- Home

- »

- Biotechnology

- »

-

Hospital Acquired Infections Diagnostics Market Report, 2030GVR Report cover

![Hospital Acquired Infections Diagnostics Market Size, Share & Trends Report]()

Hospital Acquired Infections Diagnostics Market Size, Share & Trends Analysis Report By Test Type (Conventional), By Infection Type (UTI, Pneumonia), By Product (Consumables), By Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-783-4

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global hospital acquired infections diagnostics market size was valued at USD 4.07 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. Hospital acquired infections (HAIs) have been of increasing concern in healthcare facilities across the globe. A hospital-acquired infection is acquired in a hospital or any other healthcare facility. According to WHO estimates, out of every 100 patients, 7 in high-income and 15 in low-/middle-income countries (LMIC) will acquire at least one HAI in acute care hospitals. These infections are caused by the outside environment, other contaminated patients, potentially infected staff members, or in certain circumstances, the source of the illness cannot be identified.

According to the National Healthcare Safety Network (NHSN), in 2021, the rates of infections such as ventilator-associated events (VAEs), central line-associated bloodstream infections (CLABSIs), methicillin-resistant Staphylococcus aureus (MRSA) bacteria, and catheter-associated urinary tract infections (CAUTIs) are predicted to be higher than they were in 2019. Among these infections, VAEs are expected to have the biggest growth compared to previous years. Certain infections are becoming more common in 2021, and VAEs have seen the largest rise in prevalence.

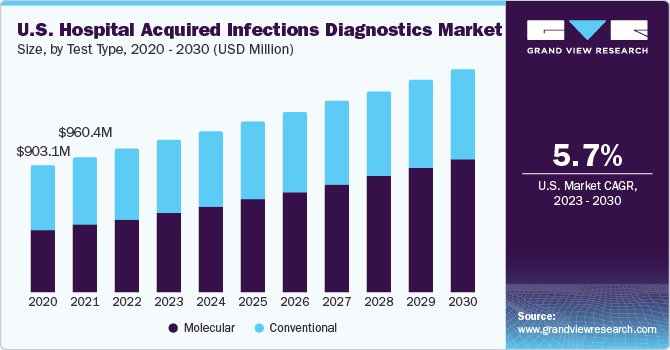

Test Type Insights

The molecular tests segment accounted for the larger revenue share of 50.5% in 2022 and is expected to expand at the fastest CAGR of 9.4% during the forecast period. Molecular diagnostic microbiology tests have become widely available due to technological advancements and commercial business incentives. Owing to an urgent need for more sophisticated disease detection systems, this segment is expected to maintain its dominance through 2030.

Using these approaches directly on clinical samples minimizes the time it takes to respond. It also has economic benefits because it takes less time to receive proper medical care, which minimizes hospitalization expenses and the risks of co-morbidity and death. According to an article published by the National Center for Biotechnology Information in October 2018, metagenomic next-generation sequencing (mNGS) is a strong pathogen detection technology that may identify nucleic acids (DNA and RNA) of all infectious illnesses, including bacteria, fungi, viruses, and parasites, in a single test.

Infection Type Insights

HAIs contribute to significant morbidity, mortality, and financial burden on patients, families, and healthcare systems. According to an article by the National Center for Biotechnology Information (NCBI), in October 2018, 3.2% of all hospitalized patients in the U.S. had HAI, compared to 6.5% in the European Union/European Economic Area, and the prevalence is most likely substantially greater globally. Due to a noticeable lack of HAI surveillance systems, the global burden of HAIs is unknown. However, infection prevention and control programs have worked hard to establish surveillance systems and infection control approaches.

The COVID-19 pandemic has presented hospitals with unique challenges in preventing infections. In 2020, hospitals had to cope with a surge in patients, more severe cases, and shortages of staff and supplies. As a result, there was a rise in healthcare-associated infections (HAIs) and increased use of medical devices. According to the National Healthcare Safety Network (NHSN), in 2021, the rates of infections such as ventilator-associated events (VAEs), methicillin-resistant Staphylococcus aureus (MRSA) bacteria, and catheter-associated urinary tract infections (CAUTIs) are predicted to be higher than they were in 2019.

Product Insights

The consumables segment held the largest revenue share of 63.5% in the hospital acquired infections diagnostics market in 2022 and is expected to expand at the fastest CAGR of 7.7% over the forecast period, owing to the rising incidence of HAIs. The most typical form of treatment for nosocomial infections is the administration of antibiotics. Medical examinations assist in identifying the precise microorganisms causing an individual’s ailment.

Common broad-spectrum antibiotics such as penicillin, cephalosporins, tetracyclines, or erythromycin may be used as the first line of treatment. However, when patients with chronic illnesses receive frequent antibiotic medication over extended periods of time, some bacteria are able to increasingly develop a strong resistance to these common antibiotic therapies, thus decreasing their effectiveness.

In 2021, New Zealand conducted its first national survey to study healthcare-associated infections (HAIs) across all 20 of the country’s district health boards. They surveyed 5,469 adult patients in 291 wards across 31 hospitals and discovered 423 active HAIs in 361 patients, resulting in an estimated national prevalence of 6.6%. This means about 6.6% of adult patients had these infections in the country.

The most common types of HAIs were surgical site infections, urinary tract infections, pneumonia, and bloodstream infections. In simple terms, the survey showed that some patients in New Zealand hospitals had infections related to healthcare, with surgical sites, urinary tract, pneumonia, and the bloodstream being the most common sources of the illnesses.

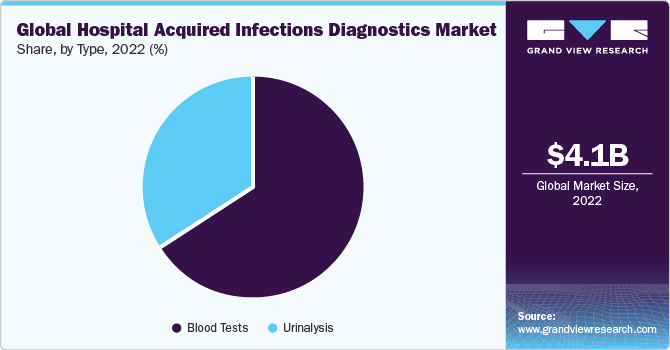

Type Insights

The blood tests segment accounted for the largest revenue share of 65.8% in 2022 and is expected to advance at the fastest CAGR of 7.08% during the forecast period. The analysis of white cells that fight infection is done using a complete blood count, which helps to monitor the effects of medication therapy on blood cell counts. BD (Becton, Dickinson and Company), one of the leading global medical technology companies, has obtained Emergency Use Authorization (EUA) from the U.S. FDA for its rapid diagnostic test for detecting SARS-CoV-2.

The test is designed to be used at the point of care with the widely accessible BD Veritor Plus System. With results available in just 15 minutes using a portable instrument, this new assay is pivotal in improving access to COVID-19 diagnostics. It allows for real-time results and quick decision-making, right at the testing location.

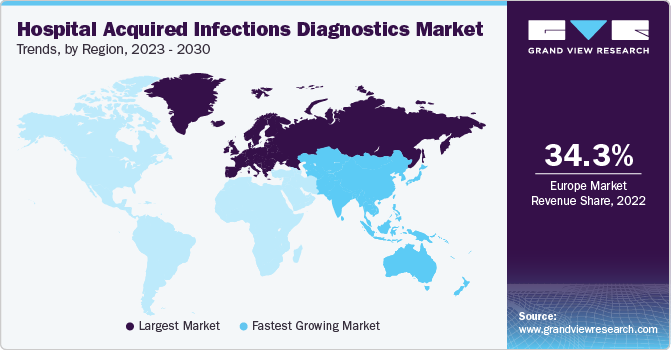

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 34.3% in 2022, owing to the high disease burden, the availability of infrastructure, increased healthcare expenditure, rapid technological advancements, proactive government initiatives, rise in patient awareness, and the presence of major players. According to an article from the National Center for Biotechnology Information (NCBI), the major subtype of healthcare-associated diseases is urinary tract infections (HTIs). According to regional research, the prevalence of HAUTIs varied from 19.6% in Europe to up to 24% in poor nations in 2019.

Asia Pacific is expected to witness the highest CAGR of 9.0% during the forecast period. The high growth rate can be attributed to the rising disease incidence rate and the high geriatric population in the region. Increasing demand for cost-effective diagnostics and a growing population are among the factors significantly contributing to regional market growth. The rising incidence of HAI in countries such as India and China is expected to boost the industry in the near further.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are some of the important business strategies used by market participants to maintain and expand their global reach. For instance, in February 2023, Mylab Discovery Solutions and Thermo Fisher Scientific collaborated to provide RT-PCR kits for infectious illnesses in India.

Key Hospital Acquired Infections Diagnostics Companies:

- BIOMÉRIEUX

- Abbott

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare Private Limited

- BD (Becton, Dickinson and Company)

- Bioscience, Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Meridian Bioscience, Inc.

- Hologic, Inc.

Hospital Acquired Infections Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.34 billion

Revenue forecast in 2030

USD 7.15 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, infection type, type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BIOMÉRIEUX; Abbott; F. Hoffmann-La Roche Ltd.; Siemens Healthcare Private Limited; Becton, Dickinson and Company (BD); Hologic, Inc.; Meridian Bioscience, Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Bioscience, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Acquired Infections Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hospital acquired infections diagnostics market report on the basis of test type, infection type, product, type, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular

-

Conventional

-

-

Infection Type Outlook (Revenue, USD Million, 2018 - 2030)

-

UTI

-

Pneumonia

-

Surgical Site Infection

-

Blood Stream Infections

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instruments

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Tests

-

Urinalysis

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital acquired infections diagnostics market size was estimated at USD 4.07 billion in 2022 and is expected to reach USD 4.34 billion in 2023.

b. The global hospital acquired infections diagnostics market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 7.15 billion by 2030.

b. North America dominated the hospital acquired infections diagnostics market with a share of 27.80% in 2022. This is attributable to the developed healthcare infrastructure and increasing incidence & prevalence of bloodstream infections in the region. Due to this, Surgical Site Infections (SSIs), and other infectious diseases, the demand for diagnostic products is high.

b. Some key players operating in the hospital acquired infections diagnostics market include bioMérieux; Abbott Laboratories; F. Hoffmann-La Roche Ltd; Siemens Healthineers; Becton Dickinson and Company; Danaher Corporation; Thermo Fisher Scientific; Seegene, Inc.; and Qiagen.

b. Key factors that are driving the market growth include rising awareness levels among the healthcare personnel regarding various HAIs, increase in the incidence and prevalence of chronic diseases such as cancer, hepatitis C, multiple sclerosis, & other infectious diseases, increase in government initiatives and growing demand for HAI diagnostics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."