Luxury Bath And Body Products Market Size, Share & Trends Analysis Report By Product (Body Oil, Body Washes, Body Creams & Lotions), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-912-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global luxury bath and body products market size was valued at USD 14.46 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.9% from 2022 to 2030. Increased self-care trends and rising demand for luxury products such as lotions, shower gels, and body wash are driving the market. Furthermore, the increasing number of product launches in the premium category of lotions and creams is projected to attract millennials and youngsters.

The COVID-19 pandemic is likely to slow down the growth of the market in the near term as most of the brick-and-mortar stores were shut down for many weeks. Since many consumers could not have access to the store and the right products of their choice, DIY procedures and home remedies comprising all-natural household ingredients gained popularity, especially in countries such as India, where herbal and Ayurvedic products are already popular.

With a growing focus on luxury and essential body and bath products, an increasing number of companies have been offering a wide range of products in different markets. For instance, in July 2020, Amorepacific Group expanded the offerings of premium body care brand Sulwhasoo in India exclusively with Nykaa. Such product offerings also prompt consumers to buy luxury skincare products, which has been a prominent factor driving the market in the forecast period.

Luxury bath and body products have evolved and cover a broad product portfolio and different styles. Key players in the market are expanding their scope by using biotechnology expertise to develop performance-based showers and aromatherapy. For instance, Massey Medicinals offers the Candida Freedom handcrafted luxury product range, which includes biodegradable bath oils, soaps, and bath salts that are formulated with LactoSpore developed by Sabinsa.

The women segment is expected to maintain its lead over the forecast period. In December 2020, CeraVe experienced growth in its revenue, with products selling out on shelves across the U.S. after skincare influencers promoted the brand’s efficacy on TikTok and the brand’s media value was up by 128% y-o-y. Customers follow and trust influencers, with 62% of women admitting that they dedicatedly follow beauty and skincare influencers for product reviews and new product launches.

The high cost of products is expected to pose a significant challenge for the growth of this market. There are various cheaper alternatives available in the market, especially those offered by small and unorganized players in the beauty and personal care market. Some people are also turning toward the use of home remedies, such as baking soda, apple cider vinegar, lime juice, and shikakai (acacia) powder to attain long-term benefits and do away with the harmful chemicals that many bath and body care products contain.

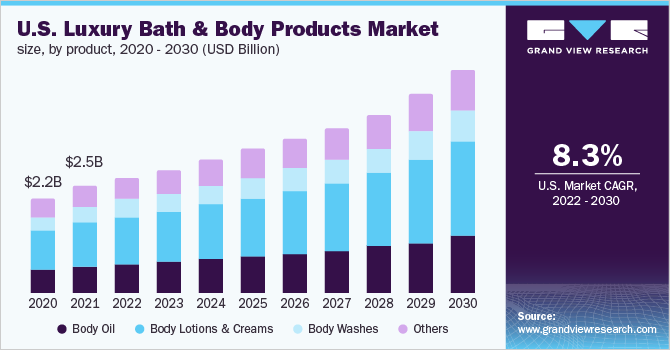

Product Insights

Body lotions and creams held the largest revenue share of over 35.0% in 2021 and are expected to maintain their lead over the forecast period. An increasing number of millennials and Gen Z are willing to pay a premium price for body lotions and creams that contain complexion-improving niacinamide that benefits the skin, offer 24-hour nourishment and hydration, contain essential vitamins like A, C, and E, and restore smooth texture and firmness. These factors are also likely to drive the demand for luxury body lotions and creams.

The body oil segment is projected to register the second-fastest growth rate of 8.0% from 2022 to 2030. Aromatherapy is gaining popularity as a medical replacement to relieve symptoms such as pain, anxiety, and insomnia. The demand for luxury bath oils has seen a rapid surge in recent years owing to the growing prevalence of aromatherapy and the expanding number of spas and wellness centers across the globe.

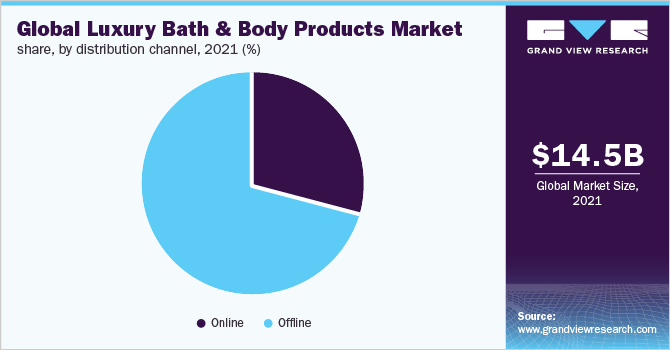

Distribution Channel Insights

The offline distribution channel held the largest revenue share of over 70.0% in 2021. The increased focus on self-care has driven consumers’ interest in luxury bath products, which has led major offline retailers, including prominent supermarket chains such as Walmart and Costco Wholesale Corporation, that stock and sell a range of luxury products to witness a surge in the sale, which is driving the offline segment.

The online distribution channel is projected to register the fastest CAGR of 10.0% from 2022 to 2030. Online channels have been gaining popularity over the past years owing to the growing prevalence of online shopping across the globe. Consumers across the world are increasingly turning toward online shopping due to the rising visibility from several premium brands like The Estée Lauder Companies Inc.; Diptyque; Chanel Limited; and Murad Skincare.

Regional Insights

North America held the largest revenue share of over 25.0% in 2021. Manufacturers of luxury skincare products such as Tata Harper and Onsen Secret are focusing on developing sustainable body lotions and butter made of organic ingredients to cater to the changing consumer preferences. Thus, the rising consumer awareness regarding health and hygiene and the increasing preference for premium sustainable products are likely to fuel the demand in North America over the forecast period.

Asia Pacific is expected to register the fastest CAGR of 8.7% from 2022 to 2030. An increasing number of consumers are seeking luxury products for bathing and personal use owing to the spa-style and aromatherapy indulgence that they offer. In addition, consumers are aspiring to maintain a healthy lifestyle, prevent diseases, and enhance their overall physical and mental well-being, thereby driving the market in the region.

Europe is expected to witness significant growth from 2022 to 2030. The growing trend of natural and organically manufactured products has fueled the consumer demand for luxury bath and body products. According to the survey by Nature, in March 2021, 24% of consumers in France considered buying products that are natural and manufactured with premium-quality ingredients. This scenario is expected to boost the demand for luxury bath and body products in the years ahead.

Key Companies & Market Share Insights

The market is characterized by the presence of some large established brands and a number of developing luxury skincare companies. Leading manufacturers hold a significant market share in major parts of Europe and North America. For instance, in March 2020, Omorovicza, a premium beauty brand, added another luxury scalp care serum to its line-up. The new Scalp Reviver is said to absorb excess oil at the roots, remove product build-up, stimulate hair growth, and shield the scalp from urban stresses.

Similarly, in July 2019, cult skin-care brand Augustinus Bader debuted its luxury body cream. The product is meant to bring the benefits of the company’s proprietary “trigger factor” technology to the body, which aims to guide nutrients into the skin’s stem cells to prompt renewal. It also contains Brazilian Candeia Oil, meant to help the skin barrier. In another instance, in December 2019, Estée Lauder Companies Inc. acquired a global skincare company Dr. Jart+, which has a strong presence in South Korea. This acquisition was aimed at helping Estée Lauder expand its beauty care business in South Korea. Some prominent players in the global luxury bath and body products market include: -

-

The Estée Lauder Companies Inc.

-

Chanel Limited

-

Aromatherapy Associates

-

Kao Corporation

-

Diptyque

-

Chantecaille (UK) Ltd.

-

Susanne Kaufmann

-

Omorovicza

-

Augustinus Bader

-

Tata Harper

-

Bamford

-

This Works Products Limited

Luxury Bath And Body Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 15.49 billion |

|

Revenue forecast in 2030 |

USD 28.65 billion |

|

Growth Rate |

CAGR of 7.9% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Germany; U.K.; France; China; Japan; India; Brazil; South Africa |

|

Key companies profiled |

The Estée Lauder Companies Inc.; Chanel Limited; Aromatherapy Associates; Kao Corporation; Diptyque; Chantecaille (UK) Ltd.; Susanne Kaufmann; Omorovicza; Augustinus Bader; Tata Harper; Bamford; This Works Products Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global luxury bath and body products market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Body Oil

-

Body Lotions & Creams

-

Body Washes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury bath and body products market size was estimated at USD 14.46 billion in 2021 and is expected to reach USD 15.49 billion in 2022.

b. The global luxury bath and body products market is expected to grow at a compound annual growth rate of 7.9% from 2022 to 2030 to reach USD 28.65 billion by 2030.

b. North America dominated the luxury bath and body products market with a share of 28.7% in 2021. Manufacturers of luxury skincare products, such as Tata Harper and Onsen Secret, are focusing on developing sustainable body lotions and butter made of organic ingredients, to cater to the changing consumer preferences. Thus, the rising consumer awareness of health and hygiene and the increasing preference for premium sustainable products are likely to fuel the demand in North America over the forecast period.

b. Some key players operating in the luxury bath and body products market include The Estée Lauder Companies Inc.; Chanel Limited; Aromatherapy Associates; Kao Corporation; Diptyque; Chantecaille (UK) Ltd; Susanne Kaufmann; Omorovicza; Augustinus Bader; Tata Harper; Bamford; and This Works Products Limited.

b. Key factors that are driving the luxury bath and body products market growth include increased self-care trends and rising demand for luxury products such as lotions, shower gels, and body washes. Furthermore, the increasing number of product launches in the premium category of lotions and creams is projected to attract millennials and youngsters.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."