- Home

- »

- Power Distribution Systems

- »

-

Ring Main Unit Market Size, Share & Growth Report, 2030GVR Report cover

![Ring Main Unit Market Size, Share & Trends Report]()

Ring Main Unit Market Size, Share & Trends Analysis Report, By Insulation Type (Gas, Air, Oil, Solid), By Installation (Indoor, Outdoor), By Voltage Rating, By Application (Transmission and Distribution, Power), By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455978

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Data: ---

- Industry: Energy & Power

Ring Main Unit Market Size & Trends

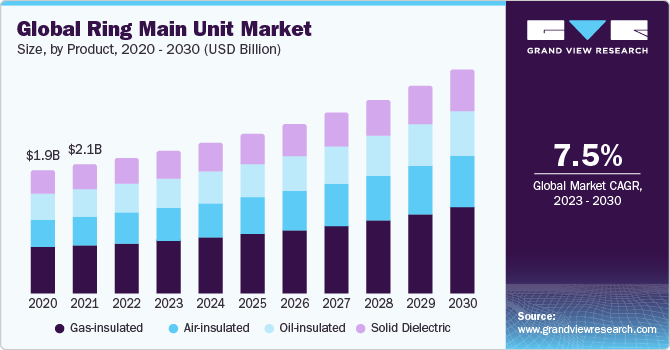

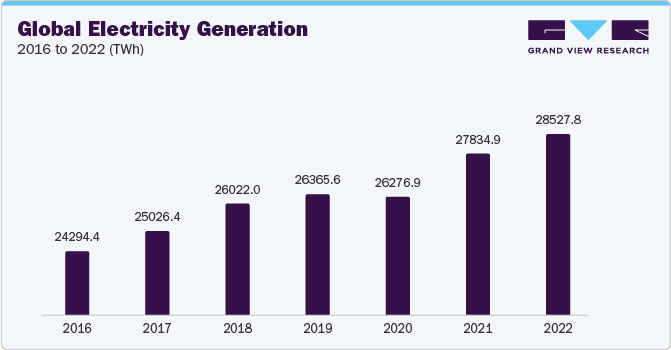

The global ring main unit market was valued at USD 2234.54 million in 2022 and is expected to grow at a CAGR of 7.5% over the forecast period. The global ring main unit market has witnessed significant growth and evolution in recent years. ring main units are essential components in medium-voltage electrical distribution networks, used for efficient power distribution and protection. One of the primary drivers of the ring main unit market is the increasing demand for reliable and uninterrupted power supply. With the growing urbanization and industrialization, the need for efficient power distribution systems has surged. ring main units provide a compact and robust solution for medium-voltage distribution, ensuring power continuity and minimizing downtime.

The pandemic-induced restrictions on international trade, factory shutdowns, and logistical challenges disrupted the production and delivery of ring main units. Many manufacturers experienced delays in receiving essential components, which in turn delayed the production and delivery of RING MAIN UNITs to customers. These supply chain disruptions not only affected the manufacturers but also had a domino effect on project timelines for end-users. Delays in obtaining RING MAIN UNITs could lead to increased project costs and potential setbacks in infrastructure development and maintenance.

The emphasis on renewable energy integration and the expansion of smart grid systems has boosted the ring main unit market. ring main units play a crucial role in integrating renewable energy sources into the grid and enabling effective load management. They are also compatible with advanced monitoring and control systems, making them a valuable component of modern smart grids.

Furthermore, safety and environmental concerns have led to the adoption of RING MAIN UNITs. These units are designed to enhance safety by minimizing the risk of electrical faults and protecting against short circuits. Moreover, ring main units are environmentally friendly due to their compact design, which reduces the space required for installation and minimizes environmental impact.

Insulation Type Insights

Based on the product, the Ring main unit market is segmented into oil insulated, solid dielectric, and air insulated, gas insulated. The gas insulated segment held the largest market share in 2022due to its unique design and advantages in medium-voltage electrical distribution networks. Gas-insulated ring main units are a key component of modern power distribution systems, offering several benefits and catering to specific requirements. Gas-insulated ring main units employ sulfur hexafluoride (SF6) gas as an insulating medium, which enables compact and robust design. This compactness is a significant advantage, as it allows for installations in confined spaces, such as underground substations or densely populated urban areas, where space is limited. The use of SF6 gas also enhances the dielectric properties of the RING MAIN UNIT, contributing to its efficient performance.

Installation Insights

On the basis of installation the market is segmented into indoor and outdoor. Bulk and general cargo fleet is the largest vessel type in 2022. ring main units designed for outdoor installation offer specific advantages and are well-suited for a range of applications. These units are engineered to operate in outdoor settings where they are exposed to temperature variations, humidity, and other elements. Their robust and weatherproof construction ensures that they can function reliably in challenging environments, making them suitable for rural areas, remote substations, and locations where indoor space may be limited.

Voltage Rating Insights

Based on voltage rating, the Ring main unit market is segmented into up to 15 kV, 15–25 kV, and above 25 kV. Up to 15 kV segment dominated the end-use segmentation in 2022. Up to 15 kV is a common voltage range for medium-voltage electrical distribution systems, which are extensively used in industrial complexes, residential areas, and commercial settings. RING MAIN UNITs in this segment are engineered to efficiently distribute electrical power while ensuring protection against faults, such as short circuits. Their versatility and adaptability make them suitable for a variety of settings, from urban centers to remote locations.

Application Insights

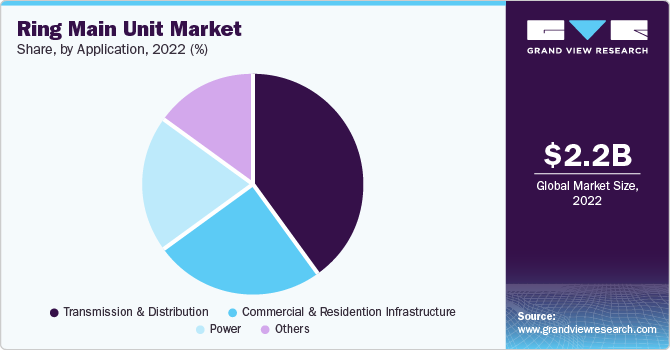

Based on application, the ring main unit market is segmented into transmission and distribution, commercial and residential infrastructure, power, and others. Electricity distribution segment dominated the end-use segmentation in 2022. The electricity distribution segment of the RING MAIN UNIT market is characterized by a diverse range of applications. RING MAIN UNITs are used in residential neighborhoods to ensure homes receive reliable electricity, in commercial areas to power businesses and services, and in industrial settings to support manufacturing processes and heavy machinery. They are also employed in critical infrastructure, such as hospitals and data centers, where uninterrupted power supply is essential for public safety and data integrity.

Regional Insights

Asia Pacific dominated the largest market share in 2022. As a rapidly growing economic and industrial hub, Asia Pacific's demand for reliable and efficient power distribution infrastructure has driven the expansion of the ring main unit market in the region. One of the key drivers for the RING MAIN UNIT market in Asia Pacific is the region's rapid urbanization and industrialization. As cities expand and industries flourish, the need for effective and resilient medium-voltage distribution networks has surged. ring main units, with their compact design and enhanced protection capabilities, are well-suited to meet these demands, particularly in densely populated urban areas where space is at a premium.

Key Companies & Market Share Insights

The competitive scenario of the ring main unit market is characterized by a mix of well-established players and emerging companies striving to address the growing demand for efficient and reliable medium-voltage power distribution solutions. Leading manufacturers such as ABB, Siemens, Schneider Electric, and Eaton dominate the global ring main unit market. These industry giants have extensive experience, robust research and development capabilities, and a wide geographic presence, making them formidable competitors. They offer a comprehensive range of ring main units that cater to various applications, and their innovative designs often incorporate features like gas insulation and digital monitoring systems, enhancing the overall performance of their products.

In June 2022, Mitsubishi Electric announced its intentions to construct a new production facility for Factory Automation Control Systems within India and to augment its manufacturing capabilities in the nation. Mitsubishi Electric India is set to invest USD 27 million into this manufacturing plant, which is scheduled to commence operations in December 2023.

In August 2021, Tanweer, whish is a Nama Group subsidiary, completed a project in Muscat, Oman. The project involved the installation of an 11 kV underground cable to the existing RING MAIN UNIT and the addition of a 6MVA transformer to the Dowa primary sub-station, aimed at improving grid reliability. The total investment in this grid reliability enhancement project amounted to OMR 186,340.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."