- Home

- »

- Electronic Devices

- »

-

Industrial And Commercial LED Lighting Market Report, 2030GVR Report cover

![Industrial And Commercial LED Lighting Market Size, Share & Trends Report]()

Industrial And Commercial LED Lighting Market Size, Share & Trends Analysis Report By Product (Lamps, Luminaires), By Application (Indoor, Outdoor), By End Use (Industrial, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-575-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The global industrial and commercial LED lighting market size was valued at USD 51.37 billion in 2023 and is projected to grow at a CAGR of 10.2% from 2024 to 2030. Lower prices of semiconductor chips and components are leading to decreasing manufacturing costs. There is an increasing need for LED lighting solutions that are energy-efficient and affordable. These lights have longer lifespans and require less energy than traditional lighting systems. This substitution pattern is driving the growth of the market.

Continuous improvements in LED efficiency, lifespan, and performance drive its demand in businesses and industries. Advanced features such as smart lighting systems have significantly boosted the adoption of LED lighting in the industrial and commercial sectors. These systems offer automation capabilities, allowing businesses to optimize lighting schedules and reduce energy consumption. Remote control features enable users to adjust light settings from any location, enhancing convenience and operational efficiency. Moreover, the low energy consumption of LED light leads to substantial savings on electricity bills. The long lifespan of LED lights reduces the frequency of replacements, leading to lower maintenance costs. These features and economic benefits reduce operational expenses and drive its adoption in industrial and commercial sectors.

Government policies and regulations promoting energy efficiency and reducing carbon emissions are driving the adoption of LED lighting. The U.S. government has implemented several initiatives to encourage the adoption of LED lighting in public spaces. These initiatives focus on improving energy efficiency, reducing costs, and enhancing public safety. These initiatives also provide local governments with resources, tools, and support to adopt LED street lighting. In July 2023, Chicago upgraded its 280,000 streetlights to new smart LED lights that use 50% less energy. This modernization leads to significant cost savings, lower carbon emissions, and enhanced public safety.

Filament and fluorescent lights consume more energy and have a higher carbon footprint. LED lights do not contain hazardous substances, making them safer for the environment and human health. The growing awareness and emphasis on corporate social responsibility and sustainable practices have led businesses to adopt LED lighting solutions as part of their green initiatives.

Product Insights & Trends

Luminaires dominated the market and accounted for a share of 58.6% in 2023. Advances in LED chip technology, optics, and thermal management improved the performance, efficiency, and reliability of LED luminaires. These innovations result in higher lumen output, better color, and longer lifespans. These smart features improve energy efficiency and enhance user experience and operational convenience. LED luminaires consume less energy, reducing energy consumption, leading to cost savings on electricity bills and driving demand in the commercial and industrial sectors.

The lamps segment is expected to register the fastest CAGR of 11.3% during the forecast period. LED lamps offer superior lighting quality, essential for industrial and commercial applications. High color rendering index (CRI) LED lamps provide better color accuracy and consistency, improving visibility and reducing eye strain. This makes them suitable for demanding applications that require precise lighting, such as manufacturing, healthcare, and retail. For instance, in October 2023, Halonix Technologies launched a 'UP-DOWN GLOW' LED Bulb. The upper part (Dome) and the lower part (stem) glow in different colors, giving consumers options for creating three switch-enabled modes. The 10W 'UP-DOWN GLOW' LED Bulb provides two variants. The first variant offers warm, white, and mixed lighting, and the second offers blue, white, and mixed lighting options.

Application Insights & Trends

The indoor segment accounted for the largest market revenue share in 2023. This section includes a variety of indoor lighting uses, such as in businesses, factories, and schools. Smart indoor lighting solutions are essential in modern workspaces for meeting rooms, corridors, and cabins. Installing LED lights consumes less energy, increases electricity bill savings, and makes LEDs a useful option for businesses looking to reduce operational expenses. As these advancements increase, the demand for cost-effective and efficient LED lights is expected to rise.

The outdoor segment is expected to register the fastest CAGR during the forecast period. The expansion and development of cities and new urban areas are increasing the need for efficient and reliable lighting solutions for streets, highways, public transportation hubs, and other infrastructure projects. Outdoor LEDs are available in various designs, color temperatures, and beam angles, allowing customized light solutions depending on the requirement. This capability makes it suitable for public parks, monuments, bridges, and commercial properties for highlighting architectural features, creating ambiance, and supporting branding. For instance, in October 2023, Access Fixtures announced the launch of HAMO LED Wall Pack Lights for outdoor facades. It includes an up light option and a down light option, each providing 30w of illumination, and a combined up and down light option, providing 60w of illumination. The company allows customers to choose their preferred Kelvin temperature between white color varieties such as cool 4000K, warm 3000K, and bright 5000K.

End Use Insights & Trends

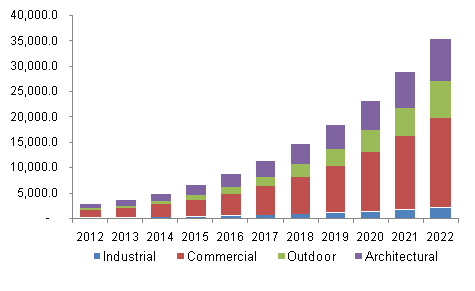

The commercial segment dominated the market in 2023. Increasing building and construction activities, healthcare applications, and government energy efficiency regulations are driving this segment's demand. The automotive sector is increasingly adopting LED lights as they have less maintenance and consume less power, which is particularly important for electric vehicles (EVs), for conserving battery life is essential. This efficiency benefits manufacturers and consumers. For instance, in January 2024, Lumax Auto Technologies launched Japanese-designed fog lamp projectors. These projectors utilize an 80-watt LED that emits an 800-metre light throw with less power consumption.

The industrial segment is projected to grow at the fastest CAGR over the forecast period. Industrial applications involve harsh conditions, such as extreme temperatures, humidity, dust, and vibrations. LED lights offer high performance and durability in these environments. This durability reduces the need for frequent replacements and maintenance, leading to significant downtime and productivity losses. This durability and effectiveness drive the demand for energy-efficient LED lights in different industrial sectors.

Regional Insights & Trends

The North American region market is expected to witness significant growth over the forecast period. As cities and municipalities undertake infrastructure upgrades and smart city initiatives, there is a growing emphasis on incorporating energy-efficient and sustainable technologies. LED lights offer reduced energy consumption, lower maintenance costs, and enhanced public safety through improved illumination. These advantages increase its demand in offices, warehouses, and manufacturing plants, where lighting quality can enhance productivity and safety.

U.S. Industrial And Commercial LED Lighting Market Trends

The U.S. market is expected to witness significant growth over the forecast period. Technological advancements have enabled the creation of smart lighting systems that can be controlled remotely and programmed for various functions, such as dimming, color tuning, and occupancy sensing. These smart features enhance convenience and user experience and contribute to additional energy savings. These advancements are driving the demand for LED lights in the U.S. market. For instance, in January 2023, Cree LED released the XLamp Pro9 LEDs. These lights deliver up to 15% greater efficiency for 90 and 95 CRI LEDs while maintaining color rendering quality.

Asia Pacific Industrial And Commercial LED Lighting Market Trends

Asia Pacific region accounted for the largest revenue share in 2023. The Asia region is experiencing extensive growth in urban areas, leading to increased construction of commercial buildings, industrial facilities, and public infrastructure. Due to their energy efficiency, long lifespan, and reduced maintenance costs, LED lighting solutions are being utilized more in these new developments. Governments and private developers are increasingly adopting LEDs for street lighting, public buildings, and transportation hubs, recognizing this technology's long-term economic and environmental benefits.

The Indian market is expected to witness significant growth over the forecast period. The Indian government has launched several programs to promote energy efficiency and reduce carbon emissions. These initiatives make LED lighting more accessible, raise awareness about the benefits of energy-efficient lighting solutions, and drive its adoption for industrial and commercial sectors. In December 2023, The Union Minister for Power and New & Renewable Energy announced that under the Street Lighting National Programme, launched in January 2015, targeting the replacement of conventional streetlights with LED streetlights, Energy Efficiency Services Limited had installed around 1.30 crore LED streetlights across the country.

The China market is expected to witness significant growth over the forecast period. Industrial and commercial entities face high energy costs, and LED lights, which consume significantly less electricity, offer substantial savings on energy bills. The financial benefits of LED lights, such as long lifespan, reduced maintenance, and lower replacement costs, are increasing the demand for businesses looking to reduce operational expenses. Additionally, the ability of LEDs to operate effectively in various environmental conditions makes them an ideal choice for industrial and commercial applications.

Latin America Industrial And Commercial LED Lighting Market Trends

The Latin American market is expected to witness the fastest CAGR over the forecast period. LED lighting, with its high energy efficiency and lower greenhouse gas emissions, supports corporate sustainability goals and aids companies in meeting environmental regulations. By adopting LED lighting, businesses can demonstrate their commitment to sustainability, improve their corporate image, and attract environmentally conscious customers and investors. As economies in the region continue to develop, there is a growing need for efficient and reliable lighting systems to support industrial activities and commercial operations. This environmental sustainability and development factor drives the demand for LED lights in this market.

The Brazil market is expected to witness significant growth over the forecast period. LEDs provide bright, uniform illumination with a high CRI, ensuring accurate color representation. This improved visibility enhances worker productivity and safety, preventing accidents and improving task accuracy. The leading automakers are increasingly integrating LEDs into their vehicle designs due to their superior energy efficiency, longevity, and performance. Additionally, the automotive sector in this region utilizes LED lighting in manufacturing processes, such as factory and assembly line illumination, to ensure precise and efficient production. This superior lighting quality of LEDs drives its adoption in the automotive sector.

Key Industrial And Commercial LED Lighting Company Insights

Some of the key companies in the industrial and commercial LED lighting market include Zumtobel Group, AIXTRON, Signify Holding, Eaton, Advanced Lighting Technologies, LLC and others. Market vendors are focusing on expanding their customer base to have a competitive advantage in the sector. As a result, major players are implementing various strategic actions, including mergers and acquisitions, and forming partnerships with other leading firms.

-

Eaton is a diversified power management company with a history of over 100 years. The organization works in multiple sectors such as electrical products, electrical systems and services, aerospace, automotive, and the newest addition, eMobility. Their energy-saving offerings assist customers in efficiently handling electrical, hydraulic, and mechanical power in a reliable, safe, and sustainable manner.

-

The Zumtobel Group is an Austrian company specializing in lighting. It develops, produces, and sells luminaires, lightings, lighting components, and lighting management for indoor and outdoor applications. The company's services comprise consultation for smart lighting controls and emergency lighting systems, design services, and complete lighting solutions project management.

Key Industrial And Commercial LED Lighting Companies:

The following are the leading companies in the industrial and commercial LED lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Lighting Technologies, LLC

- AIXTRON

- Dialight

- Eaton

- Emerson Electric Co.

- OSRAM SYLVANIA Inc

- Signify Holding

- SiteWorx Software

- TOYODA GOSEI Co., Ltd.

- Zumtobel Group

Recent Developments

-

In July 2023, Dialight launched new and improved area light with battery backup. Proper lighting is crucial in industrial facilities, especially those prone to power outages, as "poor visibility" is a major factor in accidents and due to this they launched their new product. The latest auxiliary battery backup system from Dialight comes in a more compact and stylish housing, and is capable of offering lighting for at least 90 minutes as recommended by the National Fire Protection Association (NFPA) emergency lighting guidelines.

-

In January 2023, RapidGrow LED, a PANGEA Global Technologies, Inc. subsidiary, introduced SOLITE, its newest high-efficiency LED light designed specifically for legal cannabis growers and operators. SOLITE integrates UV and blue light to enhance genetic expression and improve resin production. Paired with PANGEA software, operators can independently control each fixture and daisy-chain up to 12 fixtures on a 20A circuit.

Industrial And Commercial LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 58.00 billion

Revenue forecast in 2030

USD 103.67 billion

Growth Rate

CAGR of 10.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

Zumtobel Group, Eaton, Dialight, Advanced Lighting Technologies, LLC, AIXTRON, OSRAM SYLVANIA Inc, TOYODA GOSEI Co., Ltd., SiteWorx Software, Emerson Electric Co., Signify Holding

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial And Commercial LED Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial and commercial LED lighting market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lamps

-

Luminaires

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."