- Home

- »

- Organic Chemicals

- »

-

Global Industrial Salts Market Size & Share Report, 2025GVR Report cover

![Industrial Salts Market Size, Share & Trends Report]()

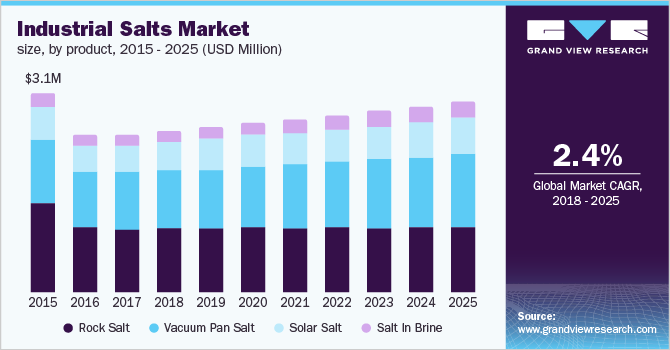

Industrial Salts Market Size, Share & Trends Analysis Report By Source (Brine, Salt Mines) By Product (Rock Salt, Salt in Brine, Solar Salt, Vacuum Pan Salt), By Application, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-210-5

- Number of Report Pages: 148

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Report Overview

The global industrial salts market size to be valued at USD 15.9 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 2.4% during the forecast period. Rising demand for the product in key application industries including highway deicing, oil & gas industry, water treatment, agriculture, and chemical processing, primarily for the production of chlorine, caustic soda, and soda ash is expected to drive growth over the forecast period. The industry is expected to witness significant growth owing to a wide range of direct uses such as for deicing and agriculture purposes and indirect uses including in the chemical processing industry to derive chlorine and caustic soda. The chlor-alkali sector in the chemical industry is a major consumer of the product owing to unavailability of any economic substitute for the product.

The market is expected to grow on account of the growing technological innovations pertaining to the production of high purity salt such as vacuum pan technology. However, the adoption of the technology is low owing to the presence of low-cost production techniques such as conventional mining, solution mining, and solar evaporation.

Deposits or solar evaporation operations of with different production capacities are available in almost every country across the globe. Landlocked countries majorly import the product; however, some of the landlocked African countries have rock salt deposits as a source. Furthermore, unavailability of perfect substitutes is expected to drive growth.

Mining regulations such as the Mine Health and Safety Act related to health and safety of the miners and regulations enforced by the Environmental Protection Agency (EPA) for environmental protection regulate the industry. Furthermore, manufacturers have to adhere to several regulations related to permits from the government which is expected to restrain growth.

The supply chain management in the industry governs and monitors the entire channel in order to ensure reliable distribution under competitive terms and conditions. Major players involved in the industrial salts market use various transport carriers including cost-effective railway lines, waterways, and their own logistics services to improve supply chain efficiency.

Industrial Salts Market Trends

The high availability of the industrial salts and simpler engineering processes facilitate a reduction in the costs which drives demand in varied application areas. These areas include chemical processing, preparation of caustic soda, soda ash, water treatment, highway deicing, and others. It is a major resource or raw material which is used for the manufacturing process of different chemicals that constitutes surging demand for the product. This is expected to drive the growth of the market during the forecast period.

The large availability of the salt reserves is the key factor in increasing the growth of the industrial salts market. The oil and gas industry shares a major share in this market due to which industrial salt facilitates extensive drilling of natural gas and crude oil. This is another application area which has a positive effect on the growth of the industrial salts market. The pharmaceutical industry is another extensive user of the industrial salts for making capsules and preparing other saline solutions. The demand for industrial salts has been found in the manufacturing process of varied products in food, cosmetics, and other industrial purposes. Furthermore, the use of industrial salt is found in the chlor-alkali sector, wherein salt is used as a filler in the detergents and solvents due to its cost-effectiveness attribute which determines significant importance. This is another application area which has a positive effect on the growth of the industrial salts market. Hence, the market is expected to witness high growth during the forecast period. Water treatment projects are other vital areas wherein industrial salt is utilized forthe process of water softening and purification, which creates an opportunity for the market. The lack of availability of affordable substitutes provides a huge opportunity for the growth of this market.

The use of industrial salts in different applications can cause health problems such as brain damage and is toxic to nature. For example, the application of mercury salts has an impact on the functioning of the kidneys and in some cases leads to death. In addition, government regulations over the extensive use of industrial salt in the chemical processes is another factor impacting the progress of the market. Thus, such factors hold back the expansion of the market; restraining the growth during the forecast period.

Source Insights

Brine is a major source of industrial salts as it is derived from large saline waters bodies or through solution mining. The growing restrictions on mining activities are expected to have a positive impact on the use of brine in the application industries. Brine is majorly used in chemical processing, which is a major application industry, leading to high demand for the brine.

Processing cost associated with brine to produce crystals is high owing to increased energy consumption to vaporize the brine. In addition, boiling operations in the vacuum pan technique consume high energy responsible for increased prices. As a result, the technology is used in specific high-purity applications.

Salt mines account for a large market share and are expected to witness growth over the forecast period owing to rising consumption of rock salt in application industries. In addition, demand in de-icing applications expected to have a positive impact on the demand. However, several regulations pertaining to the mining activities are expected to restraint growth.

The process of obtaining the product from mines require several approvals, license, and permits from mining authorities across the globe, which is expected to restrain growth. In addition, the operating rate of mine facilities fluctuates with changing demand for the de-icing application, which is expected to slow down the overall growth over the projected period.

Product Insights

Brine is a high-concentration saline solution, which is obtained from large water bodies and dissolving mine deposits through solution mining technique. Chemical companies utilize a significant amount of the product in the form of brine, for production of chlorine and caustic soda. According to the statistics by USGS, brine accounted for 38% of the consumption in the U.S. in 2016.

Solar salt accounts for 40% of the overall production worldwide and is expected to witness the fastest growth owing to the high demand in water-treatment and agricultural applications. However, factors associated with the product including production cost, time, purity level, and harvesting based on climatic conditions, are expected to restraint market growth.

The demand for rock salt is dependent on winter weather conditions from cold regions as deicing is the major application of the product. In addition, demand from other application industries including agriculture and food processing is expected to grow further driving the market growth for the product worldwide.

Pellet, mini cube, and special purity salt are high purity products produced using vacuum pan technique and find applications in hospitals, food plants, medical industry, circuit board manufacturing, and water softening. The vacuum pan technique is expected to witness robust growth, supported by increasing penetration in the chemical and food processing industry.

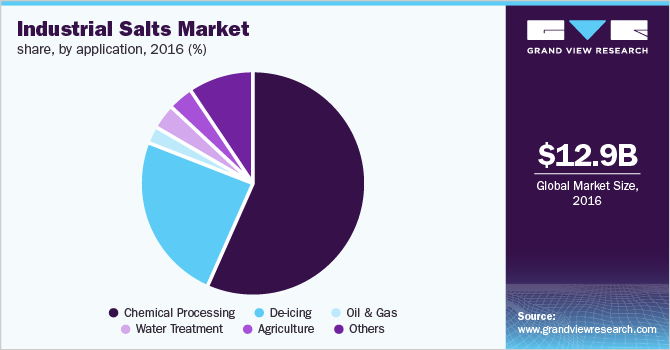

Application Insights

Increasing penetration of the product in chemical processing, de-icing, water treatment, oil & gas, and agriculture products is expected to drive the demand over the forecast period. Rising demand for the product in chemical processing and chlor alkali applications, primarily in China and India is expected to augment growth.

The chemical industry accounted for over 50% of the global consumption in 2016. Chemical manufacturers utilize the product in various grades including rock, brine, and high purity grades. However, major chemical companies prefer to produce artificial brine with high purity level for captive consumption by solution mining technique.

De-icing is the second-largest application on account of abundant supply, low cost, and effective ice control properties. Rock salt is majorly used for this application as it does not require any kind of purification. Use of brine for road de-icing has been increasing for the past few years on account of its high effectiveness at a lower temperature, i.e., below 25oF.

Rising demand for the product in water treatment applications from developing economies is expected to drive the market over the forecast period. Increasing industrialization, rising water quality standards, more complex manufacturing processes, and improved access to safe drinking water supplies and sanitation facilities are expected to aid market growth for water treatment.

Regional Insights

China and the U.S. combined accounted for the largest revenue share in 2016. China has increased its production owing to the increasing demand and is expected to grow at 2.7% over the forecast period. Growing industrialization in Asia Pacific and rising demand for the product in chemical industries is expected to increase consumption over the projected period.

The market in North America is expected to witness growth owing to widespread use in de-icing in extreme weather conditions. The market in the U.S. accounted for 16.4% of global consumption is 2016, primarily due to rising product demand in highway deicing and chemical processing.

Central & South America is rich in natural deposits, with high production capacities. Brazil and Chile are dominant producing as well as consuming nations in the region, exporting a large amount of the product to North America and Europe. In addition, the growing demand for the product in agricultural applications is expected to increase captive consumption in the region.

The market in the Middle East & Africa is expected to have the highest growth of 3.3% over the forecast period. The region is expected to indicate increase in demand on account of industrial diversification in the region, particularly the expansion of chemical production and chemical processing capacities.

Key Companies & Market Share Insights

Established players such as K+S Group, benefits from the logistically favorable proximity of the production sites in Europe, North & South America. With a network of production facilities, global players can respond more flexibly than local competitors to fluctuations in weather-dependent demand for de-icing, ensuring reliable supply to customers.

The companies in the industry are highly competitive and compete on the basis of the quality of the product produced and regional expansion. Established players such as Morton Salt and Compass Mineral compete in terms of regional expansion with a focus on high-margin segments, such as pharmaceutical and food processing.

Recent Developments

-

A leading manufacturer of minerals, salt, and other products, Compass Minerals reported an increase in highway anti icing product sales of approximately 4.8 million tonnes during the fiscal 2022 second quarter. This sale included all the highway maintenance products which were sold in various sectors of the U.S., Canada, and the United Kingdom. These salt products are of utmost importance, and they keep the roadways safe, especially during the winter weather and assure safety for the travelers. Additionally, salt is useful for consumer, industrial, and agricultural applications. Moreover, the chemical specialty business of the firm aids in sustainable agricultural practices, and water treatment projects or activities

-

A German chemical company, K+S, ensured its contribution to water treatment projects owing to the process of treating saline water and facilitating recovery of the dissolved minerals. With the extensive application of advanced salt technologies, the company has made improvements in the quality of water, further minimizing the negative impact on the environment. Therefore, this improvement is expected to drive demand for industrial salt products, and technology leading to the increased growth of the market during the forecast period

-

In 2021, Tata Chemicals Ltd., an Indian Global company that manufactures alkali products, and other chemical-based products announced its plans to acquire the salt unit of the Archean’s Group. The acquisition is expected to lead to an increase in the share of the company with the support of Archean’s Group, which is expected to constitute a high growth during the forecast period

Some of the key players operating in this market include:

-

Compass Minerals Limited

-

Cargill Inc.,

-

INEOS Enterprises

-

China National Salt Industry Corporation (CNSIC)

-

Tata Chemicals Limited

-

K+S Group

-

Morton Salt

-

Mitsui & Co. Ltd.

-

Rio Tinto PLC

-

Delmon Salt Factory Co. Ltd

-

Donald Brown Group

-

European Salt Company

Industrial Salts Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 14.0 billion

Revenue forecast in 2025

USD 15.9 billion

Growth Rate

CAGR of 2.4% from 2017 to 2025

Base year for estimation

2016

Historical data

2014 - 2016

Forecast period

2017 - 2025

Quantitative units

Volume in million ton, revenue in USD million and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

K+S Group; Morton Salt; Compass Mineral compete

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

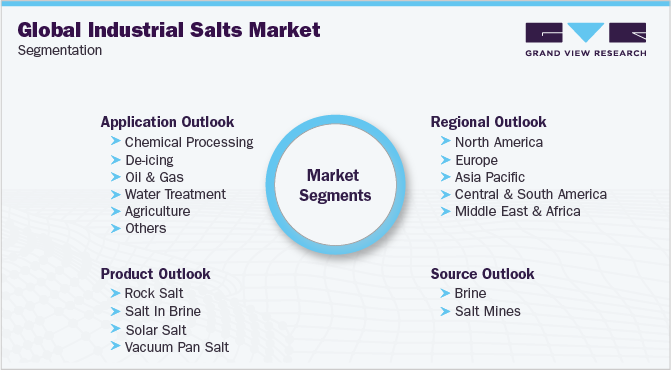

Global Industrial Salts Market SegmentationThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global industrial salts market on the basis of source, product, application, and region.

-

Source Outlook (Volume, Million Tons, Revenue, USD Million, 2014 - 2025)

-

Brine

-

Salt mines

-

-

Product Outlook (Volume, Million Tons, Revenue, USD Million, 2014 - 2025)

-

Rock salt

-

Salt in brine

-

Solar salt

-

Vacuum pan salt

-

-

Application Outlook (Volume, Million Tons, Revenue, USD Million, 2014 - 2025)

-

Chemical processing

-

Caustic soda

-

Soda ash

-

Chlorine

-

-

De-icing

-

Oil & Gas

-

Water treatment

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Million Tons, Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global industrial salts market size was estimated at USD 13.7 billion in 2019 and is expected to reach USD 14.0 billion in 2020.

b. The global industrial salts market is expected to grow at a compound annual growth rate of 2.4% from 2019 to 2025 to reach USD 15.9 billion by 2025.

b. Chemical Processing dominated the industrial salts market with a share of 57% in 2019. This is attributable to chemical manufacturers utilizing the product in various grades including rock, brine, and high purity grades.

b. Some key players operating in the industrial salts market include Compass Minerals, Cargill Inc, INEOS Enterprises, China National Salt Industry Corporation (CNSIC), Tata Chemicals Limited, K+S Group, Morton Salt, Mitsui & Co. Ltd., Rio Tinto PLC, Delmon Salt Factory, Donald Brown Group, AkzoNobel N.V, Exportadora De Sal SA., European Salt Company, and ZOUTMAN Industries.

b. Key factors that are driving the industrial salts market growth include rising demand for the product in key application industries including highway deicing, oil & gas industry, water treatment, agriculture, and chemical processing, primarily for the production of chlorine, caustic soda, and soda ash.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."