- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Terephthalate Market Size Analysis Report, 2025GVR Report cover

![Polyethylene Terephthalate Market Size, Share & Trends Report]()

Polyethylene Terephthalate Market Size, Share & Trends Analysis Report, By Application (Packaging, Films & Sheets), By Packaging Application And Segment Forecasts, 2020 - 2025

- Report ID: GVR-3-68038-780-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2018

- Forecast Period: 2020 - 2025

- Industry: Bulk Chemicals

Report Overview

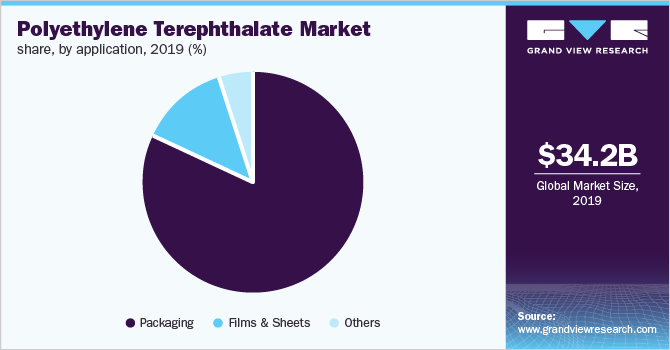

The global polyethylene terephthalate market size was valued at USD 34.15 billion in 2019. It is anticipated to register a compound annual growth rate (CAGR) of 5.6% over the forecast period. Polyethylene terephthalate, commonly known as PET or PETE, is a non-toxic, lightweight, safe, and flexible material, which can be recycled and reused efficiently. It can also be processed up to 3 to 4 times without affecting its chemical properties. These features make polyethylene terephthalate an ideal choice for use in various industries such as automotive, electronics, and textiles, among others.

Moreover, polyethylene terephthalate offers unique physical properties, such as it is shatterproof and non-reactive to food and water, due to which it is widely used in flexible packaging applications. The growing technological advancements and innovations in packaging applications, mainly through weight reduction, are expected to positively influence market growth. Major factors driving the market growth for Polyethylene Terephthalate (PET) include increasing consumption of textiles and fabrics, increasing recycling and collection rate of PET in Europe, and rising demand for sustainable & recyclable products globally. Meanwhile, stringent environmental regulations controlling the increasing use of PET and rising demand for environmentally friendly alternatives such as High-Density Polyethylene (HDPE) are expected to negatively impact the growth of the market.

The increasing demand for lightweight packaging solutions for electronics and food is anticipated to introduce new application avenues for polyethylene terephthalate. Moreover, the intensity of rivalry is expected to increase over the forecast period. Hence, players are focusing on strengthening their market position through the development of novel technologies. Companies are also focusing on the cost-effective and high-quality manufacturing processes of PET to gain a competitive edge in the market.

The bottled water segment has emerged as the largest application segment in the market for polyethylene terephthalate (PET) owing to the increasing demand for bottled water and carbonated soft drinks across the globe. The segment accounted for over 65% market share in 2018 and is expected to further grow over the forecast period. Packaging product manufacturers are expanding in terms of infrastructure and production capacity to cater to the dynamically growing market requirements. Moreover, numerous PET film & sheet manufacturers are adopting strategies such as acquisitions and collaborations for procuring raw material.

Polyethylene Terephthalate Market Trends

Rising investments in infrastructural development has boosted industrial manufactured, coupled with the exponential expansion of the organized retail sector in emerging economies. These factors are likely to positively influence the overall polyethylene terephthalate market. Expanding healthcare & cosmetics industries are also projected to drive the demand for PET packaging in China, India, Brazil, Russia, and other emerging economies.

Improving standards of living and growing personal disposable income in these and other developing regions is further anticipated to fuel the demand for PET in packaging applications.

Growing packaging demand in the food & beverage industry is another factors anticipated to spur market demand. Furthermore, wide application areas in different sectors of consumable goods are driving the demand for PET packaging. Increasing investments in the packaging industry for development of technologically advanced packaging solutions at economical prices is projected to propel market growth over the coming years

PET is also becoming more popular in the pipes and fittings industry, thanks to its low cost constructions, extended life duration, corrosion resistance, and light weight. PET is also being used to replace traditional glass and wood materials in building and infrastructure applications including as fence, siding, windows, and decking.

Future supply-demand shifts are projected to make PET prices in all worldwide markets very volatile. The majority of raw materials are created by petrochemicals' downstream operations. Political instability, supply-demand mismatches, and seasonal changes all contribute to crude oil price volatility.

Because crude oil is a source for petrochemicals, crude oil prices have a significant impact on petrochemical pricing. Because the majority of the ingredients used in plastic compounding are mostly reliant on petrochemicals, volatility in petrochemical pricing is projected to provide a hurdle to the global PET market's growth throughout the forecast period.

Application Insights

Based on application, the market for Polyethylene Terephthalate (PET) has been segmented into packaging, films & sheets, and others. The packaging application emerged as the largest segment in 2018, accounting for a market share of over 32.0%. The growing packaging industry, which is driven by high consumerism in emerging economies, is expected to boost the demand for plastics such as polyethylene and PET over the forecast period. Regulatory bodies have laid down various guidelines regarding the safe use of packaging materials in food contact applications, which is influencing the demand for PET in this segment.

Meanwhile, the increasing consumption of food containers in emerging economies such as China and India is expected to significantly drive the demand for PET in films & sheets applications. These containers offer thermal insulation to the products stored in them along with an aesthetic appeal. Moreover, microwave-safe containers are paving the way for the growth of the films & sheets segment. Customers across the globe prefer using microwave-compatible food containers to save preparation time.

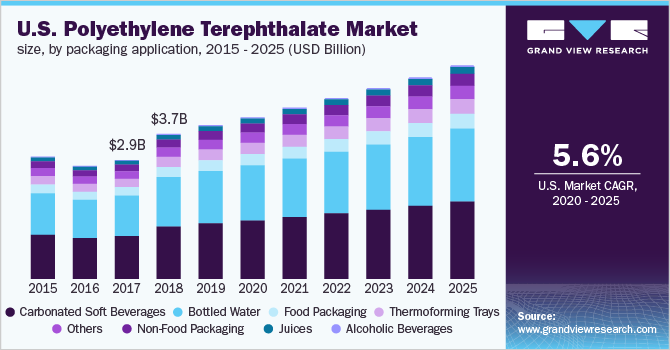

Packaging Application Insights

Based on packaging application, the polyethylene terephthalate market has been segmented into bottled water, carbonated soft beverages, juices, alcoholic beverages, thermoforming trays, food packaging, non-food packaging, and others.PET is widely used in packaging applications on account of its features such as durability and lightweight. The material finds numerous uses in the packaging of bottled water and carbonated beverages. Meanwhile, the juices packaging segment is expected to emerge as the fastest-growing application segment as PET-based packages are easier to recycle compared to other materials.

Polyethylene Terephthalate offers various beneficial properties such as lightweight, increased flexibility, high strength, and 100% recyclable, which makes it a preferred material to be used in the packaging segment. Polyethylene terephthalate is available in both, homopolymer and copolymer forms, making it an attractive choice for beverage packaging applications. Various companies have started taking initiatives to manufacture products using eco-friendly packaging materials. For instance, Coca-Cola’s World Without Waste initiative is focused on collecting and recycling the equivalent of every bottle or can it sells globally.

Regional Insights

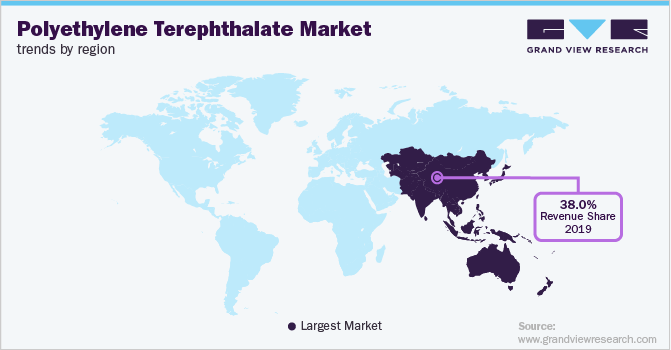

The Asia Pacific dominated the Polyethylene Terephthalate market in 2019, accounting for a market share of 38.0%. Increasing consumption of packaged food coupled with the growing demand for automobile films in countries such as China, India, Indonesia, and Malaysia is expected to drive the demand for polyethylene terephthalate in the Asia Pacific. The region is expected to account for a market share of approximately 38% of the total revenue by 2025. This can be attributed to various environmental regulations laid down by international agencies such as Environmental Protection Agency (EPA), International Union for Conservation of Nature (IUCN), and Intergovernmental Panel on Climate Change (IPCC), which is likely to influence the demand for polyethylene terephthalate in the region.

China and India, the region’s fastest growing economies provide numerous growth prospects for consumer goods segment, considering an increasing GDP per capita and improving domestic production landscape of consumer goods. Population growth, vibrant economic activity and improved purchasing power in markets of Latin America and Asia are likely to boost consumer goods sales consequently impacting PET market.

Moreover, factors such as price sensitivity of the products coupled with the presence of a large number of players in the PET market are likely to intensify competition in the region. Developing economies such as India, Indonesia, and China are expected to observe robust economic growth soon. High investments being made in the building & construction sectors for infrastructure development in Europe and the Asia Pacific are expected to boost the demand for films & sheets over the coming years. Besides, green building initiatives, especially in Europe, are anticipated to propel the demand for VOC-free films.

North America and Europe are mature markets as compared to Asia Pacific. Stringent regulations in both the former regions have forced the manufacturers to shift their production landscape towards emerging economies of Asia Pacific such as China and India. These countries offer land and skilled labor at a comparatively lower cost.

The U.S. presents a relatively mature, yet growing market for PET owing to high demand from several end-use industries which include automotive, construction, electronics, packaging and others. The recovery from the economic recession has led to a significant increase in consumer spending and confidence. Furthermore, the U.S. government and several federal agencies are increasingly investing in infrastructure, regional development and providing schemes to enchase the same. These factors are likely to lead to rapid growth in the infrastructural and construction markets, which in turn are conducive to the PET market since these materials are highly effective & lightweight with quick bonding times.

Key Companies & Market Share Insights

Prominent companies operating in the market for Polyethylene Terephthalate (PET) include BASF SE, M&G Chemicals, SABIC, Arkema, Evonik Industries, and The Sherwin-Williams Company. The majority of the key players have integrated their resin production and distribution operations to improve resin quality and expand their regional presence. This has resulted in cost reduction, thus positively impacting the profit margin for companies. Moreover, in an attempt to gain a competitive edge in the market, companies are focused on investing in R&D activities to develop new application scopes and to efficiently cater to the dynamically evolving end-user requirements.

Polyethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 35.86 billion

Revenue forecast in 2025

USD 47.46 billion

Growth rate

CAGR of 5.6% from 2020 to 2025

Base year for estimation

2019

Actual estimates/Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2020 to 2025

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

application, packaging application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

RTP COMPANY; BASF SE; DUPONT; DSM; M&G CHEMICAL GROUP; LANXESS CORPORATION; LYONDELL BASELL INDUSTRIES N.V.; Indorama Ventures; Toray Industries; Eastman Chemical Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Polyethylene Terephthalate Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the polyethylene terephthalate market report based on application, packaging application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Packaging

-

Films & Sheets

-

Others

-

-

Packaging Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Bottled Water

-

Carbonated Soft Beverages

-

Juices

-

Alcoholic Beverages

-

Thermoforming Trays

-

Food Packaging

-

Non-Food Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."