- Home

- »

- Organic Chemicals

- »

-

Nucleating & Clarifying Agents Market Size Report, 2030GVR Report cover

![Nucleating & Clarifying Agents Market Size, Share & Trends Report]()

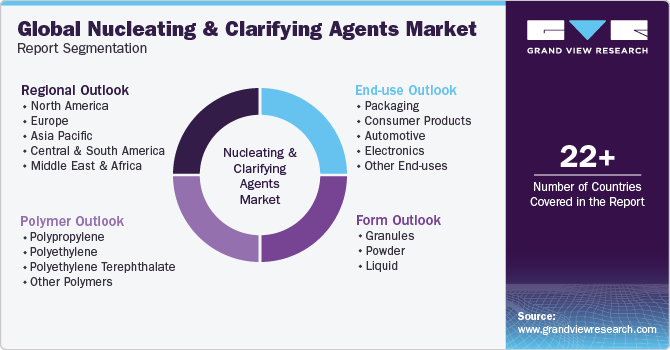

Nucleating & Clarifying Agents Market Size, Share & Trends Analysis Report By Form (Granules, Powder), By Polymer (Polypropylene, Polyethylene), By End-use (Packaging, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-257-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Nucleating & Clarifying Agents Market Trends

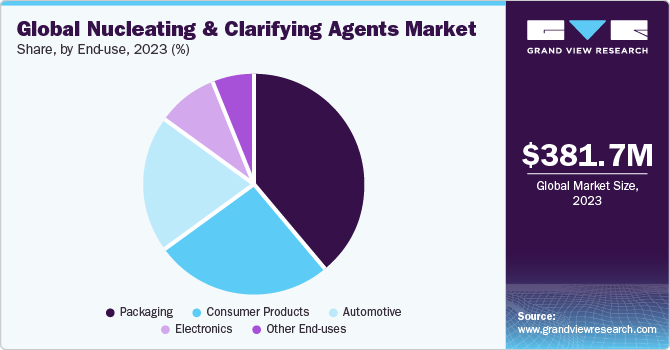

The global nucleating & clarifying agents market size was estimated at USD 381.7 million in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The market is being primarily driven by the increasing demand for polymers in diverse applications, such as automotive, consumer products, and packaging. These products are primarily used to reduce the cycle time during the polymer production process, thereby helping improve the rate of production. Plastics are employed in various end-uses, such as construction, automotive, consumer goods, agriculture, textiles, and pharmaceutical industries. They are preferred due to their superior electrical, mechanical, abrasion & chemical resistance properties as compared to other traditional materials, such as glass paper, metals, and ceramics.

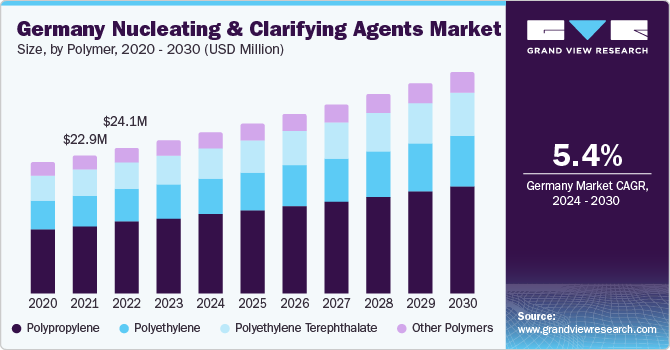

The increasing need for lighter-weight raw materials and innovation has encouraged plastics as a viable alternative to conventional materials. This phenomenon is expected to drive the demand for various polymer products in major manufacturing industries. The market in Germany is driven by the increasing demand for transparent packaging in the food and beverage industry. Nucleating agents, such as aromatic carboxylic acid salts like sodium benzoate, are used to create single-point nucleation sites, enhancing physical properties and clarifying the resin in polymer applications. The increasing emphasis on transparent packaging for food and beverages is expected to create new growth opportunities for the market in Germany. Plastics, such as polypropylene (PP), polyethylene (PE), and polyethylene terephthalate (PET), are used in large quantities due to their superior qualities and low cost for production.

Polytetrafluoroethylene (PTFE) polymers are used in large quantities owing to their chemical & high-temperature resistance as well as low coefficient of friction properties. They are used in the chemical sector for the sealing of shafts to prevent the leakage of aggressive chemicals in the food industry and prevent reaction of materials in the pharmaceutical sector. Clean labels and materials with low environmental impact are increasingly being preferred by customers as well as recommended by regulatory agencies. Nucleating & clarifying agents are used to enhance the quality & clarity of bio-based or recycled polymers, thereby promoting increased recycling & reuse of plastics and supporting sustainability initiatives. The increasing use of packaging materials in consumer goods and building supplies drives up the demand to enhance the appearance and quality of plastic items.

Market Concentration & Characteristics

The global market is moderately consolidated, with a few key players holding significant market shares. Companies, such as Milliken Chemical, ADEKA Corporation, and BASF SE, are among the leading players in this market. The market is segmented based on agent type, form, polymer, application, and region, reflecting the diverse nature of the industry.

The degree of innovation in the market is significant, with ongoing research and development activities aimed at introducing advanced products that offer enhanced performance and efficiency. For instance, the development of products that induce the formation of specific crystal forms in polymers, leading to improved impact strength and heat resistance, reflects the industry's commitment to innovation and product enhancement. Regulations play a significant role in shaping the global market.

The stringent environmental regulations imposed by governments, such as the ban on single-use plastics, have a direct impact on the market's growth and development. For example, the EU's ban on single-use plastics and the pledge by major emerging markets like China and India to ban them have led to a drastic reduction in global plastic usage. These regulations pose challenges for the future growth of the industry driving the industry to explore sustainable and environmentally friendly alternatives.

Form Insights

The powder form segment dominated the market with a revenue share of 57.2% in 2023. Powdered products offer ease of handling, storage, and dispersion. The powder form is particularly suitable for applications where precise dosing and dispersion are essential. For instance, in the PE and PET polymer industries, powder nucleating and clarifying agents are utilized to enhance the optical properties and clarity of the polymers. Aromatic carboxylic acid salts and metal salts of phosphate esters are examples of traditional products used in powder form to enhance physical properties and clarify the resin in polymer applications.

Granules are a popular form of nucleating and clarifying agents, known for their better flow properties and increased compressibility. Granules provide ease of handling and dispersion, making them suitable for a wide range of polymer applications. For instance, in the PP polymer industry, granular nucleating and clarifying agents are widely used to enhance the optical, thermal, and mechanical properties of the polymer. A common example of a granular nucleating agent is a talc product specifically designed for nucleation, which, when loaded at high levels, can significantly speed crystallization and improve the properties of the polymer.

Liquid nucleating and clarifying agents are characterized by their higher migration into material surfaces, making them suitable for specific polymer processing requirements. The liquid form offers advantages in applications where uniform dispersion and rapid integration into the polymer matrix are essential. In the packaging and consumer products industries, liquid products are utilized to enhance the optical properties and transparency of polymers, contributing to the production of high-quality and visually appealing products.

Polymer Insights

The PP polymers segment dominated the market with a revenue share of 48.6% in 2023. Nucleating agents, such as aromatic carboxylic acid salts like sodium benzoate, are used to speed up and tune the crystallization of PP, resulting in improved performance and processing properties. These agents contribute to improved clarity, reduced haze, enhanced strength and stiffness, and improved Heat Deflection Temperature (HDT) in PP formulations. In addition, special nucleating agents produce spherulites, which do not scatter visible light, providing transparent PP. In PE polymers, nucleating and clarifying agents are utilized to drive demand in the packaging industry.

They contribute to the enhancement of physical properties and the clarification of the resin in PE polymers, addressing the packaging sector’s specific needs. The market size of nucleating and clarifying agents for PE is influenced by the demand for packaging materials, reflecting the essential role of these products in improving the optical properties and clarity of PE polymers. The product demand in the PET polymer industry is driven by the need for beverage packaging. They are utilized to enhance the optical properties and transparency of PET polymers, catering to the specific requirements of the beverage packaging sector. The market size of clarifying & nucleating agents for PET reflects the industry's emphasis on producing high-quality and visually appealing beverage packaging solutions.

End-use Insights

The packaging end-use segment dominated the market with a revenue share of 38.9% in 2023. In the packaging industry, nucleating and clarifying agents play a pivotal role in enhancing the optical properties and clarity of polymers used for packaging materials. These agents are utilized to improve the physical properties and clarify the resin in polymers, addressing the specific needs of the packaging industry. In the production of PP-based packaging materials, nucleating agents, such as sodium benzoate and metal salts of phosphate esters, are used to create single-point nucleation sites, enhancing physical properties and clarifying the resin.

In the automotive industry, nucleating and clarifying agents are utilized to enhance the properties of polymers used in automotive components and parts. These agents contribute to the improvement of physical properties, optical properties, and thermal stability of polymers, addressing the specific needs of the automotive sector. The wide-scale use of nucleating and clarifying agents in the automotive industry reflects the industry's emphasis on delivering high-performance and visually appealing automotive components, highlighting their essential role in addressing the specific requirements of the automotive sector.

Nucleating & clarifying agents contribute to the improvement of the physical properties, optical properties, and thermal stability of polymers, addressing the specific needs of the electronics sector. In the production of PP-based materials for electronic devices, nucleating agents are used to enhance the optical properties and clarity of the polymer, contributing to the production of high-quality and visually appealing electronic components.

Regional Insights

The North America nucleating & clarifying agents market was a significant regional market in 2023. Its growth is driven by factors, such as the demand for high-performance polymers in industries like automotive and electronics, stringent regulations, and a focus on product innovation.

U.S. Nucleating & Clarifying Agents Market Trends

The nucleating & clarifying agents market in the U.S. is estimated to grow at a significant CAGR from 2024 to 2030. It is primarily driven by the demand for high-quality packaging materials, technological advancements, and the focus on sustainable solutions.

Europe Nucleating & Clarifying Agents Market Trends

The Europe nucleating & clarifying agents market accounted for the largest revenue share of 35.7% share in 2023. The increasing demand for transparent packaging solutions, stringent environmental regulations, and the focus on sustainable and eco-friendly alternatives are primary factors driving the regional market growth, which is characterized by the emphasis on high-quality and visually appealing packaging materials, augmenting the product demand.

The nucleating & clarifying agents market in Germany held the largest share of 18.6% in Europe in 2023. It is attributed to factors, such as the focus on high-performance polymers, the demand for sustainable packaging solutions, and the emphasis on product customization.

The UK nucleating & clarifying agents market is expected to grow at a significant CAGR during the forecast period. It is driven by the increasing demand for transparent packaging solutions, stringent environmental regulations, and the focus on sustainable and eco-friendly alternatives.

Asia Pacific Nucleating & Clarifying Agents Market Trends

The nucleating & clarifying agents market in Asia Pacific is expected to grow at a significant CAGR from 2024 to 2030 due to rapid growth of the packaging industry, increasing demand for high-quality plastics, and the focus on technological advancements.

The China nucleating & clarifying agents market held the largest share in 2023 and is mainly driven by rapid growth of the packaging industry, increasing demand for high-quality plastics, and the focus on technological advancements.

The nucleating & clarifying agents market in India is expected to grow at a significant CAGR from 2024 to 2030. Expanding industries in the country, such as automotive, electronics, and consumer goods, have led to increased product usage in various applications.

Central & South America Nucleating & Clarifying Agents Market Trends

The Central & South America nucleating & clarifying agents market is anticipated to witness significant growth from 2024 to 2030. The region’s growing demand for packaging materials, focus on sustainable solutions, and impact of regional regulations are expected to have a major impact on the regional market growth.

The nucleating & clarifying agents market in Brazil is estimated to grow at a significant CAGR over the forecast period. The growth is attributed to a growing demand for automotive and electronic appliances.

Middle East & Africa Nucleating & Clarifying Agents Market Trends

The MEA nucleating & clarifying agents market is growing significantly due to factors, such as the expanding packaging industry, focus on sustainable solutions, and impact of economic development.

The nucleating & clarifying agents market in Saudi Arabia is expected to grow at a lucrative rate due to the increasing product usage in various industrial applications. Moreover, a strong emphasis on sustainable solutions, rapidly growing packaging sector, and the impact of economic development will drive the market expansion.

Key Nucleating & Clarifying Agents Company Insights

The competitive landscape of the market is characterized by the presence of major companies focusing on strategies, such as product innovation, expansion, and strategic partnerships, to gain a competitive edge. Key companies have been actively involved in new product launches, strategic alliances, and R&D investments to strengthen their market position and cater to the evolving consumer demands.

Some of the key players operating in the market include

-

The BASF SE offers clarifiers & nucleating agents under the plastics & rubber segment. It offers different agents, such as Irgaclear and Irgastab, for application as processing and thermal stabilizers as well as nucleating agents for the plastic industry

-

Amfine Chemical Corp. offers nucleating agents & clarifiers, which offer a heterogeneous surface to polymers, thereby making the crystallization more thermodynamically favorable. It offers different clarifying products, such as NA-71, and NA-21, and nucleating agents, such as NA-27, NA-902, and NA-11

Zibo Rainwell Co. Ltd., Milliken Chemical, and Polyvel Inc. are some of the emerging market participants in the nucleating & clarifying agents market.

-

Zibo Rainwell Co. Ltd. primarily offers three products under its portfolio-antioxidants, nucleating agents, and additives pre-blend. It offers four main nucleating products: Maxstab RY 501, Maxstab RY 511, Maxstab RY 521, and Maxclear RY 698

-

Milliken Chemical offers clarifying agents, such as Millad NX PP, to make blow molding and injection molding processes more efficient

Key Nucleating & Clarifying Agents Companies:

The following are the leading companies in the nucleating & clarifying agents market. These companies collectively hold the largest market share and dictate industry trends.

- Adeka Corporation

- Amfine Chemical Corporation

- BASF SE

- Everspring Chemical Co., Ltd.

- Palmarole AG

- Milliken Chemical

- Zibo Rainwell Co. Ltd.

- Polyvel Inc.

- Teknor Apex

- CASE & Plastics

Recent Developments

-

In October 2023, CAI Performance Additives introduced a new crystal nucleating agent meant to improve the performance of PP used in lithium battery separators. The agent called ST-NAP32 comes under the class of beta nucleators and causes a different crystal structure for PP when cooled from the melt state

-

In November 2022, Avient Corp. announced the sale of its distribution business to a subsidiary of H.I.G. Capital for a sum of USD 950 million. The sale of distribution would enable Avient Corporation’s transformation into the specialty chemicals domain after the acquisition of the protective materials business of DSM

Nucleating & Clarifying Agents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 406.1 million

Revenue forecast in 2030

USD 609.5 million

Growth rate

CAGR of 7.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, polymer, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Adeka Corp.; Amfine Chemical Corp.; BASF SE; Everspring Chemical Co., Ltd.; Palmarole AG; Milliken Chemical; Zibo Rainwell Co. Ltd.; Polyvel Inc.; Teknor Apex; CASE & Plastics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nucleating & Clarifying Agents Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nucleating & clarifying agents market report based on form, polymer, end-use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Granules

-

Powder

-

Liquid

-

-

Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Polyethylene

-

Polyethylene Terephthalate

-

Other Polymers

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Consumer Products

-

Automotive

-

Electronics

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nucleating & clarifying agents market size was valued at USD 381.7 million in 2023 and is expected to reach USD 406.1 million in 2024.

b. The global nucleating & clarifying agents market is to expand at a CAGR of 7.0% during the forecast period and reach USD 609.5 million by 2030

b. Europe dominated the market with a revenue share of 35.7% share in 2023. The increasing demand for transparent packaging solutions, stringent environmental regulations, and the focus on sustainable and eco-friendly alternatives are primary drivers for the European market.

b. Some prominent players in the nucleating & clarifying agents market include ADEKA CORPORATION, Amfine Chemical Corporation, BASF SE, Everspring Chemical Co., Ltd , Palmarole AG, Milliken Chemical , zibo rainwell co ltd. , Polyvel Inc., Teknor Apex, CASE & Plastics

b. The nucleating & clarifying agents market is being primarily driven by the increasing demand for polymers in diverse applications such as automotive, consumer products and packaging. These products are primarily used to reduce the cycle time during polymer production process, thereby helping to improve the rate of production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."