulation and increasing initiatives to reduce global warming, the demand for solar control glass is likely to contribute to the region's dominance.

India solar control glass market is expected to experience the fastest CAGR from 2024 to 2030. This market is mainly influenced by the growing awareness regarding the alarming need to address global warming and associated climate changes, increasing new developments and redevelopments of commercial buildings in the country, and entry of multiple businesses from different parts of the world, leading to increasing demand for modern commercial spaces and others.

Key Companies & Market Share Insights

Some key companies involved in the solar control glass market include, Vitro Architectural Glass, Guardian Industries, Xinyi Glass Holdings Limited, and others. To address the increase in competitive nature of the market, key companies of the industry are adopting strategies such as enhanced research and development effort, innovation based new product developments, collaborations and partnerships.

-

AGC Glass, one of the prominent companies in the industry, offers a wide range of products and technologies, such as architectural glass, automotive glass, glass displays, performance chemicals, ceramics, essential chemicals, and electronic materials. The company's diverse product portfolio also entails extra clear float glass offerings developed for various solar applications. The heat reflection glass provided by the company offers high heat shielding performances with the help of thin metallic film coating.

-

Central Glass Co., Ltd. is a major market participant in fertilizers, glass fiber and glass, and fine chemicals business. The company offers a range of products, including applied chemicals, medi-chemicals, electronic chemicals, energy materials, fertilizers, architectural glass, glass fibers, and automotive glass. The company's solar control glass offerings include Eco-Glass, a high-performance product with insulation for heat shielding and emissions control.

Key Solar Control Glass Companies:

The following are the leading companies in the solar control glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Central Glass Co., Ltd.

- EUROGLAS

- Fuyao Group

- CSG Architectural Glass (CSG HOLDING CO., LTD.)

- Guardian Industries

- Nippon Sheet Glass Co., Ltd.

- SAINT-GOBAIN

- Şişecam

- Viracon

- Vitro

- Xinyi Glass Holdings Limited

- PPG Industries, Inc.

- Asahi India Glass Limited.

- CARDINAL GLASS INDUSTRIES, INC

Recent Developments

-

In March 2024, Guardian Glass, one of the key organizations in the solar control glass industry, and VELUX Group, a company that specializes in skylights, roof windows, sun tunnels, and other related products, entered an agreement to jointly develop tempered vacuum-insulated glass (VIG). This is expected to result in innovation and the sharing of technological expertise between the two businesses.

-

In April 2024, AGC, an applauded company operating in multiple industries such as glass, ceramics, electronics, life science, chemicals, and others, obtained its first Environmental Product Declaration (EPD) for one of its products, an architectural float glass produced at company’s plant in Kashima.

Solar Control Glass Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.76 billion

Revenue Forecast in 2030

USD 13.66 billion

Growth Rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume kilotons and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Brazil, Saudi Arabia, UAE

Key companies profiled

AGC Inc.; Central Glass Co., Ltd.; EUROGLAS; Fuyao Group; CSG Architectural Glass (CSG HOLDING CO., LTD.); Guardian Industries; Nippon Sheet Glass Co., Ltd.; SAINT-GOBAIN; Şişecam; Viracon; Vitro; Xinyi Glass Holdings Limited; PPG Industries, Inc.; Asahi India Glass Limited; CARDINAL GLASS INDUSTRIES, INC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Control Glass Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the solar control glass market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Coating

-

Soft Coating

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential Buildings

-

Commercial Buildings

-

Automotive

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."