- Home

- »

- Medical Devices

- »

-

Nasal Splints Market Size, Share And Growth Report, 2030GVR Report cover

![Nasal Splints Market Size, Share & Trends Report]()

Nasal Splints Market Size, Share & Trends Analysis Report By Type (Malleable, Airway), By Material Type (Plastic Splints, Metal Splints), By Application, By Mechanism, By End user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-248-5

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Nasal Splints Market Size & Trends

The global nasal splints market was estimated at USD 1.56 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The growing demand for nasal splints is attributed to their crucial application in healing from nose surgery to protect and maintain the nose shape. As a result, the rise in the number of nose surgeries conducted to rectify breathing problems, fix nose deformities, repair broken noses, and enhance nose appearance has boosted the demand for market growth.

The market is anticipated to grow due to an increasing number of accidents. These accidents often result in nose deformities, which can be corrected through nose surgery with the help of a nasal splint. According to the WHO article published in December 2023, 1.19 million deaths occur due to accidents and 20 to 50 million people suffer non-fatal damages. Hence, to correct the nose deformities, patients undergo nose surgery in which a nasal splint protects and maintains the nose shape. Hence, a growing prevalence of accidents boosts the nasal splints demand.

Post rhinoplasty, doctors often apply external nasal splints to reposition the nasal bone and reshape the cartilage. The use of nose splints is beneficial in reducing swelling and facilitating safe healfing of the nose. They keep the bone and cartilage in position, allowing them to heal in a new shape. The doctor-provided professional nose splint minimizes the risks of post-surgery complications, such as filler migration, malposition, and implant displacement. Wearing an external splint reminds the patient to be careful and keep their nose protected until it fully recovers. The increasing number of rhinoplasties in the younger and middle-aged population has increased the demand for nasal splints.

Chronic rhinosinusitis (CRS) is one of the most common chronic diseases, affecting individuals of all ages. It causes inflammation in the nasal airways, leading to sinusitis and rhinitis symptoms. If non-surgical treatments are not effective, doctors may recommend surgery to restore proper sinus ventilation and correct mucosal opposition. This helps to restore the normal functioning of the inflamed mucosal lining and mucociliary clearance system. The rise in sinus problems has increased the demand for nasal splints.

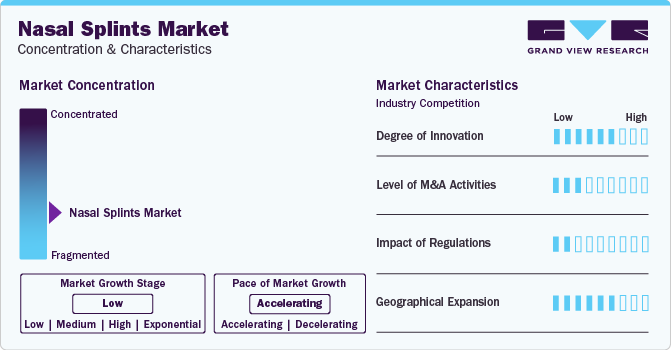

Market Concentration & Characteristics

The degree of innovation in the global market is low. The innovation is in terms of manufacturing nasal splints. For instance, some companies design nasal splints using 3D printing. Some companies manufacture nasal splints using silicone, thermoplastic, fluoroplastic, or aluminium.

Various business strategies are implemented by market players to support their business revenues, further promoting global market growth. The market players undertake mergers & acquisitions, partnerships, and product launches to strengthen their product portfolio, ultimately contributing to the market growth.

Regulatory bodies, such as the FDA, administer nasal splint devices. For instance, intranasal splint is classified under Class I medical devices. However, it is not expected to follow premarket notification procedures as mentioned in part 807 (subpart E). The devices also need to be CE-marked to be traded in Europe. For instance, Innovia Medical has CE-marked and FDA-approved nasal splints.

Major players are focusing on geographical expansion to capture new geographical markets. The expansion is generally done by launching R&D centers or manufacturing facilities in new locations or mergers and acquisitions of companies based in different countries.

Type Insights

Based on type, the malleable nasal splints segment led the market with the largest revenue share of 37.4% in 2023. The segment's growth is attributed to the splint's septal support and placement as per the requirement. Companies offer a variety of malleable nasal splints to satisfy the patient's requirement. For instance, Innovia Medical offers NETWORK ENT External Malleable Nasal Splints which can be used without heat, and RhinoSurgical offers External Aluminium Splint which is malleable and comes in three sizes: small, medium, and large.

The airway nasal splints segment is expected to register at the fastest CAGR during the forecast period. The growth is attributed to its integral airway, allowing nasal breathing and suture holes for stabilization. Furthermore, airway nasal splints allow better nasal breathing, minimize blockage, and effortless clearing of nasal secretions.

Material Type Insights

Based on material type, the silicon splints segment led the market with the largest revenue share of 47.0% in 2023. Silicone nasal splints are hard-shaped molding fabricated from a biocompatible silicone elastomer, latex and are phthalate-free. The splints come in various sizes and designs to satisfy different surgical insertion techniques and facilitate short-term use in the nasal cavity. Furthermore, medical-grade silicone devices are stable in extreme temperatures and immune to thermal and chemical degradation. Silicone offers comfort to patients whether applied on or under the skin, making it a commonly used material in manufacturing medical devices.

The plastic splints segment is expected to grow at the fastest CAGR over the forecast period. The growth is due to several benefits of medical-grade plastics. These plastics are appropriate for manufacturing medical devices due to their properties such as biocompatibility, specifically for medical devices that come in touch with the human circulation system. These plastics are also precise, malleable, hard, and compatible with 3D printing and injection molding. Furthermore, some individuals are allergic to silicone, which increases the preference for plastic nasal splints.

Application Insights

Based on application, the septoplasty segment held the market with the largest revenue share of 61.4% in 2023. Septoplasty is a common surgical procedure performed to correct the deviated septum. A deviated septum can make breathing difficult through the nose. According to the BMJ Publishing Group Ltd study published, in 2021 to 2022, in England, approximately 16,700 septoplasty procedures were performed, whereas in the U.S. 250,000 septoplasty procedures are performed annually. Hence, increasing septoplasty procedures are expected to drive the market growth.

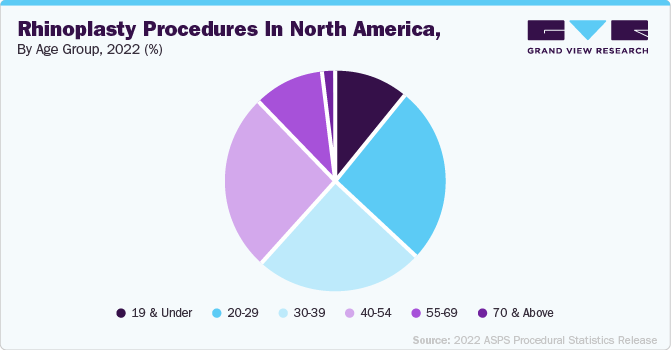

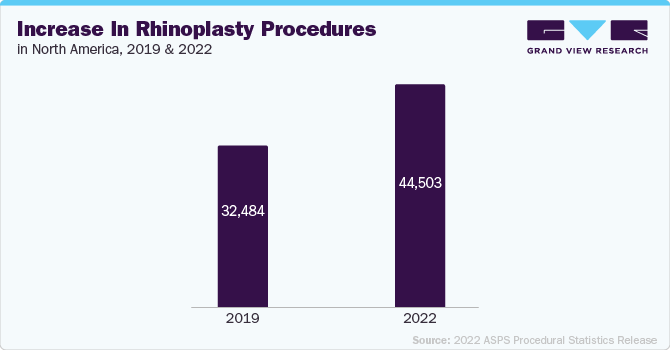

The rhinoplasty segment is expected to register at the fastest CAGR of 5.0% during the forecast period, owing to the increasing popularity of rhinoplasty. It is done to modify the nose's appearance or help better breathing. It is one of the most common forms of plastic surgery. Nasal splints are widely used in rhinoplasty to help maintain the nose's new shape until the tissues are healed. According to the British Association of Aesthetic Plastic Surgeons, rhinoplasty was the most commonly performed cosmetic surgery among men in the UK in 2022, accounting for 45% of all cosmetic procedures. In addition, there was an observed 67% increase in the number of rhinoplasty surgeries performed in 2022 compared to the previous year.

Mechanism Type Insights

Based on mechanism type, the intranasal segment led the market with the largest revenue share of 50.7% in 2023. Intranasal splints are intended to be used in sinus/nasal surgery to separate tissue or nasal structures disturbed by surgical trauma and prevent & separate bonding between mucosal surfaces in the nasal cavity during mesothelial cell regeneration. Furthermore, it helps contain minimal bleeding after surgery and is a supplement to aid in natural healing.

The external splints segment is expected to register at the fastest CAGR of 5.0% during the forecast period. External nose splint comprises a bandage that covers the nose and two parts of plastic or metal running across the length to help the nose maintain its new shape externally. These devices are used in many nasal surgeries, as they keep swelling to a minimum. Hence, considering the benefits and easy application, external nasal splints are expected to witness a significant demand during the forecast period.

End-user Insights

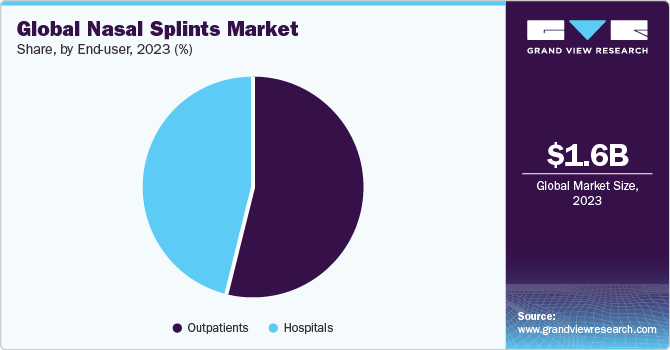

Based on end-user, the outpatient facilities segment led the market with the largest revenue share of 53.9% in 2023. The increase in growth can be attributed to affordable diagnosis, treatment, and procedures that are available at lower costs. The low cost is due to standard procedures performed in less time requiring no hospital or a single night stay. Moreover, in 2022, according to the 2022 Procedural Stats Release, around 19% of reconstructive procedures were performed in the office and 25% in the free-standing ambulatory surgical facility.

The hospitals segment is expected to register at the fastest CAGR of 4.6% during the forecast period. The growth is owing to the high preference of hospitals by the patients. For instance, in 2022, according to the 2022 ASPS Procedural Statistics Release, in the U.S., 578,599 reconstructive procedures were performed in the hospitals. It contributed to 57% of reconstruction procedures performed in the country. The preference is attributed to access to specialists and other medical services that can be needed in any unforeseen circumstance.

Regional Insights

North America dominated the nasal splints market with the largest revenue share of 35.2% in 2023. The market growth is attributed to the increasing expenditure on cosmetic surgeries, advanced healthcare infrastructure, and increased prevalence of nose deformities. For instance, according to the 2022 ASPS Procedural Statistics Release, in 2022, 44,503 rhinoplasty procedures were performed in the U.S. alone.

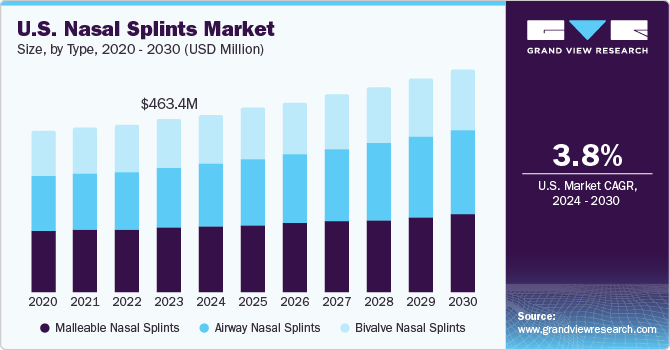

U.S. Nasal Splints Market Trends

The nasal splints market in U.S. accounted with the revenue share of 89.1% in 2023. The market is driven by the prominent presence of key players undertaking several business initiatives, increasing number of accidents, well-established healthcare infrastructure, and increasing rhinoplasty.

The Canada nasal splints market is anticipated to grow at the fastest CAGR over the forecast period. The presence of market players drives the market in Canada. Olympus Corporation, Medtronic, and Smith & Nephew are some of the market players operating in the Canada nasal splints market. For instance, according to the Organization for Economic Co-operation and Development, in 2021, 4.63 people died due to road accidents per 1,000,000 inhabitants in Canada.

Europe Nasal Splints Market Trends

The nasal splints market in Europe is expected to witness at the substantial CAGR over the forecast period. The growth is attributed to the increasing number of cosmetic surgeries, rising preference for rhinoplasty, and advanced healthcare infrastructures. Furthermore, the lenient regulatory framework also contributes to the region's market growth. In addition, countries like Italy and Spain for over 4% of all plastic surgeries globally.

The UK nasal splints market is anticipated to grow at the fastest CAGR over the forecast period. The increasing number of market players, growing preference for nose surgeries for aesthetic or health purposes, a significant number of accidents, and an established healthcare infrastructure contribute to the market growth in the UK. For instance, according to the Organization for Economic Co-operation and Development, in 2022, 2.61 people died due to road accidents per 1,000,000 inhabitants in the UK.

The nasal splints market in Germany is anticipated to grow at the fastest CAGR over the forecast period. The increasing number of rhinoplasties in Germany is majorly driving the market growth in the country. For instance, according to the VDÄPC-Association of German Aesthetic-Plastic Surgeons, in 2022, 2,357 rhinoplasty procedures were performed, making it one of the top 5 plastic surgeries performed in Germany.

Asia Pacific Nasal Splints Market Trends

The nasal splints market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the rapid development of healthcare structures, the growing number of plastic surgeons to meet the demand, the significant prevalence of nose deformities, and a growing number of accidents. For instance, according to the Asia Development Bank, over 645,000 road accidents fatalities occur in Asia Pacific annually. Road accidents might cause head and neck injuries, resulting in nose deformities, ultimately contributing to the region's market growth.

The Japan nasal splints market is anticipated to grow at the fastest CAGR over the forecast period. The increasing number of cosmetic surgical procedures contributes to market growth in Japan. For instance, according to the Asian Plastic Surgery Sydney, in 2020, over 222,600 plastic surgery procedures were performed in Japan. Rhinoplasty contributed to 15,329 surgical procedures, ranking in the top 5 plastic surgeries performed.

Middle East & Africa Nasal Splints Market Trends

The nasal splints market in Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period. The growing rhinoplasties and other nasal surgeries performed to correct deformities is driving the demand for nasal splints in the Middle East a0nd African markets. Furthermore, individuals in the Middle Eastern countries are increasingly opting for cosmetic nasal surgeries and the growing healthcare spending is anticipated to boost the market growth. In Middle East, the concept of ethnic rhinoplasty is rapidly gaining popularity, which in turn is anticipated to boost the demand for nasal splints

The Saudi Arabia nasal splints market is anticipated to grow at the fastest CAGR over the forecast period. The increasing popularity of plastic surgery highly influences the market growth in Saudi Arabia. According to the National Library of Health study published in 2019, rhinoplasty is one of the most preferred plastic surgeries in South Korea, contributing to 29.6% of total plastic surgery procedures.

Key Nasal Splints Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Market players such as Olympus Corporation; Medtronic; Smith & Nephew; and others dominated the market. These key players have been developing new nasal splints to cater the market need.

Key Nasal Splints Companies:

The following are the leading companies in the nasal splints market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Medtronic

- Smith & Nephew

- Boston Medical Products Inc

- Surgiform Innovative Surgical Products

- Anthony Products Inc.

- Audio Technologies SRL

- Teleflex Inc.

- E. Benson Hood Laboratories, Inc.

- ENTPROMED Healthcare Products Inc.

Nasal Splints Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.62 billion

Revenue forecast in 2030

USD 2.10 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material type, application, mechanism, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Olympus Corporation; Medtronic; Smith & Nephew; Boston Medical Products Inc; Surgiform Innovative Surgical Products; Anthony Products Inc.; Audio Technologies SRL; Teleflex Inc.; E. Benson Hood Laboratories, Inc.; and ENTPROMED Healthcare Products Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nasal Splints Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the nasal splints market report based on type, material type, application, mechanism, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Malleable Nasal Splints

-

Airway Nasal Splints

-

Bivalve Nasal Splints

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Splints

-

Metal Splints

-

Silicon Splints

-

Bioabsorbable Splints

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rhinoplasty

-

Septoplasty

-

-

Mechanism Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intranasal

-

External

-

-

End user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatients

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nasal splints market size was estimated at USD 1.56 billion in 2023 and is expected to reach USD 1.62 billion in 2024.

b. The global nasal splints market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 2.1 billion by 2030.

b. North America dominated the nasal splints market with a share of 35.2% in 2023. This is attributable to increasing expenditure on cosmetic surgeries, advanced healthcare infrastructure, and increased prevalence of nose deformities

b. Some key players operating in the nasal splints market include Key companies profiled Olympus Corporation; Medtronic; Smith & Nephew; Boston Medical Products Inc; Surgiform Innovative Surgical Products; Anthony Products Inc.; Audio Technologies SRL; Teleflex Inc.; E. Benson Hood Laboratories, Inc.; and ENTPROMED Healthcare Products Inc.

b. Key factors that are driving the market growth include the growing demand for nasal splints is attributed to their crucial application in healing from nose surgery to protect and maintain the nose shape.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."