- Home

- »

- Renewable Energy

- »

-

Hydrogen Fueling Station Market Size & Share Report, 2030GVR Report cover

![Hydrogen Fueling Station Market Size, Share & Trends Report]()

Hydrogen Fueling Station Market Size, Share & Trends Analysis Report By Size (Small Station, Medium Station, Large Station), By Type (On Site, Off Site), By Mobility, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-140-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Energy & Power

Hydrogen Fueling Station Market Trends

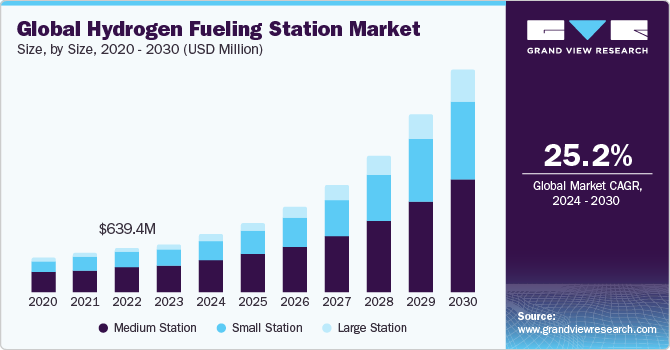

The global hydrogen fueling station market size was estimated at USD 695.0 million in 2023 and is projected to grow at a CAGR of 25.2% from 2024 to 2030. The driving factors for the market growth include the increasing demand for zero-emission vehicles, as well as government initiatives and policies aimed at promoting the adoption of hydrogen fuel cell vehicles. As more countries set targets to reduce their carbon emissions and improve air quality, there is growing interest in fuel cell vehicles as promising alternatives to gasoline and diesel vehicles. Hydrogen fuel cell vehicles emit only water and do not produce harmful air pollutants, making them an attractive option for consumers and policymakers.

The market is driven by a combination of regulatory support, technological innovation, and a growing commitment to decarbonize the transportation sector. Government initiatives and policies aimed at reducing carbon emissions, such as federal grants and incentives, tax credits, and funding for research and development, play a crucial role in stimulating investment and infrastructure development. In addition, partnerships between automotive manufacturers, energy companies, and government agencies are driving innovation in hydrogen production and distribution technologies, making fuel cell vehicles more viable and attractive to consumers. For instance; on 2 May 2023, Voltera and Nikola announced a partnership to set up 50 hydrogen stations in North America.

The drive for self-reliance in energy and the vision to establish a resilient national hydrogen sector are significant drivers for market growth in the country. Hydrogen is increasingly recognized as an adaptable and eco-friendly substitute for traditional fuels, especially in demanding sectors like heavy-duty transportation and long-distance travel. Consequently, the U.S. is witnessing a consistent development of its hydrogen refueling towards greener and more sustainable transportation options. The aforementioned factors are expected to fuel the demand for hydrogen refueling station over the forecast period.

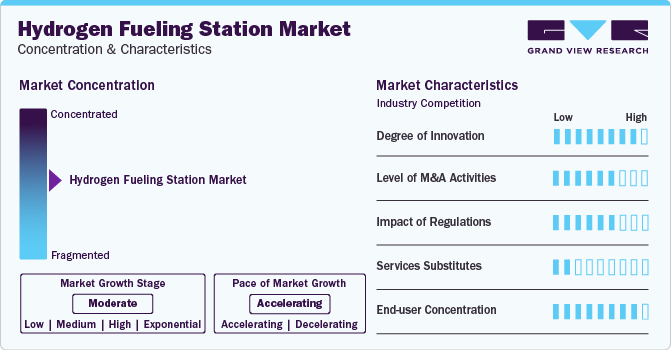

Market Concentration & Characteristics

The players operating in this global market are engaged in continuous research & development activities across the globe. The key players in this market include Air Liquide; China Petrochemical Corporation; H2ENERGY SOLUTIONS LTD; Cummins Inc.; and Air Products and Chemicals, among others. The global energy crisis has stimulated research and development into alternative sources of energy production, as well as a number of initiatives for sustainable energy conservation. Sustainable energy development is a broad field and involves many steps that need to be implemented early on as their potential environmental and commercial impacts can be significant.

Growing concerns related to air pollution have prompted governments in various regions to introduce strict emission regulations for passenger cars, light and heavy commercial vehicles, and other types of vehicles. Hydrogen generation is an emerging market that offers enormous opportunities for development and growth. The increasing carbon footprint in the atmosphere will significantly stimulate the production of clean hydrogen in the coming years.

Size Insights

Based on size, the market has been further divided into small station, medium station and large station. The medium station segment held the market with the largest revenue share of 55.86% in 2023 and is anticipated to witness at a considerable CAGR over the forecast period. With the increasing adoption of hydrogen-powered vehicles, there is a rising requirement for convenient refueling infrastructure, especially in urban and suburban regions. Medium-sized stations are adept at meeting this demand, offering a suitable balance between capacity and spatial needs. Furthermore, progress in hydrogen production methods and a shift towards sustainable sourcing are augmenting the feasibility and appeal of hydrogen as a clean energy carrier.

Large Station hydrogen refueling station emerged as fastest growing segment. With a growing acceptance of hydrogen-powered vehicles, particularly in sectors such as heavy-duty transportation and industrial applications, there exists a pressing demand for substantial refueling infrastructure. Refueling stations of a larger scale are well-equipped to meet this requirement, offering the necessary capacity and efficiency to serve a larger volume of vehicles. Emergence of hydrogen powered heavy duty vehicles is expected to propel demand over the forecast period.

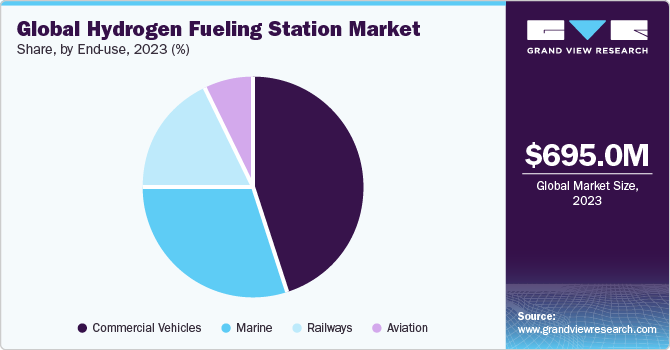

End-use Insights

Based on end-use, the market has been further divided into marine, railways, commercial vehicles, and aviation. The commercial vehicle segment led the market with the largest revenue share of 45.20% in 2023. The demand for hydrogen-based commercial vehicles is experiencing notable growth, driven by several key factors. As industries and transportation sectors seek to reduce their carbon footprint, particularly in areas with demanding operational requirements, hydrogen fuel cell technology offers an attractive solution. These vehicles provide a viable alternative to traditional internal combustion engines, especially for heavy-duty applications like trucks, buses, and other commercial fleets.

Type Insights

Based on type, the market is further divided into off-site and on-site. The on-site segment held the market with the largest revenue share of 53.15% in 2023. The increasing demand for on-site hydrogen fueling stations is attributed to several key factors. As industries and transportation sectors seek to reduce their carbon footprint, on-site stations offer a convenient and efficient solution for refueling hydrogen-powered vehicles. These stations provide a localized and reliable supply of hydrogen, eliminating the need for transportation and storage of the fuel, which can be particularly advantageous in remote or densely populated areas.

The growing demand for off-site hydrogen fueling stations is influenced by several critical factors. As the adoption of hydrogen-powered vehicles gains momentum, there is a heightened need for accessible refueling infrastructure, especially in urban and suburban areas where space constraints may limit on-site options. Off-site stations offer a practical solution by centralizing hydrogen production and distribution, allowing for greater scalability and flexibility in meeting refueling demands in various industries like automobile, marine, aviation, and others. For instance; In July 2023, ADNOC announced development of its first hydrogen refueling station in Middle East to power a hydrogen-powered fleet of commercial vehicles.

Mobility Insights

Based on mobility, the market has been further divided into fixed hydrogen station and mobile hydrogen station. The fixed hydrogen station segment led the market with the largest revenue share of 51.09% in 2023. The rising demand for fixed hydrogen fueling stations can be attributed to several key factors. As the shift towards hydrogen-powered vehicles gains momentum, there is an increasing need for reliable and stationary refueling infrastructure. Fixed stations provide a consistent and readily available source of hydrogen, offering convenience and accessibility to a growing user base. Furthermore, advancements in fixed hydrogen generation technologies, such as onsite electrolysis and pipeline supply, are enhancing the viability and sustainability of these stations.

Furthermore, Mobile stations cater to events, construction sites, and other situations where a permanent fueling infrastructure might not be practical or necessary. These temporary deployments support the increased adoption of hydrogen as a versatile and convenient fuel option for various activities. Mobile stations offer a quick and efficient solution for addressing short-term hydrogen demand, making them suitable for diverse applications, from outdoor events to construction projects, where mobility and adaptability are key considerations.

Regional Insights

The hydrogen fueling station market in North America is anticipated to grow at the fastest CAGR over the forecast period. The increasing demand for zero-emission vehicles and a sustainable transportation infrastructure is driving the market growth in North America. The expansion of hydrogen fueling infrastructure is pivotal in meeting the rising demand for these eco-friendly vehicles. Establishing a robust network of hydrogen fueling stations enhances the accessibility and convenience of hydrogen-powered vehicles for consumers across North America, driving the adoption of fuel cell technology.

U.S. Hydrogen Fueling Station Market Trends

The hydrogen fueling station market in U.S. is anticipated to grow at the fastest CAGR over the forecast period. U.S. government is actively promoting the development of hydrogen fueling infrastructure to support the widespread adoption of fuel cell vehicles. Policies, such as tax incentives and grants, are designed to encourage private investment in hydrogen infrastructure projects, reinforcing the U.S.'s goals to reduce carbon emissions and transition toward a more sustainable transportation sector.

The exponential growth of the U.S. market is driven by emphasis on a network of hydrogen export and fostering international collaboration. The U.S. is leveraging its abundant renewable resources and advanced hydrogen technologies to export hydrogen to other nations. This strategic move is expected to increase the country's economic gains significantly. In addition, deploying hydrogen fueling stations facilitates the development of a robust domestic hydrogen infrastructure. This infrastructure is expected to enable the production and export of hydrogen to other countries.

Europe Hydrogen Fueling Station Market Trends

The hydrogen fueling station market in Europe is anticipated to grow at the fastest CAGR over the forecast period. In Europe, the demand for hydrogen refueling stations has increased significantly, driven by several key factors. The continent's ambitious climate goals and the need to decarbonize various sectors, especially transport, have pushed governments, industries, and consumers toward cleaner energy solutions.

The Germany hydrogen fueling station market accounted for largest revenue share of 43.23% in Europe in 2023. Germany has several hydrogen fueling station facilities, which are used for storing and filling of hydrogen fuel. These facilities assist in balancing the intermittent nature of renewable energy by allowing excess hydrogen to be stored and pumped into the vehicle’s fuel tank. One example of a hydrogen fueling station in Germany is H2 MOBILITY, which is a hydrogen filling station operator.

The hydrogen fueling station market in France is expected to grow at the fastest CAGR of 53.9% during the forecast period. The rising demand for energy storage systems in various applications in the country has increased the pressure for the effective installation of hydrogen fueling stations in the country. France has been a leader in hydrogen fueling stations with many active and under-construction fueling stations. The government of France has been promoting the growth of green hydrogen in the country and is investing in different hydrogen fueling station projects. This has resulted in an increased demand for hydrogen fueling station facilities.

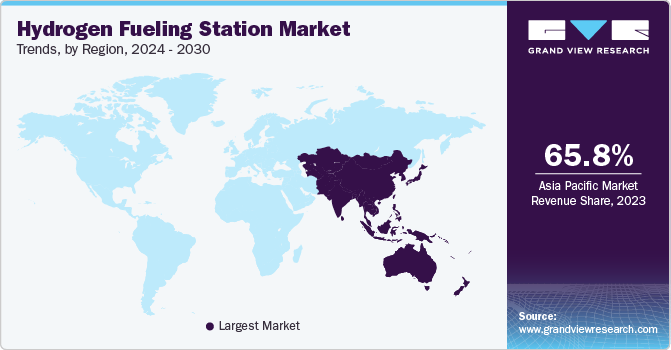

Asia Pacific Hydrogen Fueling Station Market Trends

Asia Pacific dominated the hydrogen fueling station market with the largest revenue share of 65.79% in 2023. Governments across Asia Pacific are implementing strategies to promote the adoption of hydrogen fuel cell vehicles, which is in turn increasing the demand for suitable hydrogen fueling infrastructure. As part of broader efforts to achieve carbon neutrality goals, countries in the region are investing in hydrogen production and distribution infrastructure including hydrogen fueling stations. Growing population and urbanization in the region contribute to increased demand for transportation solutions. Hydrogen fuel cell vehicles offer an alternative to traditional internal combustion engines, providing a clean and efficient means of transportation. The expanding market for fuel cell vehicles is propelling the need for a robust hydrogen-refueling infrastructure, creating opportunities for market players in Asia Pacific.

The South Korea hydrogen fueling station market accounted for largest revenue share of 36.96% in Asia Pacific in 2023. South Korea's goal to achieve carbon neutrality by 2050 is expected to drive the market growth. As part of its broader green energy initiatives, the South Korean government has identified hydrogen as a key player in transitioning to a sustainable low-carbon economy. Establishing hydrogen fueling stations is integral to supporting the widespread adoption of fuel cell electric vehicles (FCEVs) and meeting the nation's targets for reducing greenhouse gas emissions. South Korea's emphasis on carbon neutrality creates a conducive environment for investments and advancements in hydrogen-fueling infrastructure.

The hydrogen fueling station market in Australia is expected to grow at the fastest CAGR of 12.2% during the forecast period. The rising trend of sustainable tourism in Australia is creating opportunities for the Australia market. Hydrogen-powered vehicles provide an eco-friendly transportation solution for tourists exploring the country. The deployment of hydrogen fueling stations in popular tourist destinations supports the adoption of hydrogen-powered vehicles, contributing to a more sustainable and environmentally conscious travel experience. Australia's commitment to promoting sustainable tourism aligns with the expansion of hydrogen infrastructure, enhancing the attractiveness of hydrogen-powered transportation options for domestic and international tourists.

Central & South America Hydrogen Fueling Station Market Trends

The hydrogen fueling station market in Central & South America is anticipated to grow at the fastest CAGR over the forecast period. Central & South America has a relatively low demand for hydrogen fueling stations compared to other regions due to lower investment in green hydrogen technology and low demand from end-use industries. The demand for hydrogen fueling stations is concentrated in industrialized countries such as Brazil and Argentina.

The Brazil hydrogen fueling station market accounted for largest revenue share of 62.52% in Central & South America in 2023. Brazil has the potential for large-scale hydrogen production and storage owing to the country's renewable heavy electricity mix. More than 70% of Brazil’s electricity is generated by renewable sources, primarily dominated by hydropower at 55.3% and wind power at 11%, which, in turn, makes green hydrogen production cheaper in the country. The demand for hydrogen fueling stations is expected to be driven by increasing hydrogen production.

Middle East & Africa Hydrogen Fueling Station Market Trends

The hydrogen fueling station market in Middle East & Africa is anticipated to grow at the fastest CAGR over the forecast period. Governments and industry players are investing in R&D to enhance the efficiency of hydrogen production, storage, and distribution technologies. This signifies continuous improvement, aiming to overcome technical challenges and optimize the entire hydrogen value chain, ultimately making hydrogen-fueling stations more reliable, cost-effective, and accessible.

The UAE hydrogen fueling station market accounted for the largest revenue share of 31.90% in Middle East & Africa in 2023. The development of hydrogen fueling stations in the UAE is driven by the country's adoption of cutting-edge technologies. The UAE is positioning itself as a hub for innovation and technology adoption, and hydrogen fuel cell vehicles represent a frontier in automotive technology. The deployment of hydrogen fueling infrastructure aligns with the country's efforts to adopt technological advancements, fostering a culture of innovation and investment in sustainable technologies.

The hydrogen fueling station market in Saudi Arabia is expected to grow at the significant CAGR during the forecast period. The emerging trend of hydrogen blending in existing natural gas pipelines is also expected to drive the market growth. This approach involves mixing hydrogen with natural gas, creating a hydrogen-enriched gas blend that can be used for various applications, including transportation and power generation. The trend aligns with the Kingdom's efforts to utilize existing infrastructure efficiently, facilitating a smoother transition to hydrogen-based energy systems and minimizing the need for extensive modifications.

Key Hydrogen Fueling Station Company Insights

The market is characterized by the presence of several key players and a few medium and small-scale regional players. Many of the companies have their own sector that they focus on and have a very high penetration in that sector. Therefore, the increasing adoption of fuel cells in various stationary, portable, and transportation applications is expected to provide opportunities for the development of hydrogen refueling stations' market share.

Key Hydrogen Fueling Station Companies:

The following are the leading companies in the hydrogen fueling station market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- China Petrochemical Corporation

- H2ENERGY SOLUTIONS LTD

- Cummins Inc.

- Air Products and Chemicals

- FuelCell Energy, Inc.

- ITM Power PLC

- Ballard Power Systems

- NEL ASA

- TotalEnergies

Recent Developments

-

In October 2023, FirstElement Fuel Inc. opened a high-capacity hydrogen station in Oakland, U.S., growing its true zero network to 41 retail locations. The station consists of four dispensers that can provide H70 fills with a capacity of 1600 kg daily. The station is a result of a collaboration with Hyundai Motor to build 30 XCIENT fuel cell trucks. The Oakland multi-use station can handle hydrogen-powered vehicles and will become the world's largest heavy-duty hydrogen fueling station

-

In June 2023, Air Liquide partnered with Iveco Group to build Europe's first high-pressure hydrogen station for trucks in Marseille, France. The partnership is aimed at advancing hydrogen as a key element for the transport industry's energy transition, leveraging Air Liquide's expertise in the hydrogen value chain and Iveco's experience in producing vehicles powered by alternative fuels

-

In November 2023, Calvera Hydrogen launched two hydrogen-refueling stations in Poland for buses and cars, one in Katowice and the other in Poznan. The stations include compression modules, tube trailers, dispensers, storage modules, and a control system

Hydrogen Fueling Station Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 832.5 million

Revenue forecast in 2030

USD 3,213.7 million

Growth rate

CAGR of 25.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion, Volume in Units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, type, mobility, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; Netherlands; Norway; Denmark, China; India; Japan; South Korea; Singapore; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Air Liquide; China Petrochemical Corporation; H2ENERGY SOLUTIONS LTD; Cummins Inc.; Air Products and Chemicals; FuelCell Energy, Inc.; ITM Power PLC; Ballard Power Systems; NEL ASA; TotalEnergies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Fueling Station Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydrogen fueling station market report based on size, type, mobility, end-use, and region:

-

Size Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Small Station

-

Medium Station

-

Large Station

-

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

On Site

-

Off Site

-

-

Mobility Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Fixed Hydrogen Station

-

Mobile Hydrogen Station

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Marine

-

Railways

-

Commercial Vehicles

-

Aviation

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Netherlands

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hydrogen fueling station market size was estimated at USD 695.0 million in 2023 and is expected to reach USD 832.5 million in 2024.

b. The global hydrogen fueling station market is expected to grow at a compound annual growth rate of 25.2% from 2024 to 2030 to reach USD 3,213.7 million by 2030.

b. The medium station size segment dominated the overall market with a share of 55.86% in 2023. This is attributed to the rapid adoption of clean fuels in commercial and heavy-duty vehicles across the globe.

b. Some key players operating in the hydrogen fueling station market include Air Products Inc., FuelCell Energy Inc., Linde Plc, Praxair Technology, Inc., Air Liquide, and Ballard Power Systems.

b. Key factors driving the hydrogen fueling station market growth include favorable government policies and the rising need for clean and sustainable fuels to reduce the dependence on fossil fuels.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."