- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Aerosol Market Size, Industry Report, 2030GVR Report cover

![North America Aerosol Market Size, Share & Trends Report]()

North America Aerosol Market Size, Share & Trends Analysis Report By Material (Steel, Aluminium, Others), By Type (Bag-in-Valve, Standard), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-247-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

North America Aerosol Market Size & Trends

The North America aerosol market size was estimated at USD 18.46 billion in 2023 and is expected to expand at a CAGR of 4.3% from 2024 to 2030. The market is primarily driven by the rising number of aerosol applications such as hair sprays, insecticides, shaving gels, deodorants, fabric care, air fresheners, oven cleaners, furniture polish, leather care, and other personal care products. Furthermore, the high disposable income in the U.S. and Canada is propelling the cosmetics and personal care products consumption.

Aerosol is widely used in the production of sprays that are used to treat insect bites, sunburn, and dermatitis. Pain relief drugs and ointments are typically packed in aerosol form due to their ease of application. Furthermore, the increased prevalence of respiratory disorders such as asthma in North America is driving the use of aerosols in inhalers. According to the Asthma and Allergy Foundation of America’s (AAFA) updated September 2023 data, approximately 26 million people in the U.S. have asthma. The occurrence of the disease is highest amongst the Hispanic, native Alaskans, American Indians, and black communities in the region. The high migration of ethnic communities in the U.S. and Canada is a major factor attributing to the growing cases of asthma, thereby driving the market.

The market is extensively regulated owing to the adverse effect of Hydrofluorocarbon (HFC) used in aerosols. Ozone-depleting HFCs are used in aerosols, refrigeration and air conditioning, solvents, fire suppression, foam blowing, and semiconductor manufacturing. Regulations such as the Montreal Protocol on Substances that Deplete the Ozone Layer also known as Kigali Amendment to phasedown of the production and consumption of HFCs. In October 2022, the U.S. ratified the Kigali Amendment. According to the World Meteorological Organization’s Scientific Assessment of Ozone Depletion 2022 study, the implementation of the Kigali Amendment has shown considerable improvements in the stratosphere. Due to the long lifetime of toxic compounds like HFC, their effect on the atmosphere, as measured by their radiative forcing will only substantially reduce after 2040 and is estimated to be approximately 50% of its maximum by 2100.

Market Concentration & Characteristics

Market growth stage is high, and the pace is accelerating owing to a moderately fragmented market. The key players are actively implementing strategic initiatives such as new product launches, mergers & acquisitions, and production expansion, among others.

The impact of regulations is high in the market. The U.S. Environmental Protection Agency has imposed limitations on the acceptability of HFCs under the 1993 Climate Change Action Plan (CCAP). Instead, the use of perfluorocarbon (PFC) substitutes in solvent cleaning, refrigeration, and fire suppression is being promoted. Under the Clean Air Act (CAA) sec. 610(b), EPA is required to identify non-essential products containing or manufactured with Class I ozone-depleting substances (ODS) including HCFCs or CFCs.

The North America aerosol market is fragmented owing to the presence of a large number of participants offering a wide product portfolio serving key applications. Key players in the market are working on increasing their market shares along with profitability through product innovations and empowering their R&D activities. Product differentiation is high and, therefore, industry rivalry within the market is expected to be higher in the next few years.

Application Insights

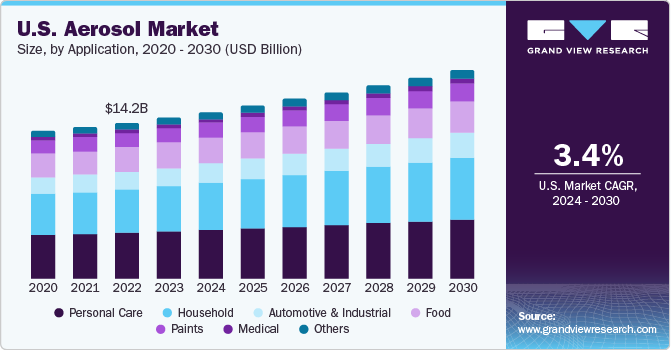

Personal care segment accounted for the largest revenue share of 31.0% in 2023. The segment includes products used for grooming such as deodorants, hair mousse, hair spray, and shaving mousse. Increasing focus on self-grooming has been driving the demand for various personal care products across the region.

The household segment is expected to expand at the fastest CAGR of 5.1% from 2024 to 2030. Aerosols are used in various household products including stain removers, shoe polish, starch, water repellents for fabric & leather, pre-wash sprays, furniture polishes & waxes, cleaning agents for fabrics, rugs & household surfaces, room disinfectants & fresheners, air fresheners, and anti-static sprays. In 2023, household was the second-largest segment of the aerosol market, in terms of revenue. This can be attributed to the benefits such as no leakage, easy application, and negligible wastage offered by household aerosol products. These factors make aerosols a preferred choice in household applications.

Material Insights

Aluminum led the market, accounting for a revenue share of 58.9% in 2023. Aluminum offers numerous advantages including lighter weight, high strength, and corrosion resistance. In addition, aluminum cans are 100% recyclable which makes them a preferred material. However, manufacturing costs of aluminum aerosol are higher than steel due to the increasing tariffs on aluminum and growing power rates. Therefore, the manufacturers have been launching lightweight aluminum aerosol cans in the market to maintain cost advantage.

Steel is projected to emerge as the second-fastest growing segment during the forecast period. Steel has a pressure resistance of 12 to 18 bars and steel-based aerosols are manufactured either by tin-plating or TFS (tin-free steel), which is also called electrolytic chromium-coated steel. A tin plate is a thin steel sheet that is coated by a tin layer. Tin-free steel is a steel plate with an electrolytic chromium coating. Among these tin-plated has been the most preferred raw material type owing to high corrosion solderability, strength, resistance, and weldability. Moreover, 3-piece cans are the key can types that are used in the steel-based aerosol, with diameters ranging from 45mm to 65mm.

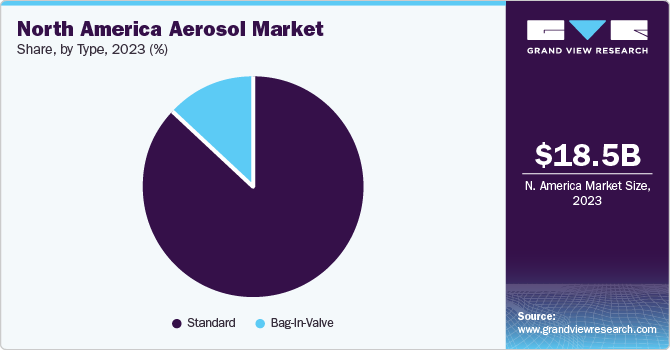

Type Insights

The standard valve segment dominated the market, with a revenue share of 86.7% in 2023 owing to the high adoption of standard valve-based food products and homecare products such as insecticides, decoration products, and rodenticides. The standard valves are used for personal care products including high-end fragrances and deodorants, pharmaceutical applications, and air fresheners. These are preferred for the efficient dispensing of metered doses of pharmaceutical products and insecticides is fueling the segment expansion.

Bag-in valve is expected to expand at the fastest CAGR from 2024 to 2030. Bag-in-valve technology is typically used for viscous liquid products. It is a barrier packaging technology and has an aerosol valve attached to a multi-layer laminated aluminum bag. It is suitable for dispensing liquid, cream, gel, or highly viscous formulation in both upright and inverted positions while preserving the product from external contaminations. Furthermore, no preservative needs to be added to the product as the content is completely sealed from any contact with air. Consumers looking for innovative technologies are opting for bag-in valves as these provide a safe, effective, and convenient during solution dispensing.

Country Insights

The North America aerosol marketheld a revenue share of 22.2% in the global aerosol market. North America has a high demand and adoption of personal care and cosmetic products. Suncare products such as self-tanning products, after-sun products, and sun protection products are widely popular in the U.S. and Canada. The increasing prevalence of skin-related diseases including skin cancer in the U.S. is expected to drive the demand for products capable of protection against UV radiation. Furthermore, hand-free application has been the key driver for aerosol sun care products offering convenience and hassle-free experience to the customers. Increasing demand for these products from Gen Z and millennials owing to growing awareness and increasing disposable incomes is expected to have a positive impact on the aerosol market. Higher consumer demand in the developed for sun care products is expected to drive the demand for aerosol products during the forecast period.

U.S. Aerosol Market Trends

Aerosol market in the U.S. dominates both personal care and household industries for the past several years. This is due to macro factors including the presence of a large number of personal care manufacturers coupled with the increasing demand for premium and natural personal care products. The rising importance of hygiene and grooming among the millennial population is affecting the growth of the skincare products market positively.

Mexico Aerosol Market Trends

Mexico aerosol market is anticipated to register the fastest CAGR of 7.1% from 2024 to 2030. Mexico is the fastest-growing economy in the North American region and is emerging as a key manufacturing hub. Growing urbanization, increasing per capita income, and changing consumer preferences are expected to drive the aerosol market in personal care applications. The high penetration of grooming products by the male population base in the country is expected to boost the demand for hair care and shaving foam products.

Skin diseases like facial post-inflammatory hyperpigmentation, melasma, and solar dermatitis are some of the frequently occurring diseases in Mexico. Increasing awareness regarding skin protection from UV radiation is expected to have a positive impact on sun care products like sunscreen, after-sun products, and self-tanning products over the forecast period which is expected to drive the aerosol market in the country.

Key North America Aerosol Companies Insights

The North America aerosol market is moderately fragmented with the presence of a large number of companies across the region. These companies have been primarily offering aerosols for personal care, household, automotive, paint, and medical end-use industries.

Key North America Aerosol Companies:

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Honeywell International Inc.

- Crabtree & Evelyn

- Estée Lauder Inc.

- Sluyter Company Ltd.

- PLZ Corp

- CCL Container

- Sprayway Inc.

- Trivium Packaging

Recent Developments

-

In August 2023, Honeywell And Recipharm collaborated to launch Solstice Air a hydrofluoroolefin (HFO) propellant with 99.9% less global warming potential as compared to HFAs. Furthermore, Solstice Air is a non-ozone-depleting, non-flammable, and volatile organic compound (VOC)-exempt under the state and federal guidelines. It fosters the ongoing efforts undertaken by pharmaceutical manufacturers in meeting their low-carbon emissions goals. In April 2023, Honeywell announced that MyDerm selected Solstice Propellant for its Mineral SPF 50 Clinical Sunscreen Continuous Spray, thereby diversifying Honeywell’s market penetration and fueling product sales.

-

In April 2023, SC Johnson launched a new FamilyGuard Brand, a new product lineup of aerosol-based disinfectant spray to help families protect themselves against germs by disinfecting hard and non-porous surfaces. The brand started the YES, PLAY! initiative that emphasizes on creating a clean and dedicated space in a home for children to play.

North America Aerosol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.16 billion

Revenue forecast in 2030

USD 25.06 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

S. C. Johnson & Son, Inc.; Procter & Gamble; Honeywell International Inc.; Crabtree & Evelyn; Estée Lauder Inc.; Sluyter Company Ltd.; PLZ Corp; CCL Container; Sprayway Inc.; Trivium Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Aerosol Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America aerosol market report based on material, type, application, and country:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Bag-In-Valve

-

Standard

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Deodorants

-

Hair Mousse

-

Hair Spray

-

Shaving Mousse/Foam

-

Suncare

-

Others

-

-

Household

-

Insecticides

-

Plant Protection

-

Air Fresheners

-

Furniture & Wax Polishes

-

Disinfectants

-

Surface care

-

Others

-

-

Automotive & Industrial

-

Greases

-

Lubricants

-

Spray Oils

-

Cleaners

-

-

Food

-

Oils

-

Whipped Cream

-

Edible Mousse

-

Sprayable Flavours

-

-

Paints

-

Industrial

-

Consumer

-

-

Medical

-

Inhaler

-

Topical Application

-

-

Others

-

-

Aerosol Country Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America aerosol market size was estimated at USD 18.46 billion in 2023 and is expected to reach USD 19.16 billion.

b. The North America aerosol market is expected to grow at a compound annual growth rate (CAGR) of 4.3% to reach USD 25.06 billion by 2030.

b. Based on type, the standard valve segment accounted for the largest regional share of 86.7% in 2023, owing to the high adoption of standard valve food products and homecare products such as insecticides, decoration products, and rodenticides.

b. The key market player in the North America aerosol market includes S. C. Johnson & Son, Inc.; Procter & Gamble; Honeywell International Inc.; Crabtree & Evelyn; Estée Lauder Inc.; Sluyter Company Ltd.; PLZ Corp; CCL Container; Sprayway Inc.; Trivium Packaging.

b. The North America aerosol market is primarily driven by the rising number of aerosol applications such as hair sprays, insecticides, shaving gels, deodorants, fabric care, air fresheners, oven cleaners, furniture polish, leather care, and other personal care products. Furthermore, the high disposable income in the U.S. and Canada is propelling cosmetics and personal care products consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."