- Home

- »

- Renewable Energy

- »

-

Hydropower Market Size Report, 2030GVR Report cover

![Hydropower Market Size, Share & Trends Report]()

Hydropower Market Size, Share & Trends Analysis Report By Component (Civil Construction, Electromechanical Equipment), By Capacity (Mini, small), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-050-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 – 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Report Overview

The global hydropower market size was valued at USD 255.30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 1.4% from 2024 to 2030. Depleting reserves of fossil fuels has prompted industry to shift to renewable sources. The growing energy demand on account of the growing global population coupled with the need to reduce reliance on conventional power generation has been prompting the industry to use renewable power sources. One of the most popular renewable power generation technologies includes hydropower which does not cause any greenhouse gas emissions and toxic waste.

Depleting fossil fuels used in power generation, such as petroleum and coal, has presented an alarming need for a growing emphasis on energy solutions derived from renewable sources. Rising urbanization, increasing automation, technological advancements, and increasing dependability of critical infrastructures on energy supply such as transport, water utility, healthcare, and others have developed a growing demand for uninterrupted power supply. These aspects are expected to drive growth for the hydropower market in the approaching years.

As concerns regarding the climate change and environmental footprint of multiple industries, including energy and power, the demand for energy solutions developed through renewable sources is growing rapidly. Increasing awareness regarding the lasting impacts caused by processes and operations related to other forms of power generation and scarcity of multiple resources has also contributed to the growing inclination towards renewable energy.

Governments are offering incentives, such as tax credits, grants, and feed-in tariffs, to encourage the development of new hydropower projects. For instance, in February 2024, the U.S. Department of Energy (DOE) selected 46 hydroelectric projects from 19 states in the country to receive Hydroelectric Efficiency Improvement Incentive up to USD 71.5 million. In 2023, the U.S. DOE announced similar incentive for 66 facilities throughout the country.

Moreover, technological advancements in hydropower industry, such as turbine design, materials, run-of-river systems, and construction techniques, have improved operational efficiency and reduced costs, making hydropower more competitive with other forms of energy.

Component Insights

Based on components, the civil construction segment dominated the hydropower market and accounted for a revenue share of 33.0% in 2023. The demand for civil construction is driven by the need for robust infrastructure capable of withstanding natural forces and ensuring long-term operational stability. The physical structures essential for hydropower plants, such as dams, reservoirs, and tunnels, play a crucial role in the foundational stages of the projects. Small power projects contribute substantially to the total cost of the civil construction sector. Setting up the entire system requires specific arrangements to allow water to enter the turbines properly, ensuring optimal results.

The electromechanical equipment is expected to experience the fastest CAGR during the forecast period. Electromechanical equipment, including generators, turbines, and transformers, plays a crucial role in converting hydropower into usable electrical energy. As the demand for renewable energy sources rises owing to global environmental concerns and the push towards sustainability, the importance of this equipment has grown substantially.

Capacity Insights

The small capacity hydropower segment accounted for the largest revenue share in 2023. The expansion of the small capacity hydropower segment is led by the growing demand for renewable energy sources, the need for sustainable and eco-friendly power generation, and supportive policies by the government focusing on reducing carbon footprints. Moreover, small hydropower systems generally produce up to 10 MW of power and offer a reliable and cost-effective solution for rural and remote regions, contributing to energy security and economic development. In addition, innovations and the development of technology backed by increased investments in infrastructure are increasing the efficiency and feasibility of small hydropower projects. Decentralizing and distributing power generation capacities into smaller projects is expected to assist countries in dealing with the impacts of natural calamities where large hydropower stations experience severe disruptions. For instance, in 2023, the northern and eastern regions of India, which are home to nearly 60% of the country’s hydropower generation capacity, were affected by a series of disasters and flash floods. This resulted in large-scale interruptions in energy generation.

The micro & pico segment is anticipated to witness the fastest CAGR during the forecast period. These hydropower projects are developed for smaller power generation requirements, specifically for smaller communities and areas. The micro & pico capacity hydropower projects include lesser civil construction, smaller equipment, minor installations, and fewer other components.

Regional Insights

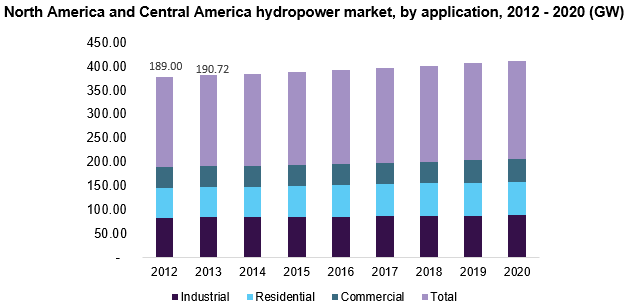

North America hydropower market is expected to experience a growth during the forecast period. The growth is driven by increasing demand for renewable energy, the presence of established large hydropower infrastructure in the U.S. and Canada, rising climate concerns, and growing focus on developing enhanced energy generation solutions based in renewable resources. The governments in the region are supporting hydropower industry to meet goals related to reduced carbon footprint and minimized dependency on availability of depleting fossil fuels.

U.S. Hydropower Market Trends

The U.S. dominated the regional hydropower market in 2023. High investment in renewable and cleaner energy is one of the primary factors in the growth of the U.S. hydropower market. Growing technology advancements and government initiatives to promote the adoption of renewable energy sources such as hydropower have also contributed to the growth of this market in recent years. Rising investment to achieve net zero and cleaner energy sources is anticipated to increase demand for the hydropower industry in the next few years. For instance, in December 2023, at the United Nations Climate Change Conference, Vice President Kamala Harris announced that the U.S. has joined more than 115 other countries in the commitment to doubling energy efficiency and enhancing renewable energy capacity by 2030.

Europe Hydropower Market Trends

Europe hydropower market held a significant revenue share of global industry in 2023. Increasing environmental awareness and demand for sustainable sources of energy driving market growth. The growing shift towards a clean energy source drives hydropower projects, particularly mini and small hydropower, which is gaining significant traction and shaping the region's future energy sector.

Asia Pacific Hydropower Market Trends

Asia Pacific dominated the hydropower market and accounted for revenue share of 37.3% in 2023. The growth of his market is primarily driven by increasing energy demand, an abundance of hydropower resources, and the support of government policies. The Asia Pacific region is home to several rivers and the large organizations operating in the hydropower market, which presents opportunities for multiple hydropower developments.

China Hydropower Market Trends

China hydropower market dominated the regional industry and accounted for a share of 42.9% in 2023. Supportive government policies, increased rural electrification by the government in recent years, and rising technological innovation have driven growth for this market. Increasing urbanization in the region leads to a larger demand for electricity, resulting in hydropower growth. The presence of the Three Georges Dam in China, one of the largest hydropower projects worldwide, meets around 10% of China's energy requirement, leading to the region's growth.

Key Companies & Market Share Insights

Some key companies involved in the hydropower market include China Three Gorge Corporation, ABB Ltd., and Tata Power Corporation. With increasing focus on adoption of advanced technologies related to power generation via renewable sources, the key market participants in hydropower industry are adopting strategies such as enhanced research and development, innovation, and collaborations and partnerships with other organizations and governments to develop new projects in multiple locations.

-

ABB, a global leader in power and automation technologies, operating in more than 100 countries, offers integrated electrical and automation solutions in the hydropower sector, including advanced SCADA systems, medium and high-voltage switchgear, and generator circuit breakers.

Key Hydropower Companies:

The following are the leading companies in the hydropower market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- Stakraft Sweden

- ANDRITZ

- China Three Gorges Corporation

- Voith GmbH & Co. KGaA

- ALFA LAVAL

- ABB

- ENGIE

- Tata Power

- Norsk Hydro ASA

Recent Developments

-

In August 2024, Tata Power and Druk Green Power Corporation (DGPC) partnered to establish the 600 MW Khorlochhu Hydropower facility. The DGPC would hold 60 %, and Tata Power would have 40% of the equity stake in this project. The development is expected to provide energy security to the region while fulfilling Tata Power’s commitment to offering a greener future.

Hydropower Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 257.13 billion

Revenue Forecast in 2030

USD 280.20 billion

Growth rate

CAGR of 1.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, capacity and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Spain, Russia, France, Netherlands, Germany, China, Japan, South Korea, India, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Siemens; Stakraft Sweden; ANDRITZ; China Three Gorges Corporation; Voith GmbH & Co. KGaA; ALFA LAVAL; ABB; ENGIE; Tata Power; Norsk Hydro ASA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydropower Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydropower market report based on component, capacity and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil Construction

-

Electromechanical Equipment

-

Power Infrastructure

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Mini

-

Micro & Pico

-

Small

-

Large & Medium

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Spain

-

Russia

-

France

-

Netherlands

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."