- Home

- »

- Advanced Interior Materials

- »

-

Molybdenum Market Size And Share Analysis Report, 2030GVR Report cover

![Molybdenum Market Size, Share & Trends Report]()

Molybdenum Market Size, Share & Trends Analysis Report By Application (Steel, Foundry, Alloys, Others), By End-Use (Oil & Gas, Chemical, Automotive, Construction), By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455968

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Data: ---

- Industry: Advanced Materials

Molybdenum Market Size & Trends

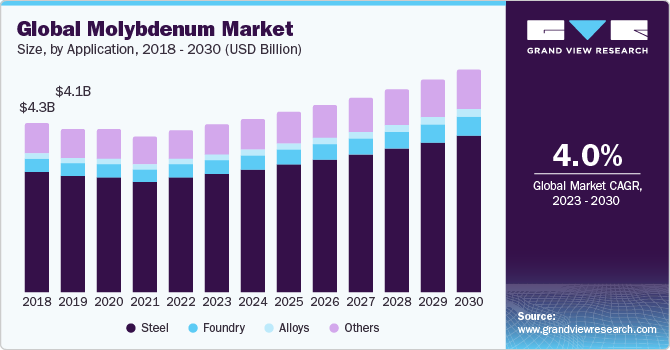

The global molybdenum market size was valued at USD 4.25 billion in 2022 and is expected to grow at a CAGR of 4.0% over the forecast period. Molybdenum is the key alloying agent required in steel production thus, the growing steel production drives the demand for the market. As per the World Steel Association, global crude steel production reached 1,885.4 million tons in 2022, compared to 1879.4 million tons in 2020.

Implementation of lockdowns and restrictions on movement and business operations to control the spread of COVID-19 disrupted various stages of the molybdenum supply chain, including mining, processing, and transportation. Mining operations faced labor shortages and logistical challenges, which led to decreased supply. This was further impacted due to temporary closures and shutdowns of numerous steel companies as molybdenum finds its major application in steelmaking. For instance, in April 2020, Tata Steel closed its manufacturing operations in Uttar Pradesh and Maharashtra due to restricted movement and a shortage of labor. The company suffered a loss of nearly INR 4,648 crore (~USD 558.9 million) in the first quarter of 2021.

Demand for molybdenum is expected to benefit from an expansion of the foundry industry. In foundry, elements such as molybdenum, silicon, chromium, vanadium, and titanium are added to improve the impact strength, tensile strength, corrosion, and heat resistance of finished products. These castings are readily available in the industrial sector and can be produced using low-cost models. A key driver for these products is the demand for heavy machinery and equipment sector wherein products such as industrial machines, trolley casting, coupling casting, pulley casting, agriculture machines, mining machinery, pumps, turbines, pulleys, oil machinery, motor covers, metals & mining crushers.

Application Insights

Based on the application, the molybdenum market is segmented into steel, foundry, alloys, and others. Steel is expected to remain the dominant application contributing to more than half of the demand. Molybdenum is used in steel for its unique ability to enhance the material's properties. When added in small amounts, molybdenum significantly improves steel's strength and toughness, making it more durable and resistant to heavy loads and impacts. It also enhances corrosion resistance by forming a protective oxide layer on the steel's surface, preventing rust. Moreover, molybdenum boosts the steel's heat resistance, making it suitable for high-temperature applications, and improves its weldability, reducing the risk of cracks and defects during fabrication. This versatile element plays a crucial role in creating steel alloys that excel in a wide range of industrial applications, from construction to aerospace and beyond.

Foundries use molybdenum-enhanced castings to produce critical components for industries like aerospace and automotive, where high-temperature resistance and precision are vital. These components include engine parts, turbocharger components, and other high-performance applications.Molybdenum is also used to create molds and cores for casting operations. Its high melting point and excellent thermal conductivity make it ideal for withstanding the extreme temperatures and thermal cycling encountered in the casting process, resulting in precise and consistent castings.

End-Use Insights

Based on end use, the molybdenum market is segmented into oil & gas, chemical & petrochemicals, automotive, construction, and aerospace & defense, among others. The market is expected to observe lucrative growth in the aerospace & defense segment, supported by rising spending by different governments to strengthen their military power. For instance, in February 2023, the Indian government announced a budget of INR 5.94 trillion (~USD 72.6 billion) for FY 2023-24, an increase of 10% from the previous financial year. The government plans to add new fighter jets, equipment, warships, and other military hardware with this budget.

Regional Insights

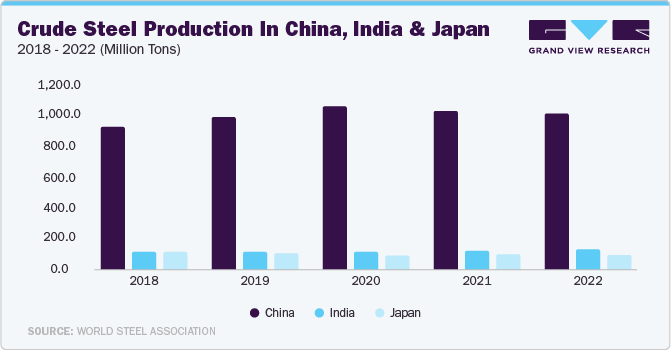

Asia Pacific dominated the market in 2022. The presence of large industrial clusters in India, China, Japan, South Korea, and ASEAN countries drives the demand for steel and thus benefits crude steel production. In terms of crude steel production, Asia Pacific emerged as the largest region in 2022, with a market share of 73.8% in 2022. In 2018, Asia Pacific’s share was 70.6%, as reported by the World Steel Association. China was the largest producer in the region, with a crude steel production volume of 1,018 million tons in 2022 compared to 928.3 million tons in 2018.

Key Companies & Market Share Insights

The market is slightly consolidated in nature with the presence of a few players such as China Molybdenum Co. Ltd, Grupo México, Antofagasta PLC, Rio Tinto and Anglo American. The market players are focused on different organic and inorganic growth strategies to optimize operations and increase their revenues. The adoption of automation and robotics to simplify the mining process is expected to remain a major trend over the coming years. The following are some instances of strategic initiatives:

-

In October 2023, Greenland Resources, a Canadian mining company, entered into an agreement with Outokumpu Europe, a stainless steel manufacturer, to supply the molybdenum. This agreement is expected to benefit the Outokumpu as the company will be able to secure the supply of molybdenum.

-

In June 2022, Rio Tinto opened its fully automated Gudai-Darri laboratory, which is integrated with the mine. This will provide better visibility of ore-grade stockpiles in the mining area.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."