- Home

- »

- Next Generation Technologies

- »

-

Smartwatch Market Size, Share And Growth Report, 2030GVR Report cover

![Smartwatch Market Size, Share & Trends Report]()

Smartwatch Market Size, Share & Trends Analysis Report By Price Band, By Display Technology (LCD, OLED), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-106-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2019

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

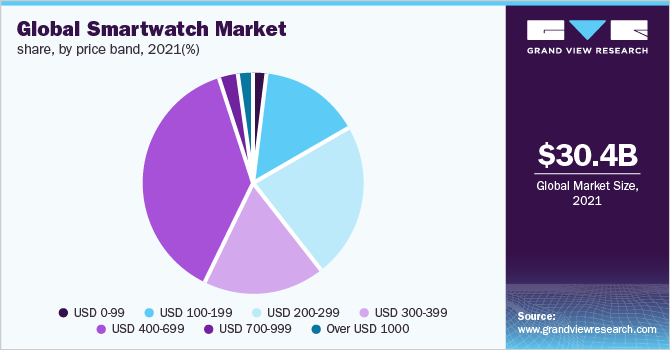

The global smartwatch market size was USD 30,434.1 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.2 % from 2022 to 2030. The market is anticipated to witness a surge in adoption owing to the growing inclination for fitness tracking and health monitoring features. Manufacturers have introduced smartwatches with advanced health monitoring features such as blood oxygen and SpO2 sensors, a stress monitor, electrocardiograms, a calorie counter, and more. Several companies such as SAMSUNG-, Noise, Fitbit, FOSSIL GROUP, INC., and more are introducing smartwatches with health monitoring devices. For example, in September 2021, Apple, Inc. launched the new Apple Series 7 smartwatch model that features multiple health monitoring functions, such as native sleep tracking, blood oxygen saturation, electrocardiogram (ECG) sensor, improved fall detection, and heart health monitoring.

Smartwatches, like other wearable devices, come packed with features such as calling/messaging, navigation, voice assistance, pairing with other connected devices, and more, enabling users to automate their daily activities. The smartwatch market has experienced fundamental technological developments related to operating systems and interfaces (UI). This has enabled companies to provide smart watches with lag-free UI and advanced features in a short span of 3-4. For instance, in June 2021, Garmin International Inc. launched the Forerunner 945 LTE, a triathlon smartwatch that has features of LTE connectivity, GPS, and more.

The Internet of Things (IoT) wearable helps make data-driven decisions and enables users to connect with colleagues remotely for video conferencing. Smartwatches include IoT-related features that allow the received information to be transmitted to a remote server, enabling real-time monitoring of individual behavior. Furthermore, IoT-based smartwatches can be connected with IoT devices to monitor users’ physical activity. IoT-enabled smartwatches are used across various applications, including edge analytics, computational offloading, sports sector, biometric readings, automatic device connection, and more. Smartwatches have finally created IoT applications with human components; hence, the growing applications of smartwatches are expected to drive the market.

The COVID-19 outbreak led to manufacturing delays and supply chain disruptions resulting in a minor setback for the consumer electronics industry. The manufacturing and supply of the smartwatches were impacted during the first two quarters of 2020. However, as manufacturing returned to operational levels by the beginning of the third quarter and high consumer demand was generated due to the work-from-home and fitness activities, the smartwatch market experienced steady growth during the pandemic.

The lack of control over the data, collected by the owners via their various smart wearable devices, limits the growth of the market. Most wearable device privacy policies indicate that data obtained would be exchanged with a third-party vendor, paving the way for a data breach. For instance, Fitbit and Apple users' data was leaked online in the year 2021 because of an insecure database comprising more than 61 million records related to wearable and fitness trackers.

Price Band Insights

The USD 200-299 segment dominated the market and accounted for more than 22.6% of the market share in 2021. Vendors such as Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Apple Inc., and Fitbit, Inc. have contributed mainly to the market share. Apple Inc. possesses the highest market share of more than 30.0% and is anticipated to retain its dominance in the future.

The USD 0-99 segment is expected to expand at a significant growth rate of 9.8% from 2022 to 2030. The economic downturn and related uncertainties caused by COVID-19 have boosted the growth of the USD 0-99 segment. Chinese and Indian brands such as Huami Co. Ltd., TAGG, COLMI, boAt, and Noise have launched several products in the USD 0-99 range. This has led to a decline in selling higher-priced products, dropping the average selling prices for smartwatches, worldwide in 2020.

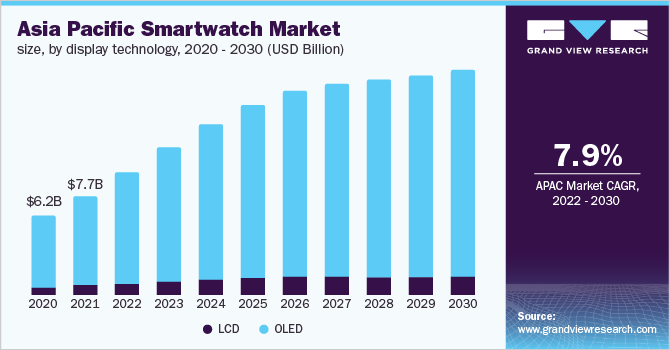

Display Technology Insights

The OLED-based smart watches held a high market share of more than 91.5% in 2021 and are expected to retain their dominance during the forecast period. Almost all smartwatches nowadays are equipped with OLED and LCDs and variants. Although OLED technology has a high manufacturing cost, the demand for clear and dynamic displays has propelled manufacturers to incorporate them due to their advantages over LCDs. Furthermore, OLED displays were already in use in televisions and smartphones, which helped the manufacturers, measure the demand for each technology and implement them in smartwatches on a larger scale, thereby bringing down the overall cost under mass production.

OLED displays provide an enhanced experience to the user due to their high image quality and low power consumption. It also offers more room for innovation to the manufacturers, with design possibilities extending to flexible OLED displays. This helps the manufacturers to produce displays in various sizes and shapes without compromising their resolution and quality. Despite the advantages of OLED displays, the LCDs are expected to stay in the market due to their low cost and readability under various conditions

Regional Insights

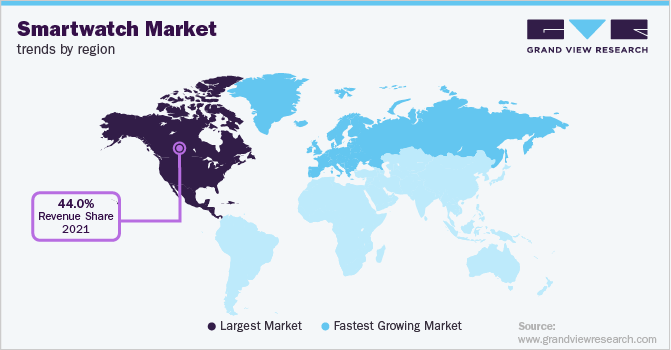

North America held the highest market share of more than 44.0% of the overall smartwatch market, followed by Europe and the Asia Pacific. The popularity of Apple, Inc.’s smartwatch series has been a significant factor in driving demand for smartwatches in North America. The early availability of newly launched products and high technology adoption has been critical driving factors to the market growth. Additionally, the proliferation of connected devices and the integration of IoT in smartwatches, adding to the user's convenience, have contributed to higher sales in North America.

Europe emerged as one of the largest regional markets in 2021 and is likely to expand further at a steady growth rate of 8.9% during the forecast period. The increasing disposable income of the various people in European countries and the rising number of connected cars in the region is expected to drive market growth. Furthermore, the increasing inclination of the youth customers toward smart wearables is expected to drive the market growth.

Key Companies & Market Share Insights

The market is competitive with vendors such as Apple Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Fitbit, Inc., and Garmin Ltd. holding a significant portion of the overall market. Companies are primarily focused on enhancing the connected experiences between connected devices and smartphones with smartwatches by offering software support through upgrades.

Although the brands mentioned above are dominant in the market, they are also facing competition from classic watch-making brands such as Fossil, Swatch, and Tag Heuer. They are focused on making hybrid watches with more modern features. However, many premium brands are losing their market share to Chinese and Indian vendors that offer differentiated features at affordable prices. Some of the prominent players in the global smartwatch market include:

-

Apple Inc.

-

Samsung Electronics Co., Ltd.

-

Fitbit, Inc.

-

Garmin Ltd.

-

Fossil Group, Inc.

-

Huami Co., Ltd.

-

Huawei Technologies Co., Ltd.

Recent Developments

-

In July 2023, Samsung Electronics Co., Ltd. launched the latest Galaxy Watch6 and Galaxy Watch6 Classic. The watch provides advanced health monitoring, design modifications, and an improved mobile experience, an essential advancement in the smartwatch sector

-

In June 2023, Apple launched watchOS 10. This smartwatch includes new Smart Stack, additional watch faces, cycling and hiking functions, redesigned applications, and mental health tools

-

In May 2023, Garmin launched the Epix Pro Series smartwatches. This watch comes with an AMOLED crystal-clear display, 31 days of battery life, monitors health and fitness, and comprises a built-in illumination LED in three watch designs

Smartwatch Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 37,966.5 million

Revenue forecast in 2030

USD 71,565.3 million

Growth Rate

CAGR of 8.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2019

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, Volume in Million Units, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price band, display technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan, Southeast Asia, Brazil, Mexico

Key companies profiled

Apple Inc; Samsung Electronics Co., Ltd.; FitbitFit bit, Inc; Garmin Ltd; Huami Co. Ltd; Fossil Group, Inc

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

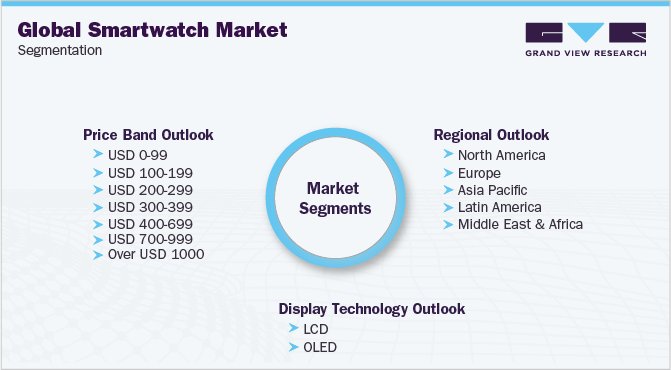

Global Smartwatch Market Segmentation

The report forecasts growth in terms of revenue and volume at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smartwatch market based on the price band, display technology, and region.

-

Price Band Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

USD 0-99

-

USD 100-199

-

USD 200-299

-

USD 300-399

-

USD 400-699

-

USD 700-999

-

Over USD 1000

-

-

Display Technology Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

LCD

-

OLED

-

-

Region Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global smartwatch market size was estimated at USD 30,434.1 million in 2021 and is expected to reach USD 37,966.5 million in 2021

b. The global smartwatch market is expected to grow at a compound annual growth rate of 8.2% from 2022 to 2030 to reach USD 71,565.3 million by 2030.

b. North America dominated the smartwatch market with a share of 44.2% in 2021. This is attributable to the increasing health awareness among athletes

b. Some key players operating in the smartwatch market include Apple Inc.; SAMSUNG, Fitbit, Inc.; Garmin Ltd.; and Xiaomi.

b. Key factors that are driving the smartwatch market growth include growing appetite for fitness tracking and health monitoring features among consumers and increasing use of IoT-enabled smartwatches across various applications, including edge analytics, computational offloading, sports sector, biometric readings, and automatic device connection.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."