- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Compounding Market Size And Share Report, 2030GVR Report cover

![Plastic Compounding Market Size, Share & Trends Report]()

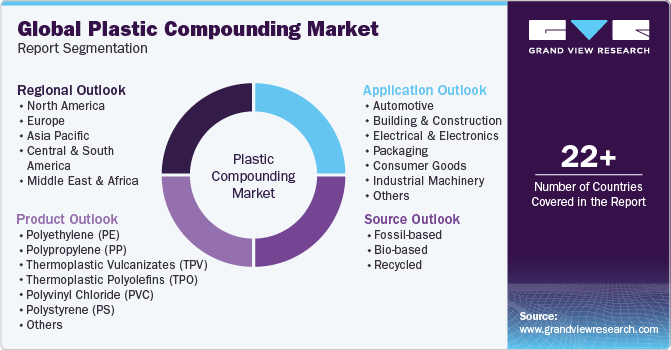

Plastic Compounding Market Size, Share & Trends Analysis Report By Source (Fossil-based, Bio-based, Recycled), By Product, By Application (Automotive, Aerospace & defense), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-446-8

- Number of Report Pages: 195

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Plastic Compounding Market Size & Trends

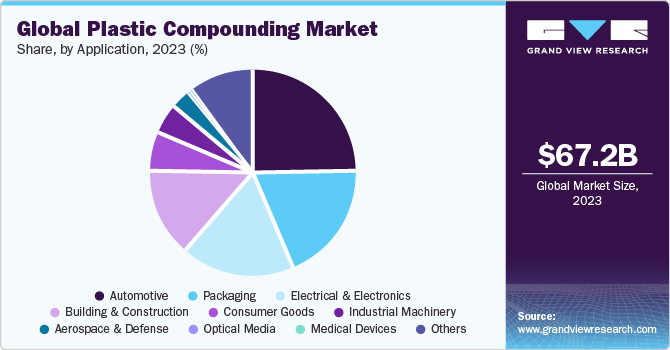

The global plastic compounding market size was estimated at USD 67.17 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. Increasing substitution for natural rubber, wood, metals, glass, and concrete by plastic is expected to drive the growth of the plastic compounding industry over the forecast period. The demand for plastic is rising due to its use in various industrial applications because of its ability to form desired shapes and easy molding. Plastic fittings are considered very easy to install compared to metal or wood fittings. These fittings are available in a wide range of color combinations, which adds to their aesthetic appeal.

Moreover, plastic fittings can be sealed very tightly, thus creating a barrier to external unwanted factors like dust or water. The properties of plastic compounds can drive its market growth in the coming years. Plastic compounding process involves various stages, such as determining additives ratio, high-speed mixing via twin screw extruders and other plastic compounding machines, melt mixing, and cooling before final pellet cutting and packaging.

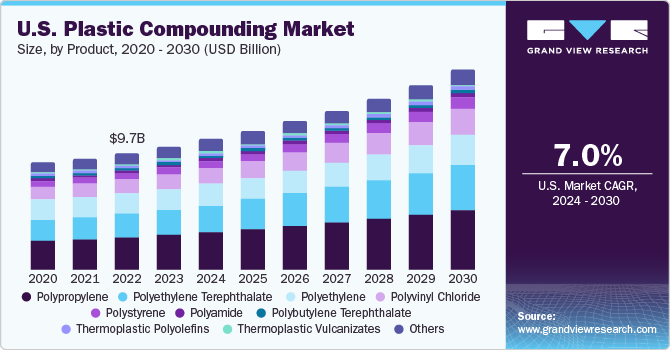

The U.S. dominated the North American market for plastic compounding in 2023 and is expected to continue its dominance over the forecast period. The demand for plastic compounding in the country is majorly generated from the expanding automotive industry coupled with the rise in a number of construction activities. Capacity addition and plant expansion by automotive companies in the U.S. are further expected to augment the demand for plastics compounding.

Polyethylene Terephthalate (PET) is expected to be one of the fastest-growing segments in the U.S. plastics market due to its high demand from the packaging sector. PET is mostly used in the production of bottles and contributes to a significant market share in plastics industry. Most PET processors in the U.S. are increasingly focusing on implementing Good Manufacturing Practices (GMPs) in an attempt to optimally utilize available resources, conserve resources, and increase production efficiency. These initiatives are further expected to boost the market growth of PET over the forecast period.

Rising demand for plastic compounded resins in comparison to the traditional plastic resins across various industries including automotive and others has provided an opportunity for the plastic compounding market to propel globally. Compared to traditional materials such as rubber or metals, the usage of plastic compounded goods in automotive applications helps minimize fuel consumption by reducing the density and weight of cars. Over the projected period, rising consumer awareness of consumer safety and health concerns in different industries such as electronics, healthcare, wire & cable, construction, and automotive is expected to increase global demand for plastic compounding for manufacturing of plastic compounded resins.

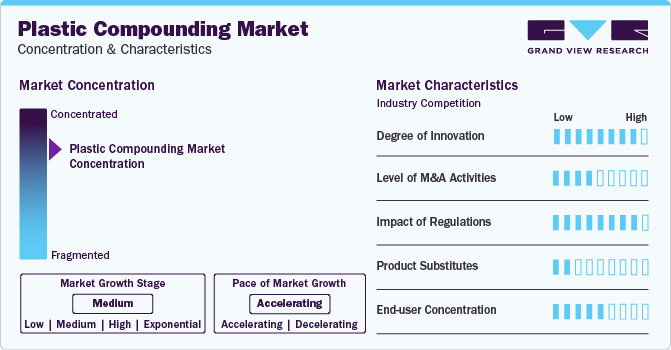

Market Concentration & Characteristics

The global plastic compounding market is highly consolidated in nature with the presence of various key players such as BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc., LyondellBasell Industries Holdings B.V., RTP Company, and Kingfa SCI. & TECH. CO., LTD. as well as a few medium and small regional players operating in different parts of the world. The global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations.

The companies in the market compete on the basis of product quality offered and the technology used for the production of plastics. Major players, in particular, compete on the basis of application development capability and new technologies used in product formulation. Established players such as BASF SE are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players.

To maintain strong and healthy competitive environment across the marketspace, the global plastic compounding companies manufacturing compounded plastics have implemented various strategic initiatives such as acquisition & merger, new product launch, production expansion, and various others. For instance, in October 2023, Covestro AG launched their new mechanical recycling polycarbonate compounding production unit in Shanghai, China with a plastic compounding capacity of 25 kilotons per annum.

Source Insights

Fossil-based compounded plastics dominated the source segmentation in 2023 with a market revenue share of above 56.0%. This growth rate is attributed to the major utilization of petrochemical-based plastics from major end-use industries such as automotive, building & construction, medical, packaging, and others, for which fossils act as raw materials. Furthermore, the derivation of petrochemical from fossil fuels and further manufacturing of plastics is highly convenient and economic for the manufacturers in comparison to the manufacturing of their counter parts such as bio-based plastics.

Followed by recycled plastics with a market revenue share of more than 30.0% in 2023, owing to the rise in demand for recycled plastics from end-use industries in line with the increasing concerns regarding environmental damage caused due to increased consumption of virgin plastics, along with companies moving towards sustainability and circular economy. This has propelled the plastic recyclers to increase their recycling capacities across the globe in recent years.

Additionally, bio-based plastics have gained popularity in recent years owing to the rising governmental concerns to reduce landfilling, including programs such as U.S. 2030 Food Loss and Waste Reduction Goal, and expanding composting infrastructure are anticipated to augment the demand for compostable bags or bio-based bags used for the collection of food leftovers and other organic waste material over the forecast period.

Product Insights

Polypropylene (PP) dominated the product segmentation in 2023 with a market revenue share of above 29.0%. Polypropylene can be processed using any of the thermoplastic processing methods including injection molding, extrusion blow molding, and general-purpose extrusion. It has good fatigue and chemical & temperature resistance. Although, polypropylene is vulnerable to oxidative degradation in contact with copper and certain other materials. This has made it a popular material in developed and emerging economies for several application industries.

Automotive is the largest application segment for polypropylene (PP) compounds due to their high impact resistance and ease of maintenance. The rise of auto manufacturing in the Asian and Latin American markets has fueled the growth of the automotive sector, both in terms of vehicle sales and domestic production. Consumption of plastic compounds in automotive applications is expected to increase significantly over the forecast period due to continued growth in the automotive output market as well as regulatory trends forcing manufacturers to must reduce vehicle weight and improve energy efficiency.

Followed by polyethylene (PE) with a market revenue share of above 21.0% in 2023. Polyethylene compounds are widely used in various industries such as automotive, construction, electrical & electronics, and packaging. PE is an integral material for the packaging industry. Construction is the leading application market for polyethylene compounds with a significant market share in the global market.

Application Insights

Automotive sub-segment dominated the application segmentation in 2023 with a market revenue share above 25.0%. Exterior body parts, wiper arm casings and housings, bumpers, moldings, ignition, front grilles, cladding, roof trim, and other automobile applications all use PP and PET compounds. Low thermal expansion, high stiffness, lightweight, dimensional stability, moisture resistance, exceptional scratch resistance, and impact resistance in low temperatures are just a few of the properties that these materials possess.

Several grades of PP and PET compounds have been developed over the past years to meet diverse performance requirements. The growing demand for sustainable materials in this segment has been a major driver for lightweight plastic. In addition, the implementation of emission norms and vehicular weight regulations in the automotive industry owing to rising greenhouse gas emissions is anticipated to propel the demand for global automotive plastic compounding over the forecast period.

Followed by packaging with a market revenue share above 18.0% in 2023. Demand for compounded plastics in the packaging industry is driven by mass consumption in major economies such as China, India, Germany, the United States, and Brazil. Various regulatory agencies have established guidelines for packaging materials for food contact applications. The polypropylene formulation provides a cost-effective packaging solution that helps improve impact strength, flexibility, transparency, and process efficiency. The high demand for polyethylene in the packaging industry has contributed significantly to the growth of the plastic compounding market.

Regional Insights

Asia Pacific dominated the market and held a revenue share of over 44.0% in 2023 owing to the favorable conditions in Asia Pacific, such as increasing manufacturing output, booming e-commerce market, and favorable demographics, are promising. Investments in six Asian economies (China, Thailand, Indonesia, India, Vietnam, and Malaysia) for developing talent, improving infrastructure, and supply chain facilities are expected to drive the market growth.

Increasing demand for consumer goods such as refrigerators and washing machine in countries such as India, Vietnam, the Philippines, China, and Thailand is expected to fuel the demand for plastic compounding in these applications. Growing demand for automotive in the region coupled with favorable FDI norms by governments is further projected to facilitate investment in the Asia Pacific. In addition, low manufacturing cost in China and India as compared to Europe is expected to propel the use of plastic compounding in automobiles.

Followed by Europe with a market revenue share of above 21.0% in 2023. Growth in automotive production, high standard of living, and growing aging population, are significantly contributing towards a positive growth for plastic compounding in Europe. Well-developed infrastructure along with the presence of renowned automakers including Fiat, BMW, and Volkswagen among others are propelling the development of automotive market in this region which in turn is creating application scope of plastic compounding in this region.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, Sirmax, an Italian plastic processor, announced their expansion of plastic compounding in India with a production capacity of 20 kilotons per annum. The plant is scheduled to be completely operational by the end of 2026.

- In November 2023, Borealis AG announced its expansion of mechanically recycled plastic compounding production, increasing its compounding capacity to over 50 kilotons per annum. This expansion was possible with the acquisition of Rialti S.p.A., an Italian polypropylene (PP) compounder of recyclates.

Key Plastic Compounding Companies:

- BASF SE

- SABIC

- Dow, Inc.

- KRATON CORPORATION

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours, Inc.

- RTP Company

- S&E Specialty Polymers, LLC (Aurora Plastics)

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Eurostar Engineering Plastics

- KURARAY CO., LTD.

- Arkema

- TEIJIN LIMITED

- LANXESS

- Solvay

- SO.F.TER

- Polyvisions, Inc.

- Ravago

Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.59 billion

Revenue forecast in 2030

USD 112.08 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Singapore; Malaysia; Indonesia; Thailand; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

BASF SE; SABIC; Dow, Inc.; KRATON CORPORATION; LyondellBasell Industries Holdings B.V.; DuPont de Nemours, Inc.; RTP Company; S&E Specialty Polymers, LLC (Aurora Plastics); Asahi Kasei Corporation; Covestro AG; Washington Penn; Eurostar Engineering Plastics; KURARAY CO., LTD.; Arkema; TEIJIN LIMITED; LANXESS; Solvay; SO.F.TER; Polyvisions, Inc.; Ravago; Heritage Plastics; Chevron Phillips Chemical Company LLC; Sumitomo Bakelite Co., Ltd.; Nova Polymers, Inc.; Adell Plastics, Inc.; Foster Corporation; MRC Polymers, Inc.; Flex Technologies; Dyneon GmbH & Co. KG; Kingfa SCI. & TECH. CO. LTD.; China XD Plastics, Co., Ltd.; Avient Corporation; Guangdong Silver Age Sci; China General Plastics Corporation (CGPC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Compounding Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic compounding market report based on source, product, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fossil-based

-

Bio-based

-

Recycled

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefins (TPO)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyurethane (PU)

-

Polymethyl Methacrylate (PMMA)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & construction

-

Electrical & electronics

-

Packaging

-

Consumer goods

-

Industrial machinery

-

Medical devices

-

Optical media

-

Aerospace & defense

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Indonesia

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic compounding market size was estimated at USD 63.45 billion in 2022 and is expected to reach USD 67.17 billion in 2023.

b. The global plastic compounding market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 112.08 billion by 2030.

b. The polypropylene segment dominated the plastic compounding market with a share of 29.79% in 2022. This is attributable to the rising demand from the automotive industry owing to the high impact resistance and serviceability.

b. Some key players operating in the plastic compounding market include BASF SE, LyondellBasell Industries, N.V., and The Dow Chemical Company, SABIC, Asahi Kasei Plastics, Covestro (Bayer Material Science), and others.

b. Key factors that are driving the plastic compounding market growth include increasing incorporation of plastics as opposed to metals and alloys in automotive components and rising demand from the packaging, building & construction sectors.

b. The polypropylene (PP) product segment led the plastic compounding market, accounting for a revenue share of more than 29.79% in 2022.

Table of Contents

Chapter 1. Plastic Compounding Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Plastic Compounding Market: Executive Summary

2.1. Market Snapshot, 2023

2.2. Segment Snapshot, 2023

2.3. Competitive Landscape Snapshot

Chapter 3. Plastic Compounding Market: Variables, Trends & Scope

3.1. Global Plastics Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Opportunity Analysis

3.4.4. Industry Challenges Analysis

3.5. Porter’s Five Forces Analysis

3.5.1. Supplier Power

3.5.2. Buyer Power

3.5.3. Substitution Threat

3.5.4. Threat from New Entrant

3.5.5. Competitive Rivalry

3.6. PESTEL Analysis

3.6.1. Political Landscape

3.6.2. Economic Landscape

3.6.3. Social Landscape

3.6.4. Technological Landscape

3.6.5. Environmental Landscape

3.6.6. Legal Landscape

3.7. East European Geopolitical Implication of the Industry Overview

3.8. Impact of COVID-19 on plastic compounding market

Chapter 4. Plastic Compounding Market: Source Outlook Estimates & Forecasts

4.1. Plastic Compounding Market: Source Movement Analysis, 2023 & 2030

4.2. Fossil-based

4.2.1. Plastic compounding market estimates and forecast, by fossil-based, 2018 - 2030 (Kilotons) (USD Million)

4.3. Bio-based

4.3.1. Plastic compounding market estimates and forecast, by bio-based, 2018 - 2030 (Kilotons) (USD Million)

4.4. Recycled

4.4.1. Plastic compounding market estimates and forecast, by recycled, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Plastic Compounding Market: Product Outlook Estimates & Forecasts

5.1. Plastic Compounding Market: Product Movement Analysis, 2023 & 2030

5.2. Polyethylene (PE)

5.2.1. Plastic compounding market estimates and forecast, by PE, 2018 - 2030 (Kilotons) (USD Million)

5.3. Polypropylene (PP)

5.3.1. Plastic compounding market estimates and forecast, by PP, 2018 - 2030 (Kilotons) (USD Million)

5.4. Thermoplastic Vulcanizates (TPV)

5.4.1. Plastic compounding market estimates and forecast, by TPV, 2018 - 2030 (Kilotons) (USD Million)

5.5. Thermoplastic Polyolefins (TPO)

5.5.1. Plastic compounding market estimates and forecast, by TPO, 2018 - 2030 (Kilotons) (USD Million)

5.6. Polyvinyl Chloride (PVC)

5.6.1. Plastic compounding market estimates and forecast, by PVC, 2018 - 2030 (Kilotons) (USD Million)

5.7. Polystyrene (PS)

5.7.1. Plastic compounding market estimates and forecast, by PS, 2018 - 2030 (Kilotons) (USD Million)

5.8. Polyethylene Terephthalate (PET)

5.8.1. Plastic compounding market estimates and forecast, by PET, 2018 - 2030 (Kilotons) (USD Million)

5.9. Polybutylene Terephthalate (PBT)

5.9.1. Plastic compounding market estimates and forecast, by PBT, 2018 - 2030 (Kilotons) (USD Million)

5.10. Polyamide (PA)

5.10.1. Plastic compounding market estimates and forecast, by PA, 2018 - 2030 (Kilotons) (USD Million)

5.11. Polycarbonate (PC)

5.11.1. Plastic compounding market estimates and forecast, by PC, 2018 - 2030 (Kilotons) (USD Million)

5.12. Polyurethane (PU)

5.12.1. Plastic compounding market estimates and forecast, by PU, 2018 - 2030 (Kilotons) (USD Million)

5.13. Polymethyl Methacrylate (PMMA)

5.13.1. Plastic compounding market estimates and forecast, by PMMA, 2018 - 2030 (Kilotons) (USD Million)

5.14. Acrylonitrile Butadiene Styre (ABS)

5.14.1. Plastic compounding market estimates and forecast, by ABS, 2018 - 2030 (Kilotons) (USD Million)

5.15. Others

5.15.1. Plastic compounding market estimates and forecast, by Others, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Plastic Compounding Market: Application Outlook Estimates & Forecasts

6.1. Plastic Compounding Market: Application Movement Analysis, 2023 & 2030

6.2. Automotive

6.2.1. Plastic compounding market estimates and forecast, by automotive, 2018 - 2030 (Kilotons) (USD Million)

6.3. Building & construction

6.3.1. Plastic compounding market estimates and forecast, by building & construction, 2018 - 2030 (Kilotons) (USD Million)

6.4. Electrical & electronics

6.4.1. Plastic compounding market estimates and forecast, by electrical & electronics, 2018 - 2030 (Kilotons) (USD Million)

6.5. Packaging

6.5.1. Plastic compounding market estimates and forecast, by packaging, 2018 - 2030 (Kilotons) (USD Million)

6.6. Consumer goods

6.6.1. Plastic compounding market estimates and forecast, by consumer goods, 2018 - 2030 (Kilotons) (USD Million)

6.7. Industrial machinery

6.7.1. Plastic compounding market estimates and forecast, by industrial machinery, 2018 - 2030 (Kilotons) (USD Million)

6.8. Medical devices

6.8.1. Plastic compounding market estimates and forecast, by medical devices, 2018 - 2030 (Kilotons) (USD Million)

6.9. Optical media

6.9.1. Plastic compounding market estimates and forecast, by optical media, 2018 - 2030 (Kilotons) (USD Million)

6.10. Aerospace & defense

6.10.1. Plastic compounding market estimates and forecast, by aerospace & defense, 2018 - 2030 (Kilotons) (USD Million)

6.11. Others

6.11.1. Plastic compounding market estimates and forecast, by others, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Plastic Compounding Market Regional Outlook Estimates & Forecasts

7.1. Regional Movement Analysis & Market Share, 2023 & 2030

7.2. Plastic Compounding Market: Regional Movement Analysis, 2023 & 2030

7.3. North America

7.3.1. North America Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.2. North America Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.3.3. North America Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.3.4. North America Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.3.5. U.S.

7.3.5.1. U.S. Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.2. U.S. Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.3. U.S. Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.4. U.S. Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.3.6. Canada

7.3.6.1. Canada Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.6.2. Canada Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.3.6.3. Canada Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.3.6.4. Canada Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.3.7. Mexico

7.3.7.1. Mexico Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.7.2. Mexico Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.3.7.3. Mexico Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.3.7.4. Mexico Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4. Europe

7.4.1. Europe Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.2. Europe Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.3. Europe Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.4. Europe Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.5. Germany

7.4.5.1. Germany Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.2. Germany Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.3. Germany Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.4. Germany Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.6. France

7.4.6.1. France Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.2. France Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.3. France Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.4. France Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.7. UK

7.4.7.1. UK Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.2. UK Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.3. UK Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.4. UK Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.8. Italy

7.4.8.1. Italy Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.8.2. Italy Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.8.3. Italy Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.8.4. Italy Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.9. France

7.4.9.1. France Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.9.2. France Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.9.3. France Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.9.4. France Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.10. Spain

7.4.10.1. Spain Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.10.2. Spain Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.10.3. Spain Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.10.4. Spain Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.4.11. Netherlands

7.4.11.1. Netherlands Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.11.2. Netherlands Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.4.11.3. Netherlands Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.4.11.4. Netherlands Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5. Asia Pacific

7.5.1. Asia Pacific Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.2. Asia Pacific Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.3. Asia Pacific Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.4. Asia Pacific Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.5. China

7.5.5.1. China Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.5.2. China Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.5.3. China Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.5.4. China Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.6. India

7.5.6.1. India Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.6.2. India Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.6.3. India Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.6.4. India Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.7. Japan

7.5.7.1. Japan Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.7.2. Japan Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.7.3. Japan Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.7.4. Japan Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.8. South Korea

7.5.8.1. South Korea Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.8.2. South Korea Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.8.3. South Korea Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.8.4. South Korea Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.9. Malaysia

7.5.9.1. Malaysia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.9.2. Malaysia Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.9.3. Malaysia Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.9.4. Malaysia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.10. Thailand

7.5.10.1. Thailand Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.10.2. Thailand Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.10.3. Thailand Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.10.4. Thailand Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.11. Indonesia

7.5.11.1. Indonesia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.11.2. Indonesia Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.11.3. Indonesia Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.11.4. Indonesia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.12. Vietnam

7.5.12.1. Vietnam Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.12.2. Vietnam Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.12.3. Vietnam Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.12.4. Vietnam Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.5.13. Australia

7.5.13.1. Australia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.13.2. Australia Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.5.13.3. Australia Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.5.13.4. Australia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.6. Central & South America

7.6.1. Central & South America Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.2. Central & South America Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.6.3. Central & South America Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.6.4. Central & South America Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.6.5. Brazil

7.6.5.1. Brazil Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.5.2. Brazil Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.6.5.3. Brazil Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.6.5.4. Brazil Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.6.6. Argentina

7.6.6.1. Argentina Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.6.2. Argentina Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.6.6.3. Argentina Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.6.6.4. Argentina Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.7. Middle East & Africa

7.7.1. Middle East & Africa Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.7.2. Middle East & Africa Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.7.3. Middle East & Africa Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.7.4. Middle East & Africa Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.7.5. Saudi Arabia

7.7.5.1. Saudi Arabia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.7.5.2. Saudi Arabia Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.7.5.3. Saudi Arabia Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.7.5.4. Saudi Arabia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.7.6. United Arab Emirates (UAE)

7.7.6.1. United Arab Emirates (UAE) Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.7.6.2. United Arab Emirates (UAE) Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.7.6.3. United Arab Emirates (UAE) Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.7.6.4. United Arab Emirates (UAE) Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

7.7.7. South Africa

7.7.7.1. South Africa Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

7.7.7.2. South Africa Market estimates and forecast, by source, 2018 - 2030 (Kilotons) (USD Million)

7.7.7.3. South Africa Market estimates and forecast, by product, 2018 - 2030 (Kilotons) (USD Million)

7.7.7.4. South Africa Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Market Share/Position Analysis, 2023

8.4. Company Heat Map Analysis

8.5. Strategy Mapping

8.5.1. Expansion

8.5.2. Mergers & Acquisition

8.5.3. Partnerships & Collaborations

8.5.4. New Product Launches

8.5.5. Research And Development

8.6. Company Profiles

8.6.1. BASF SE

8.6.1.1. Participant’s overview

8.6.1.2. Financial performance

8.6.1.3. Product benchmarking

8.6.1.4. Recent developments

8.6.2. SABIC

8.6.2.1. Participant’s overview

8.6.2.2. Financial performance

8.6.2.3. Product benchmarking

8.6.2.4. Recent developments

8.6.3. Dow, Inc.

8.6.3.1. Participant’s overview

8.6.3.2. Financial performance

8.6.3.3. Product benchmarking

8.6.3.4. Recent developments

8.6.4. KRATON CORPORATION

8.6.4.1. Participant’s overview

8.6.4.2. Financial performance

8.6.4.3. Product benchmarking

8.6.4.4. Recent developments

8.6.5. LyondellBasell Industries Holdings B.V.

8.6.5.1. Participant’s overview

8.6.5.2. Financial performance

8.6.5.3. Product benchmarking

8.6.5.4. Recent developments

8.6.6. DuPont de Nemours

8.6.6.1. Participant’s overview

8.6.6.2. Financial performance

8.6.6.3. Product benchmarking

8.6.6.4. Recent developments

8.6.7. RTP Company

8.6.7.1. Participant’s overview

8.6.7.2. Financial performance

8.6.7.3. Product benchmarking

8.6.7.4. Recent developments

8.6.8. S&E Specialty Polymers, LLC

8.6.8.1. Participant’s overview

8.6.8.2. Financial performance

8.6.8.3. Product benchmarking

8.6.8.4. Recent developments

8.6.9. Asahi Kasei Corporation

8.6.9.1. Participant’s overview

8.6.9.2. Financial performance

8.6.9.3. Product benchmarking

8.6.9.4. Recent developments

8.6.10. Covestro AG

8.6.10.1. Participant’s overview

8.6.10.2. Financial performance

8.6.10.3. Product benchmarking

8.6.10.4. Recent developments

8.6.11. Washington Penn

8.6.11.1. Participant’s overview

8.6.11.2. Financial performance

8.6.11.3. Product benchmarking

8.6.11.4. Recent developments

8.6.12. Eurostar Engineering Plastics

8.6.12.1. Participant’s overview

8.6.12.2. Financial performance

8.6.12.3. Product benchmarking

8.6.12.4. Recent developments

8.6.13. KURARAY CO., LTD.

8.6.13.1. Participant’s overview

8.6.13.2. Financial performance

8.6.13.3. Product benchmarking

8.6.13.4. Recent developments

8.6.14. Arkema

8.6.14.1. Participant’s overview

8.6.14.2. Financial performance

8.6.14.3. Product benchmarking

8.6.14.4. Recent developments

8.6.15. TEIJIN LIMITED

8.6.15.1. Participant’s overview

8.6.15.2. Financial performance

8.6.15.3. Product benchmarking

8.6.15.4. Recent developments

8.6.16. LANXESS

8.6.16.1. Participant’s overview

8.6.16.2. Financial performance

8.6.16.3. Product benchmarking

8.6.16.4. Recent developments

8.6.17. Solvay

8.6.17.1. Participant’s overview

8.6.17.2. Financial performance

8.6.17.3. Product benchmarking

8.6.17.4. Recent developments

8.6.18. SO.F.TER

8.6.18.1. Participant’s overview

8.6.18.2. Financial performance

8.6.18.3. Product benchmarking

8.6.18.4. Recent developments

8.6.19. Polyvisions, Inc.

8.6.19.1. Participant’s overview

8.6.19.2. Financial performance

8.6.19.3. Product benchmarking

8.6.19.4. Recent developments

8.6.20. Ravago

8.6.20.1. Participant’s overview

8.6.20.2. Financial performance

8.6.20.3. Product benchmarking

8.6.20.4. Recent developments

8.6.21. Heritage Plastics

8.6.21.1. Participant’s overview

8.6.21.2. Financial performance

8.6.21.3. Product benchmarking

8.6.21.4. Recent developments

8.6.22. Chevron Phillips Chemical Company LLC

8.6.22.1. Participant’s overview

8.6.22.2. Financial performance

8.6.22.3. Product benchmarking

8.6.22.4. Recent developments

8.6.23. Sumitomo Bakelite Co., Ltd.

8.6.23.1. Participant’s overview

8.6.23.2. Financial performance

8.6.23.3. Product benchmarking

8.6.23.4. Recent developments

8.6.24. Nova Polymers, Inc.

8.6.24.1. Participant’s overview

8.6.24.2. Financial performance

8.6.24.3. Product benchmarking

8.6.24.4. Recent developments

8.6.25. Adell Plastics, Inc.

8.6.25.1. Participant’s overview

8.6.25.2. Financial performance

8.6.25.3. Product benchmarking

8.6.25.4. Recent developments

8.6.26. Foster Corporation

8.6.26.1. Participant’s overview

8.6.26.2. Financial performance

8.6.26.3. Product benchmarking

8.6.26.4. Recent developments

8.6.27. MRC Polymers, Inc.

8.6.27.1. Participant’s overview

8.6.27.2. Financial performance

8.6.27.3. Product benchmarking

8.6.27.4. Recent developments

8.6.28. Flex Technologies

8.6.28.1. Participant’s overview

8.6.28.2. Financial performance

8.6.28.3. Product benchmarking

8.6.28.4. Recent developments

8.6.29. Dyneon GmbH & Co. KG

8.6.29.1. Participant’s overview

8.6.29.2. Financial performance

8.6.29.3. Product benchmarking

8.6.29.4. Recent developments

8.6.30. Kingfa SCI. & TECH. CO., LTD.

8.6.30.1. Participant’s overview

8.6.30.2. Financial performance

8.6.30.3. Product benchmarking

8.6.30.4. Recent developments

8.6.31. China XD Plastics, Co., Ltd.

8.6.31.1. Participant’s overview

8.6.31.2. Financial performance

8.6.31.3. Product benchmarking

8.6.31.4. Recent developments

8.6.32. Avient Corporation

8.6.32.1. Participant’s overview

8.6.32.2. Financial performance

8.6.32.3. Product benchmarking

8.6.32.4. Recent developments

8.6.33. Guangdong Silver Afe Sci

8.6.33.1. Participant’s overview

8.6.33.2. Financial performance

8.6.33.3. Product benchmarking

8.6.33.4. Recent developments

8.6.34. China General Plastics Corporation (CGPC)

8.6.34.1. Participant’s overview

8.6.34.2. Financial performance

8.6.34.3. Product benchmarking

8.6.34.4. Recent developments

List of Tables

Table 1. Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 2. Plastic Compounding Market estimates and forecasts, by PE, 2018 - 2030 (Kilotons) (USD Million)

Table 3. Plastic Compounding Market estimates and forecasts, by PP, 2018 - 2030 (Kilotons) (USD Million)

Table 4. Plastic Compounding Market estimates and forecasts, by TPV, 2018 - 2030 (Kilotons) (USD Million)

Table 5. Plastic Compounding Market estimates and forecasts, by TPO, 2018 - 2030 (Kilotons) (USD Million)

Table 6. Plastic Compounding Market estimates and forecasts, by PVC, 2018 - 2030 (Kilotons) (USD Million)

Table 7. Plastic Compounding Market estimates and forecasts, by PS, 2018 - 2030 (Kilotons) (USD Million)

Table 8. Plastic Compounding Market estimates and forecasts, by PET, 2018 - 2030 (Kilotons) (USD Million)

Table 9. Plastic Compounding Market estimates and forecasts, by PBT, 2018 - 2030 (Kilotons) (USD Million)

Table 10. Plastic Compounding Market estimates and forecasts, by PA, 2018 - 2030 (Kilotons) (USD Million)

Table 11. Plastic Compounding Market estimates and forecasts, by PC, 2018 - 2030 (Kilotons) (USD Million)

Table 12. Plastic Compounding Market estimates and forecasts, by PU, 2018 - 2030 (Kilotons) (USD Million)

Table 13. Plastic Compounding Market estimates and forecasts, by PMMA, 2018 - 2030 (Kilotons) (USD Million)

Table 14. Plastic Compounding Market estimates and forecasts, by ABS, 2018 - 2030 (Kilotons) (USD Million)

Table 15. Plastic Compounding Market estimates and forecasts, by Others, 2018 - 2030 (Kilotons) (USD Million)

Table 16. Plastic Compounding Market estimates and forecasts, by automotive, 2018 - 2030 (Kilotons) (USD Million)

Table 17. Plastic Compounding Market estimates and forecasts, by building & construction, 2018 - 2030 (Kilotons) (USD Million)

Table 18. Plastic Compounding Market estimates and forecasts, in electrical & electronics, 2018 - 2030 (Kilotons) (USD Million)

Table 19. Plastic Compounding Market estimates and forecasts, in packaging, 2018 - 2030 (Kilotons) (USD Million)

Table 20. Plastic Compounding Market estimates and forecasts, in consumer goods, 2018 - 2030 (Kilotons) (USD Million)

Table 21. Plastic Compounding Market estimates and forecasts, in industrial machinery, 2018 - 2030 (Kilotons) (USD Million)

Table 22. Plastic Compounding Market estimates and forecasts, in medical devices, 2018 - 2030 (Kilotons) (USD Million)

Table 23. Plastic Compounding Market estimates and forecasts, in optical media, 2018 - 2030 (Kilotons) (USD Million)

Table 24. Plastic Compounding Market estimates and forecasts, in aerospace & defense, 2018 - 2030 (Kilotons) (USD Million)

Table 25. Plastic Compounding Market estimates and forecasts, in others, 2018 - 2030 (Kilotons) (USD Million)

Table 26. North America Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 27. North America Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 28. North America Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 29. North America Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 30. U.S. Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 31. U.S. Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 32. U.S. Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 33. U.S. Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 34. Canada Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 35. Canada Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 36. Canada Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 37. Canada Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 38. Mexico Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 39. Mexico Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 40. Mexico Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 41. Mexico Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 42. Europe Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 43. Europe Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 44. Europe Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 45. Europe Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 46. Germany Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 47. Germany Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 48. Germany Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 49. Germany Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 50. UK Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 51. UK Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 52. UK Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 53. UK Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 54. France Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 55. France Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 56. France Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 57. France Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 58. Italy Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 59. Italy Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 60. Italy Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 61. Italy Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 62. Spain Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 63. Spain Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 64. Spain Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 65. Spain Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 66. Netherlands Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 67. Netherlands Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 68. Netherlands Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 69. Netherlands Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 70. Asia Pacific Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 71. Asia Pacific Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 72. Asia Pacific Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 73. Asia Pacific Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 74. China Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 75. China Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 76. China Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 77. China Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 78. India Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 79. India Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 80. India Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 81. India Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 82. Japan Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 83. Japan Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 84. Japan Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 85. Japan Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 86. South Korea Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 87. South Korea Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 88. South Korea Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 89. South Korea Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 90. Singapore Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 91. Singapore Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 92. Singapore Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 93. Singapore Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 94. Malaysia Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 95. Malaysia Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 96. Malaysia Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 97. Malaysia Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 98. Thailand Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 99. Thailand Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 100. Thailand Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 101. Thailand Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 102. Vietnam Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 103. Vietnam Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 104. Vietnam Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 105. Vietnam Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 106. Indonesia Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 107. Indonesia Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 108. Indonesia Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 109. Indonesia Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 110. Australia Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 111. Australia Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 112. Australia Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 113. Australia Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 114. Central & South America Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 115. Central & South America Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 116. Central & South America Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 117. Central & South America Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 118. Brazil Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 119. Brazil Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 120. Brazil Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 121. Brazil Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 122. Argentina Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 123. Argentina Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 124. Argentina Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 125. Argentina Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 126. Middle East & Africa Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 127. Middle East & Africa Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 128. Middle East & Africa Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 129. Middle East & Africa Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 130. Saudi Arabia Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 131. Saudi Arabia Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 132. Saudi Arabia Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 133. Saudi Arabia Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 134. United Arab Emirates (UAE) Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 135. United Arab Emirates (UAE) Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 136. United Arab Emirates (UAE) Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 137. United Arab Emirates (UAE) Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 138. South Africa Plastic Compounding Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 139. Argentina Plastic Compounding Market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 140. South Africa Plastic Compounding Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

Table 141. South Africa Plastic Compounding Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

List of Figures

Fig 1. Market segmentation

Fig 2. Information procurement

Fig 3. Data Analysis Models

Fig 4. Market Formulation and Validation

Fig 5. Market snapshot, 2023 (USD Million)

Fig 6. Segmental outlook- Source, product, and application (2023, USD Million)

Fig 7. Competitive outlook

Fig 8. Plastic compounding Market, 2018-2030 (Kilotons) (USD Million)

Fig 9. Value chain analysis

Fig 10. Market dynamics

Fig 11. Porter’s Analysis

Fig 12. PESTEL Analysis

Fig 13. Plastic compounding Market, by source: Key takeaways

Fig 14. Plastic compounding Market, by source: Market share, 2023 & 2030

Fig 15. Plastic compounding Market, by product: Key takeaways

Fig 16. Plastic compounding Market, by product: Market share, 2023 & 2030

Fig 17. Plastic compounding Market, by application: Key takeaways

Fig 18. Plastic compounding Market, by application: Market share, 2023 & 2030

Fig 19. Plastic compounding Market, by region: Key takeaways

Fig 20. Plastic compounding Market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Plastic Compounding Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Fossil-based

- Bio-based

- Recycled

- Plastic Compounding Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Plastic Compounding Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Plastic Compounding Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- North America Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- North America Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- U.S.

- U.S. Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- U.S. Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- U.S. Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Canada

- Canada Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Canada Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Canada Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Mexico

- Mexico Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Mexico Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Mexico Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Mexico Plastic Compounding Market, By Source

- U.S. Plastic Compounding Market, By Source

- North America Plastic Compounding Market, By Source

- Europe

- Europe Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Europe Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Europe Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Germany

- Europe Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Europe Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Europe Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Europe Plastic Compounding Market, By Source

- UK

- UK Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- UK Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- UK Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- UK Plastic Compounding Market, By Source

- France

- France Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- France Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- France Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- France Plastic Compounding Market, By Source

- Italy

- Italy Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Italy Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Italy Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Italy Plastic Compounding Market, By Source

- Spain

- Spain Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Spain Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Spain Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Spain Plastic Compounding Market, By Source

- Netherlands

- Netherlands Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Netherlands Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Netherlands Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Netherlands Plastic Compounding Market, By Source

- Europe Plastic Compounding Market, By Source

- Asia Pacific

- Asia Pacific Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Asia Pacific Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Asia Pacific Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- China

- China Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- China Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- China Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- China Plastic Compounding Market, By Source

- India

- India Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- India Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- India Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- India Plastic Compounding Market, By Source

- Japan

- Japan Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- Japan Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Japan Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

- Japan Plastic Compounding Market, By Source

- South Korea

- South Korea Plastic Compounding Market, By Source

- Fossil-based

- Bio-based

- Recycled

- South Korea Plastic Compounding Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- South Korea Plastic Compounding Market, By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others