- Home

- »

- Green Building Materials

- »

-

Natural Fiber Composites Market Size, NFC Industry Report, 2018-2024GVR Report cover

![Natural Fiber Composites (NFC) Market Size, Share & Trends Report]()

Natural Fiber Composites (NFC) Market Size, Share & Trends Analysis Report By Raw Material, By Matrix, By Technology, By Application, And Segment Forecasts, 2018 - 2024

- Report ID: 978-1-68038-890-9

- Number of Report Pages: 139

- Format: PDF, Horizon Databook

- Historical Data: 2014-2016

- Forecast Period: 2018 - 2024

- Industry: Advanced Materials

Report Overview

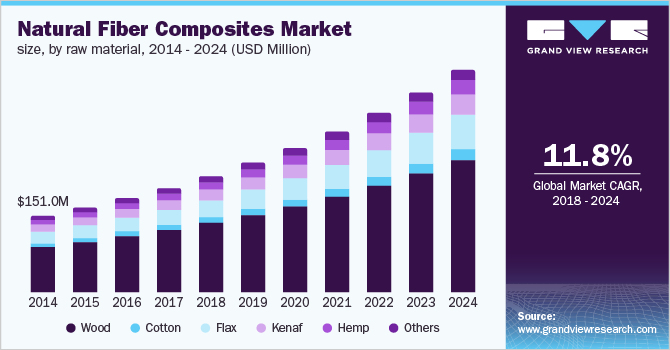

The global natural fiber composites market size to be valued at USD 10.89 billion by 2024 and is expected to grow at a compound annual growth rate (CAGR) of 11.8% during the forecast period. Spiraling demand for lightweight products from the automotive industry and growing awareness regarding green products are among the key trends escalating market growth. However, the moisture sensitivity of these composites is poised to hinder the growth of the market. Natural fibers are bio-based materials manufactured using materials such as wood, cotton, flax, kenaf, and hemp. All these materials are less harmful to the environment and easily available. Raw materials used to manufacture natural fiber composites are environment-friendly and have the potential to replace synthetic fibers over the coming years.

Rising awareness about green products, increasing disposable income of consumers, growing inclination towards eco-friendly products, and urging uptake of recyclable products are likely to play a vital role in the growth of the market.

Natural fiber composites (NFC) are 25.0% to 30.0% stronger than glass fibers of the same weight. Composites made from natural fibers help in the reduction of the mass of the component, thereby lowering the total energy consumption. In addition, the molding process of NFC consumes less energy than the glass fiber molding process, which reduces the production cost by 10.0%.

Moisture sensitivity and weak bonding with polymer matrices are anticipated to hamper growth prospects. They absorb moisture, which results in the swelling of fibers. Therefore, their application in the automotive industry is limited to car interiors only.

Natural Fiber Composites (NFC) Market Trends

The use and manufacturing of non-biodegradable synthetic fibers are causing increasing environmental concerns. Strict legislation governing non-biodegradable composites in regions such as Europe, and North America has opened new industry prospects in these areas. The market indicates new growth prospects for expansion throughout the forecast period, with increased demand for sustainable natural fiber composites in developing nations for the building, textile, and automotive industries. As a result, the demand for this market is expected to grow in the forecast period.

Technological developments in manufacturing methods including compression molding, injection molding, and extrusion are anticipated to have a beneficial impact on growth. Natural fibers have recently replaced glass and carbon fibers due to lower costs and increased sustainability. Moreover, natural fibers are abundant in Europe and the Asia Pacific, thereby, fueling the demand of the market in this region.

Some of the factors restraining the market growth are poor strength, fluctuation of the price of natural fiber, and less knowledge among end-user in developing regions. Additionally, the growth prospects are expected to be hampered by properties such as moisture sensitivity, and weak bonding with polymer matrix associated with the natural fiber composites. They absorb moisture, which causes the fibers to swell. As a result, its use in the automobile sector is restricted to car interiors. This is expected to hinder the growth of the market during the forecast period.

Raw Material Insights

Some of the major raw materials include wood, flax, kenaf, cotton, and hemp. Wood dominated the market and represented 59.3% of the overall revenue in 2015. The trend is estimated to continue until 2024. Advantages of wood such as high strength and solidity are projected to fuel its utilization over the coming years.

Flax was one of the most widely used materials in 2015, with a market share of 13.0%. Flax is CO2 neutral, vibration damper, and renewable as compared to carbon fibers. Advantages of flax, including high tensile strength, ultraviolet rays blocking properties, vibration absorbent, and high water retention, are rendering it one of the most used raw materials in the industry.

Cotton belongs to the seed fiber category which is commonly used for textiles all over the world. Cotton is comparatively weak than other natural fibers due to its moisture absorption property. It can absorb moisture up to 20% of its dry weight. The market in this segment is expected to grow with the growth of the textile and sporting goods industries.

The use of kenaf has been growing in various industries such as construction, oil & chemical absorbent, food packaging, and automotive. The material is highly sustainable and can be completely recycled. Swelling demand for biodegradable products is likely to play an instrumental role in stimulating the growth of the market.

Composites that are made from hemp can replace glass fiber in many applications, and they are biodegradable. Surging demand for eco-friendly and renewable materials from the automotive and construction industries is poised to trigger the growth of the segment.

Matrix Insights

The market, on the basis of matrix, has been segmented into inorganic compound, natural polymer, and synthetic polymer. The natural polymer matrix is anticipated to witness the fastest growth over the forecast period. Rising demand for green products due to changing lifestyles and the growing trend of go green is expected to supplement the growth of the segment.

Inorganic compounds are one of the most effective matrices in the market. These are mainly applied to wooden fibers. Inorganic compounds accounted for a large share of 43.4% in 2015 and it is estimated to continue the trend over the coming years. Wood fibers with inorganic matrix have benefits such as improved toughness, cracking deformation of composite, and tensile strength.

Natural polymers include starch, rubber, and synthetic polymers such as PLA and PHB (polyhydroxy butyrate). Growing demand for renewable and degradable products is projected to propel the market over the coming years. This segment accounted for a share of 25.1% in the market in 2015.

Synthetic polymers are used as a matrix for wood fibers, which include thermoplastics and thermosets. This segment is likely to account for the second-largest share over the coming years.

Technology Insights

On the basis of technology, the NFCs market has been segmented into injection molding, compression molding, and pultrusion. Injection molding requires a low molecular weight polymer to maintain low viscosity. It is mainly used to produce parts in large volumes. Growing demand for large volume production from end-use industries is poised to contribute to the growth of the segment.

Injection molding accounted for a revenue share of 10.0% in 2015. It is a high-volume, high-pressure, closed molding method used for the development of composite products. This method is followed by two steps, namely, preheating and pressurizing.

Compression molding is a high pressure, high volume molding method mainly used to mold high strength and complex objects for industries such as automotive, transportation, appliance, and other high-volume segments.

Pultrusion process is largely used to produce various products in rail transport, aerospace, boats & marine, sports goods, wind turbine blades, storing and transporting corrosive liquids. Demand for low weight, maintenance-free, corrosion resistant and electrically nonconductive products are expected to support the growth of the segment.

Application Insights

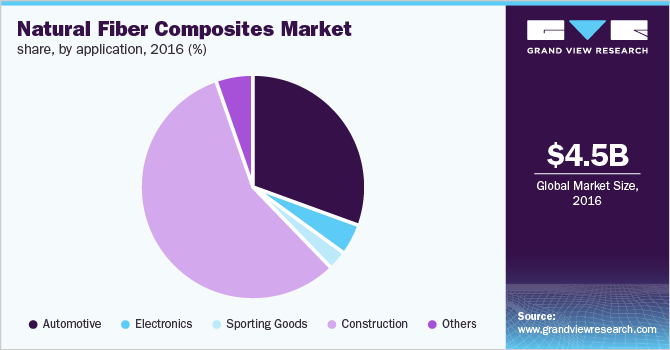

NFC is majorly used in the automotive and construction industries to manufacture door panels, seat backs, dashboards, truck liners, headliners, decking, railing, windows, and frames. Electronics and sporting goods are promising segments in the market. Numerous products such as mobile cases, laptop cases, tennis rackets, bicycles, frames, and snowboards are produced using natural fiber composites.

Natural fiber reinforced bio-composites are used in the automotive industry to produce lightweight parts with good mechanical properties in order to improve fuel efficiency and reduce CO2 emissions. It contributes to weight reduction by 30.0% and cost reduction by 20.0% during the manufacturing of a vehicle. This segment accounted for a revenue share of over 30.0% in 2015.

NFCs used in the automotive industry are developed using wood as well as non-wood fibers such as flax, hemp, and cellulose as an alternative to glass fiber. The resultant products are lighter compared to modern materials. The use of these materials in the manufacturing process leads to a cost reduction of approximately 20.0%.

Natural fibers are a cheap and sustainable alternative to synthetic and metallic fibers used as building materials. In some cases, its mechanical properties such as impact resistance, flexural properties, and fracture toughness are better than glass fibers. The construction segment held 56.0% of the overall market volume in 2015.

Regional Insights

Soaring demand for NFC manufactured from flax, growing popularity, and surging demand for consumer goods are anticipated to provide a significant push to the North American market. NAFILEAN process in the automotive industry in the region has resulted in sustainable design for center consoles, instrument panels, and door panels.

Extensive research is being done by European car manufacturers to develop a natural polymer matrix for front and rare door lines, boot lines, and parcel shelves. Europe accounted for a share of 15.4% in terms of volume in 2015.

Germany is one of the largest producers of automobiles and a major importer of hemp in Europe. Increasing demand for biodegradable and lightweight products from the automotive industry in order to increase fuel efficiency is estimated to stoke the growth of the country.

Sporting goods, electronics, and automotive industries in the Asia Pacific are projected to register a healthy growth rate in the coming years due to increasing disposable income coupled with an improving standard of living. China dominated the Asia Pacific market and it is likely to continue the trend over the coming years.

Key Companies & Market Share Insights

The market is very competitive in nature, with the presence of many multinationals and small producers operating their businesses through a variety of products and a wide distribution network.

The companies in the industry are highly integrated from the manufacturing to the distribution of finished products to various locations.

Recent Developments

-

In June 2021, Procotex acquired ELG UK’s short carbon fiber business. This acquisition lead to the successful completion of the next critical step in providing carbon fibers withlarger capacities and feedstocks to the compounding and other industries.

-

In December 2021, International Paper started the construction of a state-of-the-art corrugated packaging plant in Atglen, Pennsylvania, to meet the region's growing customer demand.International Paper will be able to grow its industrial packaging footprint in the north eastern region of the United States based on the availability of the new facility.

Some of the prominent players in the industry include:

-

FlexForm Technologies LLC

-

Procotex Corp SA

-

TECNARO GMBH

-

UPM Biocomposites

-

Trex Company, Inc

Natural Fiber Composites (NFC) Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 10.89 billion

Growth rate

CAGR of 11.8% from 2018 to 2024

Base year for estimation

2016

Forecast period

2018 - 2024

Quantitative units

Revenue in USD billion and CAGR from 2018 to 2024

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, matrix, technology, application and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Germany, China

Key companies profiled

FlexForm Technologies LLC; Procotex Corp SA; TECNARO GMBH; UPM Biocomposites; Trex Company, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Fiber Composites (NFC) Market Segmentation

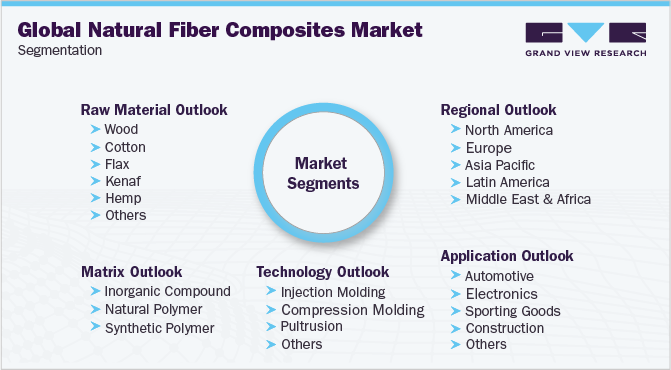

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2013 to 2024. For the purpose of this study, Grand View Research has segmented the global natural fiber composites market report on the basis of product, application, distribution channel, and region.

-

Raw Material Outlook (Volume, Kilo tons; Revenue, USD Million, 2013 - 2024)

-

Wood

-

Cotton

-

Flax

-

Kenaf

-

Hemp

-

Others

-

-

Matrix Outlook (Volume, Kilo tons; Revenue, USD Million, 2013 - 2024)

-

Inorganic Compound

-

Natural Polymer

-

Synthetic Polymer

-

-

Technology Outlook (Volume, Kilo tons; Revenue, USD Million, 2013 - 2024)

-

Injection Molding

-

Compression Molding

-

Pultrusion

-

Others

-

-

Application Outlook (Volume, Kilo tons; Revenue, USD Million, 2013 - 2024)

-

Automotive

-

Electronics

-

Sporting Goods

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilo tons; Revenue, USD Million, 2013 - 2024)

-

North AmericaU.S.

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."