- Home

- »

- Pharmaceuticals

- »

-

India Pharmaceutical Manufacturing Market, Industry Report, 2030GVR Report cover

![India Pharmaceutical Manufacturing Market Size, Share & Trends Report]()

India Pharmaceutical Manufacturing Market Size, Share & Trends Analysis Report By Dosage Form (Tablets, Injectables), By Manufacturing Type (In-house, Contract), By Therapeutic Category (Endrocrinology, Cardiovascular), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-261-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

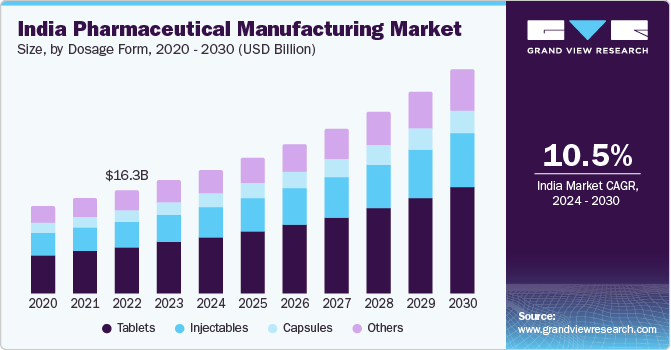

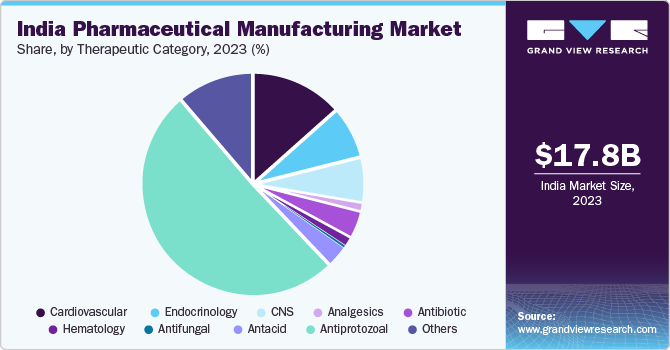

The India pharmaceutical manufacturing market size was estimated at USD 17.79 billion in 2023 and is estimated to grow at a CAGR of 10.5% from 2024 to 2030. The key factors driving the market include rising R&D spending, advancements in manufacturing technologies, and an increasing geriatric population aided by the rising prevalence of chronic disorders. Furthermore, the growing number of clinical trials and increasing investments in pharmaceutical IT are anticipated to offer lucrative opportunities for market growth over the forecast years.

India's geriatric population is increasing, which is anticipated to boost the demand for pharmaceutical products and urge companies to adopt automation & advanced technology to accelerate production. The estimates published by the United Nations Population Fund suggest that the Indian population in the age group 65 years and above is expected to double and touch 192 million by 2030. By 2050, it is expected that every fifth Indian will be aged above 65 years. Aging increases the risk of cardiovascular disease, cancer, and other chronic diseases. Therefore, an increase in the geriatric population is anticipated to boost the demand for continuous monitoring via facilities requiring POC diagnostics, such as home care services and assisted living facilities.

India is a prominent player in the global pharmaceutical manufacturing market, with over 10,000 pharmaceutical manufacturing locations. Moreover, companies are encouraged to streamline their processes and reduce drug development costs. Thus, companies are optimizing complex processes by adopting novel software such as Pharma 4.0 to promote the computerization of manufacturing procedures. This approach leads to the development of intelligent networks along the value chain. Thus, advancements in pharmaceutical manufacturing technologies is driving the market growth in India.

Furthermore, compliance, increasing profitability, process optimization, alignment with corporate standards, and improvements in the supply chain are driving investments in IT for the pharmaceutical sector. Corporate IT budgets continue to increase for manufacturing processes. The pharmaceutical sector has integrated manufacturing IT as a strategic initiative for improved quality and production efficiencies. Digital transformation in the pharmaceutical sector helps boost revenue generation by manufacturers while achieving efficiency and productivity gains from better equipment utilization & rapid throughput times. Hence, increasing funding and investment in pharmaceutical IT is expected to fuel the market in the near future.

However, the relatively low spending on research and innovation is one of the hurdles in the Indian pharmaceutical business. India spends about 0.7% of GDP on R&D, while many other countries spend over 2.5 to 3%. Pharmaceutical businesses invest around 7% of net sales in R&D, compared to 15% to 20% spent by global companies. It is estimated that the R&D spending in this country has remained stagnant for three consecutive years post pandemic. This is due to high prices, extended research gestation periods, and unknown outcomes, as manufacturing a product can take a decade with unpredictable consequences, making it a high-risk venture.

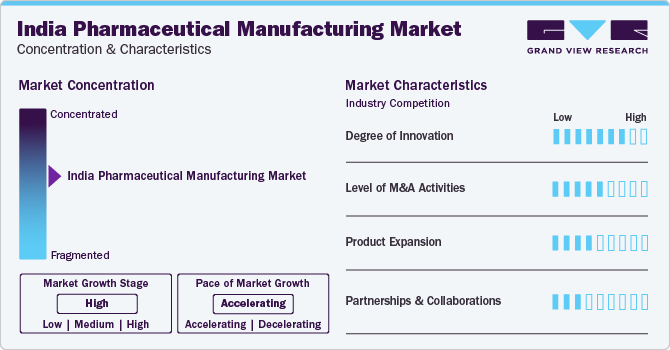

Market Concentration & Characteristics

Market growth stage is high, and pace of the growth is accelerating. The market is characterized by a high degree of innovation owing to personalized treatment approaches & emerging novel drugs aiming to limit disease progression. Additionally, continuous increase in clinical trials of pharmaceutical products is expected to create numerous opportunities for market growth in the coming years.

The market is characterized by a high level of acquisition activity by the leading players. It is one of the most adopted strategies by players to increase their capabilities, expand product portfolios, and improve competencies.

Expansion of companies in various application areas is a significant factor in driving the growth of the market. This strategy aims to increase market penetration, capture new customers, and capitalize on emerging opportunities. It involves adapting to regulatory requirements and healthcare infrastructure to address local needs effectively.

The market is witnessing moderate partnerships and collaborative efforts between established and emerging players. For instance, in September 2023, Sun Pharmaceutical Industries Ltd. entered into a licensing agreement with Pharmazz Inc. for the introduction of Tyvalzi, used for the treatment of cerebral ischemic stroke in India.

Dosage Form Insights

The tablets segment dominated the India pharmaceutical manufacturing market with a share of 45.3% in 2023 and is expected to grow at the fastest rate during the forecast period. The growth is attributed to the wide acceptance of tablets by patients & physicians, continuous advancements in pharmaceutical sciences that have resulted in the development of tablets with desired properties, and ease of manufacturing. Moreover, increasing R&D initiatives in the segment are anticipated to fuel the demand for tablets in the coming years. For instance, in December 2021, VVDN Technologies announced offering complete design, development, and manufacturing of Make In India tablets for global and domestic customers. This initiative is expected to further increase the global supply of tablets, thereby driving revenue for the segment.

Injectable segment is anticipated to grow at lucrative growth over the forecast period. The increase in approvals for prefilled syringes and auto-injectors is one of the factors responsible for the fastest growth rate. Moreover, a change in preference toward larger dosage volumes has resulted in an increased demand for 2.25ml needle syringes, which considerably contributes to the revenue of this segment. For many years, injectable insulin has been regarded as the base treatment for diabetes. Prefilled syringes and insulin pens are the leading modes of insulin administration. With the rise in the number of diabetes cases, the usage rate of insulin pens is estimated to grow.

Manufacturing Type Insights

Contract manufacturing segment dominated the market with a share of 53.2% in 2023 and is anticipated to grow at fastest growth rate over the forecast period. Recently, many manufacturers have shifted their focus toward external service providers for R&D and manufacturing services. The growth in demand for customized products, the need for enhanced productivity & efficiency across the value chain, and continuous pressure from regulatory bodies on drug pricing have compelled pharmaceutical companies to rely majorly on outsourcing drug development processes. In addition, pharmaceutical companies focus on reducing expenses during formulation development, API manufacturing, analytical & testing services for solid dose manufacturing, and clinical trials management.

The in-house manufacturing segment is expected to grow at a substantial growth rate during the forecast period. The growth can be attributed to the continuous expansion of in-house manufacturing facilities by market players. For instance, in May 2023, Aurigene Pharmaceutical Services, a subsidiary of Dr. Reddy’s Laboratories, announced a spending of USD 40 million for the expansion of its production facility for therapeutic antibodies, proteins, and viral vectors. Moreover, in February 2023, Gland Pharma announced an investment in Genome Valley, near Hyderabad. This strategic investment is geared toward enhancing their current infrastructure and facilitating the production of biologicals, biosimilars, antibodies, and recombinant insulin.

Therapeutic Category Insights

Cardiovascular segment dominated the market with a revenue share of 13.7% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The rising investment in research and development to develop innovative cardiovascular drugs, as well as generic versions of existing medications, to cater to both domestic & international markets is driving the growth of the manufacturing process in the country. Cardiovascular diseases encompass a wide range of conditions affecting the heart and blood vessels, including hypertension, coronary artery disease, heart failure, and arrhythmias, which are highly prevalent in the country and propel the demand for effective therapeutics. Furthermore, the innovative development of novel formulations aided by the growing export of the formulation are propelling the overall market growth.

The endocrinology segment is projected to grow at a lucrative rate during the forecast period. The growth can be attributed to the increasing prevalence of endocrine-related diseases, a growth in aging population, rising awareness about these conditions, and advancements in pharmaceutical research & development.Moreover, a growing number of manufacturing facilities in India and increasing exports from the country are further anticipated to drive overall market growth.

Key India Pharmaceutical Manufacturing Company Insights

Some of the established companies operating in the market include Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cipla, Inc., and Lupin. These companies are focusing on enhancing their product portfolio by upgrading their products and adopting strategies such as acquisitions and government authorizations to increase their client base and obtain a larger market share. Emerging players are focusing on partnering with established players in order to leverage their market foothold and distribution channel.

Key India Pharmaceutical Manufacturing Companies:

- Akums Drugs and Pharmaceuticals Ltd.

- Pure & Cure Healthcare

- Alkem Laboratories Ltd.

- BDR Pharmaceuticals Internationals Pvt. Ltd.

- Hetero

- Sun Pharmaceutical Industries Ltd.

- Ajanta Pharma Ltd.

- Synokem Pharmaceuticals Ltd.

- Cipla Inc.

- La Renon Healthcare Pvt. Ltd.

- Eris Lifesciences

- Lupin

- Glenmark Pharmaceuticals Ltd.

- Torrent Pharmaceuticals Ltd.

- Ipca Laboratories Ltd.

- Intas Pharmaceuticals Ltd.

- Micro Labs Ltd.

- MSN Laboratories

Recent Developments

-

In September 2023, Cipla Inc. announced the acquisition of Actor Pharma to enhance and expand the OTC offering portfolio.

-

In August 2023, BDR Pharmaceuticals Internationals Pvt. Ltd. announced the launch of Dalbonova injection, used for the treatment of skin structure infections and acute bacterial skin caused by susceptible strains of gram-positive microorganisms.

-

In September 2023, Akums Drugs and Pharmaceuticals Limited announced the launch of Tamsulosin + Tadalafil capsule, a combination therapy approved by DCGI in the Indian market for the management of lower urinary tract symptoms and erectile dysfunction in men. The company announced its launch with an aim to expand its urology segment.

-

In February 2023, Sun Pharmaceutical Industries Ltd. received FDA approval for the generic version of Lenalidomide Capsules.

India Pharmaceutical Manufacturing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 35.38 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Dosage form, manufacturing type, therapeutic category

Country scope

India

Key companies profiled

Akums Drugs and Pharmaceuticals Ltd.; Pure & Cure Healthcare; Alkem Laboratories Ltd.; BDR Pharmaceuticals Internationals Pvt. Ltd.; Hetero; Sun Pharmaceutical Industries Ltd.; Ajanta Pharma Ltd.; Synokem Pharmaceuticals Ltd.; Cipla Inc.; La Renon Healthcare Pvt. Ltd.; Eris Lifesciences; Lupin; Glenmark Pharmaceuticals Ltd.; Torrent Pharmaceuticals Ltd.; Ipca Laboratories Ltd.; Intas Pharmaceuticals Ltd.; Micro Labs Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Pharmaceutical Manufacturing Market Report Segmentation

This report forecasts the country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the India pharmaceutical manufacturing market report based on dosage form, manufacturing type, and therapeutic category:

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gelatin Capsule

-

Hard Gelatin Capsule

-

Others

-

-

Injectables

-

Others

-

-

Manufacturing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house Manufacturing

-

Contract Manufacturing

-

-

Therapeutic Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Endocrinology

-

Canagliflozin

-

Empagliflozin

-

Semaglutide

-

Tirzepatide

-

Linagliptin

-

Alogliptin

-

Trelagliptin

-

Myo-inositol

-

-

Cardiovascular

-

Treprostinil

-

Azilsartan Medoxomil

-

Azilsartan+Amlodipine

-

Amlodipine+Lisinopril

-

Sparsentan

-

Esaxerenone

-

-

CNS

-

Cariprazine

-

Brexpiprazole

-

Lisdexamfetamine

-

Vortioxetine

-

Mirogabalin Besylate

-

Lasmiditan

-

Siponimod

-

-

Analgesics

-

Ibuprofen+Famotidine

-

Upadacitinib

-

-

Antacid

-

Pantoprazole

-

-

Antibiotic

-

Doxycycline

-

Tedizolid

-

-

Antifungal

-

Posaconazole

-

-

Antiprotozoal

-

Nitazoxanide

-

-

Hematology

-

Lenalidomide

-

Daprodustat

-

Roxadustat

-

Edoxaban

-

Avatrombopag

-

-

Others

-

Linaclotide

-

Apremilast

-

Tegoprazan

-

Suvorexant

-

Vonoprazan

-

Rolapitant

-

Elagolix

-

-

Frequently Asked Questions About This Report

b. The global India pharmaceutical manufacturing market size was valued at USD 17.79 billion in 2023 and is anticipated to reach USD 19.46 billion in 2024.

b. The global India pharmaceutical manufacturing market is expected to witness a compound annual growth rate of 10.47% from 2024 to 2030 to reach USD 35.38 billion by 2030.

b. Cardiovascular segment dominated the India pharmaceutical manufacturing market with a revenue share of 13.66% in 2023 and is anticipated to grow at fastest growth rate over the forecast period.

b. Some of the key players in the India pharmaceutical manufacturing market are Akums Drugs and Pharmaceuticals Ltd.; Pure & Cure Healthcare; Alkem Laboratories Ltd.; BDR Pharmaceuticals Internationals Pvt. Ltd.; Hetero; Sun Pharmaceutical Industries Ltd.; Ajanta Pharma Ltd.; Synokem Pharmaceuticals Ltd.; Cipla Inc.; La Renon Healthcare Pvt. Ltd.; Eris Lifesciences; Lupin; Glenmark Pharmaceuticals Ltd.; Torrent Pharmaceuticals Ltd.; Ipca Laboratories Ltd.; Intas Pharmaceuticals Ltd.; Micro Labs Ltd.

b. The key factors driving the India pharmaceutical manufacturing market include rising R&D spending, advancements in manufacturing technologies, and an increasing geriatric population aided by the rising prevalence of chronic disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."