- Home

- »

- Water & Sludge Treatment

- »

-

Point Of Entry Water Treatment Systems Market Report 2030GVR Report cover

![Point Of Entry Water Treatment Systems Market Size, Share & Trends Report]()

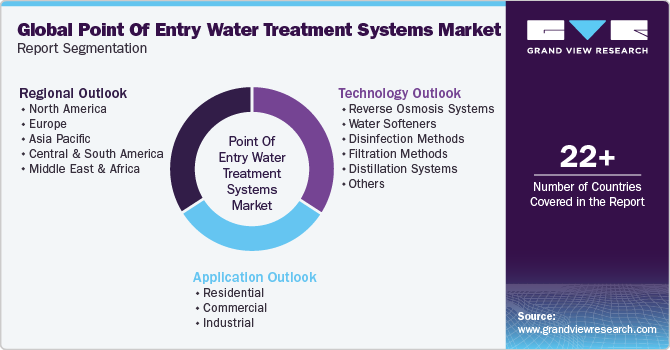

Point Of Entry Water Treatment Systems Market Size, Share & Trends Analysis Report By Technology (RO Systems, Filtration Methods), By Application (Residential, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-255-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

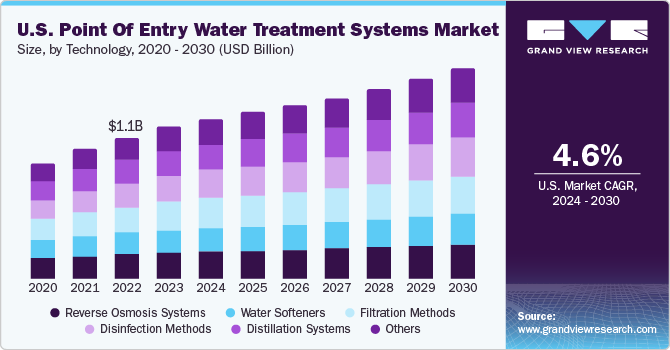

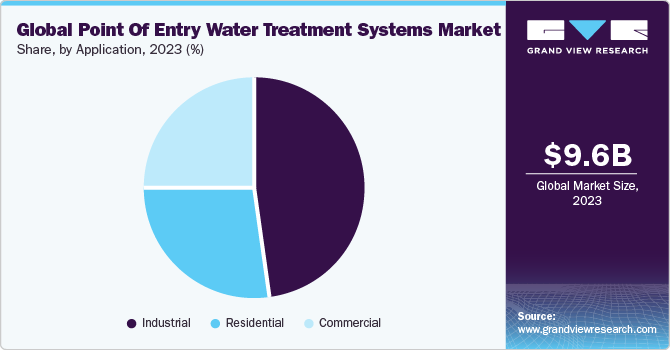

The global point of entry water treatment systems market size was estimated at USD 9.62 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. Increasing demand for water treatment systems due to the growing pollution and population in urban areas is expected to have a positive impact on market growth. In the U.S., increasing levels of contamination have resulted in the rising adoption of water treatment systems, thereby boosting market growth. The EPA is carrying out administrative orders to ensure safe drinking water through public water systems in the U.S. Moreover, the announcement of the Drinking Water and Wastewater Infrastructure Act of 2021 in May 2021 by the U.S. government with funding of USD 35 billion has created opportunities for the market.

The U.S. government is undertaking several initiatives to improve its public infrastructure. For instance, in November 2023, the U.S. Department of Treasury announced a plan to invest USD 7.8 billion in airport infrastructure development projects, USD 34.1 billion in public transportation infrastructure, and USD 22.8 billion for water infrastructure in the country. Thus, growing number of commercial projects in the country is expected to drive market demand in North America. Population growth, rapid urbanization, technological advancements, and infrastructure expansion have all increased global demand for fresh and processed water. The human population has doubled in the last 50 years resulting in high consumption of water.

Moreover, depleting water resources and rising water pollution levels are also contributing to product demand, which is expected to fuel industry growth. According to the United Nations Educational, Scientific and Cultural Organization (UNESCO) World Water Development Report 2022, approximately 829,000 people, including nearly 300,000 children under the age of five years, die each year across the world from diarrhea caused by contaminated drinking water, poor sanitation, and poor hand hygiene. Rising public awareness about the need for treated drinking water has aided in the widespread adoption of point of entry water treatment systems.

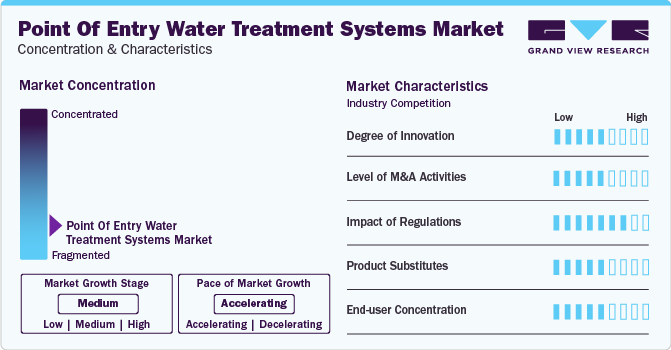

Market Concentration & Characteristics

Market growth stage is medium, and the market growth pace is accelerating. The market is characterized by a high degree of competition owing to various technologies used in the product and large number of manufacturers operating at global level.

The market is also characterized by a high degree of product innovation, which results in the optimization of water treatment process. The use of sustainable technology and energy-efficient product demand is increasing across different industries. A similar trend can be observed in this market.

The industry is also significantly influenced by the growing regulatory compliance. These systems are installed for achieving maximum contaminant levels (MCLs) compliance under the federal Safe Drinking Water Act (SDWA) in the National Primary Drinking Water Regulations.

End-user concentration is a significant factor in this industry owing to a high number of commercial and industrial facilities that require such systems.

Technology Insights

The reverse osmosis (RO) systems technology segment held a revenue share of 16.2% in 2023. An RO system is positioned at the entry point of the pipe that supplies water. The pore size of an RO filter is around 0.0001 microns, making it highly efficient in removing protozoa, bacteria, and viruses. This technology also aids in eliminating various aqueous salts and metal ions, including lead, chromium, copper, chloride, and sodium. The rising importance of water quality is likely to have a positive impact on segment growth. Owing to industrialization and urbanization, freshwater bodies are becoming polluted and are drying up.

The increasing presence of industrial pollutants in water supply is expected to fuel the demand for more water treatment systems and thus, drive market growth. The distillation systems segment is projected to witness lucrative growth rate from 2024 to 2030. Distilled water is used for various purposes, such as drinking, cooking, cleaning, bathing, laundry, etc. For commercial applications, such as dental offices and laboratories, the point of entry water distillation units are used to ensure the safety of patients as well as equipment. Also, for hospitals, restaurants, schools, etc., these systems offer high-quality distilled and safe water for various applications.

Application Insights

The industrial segment dominated the market in 2023. The water used in various breweries, bottling plants, beverage manufacturing, and food processing facilities must be of high quality; hence, these industries use point of entry water treatment systems. Moreover, the penetration of these systems is increasing in the residential sector as well. The increasing preference for soft, odorless, and filtered water for purposes, such as showering, cleaning, bathing, and washing, is anticipated to contribute to segment growth.

The commercial sector is projected to grow at the fastest CAGR from 2024 to 2030. Commercial applications include small-scale commercial, educational, recreational, healthcare, and transport facilities. Point of entry water treatment systems possess a larger capacity and are installed at the water inlet. Similarly, in the healthcare & hospitality industry, protective filters are fitted at all water source inlets to supply treated water to hospitals, dental clinics, hotels, public swimming pools, and restaurants. The growth in commercial spaces and demand for purified water for various applications are likely to propel segment growth.

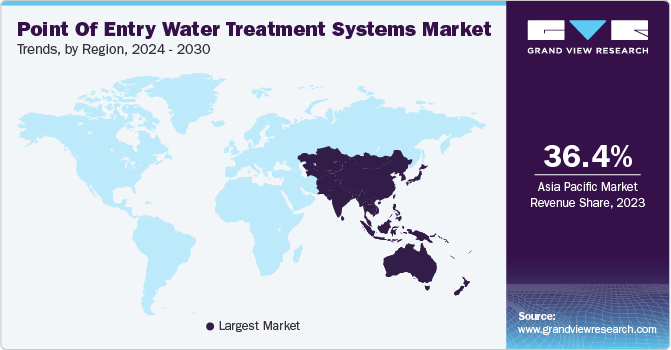

Regional Insights

Asia Pacific dominated the market and accounted for a 36.4% share in 2023 due to the high concentration of industrial end-users and large consumer base in residential application. Emerging economies, such as China, India, and Japan, are the key countries driving the development of manufacturing and building & construction industries in this region.

The ongoing industrialization & urbanization and improving public infrastructure, including transportation, healthcare, and sports facilities, in countries, such as China, India, and South Korea, are expected to positively affect the region’s growth. Central & South America is anticipated to witness significant growth from 2024 to 2030. The growing foreign direct investments and initiatives taken by the local governments in various sectors including general manufacturing, oil & gas, travel & tourism, hospitality, etc. are contributing to the region’s growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3M, DuPont, Pentair plc, and BWT Holding GmbH.

-

DuPont, through its business segment-the Safety & construction segment, offers a wide range of products including water purification technology. Its product line FilmTec, Amber, TapTec, and MEMCOR offer products for water treatment systems

-

Pentair Plc is a U.S.-based company that operates through three business segments, namely Aquatic Systems, Filtration Solutions, and Flow Technologies. Its product offering includes water softeners, whole house systems for water treatment

Aquasana Inc., EcoWater Systems LLC, and Calgon Carbon Corporation. are some of the emerging market participants in the point of entry water treatment systems market.

-

Aquasana Inc. is a manufacturer of whole-house water treatment systems, under-counter filters, countertop water filters, salt-free water conditions, replacement filters, etc.

-

Calgon Carbon Corporation offers various innovative products including granular activated carbon, powdered activated carbon, activated carbon cloth, pelletized activated carbon, and ultraviolet (UV) technologies

Key Point Of Entry Water Treatment Systems Companies:

- 3M

- DuPont

- Pentair plc

- BWT Holding GmbH

- Culligan

- Watts

- Aquasana, Inc.

- Calgon Carbon Corporation

- EcoWater Systems LLC

- GE Appliances

Recent Developments

-

In December 2023, Watts formed an agreement to acquire Josam Company, a manufacturer of plumbing and drainage products. This acquisition will expand sales networks and provide increased cross-selling opportunities to the former

-

In October 2023, Calgon Carbon announced completion of its facility expansion at its Pearlington, Mississippi site. The second production line of virgin activated carbon will be added in the existing facility, resulting in a significant increase in production capabilities

Point Of Entry Water Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.17 billion

Revenue forecast in 2030

USD 13.42 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; Russia; China; Japan; South Korea; India; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

3M; DuPont; Pentair Plc; BWT Holding GmbH; Culligan; Watts; Aquasana, Inc.; Calgon Carbon Corp.; EcoWater Systems LLC; GE Appliances

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Entry Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of entry water treatment systems market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reverse Osmosis Systems

-

Water Softeners

-

Disinfection Methods

-

Filtration Methods

-

Distillation Systems

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Offices

-

Hotels

-

Restaurants

-

Café

-

Hospitals

-

Schools

-

Other

-

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global point of entry water treatment systems market size was estimated at USD 9.62 billion in 2023 and is expected to be USD 10.17 billion in 2024.

b. The global point of entry water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 13.42 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 36.4% share in 2023. The region has been witnessing robust growth in the market owing to increasing population, strong growth of the industrial sector, rising disposal income, and alarming lack of fresh water.

b. Some of the key players operating in the point of entry water treatment systems market include 3M, Dupont, Pentair plc, BWT Holding GmbH, Culligan, Watts, Aquasana, Inc., Clagon Carbon Corporation, EcoWater Systems LLC, and GE Appliances.

b. The growth of the market is anticipated to be propelled by the increasing water stress regions, rising government initiatives and regulations & policies to facilitate the use of water treatment solutions, and increasing concentration of emerging pollutants in the water bodies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."