- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyvinyl Butyral Market Size, Share & Trends Report, 2030GVR Report cover

![Polyvinyl Butyral Market Size, Share & Trends Report]()

Polyvinyl Butyral Market Size, Share & Trends Analysis Report By Application (Films & Sheet, Paints & Coating, Adhesive & Sealants, Printing Inks, Others), By End-use, By Region And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-184-9

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

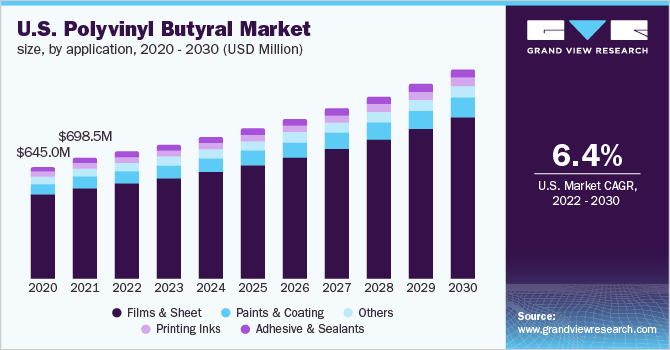

The global polyvinyl butyral market size was estimated at USD 3.23 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2030. Rising demand from the global automobile industry and increasing photovoltaic industry is expected to drive the polyvinyl butyral market.

In November 2021, the U.S senate approved the infrastructure bill valued at USD 1.2 trillion which is expected to generate demand for construction services. This is expected to increase construction spending which further is likely to create demand for the polyvinyl butyral market during the forecast period. Capacity addition by the airports and railways is likely to fuel demand for laminated glass, which, in turn, is projected to boost the market growth.

In addition, the rising utilization of PVB-based adhesives and paints & coatings in various industries including paper, packaging, assembly, manufacturing, woodwork, and consumer products is expected to drive the market throughout the forecast period.

A positive outlook toward the automotive industry in China, India, Japan, South Korea, Malaysia, Indonesia, and Vietnam is expected to promote the utilization of polyvinyl butyral. The increasing population in China and India coupled with favorable government regulations, aimed at generating investments from public-private partnerships & foreign direct investments, are also anticipated to fuel demand for polyvinyl butyral during the coming years.

Increasing demand for PVB in the automobile industry, as a laminated glass protective interlayer, is expected to drive market growth. Increasing automobile production, mainly in China, Indonesia, Japan, Malaysia, and Taiwan, is anticipated to propel the demand for PVB in the automotive industry. Rapid urbanization along with high demand for SUVs and sedans is expected to propel the use of PVB in automobile applications. India is likely to witness a high demand for automobiles due to industrialization and government support for the manufacturing of vehicles.

PVB resins have gained acceptance among photovoltaic thin film solar module manufacturers. The increasing applicability of PVB resins in the solar energy generation industry is expected to provide new growth avenues for the market. Growing economic forces, investment in R&D activities, and continuous technological developments are converging opportunities for the photovoltaic industry. Key companies manufacturing PVB resins are focusing on the efficiency of thin films, processing innovations, and low-cost processing & manufacturing techniques to increase their production capacities.

Application Insights

The films & sheet segment dominated the Polyvinyl Butyral market with a share of more than74.0% in 2021. PVB films & sheets are utilized as an interlayer in the manufacturing of laminated glasses used in architectural and automotive sectors. Laminated glass is a type of safety glass that keeps the components intact even when broken. A PVB interlayer between the two or more layers of glass holds it in place. In the case of a collision, the interlayer keeps these two layers of glass linked, and PVB's great strength prevents the glass from shattering into very big, sharp pieces.

The growth in the industrial sector is expected to fuel the demand for PVB-based paints & coatings. Industrial sector is rapidly growing in the emerging economies of China, India, Mexico, South Korea, and Brazil. Rising population and improved living standards coupled with rapid urbanization are the factors driving the growth of the industries such as manufacturing, construction, FMCG, and transportation in developing countries. Growth of industrial facilities in the Asia Pacific and Latin America are expected to boost demand for the paints & coatings, which, in turn, will boost the market growth during the forecast period.

Adhesives are versatile products that find applications in the industrial and manufacturing sectors. The demand for these products continues to increase as manufacturers continuously seek improved performance of the bonding materials, substitute synthetic substrates for traditional materials, reduce the emissions of volatile organic compounds (VOCs), recycling, and aesthetic bonding solutions for various substrates. PVB is widely used in adhesives owing to its superior strength, adhesion, and binding properties in various environmental conditions.

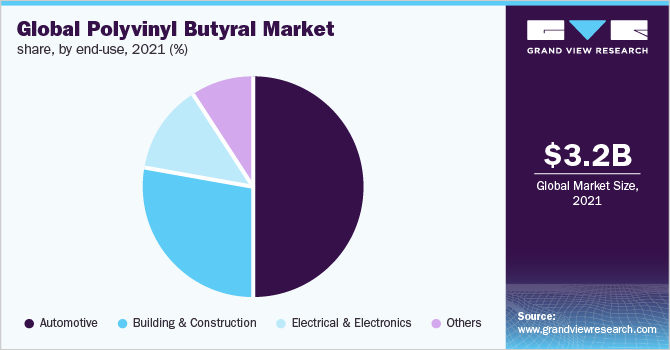

End-Use Insights

The automotive segment dominated the market with a revenue share of more than 50.0% in 2021. PVB films offer protection of graphics, a long-lasting finish, and prevent the formation of bubbles on the surface. Laminated safety glass has been effective for windshields and is increasingly adopted to produce roof and side glass on luxury cars to reduce noise, and light transfer and increase safety. In addition, owing to less smoke generation and low flammability PVB film & sheets are utilized in the construction and automotive industry for safety.

Increasing utilization of renewable sources of energy is expected to increase the utilization of PVB in the electrical & electronics industry. PVB films are economical and convenient for solar photovoltaic modules and encapsulation material which improves the UV protection and performance of the glass. Further, regulations on clean energy and a rise in demand for solar cells are anticipated to drive demand for the PVB in the electrical & electronics industry.

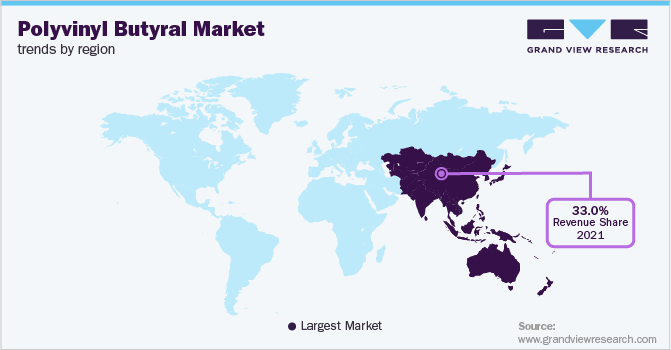

Regional Insights

The Asia Pacific dominated the market with a revenue share of more than 33.0% in 2021. Industrial expansion in the Asia Pacific is anticipated to propel the demand for PVB-based paints, coatings, and adhesives in industrial machinery, equipment, and containers. Furthermore, ascending demand for fast-moving consumer goods in the region is likely to drive consumption of PVB-based inks and packaging materials. PVB is anticipated to witness increasing utilization in packaging applications owing to the ascending demand for laminated glass and adhesives by hospitals in urban & rural areas in emerging economies.

Photovoltaic industry uses PVB films as an encapsulation material of double-glazing elements with integrated solar cells, which significantly increases the life of solar panels. Asia Pacific photovoltaic industry is an emerging industry, and it is witnessing significant growth on account of an increase in solar energy generation projects. Key manufacturers are expanding their facilities for PVB resins in developing economies, thereby boosting the consumption of PVB resins in the photovoltaic industry.

Rising EU funding coupled with various supportive measures, including subsidies, tax breaks, and incentives, taken by governments in the region is expected to drive the construction industry. The commencement of the Construction 2020 Action Plan is also likely to boost the growth of the construction sector in the region. Enlargement of the construction sector in various European countries including the U.K., the Netherlands, Germany, Italy, and others is expected to propel the demand for polyvinyl butyral during the coming years.

Key Companies & Market Share Insights

The global polyvinyl butyral market is fragmented as a large number of global and regional players are operating in the market. Key global players are facing acute competition from the regional players, who have robust distribution networks and an adequate understanding of the suppliers and regulations.

Major players in the market are involved in research & development for the production of superior-quality resins that provide improved features. Expansion activities are witnessed in the Polyvinyl Butyral market to carry out R&D activities related to polyvinyl butyral.

For instance, in March 2021, Eastman Chemical Company announced an investment to expand and upgrade its extrusion capabilities for the production of interlayer product lines at its manufacturing facility in Springfield, Massachusetts. This investment will positively impact the supply capability of Eastman Chemical Company on a regional and global level with respect to polyvinyl butyral products. Some of the prominent players in the global polyvinyl butyral market include:

-

Eastman Chemical Company

-

Chang Chun Petrochemical Co., Ltd.

-

Sekisui Chemicals Co., Ltd.

-

Kuraray Co., Ltd.

-

Huakai Plastic Co., Ltd.

-

King board (Fogang) Specialty Resins Limited

-

Everlam

-

Tiantai Kanglai Industrial Co., Ltd.

-

Dulite Co., Limited

-

Guangzhou Aojisi New Material Co., Ltd.

-

Qingdao Haocheng Industrial Co., Ltd

-

Jiangxi RongXin New Materials Co., Ltd.

-

HuzhouXinfu New Materials Co., Ltd.

-

Zhejiang Pulijin Plastic Co., Ltd.

-

Genau Manufacturing Company LLP

Polyvinyl Butyral Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.39 billion

Revenue forecast in 2030

USD 5.51 billion

Growth rate

CAGR of 6.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, South Africa

Key companies profiled

Eastman Chemical Company; Chang Chun Petrochemical Co., Ltd.; Sekisui Chemicals Co., Ltd.; Kuraray Co., Ltd.; Huakai Plastic Co., Ltd.; King board (Fogang) Specialty Resins Limited; Everlam; Tiantai Kanglai Industrial Co., Ltd.; Dulite Co., Limited; Guangzhou Aojisi New Material Co., Ltd.; Qingdao Haocheng Industrial Co., Ltd; Jiangxi RongXin New Materials Co., Ltd.; HuzhouXinfu New Materials Co., Ltd.; Zhejiang Pulijin Plastic Co., Ltd.; Genau Manufacturing Company LLP

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

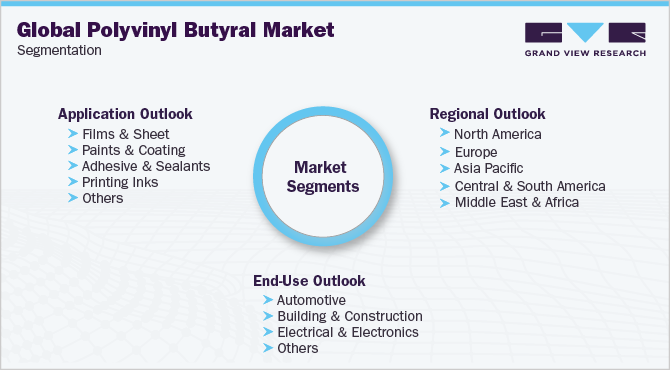

Global Polyvinyl Butyral Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global polyvinyl butyral market report based on the application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Films & Sheet

-

Paints & Coating

-

Adhesive & Sealants

-

Printing Inks

-

Others

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Automotive

-

Building & Construction

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyvinyl butyral market size was estimated at USD 3.23 billion in 2021 and is expected to reach USD 3.39 billion in 2022.

b. The global polyvinyl butyral market is expected to grow at a compound annual growth rate of 6.3% from 2022 to 2030 to reach USD 5.51 billion by 2030.

b. The films & sheets segment dominated the polyvinyl butyral market with a share of 74.5% in 2021. PVB sheets & films are largely used for manufacturing of laminated glasses, which are widely used in the architectural and automotive sectors.

b. Some key players operating in the polyvinyl butyral market include Eastman Chemical Co., Chang Chun Company Limited, Sekisui Chemical Company Limited, Kuraray Co., Limited, Huakai Plastic Co., Ltd., Kingboard Specialty Resins Limited, Tiantai Kanglai Co., Limited, Everlam, Dulite Co., Limited, and Qingdao Haocheng Co., Ltd.

b. Key factors that are driving the market growth include the rising utilization of laminated glasses in residential and non-residential buildings as a result of its several properties such as durability, UV radiation, and weather resistance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."