- Home

- »

- Automotive & Transportation

- »

-

Heavy-duty Automotive Aftermarket Industry Report, 2030GVR Report cover

![Heavy-duty Automotive Aftermarket Industry Size, Share & Trends Report]()

Heavy-duty Automotive Aftermarket Industry Size, Share & Trends Analysis Report By Replacement Part, By Vehicle Type, By Service Channel, By Region, And Segment Forecast, 2023 - 2030

- Report ID: GVR-2-68038-566-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global heavy-duty automotive aftermarket industry size was estimated at USD 137.68 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.79% from 2023 to 2030. Rising technological advancements, such as the development of connected and autonomous trucks,advances in diagnostic tools, data analytics, and telematics, have become increasingly important in the aftermarket for heavy-duty automotive, enabling better vehicle monitoring, predictive maintenance, and cost-effective repairs, are expected to boost demand over the forecast period.

The increasing adoption of electric and hybrid heavy-duty vehicles is creating a new segment in the aftermarket. Electric and hybrid vehicles have different powertrains and components compared to traditional internal combustion engine (ICE) vehicles. This shift in technology creates a demand for a new range of aftermarket products, such as batteries, electric motors, inverters, and charging infrastructure. Moreover, the growth of electric vehicles (EVs) necessitates the development of charging infrastructure, including charging stations, cables, and connectors. The aftermarket plays a role in providing these products and installing charging stations for commercial and fleet customers.

Digitalization and e-commerce are playing a significant role in driving the growth of the heavy-duty automotive aftermarket industry. Digitalization has led to the emergence of online marketplaces and e-commerce platforms specializing in heavy-duty automotive parts. Fleet operators, repair shops, and individual vehicle owners can conveniently browse catalogs, compare prices, and order parts online. Moreover, e-commerce platforms provide access to a vast array of aftermarket parts and products from various suppliers and manufacturers. Customers can explore a broader selection of products than they might find at traditional brick-and-mortar stores.

Government incentives, subsidies, and regulations related to vehicle maintenance and emissions control can influence the aftermarket. Programs to reduce pollution or promote cleaner transportation can drive demand for specific products and services. Furthermore, startups and technology companies are entering the heavy-duty automotive aftermarket with innovative solutions, such as predictive maintenance and digital marketplace platforms.

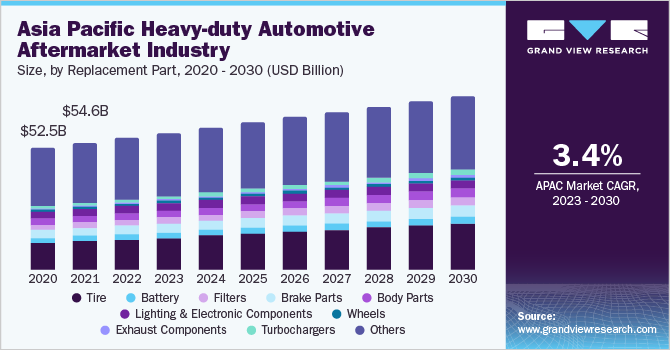

Replacement Part Insights

The other segment dominated the market with a share of over 47.4% in 2022. The other segment includes gearbox, internal and external accessories, cooling systems, and engine parts. The rising trends of remanufacturing mechanical and electrical components are expected to drive the demand for aftermarket components, as remanufactured parts assist in minimizing expenses and support the continuity of older vehicles. Moreover, the retrofitting of components and parts reduced the emissions of an older heavy-duty vehicle, enhancing the life of that vehicle and thus directly driving the demand for aftermarket products.

The turbochargers segment is expected to grow at a CAGR of 7.37% from 2023 to 2030. Turbochargers enable engine downsizing, where a smaller-displacement engine is equipped with a turbocharger to deliver the power output of a larger engine. This reduces fuel consumption and emissions while maintaining performance. Furthermore, the segment is crucial for enhancing the fuel efficiency of heavy-duty vehicles. As fuel costs remain a significant operational expense for fleet operators, there's a growing focus on adopting turbochargers to reduce fuel consumption.

Vehicle Type Insights

The class 7 to class 8 segment dominated the market with a revenue share of 64.3% in 2022. Stricter emissions regulations are driving the demand for aftermarket emissions control technologies in class 7 to class 8 vehicles. This includes diesel particulate filters (DPFs), selective catalytic reduction (SCR) systems, and exhaust gas recirculation (EGR) components. Moreover, the integration of telematics and fleet management systems is growing in this segment. Fleet operators are using these technologies for vehicle tracking, maintenance scheduling, and route optimization, leading to increased demand for related aftermarket products and services.

The class 4 to class 6 segment is expected to grow at the fastest CAGR from 2023 to 2030. The installation of safety and driver assistance systems such as backup cameras, collision avoidance, and lane departure warning systems is growing in this segment. The aftermarket offers retrofit options for existing vehicles. Moreover, to reduce operating costs, medium-duty vehicle owners are looking for efficiency improvements. Aftermarket products like aerodynamic kits, tire management systems, and engine tunings can deliver fuel savings.

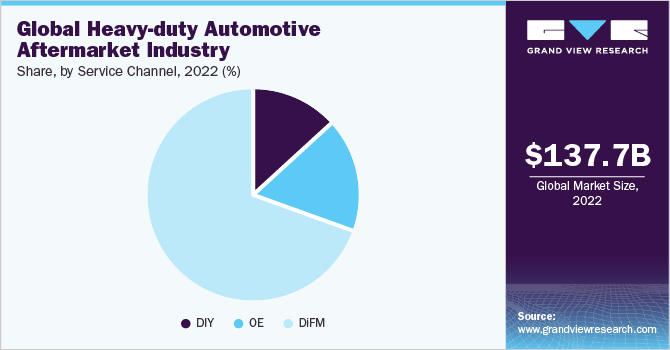

Service Channel Insights

The DiFM segment dominated the market with a revenue share of 69.4% in 2022. The "Do it For Me" (DiFM) segment in the heavy-duty automotive aftermarket is characterized by services and maintenance performed by professional technicians or service providers on behalf of vehicle owners or fleet operators. This segment is essential for those who prefer to outsource vehicle maintenance and repairs rather than doing it themselves. DiFM providers often offer fleet management services that include maintenance scheduling, cost tracking, and compliance management. These services help fleet operators optimize vehicle performance and reduce operational costs.

The Do-It-Yourself (DIY) segment refers to vehicle owners or enthusiasts who perform maintenance, repairs, and customization on their own vehicles without relying on professional mechanics or service providers. While the heavy-duty automotive sector traditionally has a strong professional service component. The availability of online resources, including repair manuals, instructional videos, and automotive forums, has empowered DIYers with the knowledge and confidence to tackle more complex projects.

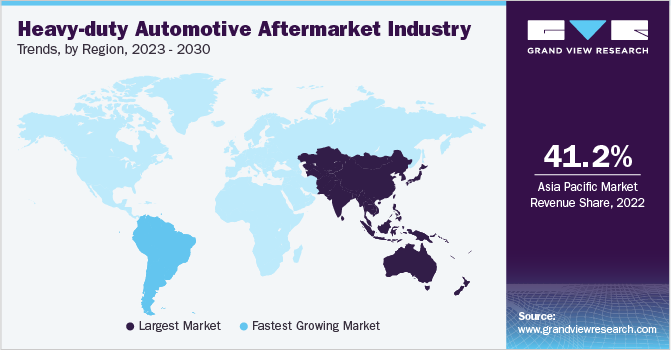

Regional Insights

Asia Pacific region dominated with the largest revenue share of over 41.2% in 2022. This dominance can be attributed to rapid urbanization and infrastructure development, which has led to an increased demand for heavy-duty vehicles such as trucks, buses, and construction equipment in the region. This growth in infrastructure projects has driven the demand for aftermarket parts and services.Moreover, the rise of e-commerce and the growth of logistics and transportation companies in the region have driven the demand for heavy-duty vehicles to transport goods. As these fleets expand, there is a growing need for aftermarket parts and maintenance services.

South America is expected to grow at the fastest CAGR of 12.1% from 2023 to 2030.Economic conditions play a significant role in the heavy-duty automotive aftermarket in South America. Economic stability and growth can lead to increased demand for transportation services, which, in turn, drives the demand for heavy-duty vehicles and their aftermarket parts and services. Furthermore, the need for infrastructure development and maintenance in South America, including road construction and improvements, has historically driven the demand for heavy-duty vehicles and their aftermarket components, such as tires, suspension systems, and engine parts.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players. In January 2023, Dorian Drake International, Inc. and maximatecc announced a strategic alliance to manage and develop sales of specialty gauges for the aftermarkets in Mexico and South Africa. The alliance will focus on the Stewart-Warner and Datcon brands of maximatecc. Some prominent players in the global heavy-duty automotive aftermarket industry include:

-

3M Company

-

ATC Technology Corp

-

Continental AG

-

Denso Corporation

-

Detroit Diesel Corporation

-

Dorian Drake International Inc.

-

Dorman Products

-

Federal-Mogul LLC

-

Instrument Sales & Service, Inc.

-

Remy International Inc.

-

UCI International Inc.

Heavy-duty Automotive Aftermarket Industry Report Scope

Report Attribute

Details

Market size value in 2023

USD 143.66 billion

Revenue forecast in 2030

USD 186.39 billion

Growth rate

CAGR of 3.79% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Market revenue in USD million/billion, and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Replacement parts, vehicle type, service channel, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil

Key companies profiled

3M Company; ATC Technology Corp; Continental AG; Denso Corporation; Detroit Diesel Corporation; Dorian Drake International Inc.; Dorman Products; Federal-Mogul LLC; Instrument Sales & Service, Inc.; Remy International Inc.; UCI International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

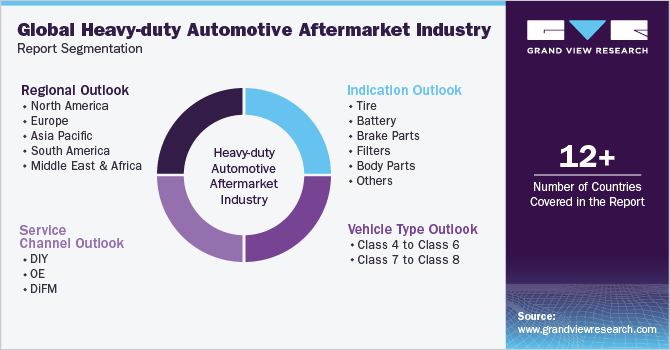

Global Heavy-duty Automotive Aftermarket Industry Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global heavy-duty automotive aftermarket industry report based on replacement parts, vehicle type, service channel, and region:

-

Replacement Parts Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tire

-

Battery

-

Brake Parts

-

Filters

-

Body Parts

-

Lighting & Electronic Components

-

Wheels

-

Exhaust Components

-

Turbochargers

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Class 4 to Class 6

-

Class 7 to Class 8

-

-

Service Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

DIY

-

OE

-

DiFM

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global heavy-duty automotive aftermarket industry size was estimated at USD 137.68 billion in 2022 and is expected to reach USD 143.66 billion in 2023.

b. The global heavy-duty automotive aftermarket industry is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 186.39 billion by 2030.

b. Asia Pacific dominated the heavy-duty automotive aftermarket industry with a share of 41.2% in 2022. This is attributable to initiatives such as one belt one road initiative in China.

b. Some key players operating in the heavy-duty automotive aftermarket industry include 3M Company; ATC Technology Corp; Continental AG; Denso Corporation; Detroit Diesel Corporation; Dorian Drake International Inc.; Dorman Products; and Federal-Mogul LLC.

b. The heavy-duty automotive aftermarket is rapidly changing with innovative technologies such as connected vehicles and hybrid vehicles being introduced in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."