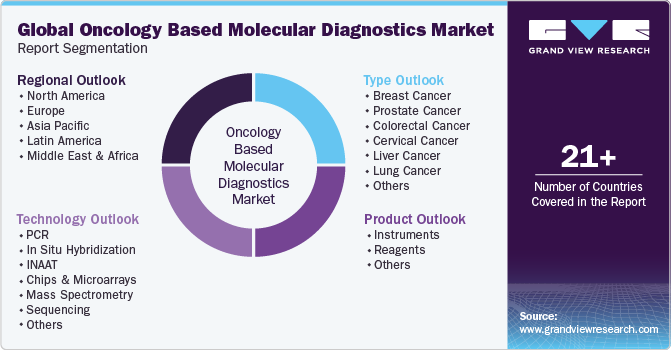

Oncology Based Molecular Diagnostics Market Size, Share & Trends Analysis Report By Type (Breast Cancer, Lung Cancer), By Product (Instruments, Reagents), By Technology (PCR, Sequencing), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-699-8

- Number of Report Pages: 139

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global oncology based molecular diagnostics market size was valued at USD 2.44 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.1% from 2023 to 2030. The rising prevalence of various types of cancer, such as breast, colorectal, and Non-Small Cell Lung Cancer (NSCLC) among the global population, as well as substantial changes in biomarker identification, the rising necessity of point-of-care testing, and advances in technology for diagnostic testing, are predicted to be the main drivers of growth in the worldwide market for molecular oncology diagnostics.

According to a report published by the American Cancer Society, in 2023, it has been anticipated that there will be over 1.95 million fresh cases diagnosed and around 609,820 deaths due to cancer in the U.S. Most common cancer sites include lung, colorectal, breast, and prostate. Such high figures suggest that the predicted rising prevalence of cancer is influencing the increased need for early detection and preventive medication. As a result of these circumstances, there is a steady rise in demand for cancer molecular diagnostic tests.

The use of molecular diagnostic tools for oncology is predicted to rise due to increased patient and healthcare professional awareness of the importance of early cancer detection and distinction. Molecular tests are being used more frequently due to improvements in diagnostic testing technologies. Numerous advances are being made in computational analysis, tumor models, and novel approaches to cancer research. For instance, Illumina released a unique pan-cancer companion diagnostic for its TruSight Oncology Comprehensive (EU) test in May 2022 that matches patients with rare genetic anomalies to targeted therapies.

Behavioral and dietary changes such as low physical activity, high tobacco and alcohol uptake, low intake of healthy food, and obesity account for the increase in cancer cases globally. Low and middle-income countries are at high risk of increasing cases owing to their low resources and ill-equipped infrastructure services to cope with the increasing prevalence of cancer.

Type Insights

The main types of cancer studied under this segment include breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, and kidney cancer, among others. Of these, breast cancer dominated the overall market in 2022 in terms of revenue share due to large test volumes and an extensive portfolio of commercialized products.

On the other hand, liver cancer and prostate cancer diagnostics markets are also estimated to witness significant growth, in addition to colorectal cancer, due to rising prevalence and increasing awareness levels among consumers. Broad avenues mark oncology-based molecular diagnostics for the development of diagnostic technology at molecular levels in personalized medicine for medication and new drug discovery.

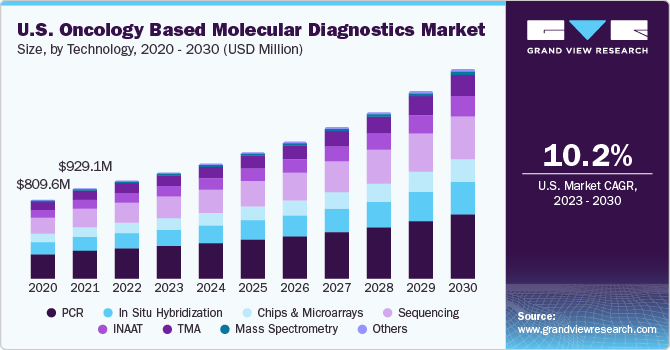

Technology Insights

The polymerase chain reaction (PCR) technology segment held the highest revenue share of 31% in 2022. This can be attributed to its growing utilization in research labs and the increased need for enhanced diagnostics. The industry is segmented on the basis of technology into seven major types, which include polymerase chain reaction (PCR), In Situ Hybridization, Isothermal Nucleic Acid Amplification Technology (INAAT), Chips & Microarrays, Mass Spectrometry, Sequencing, and Transcription Mediated Amplification.

The sequencing segment is anticipated to witness a significant growth rate of 14.3% during the forecast period. The growth in demand for sequencing technology is augmented by an increase in research and development expenditure and the widespread use of sequencing technologies in clinical diagnosis, which is anticipated to provide a favorable environment for market expansion during the forecast period, due to its benefits such as quick turnaround times and speedier processing.

For instance, in 2021, BD introduced a brand-new, completely automated, high throughput molecular diagnostic platform for American laboratories called the "BD COR PX/GX" system. The method uses robotics and sample management software programs to set a new benchmark for automation in infectious disease molecular testing. High-throughput laboratories, which handle most cervical cancer screening specimens in the U.S., can access the BD Onclarity HPV test with enhanced genotyping for the BD COR system due to this development.

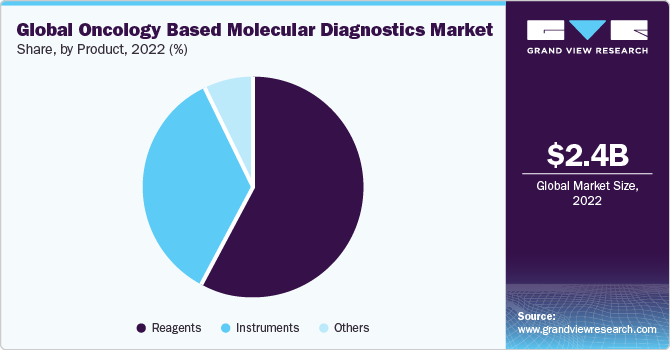

Product Insights

The reagents segment held the highest share of almost 58.0% of the overall revenue in 2022. This can be attributed to the high-volume usage of reagents for conducting tests and diagnostics in cancer research. The expansion in the field of molecular biology technology, progress in biotechnology advancements, rising demand for synthetic biology, and increasing investment in research and development by biotechnology companies are the main factors fueling the rapid growth of this industry segment.

The reagents segment is also anticipated to expand at a significant CAGR of 13.3% over the forecast period. The CE-IVD marked PD-L1 IHC 22C3 pharmDx assay from Agilent Technologies, Inc. was made available for esophageal cancer patients in August 2021. Using a cumulative positive score, this assay was employed to help identify individuals with esophageal cancer who would benefit from KEYTRUDA therapies.

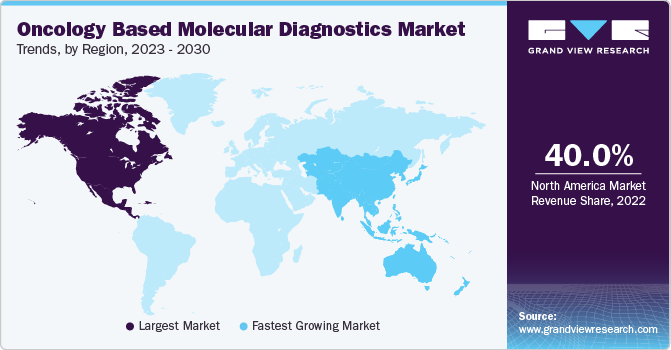

Regional Insights

North America dominated the market with a revenue share of over 40% in 2022. The strong market growth in this region can be attributed to a well-established healthcare infrastructure, the constantly rising health-conscious population base, and high healthcare expenditure.

On the other hand, the Asia Pacific region is expected to advance at the fastest CAGR of 15.8% during the projection period. There has been an increasing incidence rate of tumors in low- and middle-income countries of the Asia-Pacific region, which can be attributed to the aging population and lifestyle changes associated with economic development and epidemiologic transitions. India, China, and Australia are expected to offer immense potential for this industry in the coming years, mainly due to improving economic conditions and high unmet needs.

Key Companies & Market Share Insights

The cancer molecular diagnostics industry is highly fragmented, with several domestic and foreign market competitors. In a recent development, in December 2021, to create a companion diagnostic test for managing diffuse large B-cell lymphoma, QIAGEN collaborated with Denovo Biopharma. This test locates individuals with the Denovo Genomic Marker 1 (DGM1), which reacts to the company’s cancer treatment DB102 drug.

In another development, the advancement and commercialization of research tests to identify particular cancer genetic alterations used in the evaluation of homologous recombination deficiency (HRD) was made possible through a partnership between Illumina and Merck in September 2021.

Key Oncology Based Molecular Diagnostics Companies:

- Abbott

- Bayer AG

- BD

- Cepheid

- Agilent Technologies, Inc.

- Danaher

- Hologic, Inc.

- Qiagen

- F. Hoffmann-La Roche Ltd.

- Siemens

- Sysmex

Oncology Based Molecular Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2.70 billion |

|

Revenue forecast in 2030 |

USD 6.00 billion |

|

Growth rate |

CAGR of 12.1% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan;China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Abbott; Bayer AG; BD; Cepheid; Agilent Technologies, Inc.; Danaher; Hologic, Inc.; Qiagen; F. Hoffmann-La Roche Ltd.; Siemens; Sysmex |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Oncology Based Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oncology based molecular diagnostics market report based on type, product, technology, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Liver Cancer

-

Lung Cancer

-

Blood Cancer

-

Kidney Cancer

-

Other Cancer

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

In Situ Hybridization

-

INAAT

-

Chips and Microarrays

-

Mass Spectrometry

-

Sequencing

-

TMA

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Reagents segment dominated the oncology based molecular diagnostics market with a share of 58.0% in 2022. This is attributable to the presence of large test volumes and an extensive portfolio of commercialized products.

b. Some key players operating in the oncology based molecular diagnostics market include Abbott Laboratories, Bayer Healthcare, Beckton Dickinson, Cepheid, Dako, Danaher Corporation, Gen Probe, Qiagen, Roche Diagnostics, Siemens, and Sysmex Corporation.

b. Key factors that are driving the market growth include the rising prevalence of various types of cancer, increased demand for technologically advanced diagnostics products, and rising awareness levels among patients and healthcare professionals for early detection.

b. The global oncology based molecular diagnostics market size was estimated at USD 2.44 billion in 2022 and is expected to reach USD 2.70 billion in 2023.

b. The global oncology based molecular diagnostics market is expected to grow at a compound annual growth rate of 12.1% from 2023 to 2030 to reach USD 6.00 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."