- Home

- »

- Petrochemicals

- »

-

Polymer Modified Bitumen Market Size Report, 2030GVR Report cover

![Polymer Modified Bitumen Market Size, Share & Trends Report]()

Polymer Modified Bitumen Market Size, Share & Trends Analysis Report By Product (Elastomeric Polymers, Plastomeric Polymers), By Grade (PMB 40, PMB 70), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-756-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Report Overview

The global polymer modified bitumen market size was valued at USD 12.86 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030. Market growth worldwide is driven by the demand for durable infrastructure, sustainable products, and technological advancements. Government-funded infrastructure development and increasing construction activities, particularly in emerging economies, also contribute to market growth. Enhanced performance characteristics and adoption of road safety features further fuel market expansion.

The need for high-quality, long-lasting infrastructure is a major driver of the polymer modified bitumen (PMB) market, as it provides superior performance and extends the lifespan of pavements and structures used in road construction, roofing, and waterproofing applications. Moreover, the growing need for sustainable construction materials is contributing to market growth, as PMB offers improved performance and sustainability compared to traditional bitumen.

The increasing demand for infrastructure development projects, particularly in emerging economies, is also fueling the demand for PMB. Rapid urbanization and the emphasis on sustainable construction materials are driving investment in infrastructure development projects, which in turn is driving the demand for PMB. Furthermore, technological advancements and new product innovations are expanding the market’s potential, including eco-friendly formulations and novel polymer blends. For instance, the concept of hybrid PMB involving the combination of elastomers and plastomers is gaining traction.

Stringent environmental regulations are also driving the demand for PMB, as it provides environmental benefits such as reduced energy consumption, lower carbon footprint, and improved recyclability compared to traditional bitumen. The growing demand for pavement rehabilitation and maintenance is creating lucrative opportunities for the development of sustainable, cost-efficient, and environmentally friendly bituminous materials. As a result, PMB is poised to become a key player in the construction industry, particularly in emerging economies such as India, Brazil, and China, where infrastructure development is accelerating rapidly.

Product Insights

Elastomeric polymers dominated the market with a revenue share of 51.9% in 2023. The inclusion of styrene butadiene styrene and ethylene-vinyl acetate in bitumen formulation enhances its elasticity, allowing for flexibility in high-temperature environments. This flexibility enables modified bitumen to withstand thermal expansion and contraction without cracking or deforming, making it suitable for heavy-duty applications and optimal performance.

Plastomeric polymers are expected to register the fastest CAGR of 4.0% in the forecast period. The incorporation of plastomeric polymers, such as polyethylene and polypropylene, into PMB enhances its thermal stability, enabling it to maintain its properties at high temperatures. This characteristic makes PMB suitable for applications in areas with environmental changes. Moreover, plastomeric materials provide improved UV resistance, reducing degradation and increasing long-term value.

Grade Insights

The PMB 70 grade segment held the largest revenue share of 50.8% in 2023. PMB 70 exhibits superior performance characteristics, making it a critical requirement for modern road infrastructure. It offers excellent resistance to rutting and cracking, ideal for high-traffic roads and harsh weather conditions. Research by the IndianOil Total Pvt. Ltd. confirms that PMB 70-based roads have a longer lifespan than conventional bitumen-based roads, ensuring safer and more durable roadways.

The PMB 40 grade segment is expected to register the fastest CAGR of 4.3% during the forecast period. PMB 40 exhibits exceptional resistance to deformation and cracking, making it an ideal solution for high-traffic roads and harsh environments. Its polymer modification enhances its viscoelasticity, providing rigidity at high temperatures and flexibility at low temperatures. This versatile product is suitable for highways, airport runways, and urban applications, and is preferred by civil engineers and contractors due to its ability to handle heavy traffic loads without compromising durability.

Application Insights

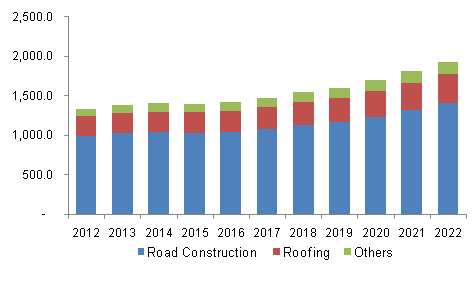

Road construction led the application segment with a revenue share of 67.5% in 2023. PMB’s load-bearing capacity surpasses traditional bitumen, making it an ideal solution for high-traffic roads. Polymers enhance its performance under weight stress, ensuring flexibility and resistance to cracking and stretching. Moreover, PMB’s components prioritize sustainable construction, utilizing recycled materials and incorporating cutting-edge polymer technology to further improve its properties.

Bridge construction is projected to be the fastest-growing application segment with a CAGR of 4.3% over the forecast period. PMB provides superior durability and resistance to ageing and oxidation, ensuring extended lifespan and reduced maintenance requirements for bridge structures. Its water-repellent properties minimize water penetration, preventing corrosion and damage to bridge decks and supporting structures. This results in cost-effective construction, reduced maintenance, and extended bridge life.

Regional Insights

Asia Pacific polymer modified bitumen market led the global market with a revenue share of 43.2% in 2023, owing to the rapid pace of infrastructure construction in many countries. Nations such as China, India, and Vietnam, experiencing rapid economic growth, are investing heavily in transportation networks, creating a significant demand for PMB.

China Polymer Modified Bitumen Market Trends

The polymer modified bitumen market in China held the largest revenue share of 32.6% in the Asia Pacific polymer modified bitumen market in 2023. The Chinese government’s investments in infrastructure development, particularly in road construction and maintenance, have significantly fueled market growth. The demand for high-performance materials such as polymer modified bitumen, which enhances durability and reduces maintenance costs, is increasing. Moreover, the government’s focus on sustainable construction practices and improving transportation networks drives market expansion.

North America Polymer Modified Bitumen Market Trends

North America polymer modified bitumen market held a significant market share in the global polymer modified bitumen market in 2023. The region’s robust infrastructure base and growing demand for eco-friendly road construction materials present a significant growth opportunity. Polymer modified bitumen offers superior aging and pavement performance, gaining popularity in North American road construction projects, particularly in the U.S. and Canada.

The polymer modified bitumen market in U.S. is expected to experience significant growth over the forecast period. Key drivers include innovation by U.S. companies, which have developed polymer modification methods to enhance bitumen performance. Growing demand for new infrastructure, driven by urbanization and population growth, also fuels demand.

Europe Polymer Modified Bitumen Market Trends

Europe polymer modified bitumen market is poised for significant growth between 2024 and 2030, driven by the region’s strong research and innovation focus in polymer modified bitumen technologies. With numerous research institutions and universities specializing in materials science, Europe is well-positioned to drive innovation. In addition, the European Union’s measures promoting the use of high-quality materials with long lifespans and minimal maintenance requirements further support market growth.

The polymer modified bitumen market in Germany held a substantial market share in the Europe polymer modified bitumen market in 2023. The country’s strong industrial platform, supported by a well-established supply chain network of suppliers, manufacturers, and research facilities, fosters a collaborative environment between academia and industry. This synergy enables the development of efficient PMB production processes and applications, driving market growth.

Middle East & Africa Polymer Modified Bitumen Market Trends

Middle East & Africa polymer modified bitumen market is expected to register the fastest CAGR of 4.4% over the forecast period. Countries such as Saudi Arabia, UAE, and South Africa are actively investing in infrastructure development, including road construction, highway construction, and airport construction, which require durable materials resistant to weather conditions. This demand is fueling the growth of the PMB market in these regions.

The polymer modified bitumen market in South Africa is expected to grow significantly over the forecast period. Key drivers include technological advancements, local demand dynamics, government policies, and the positioning of major firms within the industry. These factors will collectively contribute to the market’s growth, driven by increasing demand for durable and high-performance construction materials.

Key Companies & Market Share Insights

Some key companies in the polymer modified bitumen market include Oil India Limited, Benzene International Pte Ltd, Lagan Asphalt Group. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

Oil India Limited (OIL) is a prominent Indian public sector undertaking, under the Ministry of Petroleum and Natural Gas, specializing in exploration and production of crude oil and natural gas. Leveraging cutting-edge technology and advanced equipment, OIL produces high-quality PMB products that meet international standards.

-

Benzene international pte limited is a manufacturer and supplier of Polymer Modified Bitumen (PMB) products. Catering to diverse customer needs, the company offers a range of PMB products, suitable for various applications, including road construction, roofing projects, and industrial uses.

Key Polymer Modified Bitumen Companies:

The following are the leading companies in the polymer modified bitumen market. These companies collectively hold the largest market share and dictate industry trends.

- Oil India Limited

- Benzene International Pte Ltd

- Lagan Asphalt Group

- NYNAS AB

- Shell plc

- Exxon Mobil Corporation.

- Gazprom

- Sika AG

Recent Developments

-

In June 2024, Oil India Limited awarded a contract of approximately USD 10.0 million to NBCC (India) Limited to build a centralized core repository with lab facilities in Guwahati, Assam, as part of their existing collaborations.

-

In March 2024, Sika acquired Kwik Bond Polymers, LLC, a U.S. manufacturer of polymer systems for concrete infrastructure refurbishment. The acquisition complements Sika’s high-value systems and enhances its product portfolio.

Polymer Modified Bitumen Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.45 billion

Revenue forecast in 2030

USD 16.99 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, grade, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Turkey, China, Japan, India, Vietnam, Indonesia, Malaysia, Thailand, Brazil, Argentina, Gulf Co-operation Council (GCC), South Africa

Key companies profiled

Oil India Limited; Benzene International Pte Ltd; Lagan Asphalt Group; NYNAS AB; Shell plc; Exxon Mobil Corporation; Gazprom; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymer modified bitumen market report based on product, grade, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Elastomeric Polymers

-

Styrene Butadiene Styrene (SBS)

-

Styrene Butadiene Rubber (SBR)

-

Styrene Isoprene Styrene (SIS)

-

Styrene Ethylene Butadiene Styrene (SEBS)

-

Others

-

-

Plastomeric Polymers

-

Polyurethane (PU)

-

Polyethylene (PE)

-

Ethylene Vinyl Acetate (EVA)

-

Atactic Polypropylene (APP)

-

Others

-

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PMB 40

-

PMB 70

-

PMB 120

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Road Construction

-

Roofing Systems

-

Bridge Construction

-

Railway Systems

-

Others (Insulation, Dams & Reservoirs, Landfills, Tunnel Construction)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Vietnam

-

Indonesia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Gulf Co-operation Council (GCC)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."