- Home

- »

- Organic Chemicals

- »

-

Purified Terephthalic Acid Market Size, Share, Industry Report, 2025GVR Report cover

![Purified Terephthalic Acid Market Size, Share & Trends Report]()

Purified Terephthalic Acid Market Size, Share & Trends Analysis Report By Application (PET Resins, Polyester Fiber, Films), By End-use (Textile, Bottling & Packaging, Home Furnishing), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-965-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Industry Insights

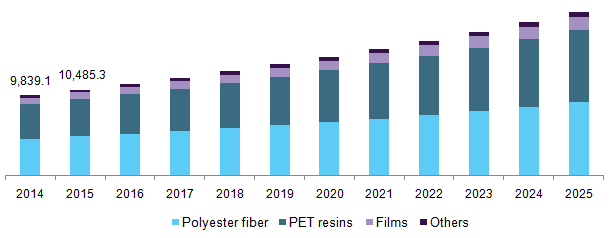

The global purified terephthalic acid market size was valued at USD 57.21 billion in 2016. Increasing usage of polyesters fibers owing to its ability to blend with other natural and synthetic fibers is expected to augment its demand over the forecast period. High consumption of polyester films in photographic films, data storage tapes, and sheet material owing to its properties of toughness and dimensional stability is expected to increase industry size.

Growing demand for purified terephthalic acid in the production of carbonated plastic bottles owing to its flexibility and toughness is anticipated to propel industry expansion. Moreover, rising usage of PTA based polyester fiber owing to its high strength, quick-drying, and high chemical & wrinkle resistance is expected to drive product demand over the forecast period.

U.S. purified terephthalic acid (PTA) market by application, 2014 - 2025 (Kilo Tons)

Rising demand from the paints and coatings industry owing to its high effectiveness is expected to drive the market over the forecast period. Furthermore, increasing government spending along with rising coating, textile, and packaging industries in China, India, Mexico, and Saudi Arabia is expected to fuel market growth. Growing food & beverages and pharmaceutical packaging will fuel industry growth over the forecast period. Increasing usage of unsaturated polyester resin (UPR) in various industries including construction, marine, transport, wind energy, and electrical on account of high performance, cost-effectiveness, and eco-friendly characteristics will spur growth.

UPR possesses excellent resistance to abrasion, chemicals, corrosion, and heat; rapid strength gain; high impact strength; superior structural strength, and excellent compressive strength. Thus, it is widely used in the construction industry as concrete and sealant. Rising demand for PTA from the soft drink industry on account of PET being a key ingredient in the manufacture of carbonated beverage bottles is expected to promote tremendous growth over the forecast period. In addition, the rising consumption of the product in pharmaceuticals, paints, water-soluble coatings, and adhesives will propel industry development. However, volatility in crude oil prices along with the increasing environmental impact of paraxylene is expected to hinder the product growth over the forecast period. Technological advancements to increase output, and reduce cost will create new growth opportunities over the forecast period.

Application Insights

PET resins will witness significant volume rise at a CAGR of 7.7% from 2017 to 2025 as it imparts a clear appearance that will augment market demand over the forecast period. Rising demand for PET resins in water bottles and soft drinks bottles is expected to augment market growth over the forecast period. Rising consumption of PET resins in packaging fresh and prepared foods will augment market size.

Moreover, superior properties such as strength and water resistance have led to its increasing use among the food and cosmetics sector. Increasing demand for water bottles is expected to remain a key driver for the purified terephthalic acid market growth. PET bottles are easier to handle, lightweight, non-breakable, and can be resealed.

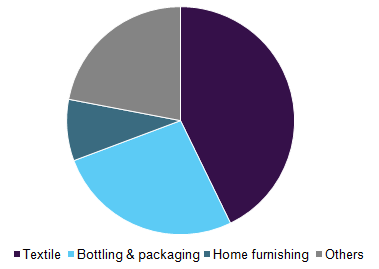

End-use Insights

The bottling & packaging segment is expected to witness significant volume growth at a CAGR of 8.0% from 2017 to 2025 on account of rising demand for soft drinks and bottles. Purified terephthalic acid is used in take-out containers, ketchup, jars, baked goods containers, household products, frozen foods, bottled water, cosmetics, juices, and carbonated drinks.

Global purified terephthalic acid (PTA) market volume by end-use, 2016 (%)

Packaging provides protection, enhances aesthetic value, and increases the shelf life of the packaged product. Rising demand for personal care products owing to the introduction of sophisticated products along with formulation development for specific consumer groups is expected to create new market avenues for the packaging market. Demand for PET bottling and packaging is expected to rise over the forecast period on account of relatively low unit cost, availability of various sizes and shapes, flexibility as well as convenient for on-the-go consumption.

Regional Insights

Asia Pacific is expected to show significant volume rise at a CAGR of 8.1% from 2017 to 2025 on account of the robust manufacturing base of food & beverages, textile, and construction sector in India, Singapore, and China. Ongoing industrialization, the rising population along with increasing foreign investments in the packaging and paints & coatings sectors will drive the industry expansion over the forecast period.

Growing processed foods industry in India in light of growing demand for Indian brands such as MTR ready to eat foodstuff, Bikanervala Foods, and ‘ITC’s Kitchens of India’ in retail outlets is projected to create immense market potential over the forecast period. In September 2014, the Ministry of Food Processing in India announced the establishment of 42 food processing parks in the near future. Therefore, regulatory support aimed at promoting the food processing output in India is expected to fuel market demand in the near future.

MEA accounted for 6.9% of the overall volume in 2016 and is expected to witness high growth in light of rising funding towards urban and infrastructural developments in countries including Saudi Arabia, Oman, Qatar, and Egypt. Infrastructural developments in these countries have increased the demand for textiles and fabrics in commercial and residential applications.

Various factors including positive demographics, favorable macroeconomics, and rising tourism activities will promote construction growth. Qatar construction sector is expected to witness significant growth on account of huge government investment along with rapid urbanization in the country, which in turn is projected to fuel industry expansion.

Purified Terephthalic Acid Market Share Insights

The global purified terephthalic acid (PTA) industry is highly competitive in nature on account of the prevalence of various large and small scale manufacturers. The industry is dominated by various major players including Sinopec, Eastman Chemical Company, British Petroleum, Reliance, and Alpek.

The market is expected to witness strong competition over the forecast period on account of growing investment in process technology and in production capacities. Key players in the market are focusing on gaining competitive advantage along with profitability through establishing strategic partnerships with regional players and providing technological expertise in order to manufacture PTA with low capital investment and conversion cost.

The Dow Chemical Company and Johnson Matthey collaborated to upgrade the COMPRESSTM PTA process to reduce investment and operating costs, improve product quality, and reduce the environmental impact of the process. In April 2017, Alpek acquired PetroquímicaSuape and Citepe for USD 385 million in order to increase its installed capacity by 450 and 640 tons per year of PET and PTA, respectively.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in Kilo Tons & Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

The U.S., Germany, The U.K., India, China, Brazil

Report coverage

Volume & Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts volume and revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global purified terephthalic acid market on the basis of application, end-use, and region:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

PET resins

-

Polyester fiber

-

Films

-

Others

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Textile

-

Bottling & packaging

-

Home furnishing

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

- Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."