- Home

- »

- IT Services & Applications

- »

-

Software Defined Storage Market Size Report, 2030GVR Report cover

![Software Defined Storage (SDS) Market Size, Share & Trends Report]()

Software Defined Storage (SDS) Market Size, Share & Trends Analysis Report By Component, By Organization Size, By Deployment, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-067-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

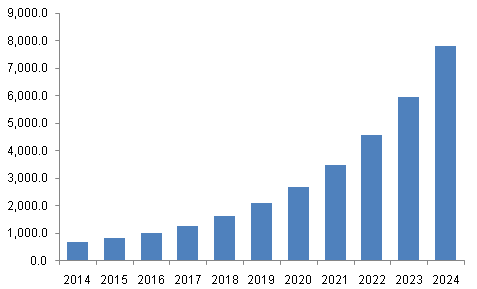

The global software defined storage market size was valued at USD 38.43 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 27.9% from 2024 to 2030. The increasing amount of data generated and utilized by businesses in different industries, the rise in cloud storage options, and the improved utilization of resources, which result in enhanced data reliability and scale, are the key growth drivers for the SDS market. SDS assists in managing complex networks by efficiently monitoring resources and data traffic. The enormous growth in the digital transformation of businesses, a growing need for sophisticated storage solutions, and enhanced security requirements are expected to generate an upsurge in demand for this market during the forecast period.

The increasing adoption of hyper-converged infrastructures (HCI) is leading to combining the capabilities of storing, networking, and computing data into a unified system. The rising demand for cost-effective solutions in data management and the growing emergence of software-defined strategies are contributing to the growth of this industry. The transformation from a traditional mode of data handling to a digital platform has also led to the development of this market in recent years.

The development of software-defined storage solutions is expected to witness remarkable growth, owing to the worldwide expansion of technological advancement in multiple industries focusing on implementing software-defined networks and storage systems to enhance robustness and agility. SDS’s ability to reduce network trafficking, time and cost savings, and adaptability in infrastructure has developed greater demand for it, primarily in the telecommunication industry.

Component Insights & Trends

Based on the components, the SDS solutions segment dominated the global market and accounted for a share of 63.3% in 2023. This is attributed to enhancements in computing power, storage capabilities, and cloud solutions provided by these solutions to organizations and institutes. These solutions include storage virtualization, replication, provisioning, and orchestration. Moreover, the capacity to collect data offers immediate analysis and results in quick decision-making. Growing dependability on data, increasing need for data reliability, and unceasing penetration of computing technologies are expected to generate growth for this segment in the approaching years.

The SDS services segment is expected to experience the fastest CAGR during the forecast period. SDS services include consulting, implementation and integration, support, and maintenance. The SDS market offers various services such as automation, cloud integration, simplified data management, AI and machine learning, data security, and governance. These services help reduce operational complexities and enhance the organization's overall efficiency.

Organization Size Insights & Trends

Based on organization size, large enterprises segment dominated the global industry for software defined storage market in 2023. Large enterprises need effective data management solutions for complex data networks and extensive operations. Increasing dependability on computing networks, the growing scale of operations for multiple organizations, enhancements provided by SDS services in data storage and security, and the need for unified systems are expected to increase demand for this segment during the forecast period.

The small and medium enterprises segment is anticipated to experience the fastest CAGR of 28.5% from 2024 to 2030. SDS solutions are cost-effective and easy to manage in SMEs. According to the U.S. Small Business Administration Office of Advocacy, in 2023, nearly 33,185,550 small businesses had active operations in the U.S. These small businesses employed approximately 61.7 million individuals, accounting for 46.4% of private sector employees. The existence of numerous companies operating on a small and medium scale, growing inclination towards the adoption of technologies, and the availability of multiple service providers in the industry are expected to fuel growth for this segment.

Deployment Insights & Trends

The on-premises deployment segment accounted for the largest revenue share in 2023. Data security is the most important aspect of data storage. The solutions deployed through the on-premises category help secure and store data effectively and with full control within the organization. The on-premises data storage systems are privately owned and controlled by the companies. This helps to preserve and use sensitive data and critical applications for the company. On-premises software is set up and operated on a company's hardware, stored locally in the SDS.

The cloud deployment segment is expected to experience the fastest CAGR during the forecast period. Cloud computing data centers are responsible for keeping our hardware secure and updated. It breaks complex data into simpler ones, which companies can easily adapt. It unifies structured, unstructured, or semi-structured data to reduce complexity and simplify it for operational use. It cuts down maintenance and hardware purchase costs, which are key components driving the growth of this segment.

Application Insights & Trends

The data backup and disaster recovery segment dominated the market in 2023. The data stored through SDS in enterprises holds critical and sensitive information, increasing the need for improved data security systems. Efficient data backup and disaster recovery infrastructure ensures the prevention of data loss and data theft. This process includes backing up databases, videos, and other media files. Growing cases of cyber-attacks, increasing dependability on internet use, and unceasing adoption of software and systems are expected to drive the growth of this segment in the approaching years.

The cloud storage segment is expected to experience the fastest growth during the forecast period. Cloud storage allows remote accessibility and simplifies collaboration and integration of multiple networks. Enhanced storage capacities offered by cloud storage, increasing acceptance of remote work profiles, growing adoption of trends such as work from home, and an increasing number of businesses operating at a global scale are projected to generate an upsurge in demand for this segment.

End Use Insights & Trends

The BFSI segment accounted for the largest revenue share of the global market in 2023. This segment operates with the help of large data collections, including financial transactions, customer records, and regulatory documents. A high need for extra bandwidth, a desire for minimal latency, cost benefits, and a constantly rising customer base are anticipated to generate larger growth for this segment in upcoming years.

The retail and e-commerce segment is projected to grow at the fastest CAGR over the forecast period. The shift from traditional retailing to the emergence of online platforms is shaping a change in organizational operations and consumer behavior. Online platforms have also been offering extra convenience for users and businesses. Online retailing has helped establish direct contact between buyer and seller, eliminating the mediator's interference. This eliminates additional costs and prolonged processes, along with reducing the time between the order and the delivery.

Regional Insights

The North America dominated the global market with a revenue share of 37.0% in 2023. The region's robust technology infrastructure drives growth as companies increasingly adopts SDS solutions, and data centers are gaining prominence. Factors such as increasing data use, utilization of web-based services, digitization of monetary transactions, and dependability on software networks for multiple functions are projected to generate higher demand for this regional industry.

U.S. Software Defined Storage (SDS) Market Trends

The U.S. Software Defined Storage (SDS) market dominated the regional industry in 2023. Rapid digital transformation in numerous industries, the rise in usage of cloud storage services and advanced I.T. systems, and multiple large enterprises with the inevitable need for SDS solutions are key factors projected to drive growth for this market in the approaching years.

Europe Software Defined Storage (SDS) Market Trends

Europe SDS market will be lucrative for this industry in 2023. The increased cost efficiency and flexibility offered by SDS systems fuel the market growth in this region. Factors such as growing incidences of data theft and cyber-attacks, rising need for data security and backup, and multiple key market participants from numerous industries such as automotive, cosmetics, e-retail, chemical, and telecommunication are expected to drive demand for this market during the forecast period.

The UK software defined storage (SDS) market is expected to grow rapidly during the forecast period. This is attributed to the scalability, flexibility, and compatibility of SDS systems' data management services. The presence of multiple SMEs with a greater need for data security solutions, rising cases of data loss, an increasing number of global companies entering the market, and growing dependability on the data have driven growth for this market in recent years.

Asia Pacific Software Defined Storage (SDS) Market Trends

Asia Pacific SDS market is anticipated to witness significant growth from 2024 to 2030. The emergence of I.T., the presence of multiple offshore I.T. service providers in countries such as China and India, enhanced accessibility and availability of the Internet, the growing number of small and medium enterprises in the region, and technological advancements adopted by the large enterprises are expected to generate greater demand for this market.

China Software Defined Storage (SDS) market held a substantial market share of the regional industry in 2023. Owing to the constant search by vendors for new market segments and customers. Focus on new product developments backed by innovation has encouraged businesses in the country to embrace technological advancements. The rising need for data security, higher dependability on the data, and the need for unified systems are expected to develop growth for this industry during the forecast period.

Key Companies & Market Share Insights

Some key of the key companies in software defined storage market include Cisco Systems, Inc., Dell Inc., IBM, Microsoft, Hewlett Packard Enterprise Development L.P., and others. As competition is extreme, key market participants have adopted different strategies to develop an advantage over other organizations. These include enhanced portfolios, service differentiations, technology improvement, innovation, collaborations, and mergers and acquisitions.

-

Nexenta Systems, Inc., a prominent company in the SDS market, offers a software-defined storage portfolio equipped with advanced technologies that can support next-generation applications and protect future data storage needs. This includes the company's flagship SDS solution, NexentaStor.

-

Cisco Systems Inc., a global technology enterprise, provides software-defined storage services through its cloud computing and data center offerings. This includes Cisco UCS, HyperFlex Hyperconverged Infrastructure by Cisco, and SDN solutions.

Key Software Defined Storage Companies:

The following are the leading companies in the software defined storage market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- DataCore Software

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft

- NetApp

- Nutanix

- Nexenta Systems, Inc.

- Pure Storage, Inc.

- Scality, Inc.

- Broadcom

Recent Developments

-

In May 2024, Hewlett Packard Enterprise Development LP, a prominent organization in technology and innovation market, announced addition of a newly developed cloud storage solution to its offerings. HPE GreenLake Block Storage for Amazon Web Services (AWS) is expected to enable users to seamlessly manage their storage acorss hybrid cloud environments.

-

In May 2023, Dell Inc. launched Dell APEX Storage for Public Cloud. This new portfolio introduced in the SDS market is a customer-managed storage solution that offers class performance, cyber resilience to major hyperscalers, and scalability complemented by centralized management tools within the Dell APEX Console.

Software Defined Storage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.05 billion

Revenue forecast in 2030

USD 201.98 billion

Growth Rate

CAGR of 27.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, deployment, application, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

Cisco Systems, Inc.; DataCore Software; Dell Inc.; Hewlett Packard Enterprise Development LP; IBM; Microsoft; NetApp; Nutanix ; Nexenta Systems, Inc.; Pure Storage, Inc.; Scality, Inc.; Broadcom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software Defined Storage (SDS) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global software defined storage market report based on component, organization size, deployment, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Storage Virtualization

-

Storage Replication

-

Storage Provisioning and Orchestration

-

-

Services

-

Consulting

-

Implementation and Integration

-

Support and Maintenance

-

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large enterprises

-

Small and medium enterprises

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Backup and Disaster Recovery

-

Storage Provisioning

-

Data Archiving

-

Big Data Storage

-

Surveillance and Monitoring

-

Cloud Storage

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecommunications

-

Retail and E-commerce

-

Healthcare

-

Logistics and Warehouse

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."