- Home

- »

- Next Generation Technologies

- »

-

Process Spectroscopy Market Size & Share Report, 2030GVR Report cover

![Process Spectroscopy Market Size, Share & Trends Report]()

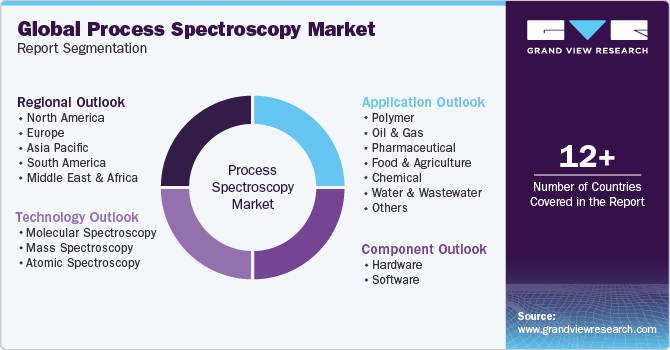

Process Spectroscopy Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (Molecular Spectroscopy, Mass Spectroscopy, Atomic Spectroscopy), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-561-8

- Number of Report Pages: 155

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Process Spectroscopy Market Size & Trends

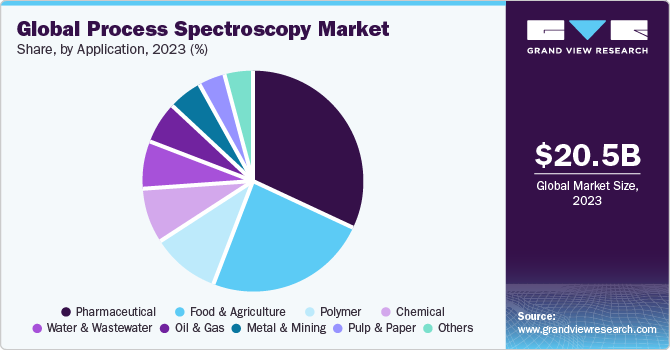

The global process spectroscopy market size was valued at USD 20.52 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.1% from 2024 to 2030. The total number of shipments in the market was 809,212 units in 2023 and is expected to reach 1,735,412 units by 2030. Key growth drivers include the increasing awareness of the importance of quality food and drugs, as well as the implementation of government regulations and standards by relevant organizations. Spectroscopy-enabled solutions offer the capability to analyze, monitor accurately, and control processes while also enabling the identification of defects in product materials.

Secondly, there has been significant development of handheld and portable instruments in process spectroscopy. These compact and portable devices offer convenience and flexibility in various industrial settings. They enable real-time analysis and monitoring, allowing on-site measurements and immediate decision-making. The advancements in handheld and portable spectrometers have contributed to the expansion of the process spectroscopy market globally.

Process spectroscopy is a methodology that encompasses the utilization of spectrum analysis for examining the interaction between matter and electromagnetic radiation. The growth of the market can be attributed to the rising utilization of spectroscopic techniques in the pharmaceutical and food & agriculture sectors. This technique involves the study of the interaction between matter and electromagnetic radiation.

Researchers have long been engaged in the intensive study and development of spectroscopy techniques, constantly striving for progress and innovation to enhance these methods. Their dedicated research and improvements have resulted in numerous breakthroughs across various applications.

For instance, in June 2023, Thermo Fisher Scientific Inc. announced the introduction of the Thermo Scientific Orbitrap Astral mass spectrometer, marking a significant milestone in mass spectrometry innovation after 15 years. This groundbreaking analyzer: Astral, seamlessly combines rapid sample processing, exceptional sensitivity, and extensive proteome coverage, empowering researchers worldwide to detect previously elusive proteins and achieve groundbreaking discoveries with unparalleled efficiency.

The pharmaceuticals, chemicals, oil & gas, and food & drug industries have achieved significant milestones thanks to the advancements in process spectroscopic techniques. The pharmaceutical industry is increasingly adopting spectroscopy instruments due to the process analytical technology (PAT) guidelines set forth by the Food and Drug Administration (FDA).

Among these instruments, Raman spectroscopy is particularly favored in the pharmaceutical sector due to its cost-effectiveness and high level of accuracy. Similarly, the agricultural industry is experiencing a high demand for Raman spectroscopy instruments, primarily because they enable non-destructive extraction of physical and chemical data from samples, facilitating faster analysis.

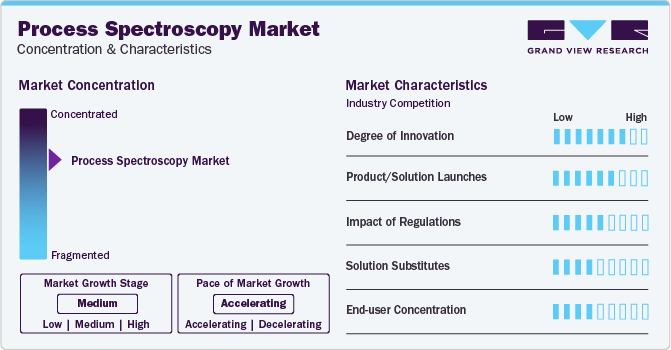

Market Concentration & Characteristics

The process spectroscopy market growth stage is medium, and the pace of the market growth is accelerating. The process spectroscopy market is consolidated. The companies operating in this market are investing in research and development initiatives. For instance, in 2022, Agilent Technologies, Inc. announced USD 20 million in the expansion of its manufacturing center in Shanghai. The expansion aimed to strengthen the company and cater to the increasing demand in China for the company's advanced liquid chromatography, spectrometer, and mass spectroscopy systems.

Market players are involved in several strategic initiatives to achieve a competitive advantage, such as mergers & acquisitions, partnerships, and new product launches. For instance, in August 2021, Danaher Corporation announced that the company had acquired Aldevron. Aldevron would be branded within the Life Science segment of Danaher Corporation and operate as a standalone company.

Process spectroscopy companies are subject to various laws and regulations, such as environmental and employee safety laws. The companies are subject to laws and regulations by regulatory agencies such as the Occupational Safety and Health Administration (OSHA) of the U.S. Moreover, the market players are subject to the laws and regulations governing the testing, development, production, and distribution of drugs, chemicals, and similar products.

The threat of substitutes for process spectroscopy solutions is moderate. Alternatives, such as chromatography, can be preferred for some use cases over spectroscopy as it is more accurate. However, spectroscopy offers a lower cost per analysis in comparison to chromatography.

The process spectroscopy solutions are offered to various industries, including oil & gas, pharmaceuticals, food & agriculture, and chemical industries. The Raman spectroscopy instrument is popular in the pharmaceutical industry owing to its low cost of analysis and highly accurate results. The rising trend among consumers for high-quality products has led to the development of spectroscopic technologies.

Technology Insights

Molecular spectroscopy led the market and accounted for a 45.1% share of the global revenue in 2023. By technology segment, this market is divided into molecular, mass, and atomic. The molecular segment is also expected to contribute significantly to the technology segment over the forecast period. The total number of atomic and molecular spectroscopy shipments was 366,493 and 329,751 units, respectively, in 2023. The shipment units are expected to increase to 750,145 and 717,677 units for both segments by 2030, respectively.

Furthermore, the molecular spectroscopy segment is also segregated into Near Infrared (NIR), Fourier-Transform Infrared (FT-IR), Raman, and Nuclear Magnetic Resonance (NMR) technology. Growing miniaturization of molecular spectroscopy instruments and improvements in Raman technologies are expected to propel the market growth over the forecast period. Moreover, increasing requirements in the pharmaceuticals and life sciences, along with significant demand in the petrochemical and chemical industries is likely to fuel the growth.

The mass spectroscopy technology segment is anticipated to witness the fastest growth, expanding at a CAGR of 11.7% throughout the forecast period. Mass spectrometry has emerged as a powerful analytical tool for pharmaceutical and health life sciences. The application of mass spectrometry in the pharmaceutical industry associated with the Drug Discovery and Development process provides superior-performing liquid chromatography-mass spectrometry in pharmacodynamics, drug metabolism, and pharmacokinetic studies.

The mass spectrometer is majorly used in biological therapeutics with more mixed indicators. It also allows the identification, characterization, and quantification of drug compounds and impurities. The increasing focus on drug safety, efficacy, and regulatory compliance has led to the growing adoption of mass spectrometers in pharmaceutical companies. This technique enables accurate metal detection in drug samples. Thus, increasing focus on drug safety regulations, where spectroscopy techniques are used to monitor several metalloid and metal impurities in drug samples to ensure patient safety.

Component Insights

The hardware segment led the market and accounted for more than 77.0% share of the global revenue in 2023. The segment is anticipated to dominate over the forecast period owing to the increasing adoption of spectroscopic techniques. Hardware refers to the physical components and instruments used to perform spectroscopic measurements. These hardware elements are crucial for generating, manipulating, and detecting light or electromagnetic radiation to obtain spectral information.

The hardware segment in this market comprises spectrometers, light sources, systems, analyzers, and accessories. The spectroscopy equipment manufacturers either design their product or assemble the components to produce the final product. Some leading players are Agilent Technologies, Inc.; Thermo Fisher Scientific, Inc.; and Danaher Corporation. The companies also offer customized solutions to their customers and analytical software for data storage and analysis. For instance, Thermo Fisher Scientific, Inc. offers a GRAMS Spectroscopy Software suite to collaborate data sets and perform analysis on the data sets.

The software segment is anticipated to grow at the fastest CAGR of 11.6% throughout the forecast period. The software employed in spectroscopy focuses on offering core facility software solutions designed to help streamline and optimize various aspects of scientific research and laboratory operations. The software solutions enhance productivity and efficiency and are widely utilized to manage workflows, ensure data integrity, and comply with regulatory requirements.

Moreover, the broad application of the software in this field is fueling the market's growth owing to the increasing integration of cutting technology for data acquisition and providing seamless control of spectrometers, detectors (with simultaneous detector control), and accessories. The software features a user-friendly interface that allows users to access powerful tools for data processing and presentation easily.

Application Insights

The pharmaceutical segment led the market and accounted for a 31.8% share of the global revenue in 2023. Based on applications, the market has been segregated into polymer, oil & gas, pharmaceuticals, food & agriculture, chemical, water & wastewater management, pulp & paper, metal & mining, and others. The pharmaceutical and food & agriculture segments together were major contributors to revenue in 2023.

The pharmaceutical segment is anticipated to dominate over the forecast period due to the increasing adoption of spectroscopic techniques. Growing research in the pharmaceutical industry and the need for regulatory compliance are driving manufacturers to develop innovative instruments that meet the demands for enhanced efficiency and accuracy in spectroscopy. In particular, the emergence of biologics, which are genetically engineered proteins derived from human genes, has created new opportunities for Ultraviolet/Visible Infrared Spectroscopy (UV/Vis) spectrometers in the pharmaceutical field.

The food & agriculture segment is anticipated to witness remarkable growth over the forecast year with a CAGR of 12.6%. The spectroscopy techniques have allowed the tracking and identification of materials, detection of impurities and identification, fermentation processing and reaction monitoring, and product uniformity and repeatability in the food & agriculture sector. Furthermore, spectroscopic techniques such as near-infrared (NIR) and Fourier transform infrared (FT-IR) enable routine analysis in the food & feed industry with advantages such as accuracy, precision, and shorter analysis time.

Spectroscopy is a highly sensitive technology that enables precise food analysis and is widely utilized for quality control purposes. Various spectroscopic techniques, such as infrared, ultraviolet-visible, Raman, nuclear magnetic resonance (NMR), and atomic emission spectroscopy, are utilized widely in common applications in the field of agriculture. Moreover, incorporating these spectroscopic techniques into compact portable devices has expanded their usability and application in agricultural settings.

Regional Insights

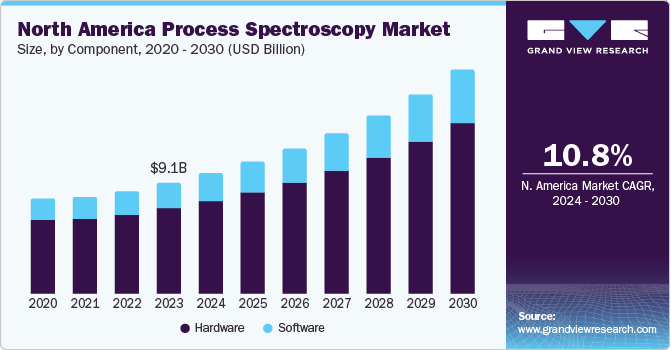

The North America process spectroscopy market emerged as the dominant regional market, with a revenue share of around 44.1% in 2023. The market is experiencing a significant shift across North America due to the increased shale gas production in the U.S. and Canada. Moreover, the growing need for process optimization in pharmaceuticals, chemicals, food, beverages, and oil and gas industries is boosting the market growth. Process spectroscopy allows real-time monitoring and analysis of various parameters, enabling companies to optimize manufacturing processes, improve product quality, and reduce operational costs.

The region is well equipped with the infrastructure for various research & development across all the major industrial sectors and has the potential for investments in various technological developments. As companies in North America witness the positive impacts of process spectroscopy on process optimization, quality control, and operational efficiency, awareness about its benefits is increasing. This has increased the demand for process spectroscopy solutions in various industries.

The process spectroscopy market in Asia Pacific is anticipated to witness fastest growth at a CAGR of 12.4% over the forecast period. This significant growth of the Asia Pacific region can be attributed to the region’s strong manufacturing hub and advancements in R&D practices. Moreover, the technological advancements in spectroscopic techniques, such as near-infrared (NIR), Raman, and Fourier-transform infrared (FTIR) spectroscopy, have made them more accessible, user-friendly, and cost-effective.

These advancements have increased the adoption of process spectroscopy in various industries in the region. The usage of spectroscopic techniques for producing, refining, and distributing oil & gas in these countries is resulting in the growing adoption of spectroscopy devices and methods, which drives the overall market at a considerable rate. All these factors have increased the adoption of spectroscopic techniques, largely helping the region to attain significant heights over the forecast period.

China Process Spectroscopy Market Trends

The process spectroscopy market in China is projected to grow at a CAGR of 12.5% from 2024 to 2030. This is attributed to the high R&D activities and investments in the biotech industry in the country. Moreover, the government initiatives to attract foreign investment and promote more biotech R&D are likely to drive the demand for process spectroscopy solutions.

Japan Process Spectroscopy Market Trends

The process spectroscopy market in Japan is witnessing significant growth owing to the presence of market players such as Yokogawa Electric Corporation and HORIBA. These players are launching new spectroscopy solutions, driving innovation.

India Process Spectroscopy Market Trends

The process spectroscopy market in India is expected to grow significantly over the forecast period owing to high agricultural and pharmaceutical production. According to Invest India, in the financial year 2022-23, the export of pharmaceuticals in India was USD 25.30 billion. Since process spectroscopy has applications in the pharmaceutical industry, the demand for process spectroscopy solutions is expected to rise.

The process spectroscopy market in Europe was valued at USD 4.93 billion in 2023. The growing investments in R&D in the region are contributing to the market growth in the region. According to the European Commission, in 2022, European Union (EU) private investments reached the highest growth rate since 2015. Moreover, sectors such as automotive, healthcare, and chemicals, among others led in R&D investments. Process spectroscopy has applications in chemical and pharmaceutical industries, and growing investments in these sectors are likely to create significant growth in the region.

U.K. Process Spectroscopy Market Trends

The process spectroscopy market in the U.K. accounted for over 43.0% share of the European market in 2023. The presence of market players, such as Keit Ltd., which offers spectroscopy solutions, drives the market’s growth in the country.

Germany Process Spectroscopy Market Trends

The process spectroscopy market in Germany is expected to grow at a CAGR of 10.8% from 2024 to 2030. The high production by the German chemical and pharmaceutical industry drives the market growth in the country. It is strong across segments, such as polymers, petrochemicals, and pharmaceuticals, among others. Moreover, the rising budget of R&D investments in the industry is likely to drive the adoption of process spectroscopy solutions.

France Process Spectroscopy Market Trends

The process spectroscopy market in France is projected to grow due to high research activities in the field of spectroscopy in the country. Molecular Spectroscopy Group (GSM), a research lab in Bordeaux, conducts research in the field of spectroscopy.

The process spectroscopy market in Middle East and Africa (MEA) is anticipated to reach USD 2.14 billion by 2030. The regional market uses process spectroscopy for various applications such as agriculture, biomedicine, and geology. Moreover, high oil and natural gas production in the region contributes to the market growth in the region.

Saudi Arabia Process Spectroscopy Market Trends

The process spectroscopy market in Saudi Arabia is witnessing significant growth owing to its high oil & natural gas production. According to the U.S. Department of Commerce’s International Trade Administration (ITA), Saudi Arabia ranks as one of the largest net exporters of petroleum. Process spectroscopy has applications in the oil & gas industry, driving the demand for process spectroscopy solutions in the country.

Key Process Spectroscopy Market Company Insights

Some of the key process spectroscopy vendors operating in the market include Agilent Technologies, Inc., Thermo Fisher Scientific, Shimadzu Corporation, and Yokogawa Electric Corporation.

-

Yokogawa Electric Corporation is a Japanese multinational electrical and mechanical engineering company. It is one of the prominent providers of industrial automation and test measurement solutions across the globe. The company offers services and solutions for a broad range of industry verticals, such as oil & gas, chemical, power & energy, water & wastewater, mining & metal, pharmaceutical, food & beverage, pulp & paper, and iron & steel.

-

Thermo Fisher Scientific is a U.S.-based company that provides laboratory equipment and scientific instruments to customers operating in hospitals, clinical diagnostic labs, pharmaceutical and biotech industry, among others. It operates in four business segments, namely, Analytical Instruments, Life Sciences Solutions, Laboratory Products and Biopharma Services, and Specialty Diagnostics.

-

Sartorius AG and HORIBA are some of the emerging process spectroscopy vendors.

-

Sartorius AG is a Germany-based company that provides solutions that aid customers in developing drugs economically and safely. It operates in two business segments, namely, Bioprocess Solutions and Lab Products & Services. The company offers tools for spectroscopy. It has a global presence with over 60 production and sales sites worldwide.

-

HORIBA is a Japan-based company engaged in designing and manufacturing precision instruments. Its product offerings include medical diagnostic analyzers, environmental measuring systems, and a wide range of scientific analyzers. As of December 2022, the company has 8,432 employees. It has a global presence with presence in numerous countries, including Brazil, Canada, France, India, Germany, and the U.K., among others.

Key Process Spectroscopy Companies:

The following are the leading companies in the process spectroscopy market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these process spectroscopy companies are analyzed to map the supply network.

- ABB

- Agilent Technologies, Inc.

- Bruker

- BUCHI

- Danaher

- FOSS

- HORIBA

- Endress+Hauser Group Services AG

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Recent Developments

-

In October 2023, HORIBA announced the launch of A-TEEM Compliance Package, a software compliance package. The software compliance package is a spectroscopic solution that is capable of identifying out-of-spec products and identifies low-level components in complex mixtures. It is designed to ensure regulatory compliance in the pharmaceutical industry.

-

In July 2022, Yokogawa Electric Corporation announced the launch of a new version of its probe-type tunable diode laser spectrometer, TDLS8200. The new version is explosion-proof and is an addition to the OpreX Analyzer family. The spectrometer features high measurement stability, reliability, and low installation cost. It is designed for industries such as chemical, oil & gas, and iron & steel.

-

In April 2022, Thermo Fisher Scientific Inc. announced the launch of a Raman spectroscopic analyzer. The analyzer offers continuous and non-destructive analysis with rapid system setup and deployment. The design of the analyzer is aimed to eliminate the Raman spectroscopy measurement complexity.

Process Spectroscopy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.52 billion

Revenue forecast in 2030

USD 41.99 billion

Growth Rate

CAGR of 11.1% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Technology, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, India, China, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

ABB, Agilent Technologies, Inc., Bruker, BUCHI, Danaher, FOSS, HORIBA, Endress+Hauser Group Services AG, Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific Inc., and Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Process Spectroscopy Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global process spectroscopy market report based on component, technology, application, and region.

-

Component Outlook (Revenue, USD Billion; 2017 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Billion; Shipment, Units; ASP, USD; 2017 - 2030)

-

Molecular Spectroscopy

-

NIR

-

FT-IR

-

Raman

-

NMR

-

Others

-

-

Mass Spectroscopy

-

Atomic Spectroscopy

-

-

Application Outlook (Revenue, USD Billion; 2017 - 2030)

-

Polymer

-

Oil & Gas

-

Pharmaceutical

-

Food & Agriculture

-

Chemical

-

Water & Wastewater

-

Pulp & Paper

-

Metal & Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global process spectroscopy market size was estimated at USD 18.89 billion in 2022 and is expected to reach USD 20.52 billion in 2023.

b. The global process spectroscopy market is expected to grow at a compound annual growth rate of 10.50% from 2023 to 2030 to reach USD 41.99 billion by 2030.

b. North America dominated the process spectroscopy market with a share of 44.2% in 2022. This is attributable to increased shale gas production in countries present in the region, such as the U.S. and Canada. Moreover, the growing need for process optimization in pharmaceuticals, chemicals, food, beverages, and oil and gas industries is boosting the market growth in the region.

b. Some key players operating in the process spectroscopy market include Bruker, ABB Group, Buchi Labortechnik AG, Danaher Corporation, Sartorius AG, and Shimadzu Corporation.

b. Key drivers of market expansion include increasing awareness of the importance of quality food and drugs and implementing government regulations and standards by relevant organizations. Spectroscopy-enabled solutions offer the capability to analyze, monitor accurately, and control processes while also enabling the identification of defects in product materials

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."