- Home

- »

- Petrochemicals

- »

-

Methanol Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Methanol Market Size, Share & Trends Report]()

Methanol Market Size, Share & Trends Analysis Report By Application (Formaldehyde, Acetic Acid, MTBE, DME), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-016-3

- Number of Pages: 89

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Methanol Market Size & Trends

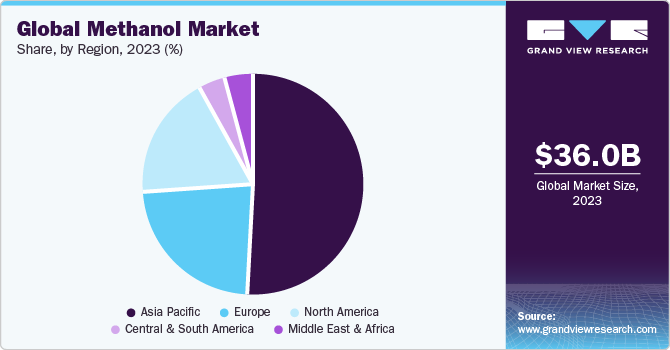

The global methanol market size was estimated at USD 36.0 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. This is attributed to the growing consumption of methanol to produce dimethyl ether and methyl tert-butyl ether (MTBE), utilized as alternatives for gasoline. In addition, the high cost of construction activities globally for developing residential and commercial sectors is also expected to propel market growth.

Methanol is one of the major components in biodiesel production, which is manufactured by chemically reacting vegetable oil or fatty acid with methanol. This chemical reaction is termed transesterification and is performed in the presence of a catalyst such as sulfuric acid. Biodiesel is a clean-burning fuel and a renewable substitute for petroleum diesel.

Methanol production has shifted to alternative feedstocks, such as coal and biomass. This diversification is driven by fluctuations in natural gas prices, concerns over energy security, and efforts to mitigate the environmental impacts of conventional methanol. Coal-to-methanol and biomass-to-methanol processes have gained attention as viable alternatives, particularly in regions with abundant coal reserves or biomass resources. In addition, the development of renewable methanol production pathways, including carbon capture and utilization (CCU) and electrolysis of carbon dioxide, represents a growing trend toward sustainable methanol production.

The manufacturing process of methanol typically involves converting carbon-based feedstocks, such as natural gas, coal, or biomass, into methanol through a series of chemical reactions. The most common method for industrial methanol production is the synthesis of methanol from synthesis gas (syngas), which is a mixture of hydrogen (H2) and carbon monoxide (CO).

Traditionally, methanol production relies on syngas derived mainly from natural gas through steam and autothermal reforming. This syngas is then converted into crude methanol using catalysts and further refined through a post-purification process. In BASF's novel process, syngas is generated through partial oxidation of natural gas. This method of BASF, in collaboration with Linde Engineering, has been proven advantageous to the former. It eliminates carbon dioxide emissions. Following this, methanol synthesis and distillation processes remain largely unaltered.

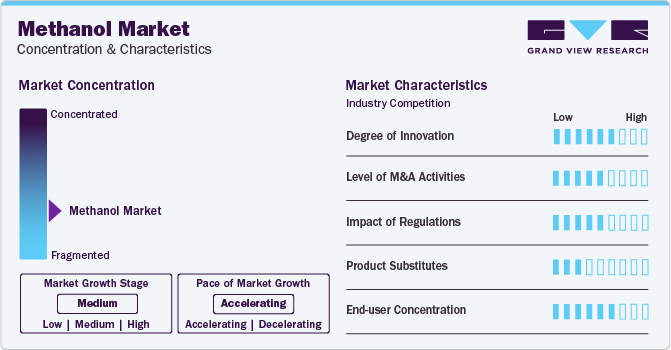

Market Concentration & Characteristics

The methanol market is fragmented, with the presence of many manufacturers. Methanol comes in various applications, such as formaldehyde, gasoline, acetic acid, MTBE, dimethyl ether, MTO/MTP, biodiesel, and others.

Carbon capture and utilization technologies can convert CO2 emissions from industrial processes into valuable products such as methanol. In the BASF SE novel process, syngas are generated via partial oxidation of natural gas. This method has been proven advantageous in collaboration with Linde Engineering.

Methanol has been classified as a toxic substance and is thus under high scrutiny by the U.S. Environment Protection Act (EPA), Occupational Safety and Health Administration (OSHA), and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). This has resulted in governments worldwide implementing stringent regulations to reduce emissions of air pollutants.

Methanol is utilized in a wide range of end-use applications. It produces chemicals such as formaldehyde and acetic acid, blends fuels such as biodiesel and gasoline, and performs industrial processes such as solvent extraction and plastics production. Companies such as LyondellBasell and SABIC, which operate large-scale chemical plants worldwide, use methanol to produce olefins and other petrochemicals.

Application Insights

Formaldehyde is one of the significant applications of methanol. It is typically produced through a vapor oxidation reaction of oxygen and methanol. However, apart from the vapor phase oxidation reaction process, formaldehyde can also be developed by the metal oxide catalyst process wherein methanol is mixed with air in a heat exchanger reactor that contains tubes filled with metal oxide catalysts. Methanol can be manufactured from various feedstocks, including natural gas, coal, and biomass. Its production involves synthesizing carbon monoxide and hydrogen, which are then reacted through a catalytic process.

Methanol is considered a feasible alternative to fossil fuels as it is clean and low cost. These factors lead to its increased demand in emerging economies of the Asia Pacific and the Middle East. Countries of Asia Pacific, including India, import large volumes of methanol from Saudi Arabia. The consumption trend of methanol is projected to witness a steady rise in the transportation industry of these countries. Methanol, which has emerged as a clean transport and cooking fuel, is expected to curb dependency on fossil fuels and their imports, reducing import bills by around 20% or more in the next five years.

Regional Insights

Methanol market in North America is expected to grow significantly during the forecast period. This growth is attributed to a strong product supply driving significant demand for methanol in the region to cater to the rising demand for MTBE, acetic acid, and formaldehyde. However, the recession between 2008 and 2010 led to reduced construction activities in the region, eventually reducing the demand for MTBE and formaldehyde. As of 2023, the industry is stable due to the steady supply of natural gas at low costs. This is one of the key factors which is driving the industry growth in North America. Yet another significant driver that is fueling the demand for methanol in the region is the increasing number of biodiesel projects in the pipeline till 2022.

U.S. Methanol Market Trends

U.S. methanol markethasproduction capacities of several manufacturers that are rising to cater to the growing demand from a robust range of application sectors resulting into growth of methanol market in the region.

Asia Pacific Methanol Market Trends

Asia Pacific dominated the market in 2023 by accounting for the largest revenue market share of 51.71%. Increasing demand for acetic acid, formaldehyde, and DME are considered the key industry drivers across Asia Pacific. Also, the adoption of methanol for fuel purposes is poised to generate new growth avenues for the industry over the forecast period.

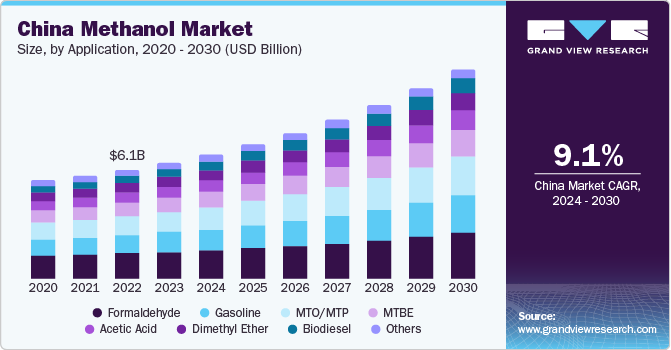

The methanol market in China is projected to rise significantly, due to the start of a new methanol to olefin (MTO) plant in the country in 2022. Conversely, weaknesses in China’s downstream olefins industry are expected to slow down the consumption pattern of methanol to a certain extent in the near future.

Europe Methanol Market Trends

The methanol market in Europe is expected to grow over the forecast period. Europe's growing renewable methanol market is driven by the increasing demand for clean energy and government support for renewable fuels. Key players in this market include CRI Green Chemicals, Enerkem, and BioMCN.

Germany methanol market is expected to grow significantly during the forecast period. The rising automotive industry in the region leads to rising demand for methanol. Germany is also considered the world's automotive hub, leading to rising demand for methanol in the country.

Central & South America Methanol Market Trends

Methanol market in CSA is expected to grow lucratively during the forecast period due to the rise in automobile production plants and rise in construction, which has led to rise in demand for methanol. Methanol is also used in the textile industry to meet the demand for methanol. CSA has increased the production of methanol. Brazil in CSA is recognized as one of the key exporters of methanol, supported by key multinationals, such as Group Peixoto de Castro and more.

Middle East and Africa Methanol Market

The Middle East & Africa accounts for a comparatively lower consumption of methanol, which is majorly driven by the production of methanol by Sasol. Sasol is the only methanol manufacturer in the country, located at Sasolberg and has an annual production capacity of 140,000 tons. In addition, the growing demand for methanol in various industries, such as chemical, transportation, and construction, is driving the market.

Key Methanol Company Insights

Some of the key players operating in the market include BASF SE, SABIC, Petroliam Nasional Berhad (PETRONAS) and among others.

-

BASF SE is a chemical manufacturer and supplier with a presence in Europe, North America, Asia Pacific, South America, Africa, and the Middle East. The company manufactures a wide range of products, including solvents, amines, resins, glues, petrochemicals, thermoplastics, foams, and polymers.

-

SABIC is a diversified manufacturing company that is publicly traded. The government of Saudi Arabia owns 70% of the company's shares, while private investors own the remaining shares. The company operates through six business units including chemicals, polymers, performance chemicals, fertilizers, metals, and innovative plastics.

QAFAC (Qatar Fuel Additives Company Limited), Methanex Corporation. and Celanese Corporation., among others, are some emerging market participants in the specialty market.

-

Qatar Fuel Additives is a joint venture between Industries Qatar, OPIC Middle East Corporation, International Octane LLC, and LCY Middle East Corp. The company primarily produces organic chemicals, solvents, polyhydric alcohols, synthetic perfumes, and other products.

-

Methanex Corporation participates in the methanol industry, with production facilities in countries such as New Zealand, Egypt, Canada, Chile, the U.S., and Trinidad. Its global supply chain is extensive, and it has well-equipped storage facilities.

Key Methanol Companies:

The following are the leading companies in the methanol market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Zagros Petrochemical Company

- Mitsui & Co. Ltd.

- Celanese Corporation

- Petroliam Nasional Berhad (PETRONAS)

- SABIC

- Methanex Corporation

- Mitsubishi Gas Chemical Co., Inc.

- QAFAC (Qatar Fuel Additives Company Limited)

Recent Developments

-

In January 2024, BASF SE partnered with Envision Energy, a leading provider of comprehensive net-zero solutions in green technology, to improve the conversion of green hydrogen and CO2 into e-methanol through advanced and dynamic process design. BASF will provide its cutting-edge SYNSPIRE catalyst technology, which Envision Energy will integrate with its innovative energy management system to convert green hydrogen and CO2 efficiently into e-methanol. Methanol, a versatile and clean-burning fuel, is the product of this collaboration.

-

In January 2024, Fairway Methanol, a joint venture between Celanese and Mitsui & Co. Corporation, commenced methanol production by utilizing carbon dioxide from plants surrounding its facility. The venture is expected to capture 180 thousand metric tons of CO2 and produce 130 thousand metric tons of low-carbon methanol annually, leading its annual production capacity to 1.63 million metric tons. This methanol production is one of Mitsui's carbon capture and utilization projects, which considers CO2 a resource that can be reused as a raw material, thus realizing carbon recycling and reducing CO2 emissions into the atmosphere.

Methanol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.50 billion

Revenue forecast in 2030

USD 64.14 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Volume in million tons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; China; India; Japan

Key companies profiled

BASF SE; Zagros Petrochemical Company; Mitsui & Co. Ltd; Celanese Corporation; Petroliam Nasional Berhad (PETRONAS); SABIC; Methanex Corporation; Mitsubishi Gas Chemical Co., Inc.; QAFAC (Qatar Fuel Additives Company Limited)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Methanol Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global methanol market report based on, application, and region:

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion; 2018 - 2030)

-

Formaldehyde

-

Gasoline

-

Acetic Acid

-

MTBE

-

Dimethyl Ether

-

MTO/MTP

-

Biodiesel

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global methanol market size was valued at USD 36.0 billion in 2023.

b. The global methanol market is projected to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2030.

b. Asia Pacific dominated the market in 2023 by accounting for the largest share of 51.71% of the global methanol market in terms of revenue in the same year. Increasing demand for acetic acid, formaldehyde, and DME are considered the key drivers of the industry across the Asia Pacific.

b. Some prominent players in the global methanol market include: ● BASF SE ● Zagros Petrochemical Company ● Mitsui & Co. Ltd. ● Celanese Corporation ● Petrolian Nasional Berhad (PETRONAS) ● SABIC

b. Key factors that are driving the market growth include growing demand for biodiesel and rising popularity of MTO process.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."