- Home

- »

- Consumer F&B

- »

-

Fruit Snacks Market Size, Share And Growth Report, 2030GVR Report cover

![Fruit Snacks Market Size, Share & Trends Report]()

Fruit Snacks Market Size, Share & Trends Analysis Report By Product (Fruit Roll-ups, Freeze Dried Fruits, Fruit Bars, Soft Chews, Others), By Nature (Conventional, Organic), By Fruit Type, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-071-1

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Fruit Snacks Market Size & Trends

The global fruit snacks market size was valued at USD 14.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. The growth of the market is primarily driven by the prevalent health and wellness trend, with consumers looking for low-calorie snacks. Additionally, the convenience of fruit snacks and their increased availability in grocery stores, convenience stores, and online retailers are also contributing to the market's growth. The market is being driven by the introduction of innovative flavors and products that cater to specific dietary requirements, such as gluten-free, low calories, and vegan options. As a result, the global snacks market is expected to continue advancing in the coming years. Various players operating in the market offer non-GMO, vegan, and allergen-free snacks. SunOpta, Inc.; The Hain Celestial Group, Inc.; and Primal Spirit Foods, Inc. are some of the major players offering such products to consumers across the globe.

With the introduction of newer healthy snacks, brands are targeting children as their primary customers. Many fruit snacks are marketed specifically to this demographic, with colorful packaging and fun shapes and flavors that appeal to younger consumers. More recently, many producers have started incorporating functional fruit snack ingredients, such as probiotics and vitamins, into fruit snacks to appeal to health-conscious consumers. Such factors will assist in market growth.

In 2021, Ferrara re-launched Kellogg's fruit snacks as "Funables". The company's focus is on targeting families who are searching for healthy snack options that also provide a fun and enjoyable experience for kids. By introducing these snacks with healthy ingredients, Ferrara aims to meet the needs of health-conscious parents who want to encourage their children to eat nutritious snacks while also satisfying their taste buds.

The COVID-19 pandemic led to a significant shift in eating habits, with most consumers eating for comfort as much as nutrition. Fruit snack sales increased in many parts of the globe, as stay-at-home consumers were looking for indulgent treats. According to a poll published in a report on Processed Fruit Snacks by Action on Sugar in September 2020, families with kids snacked more frequently. 7 out of 10 families (70%) with children under five years of age reported snacking at home, which was more than twice as often as those with no children.

People are willing to spend more on quality fruit snacks with natural and authentic ingredients. Increased health consciousness, rising demand for organic and natural products, and the convenience of pre-packaged snacks are driving the demand for fruit snacks in countries such as the U.S. Many fruit snacks are marketed specifically to children, with colorful packaging and fun shapes and flavors that appeal to younger consumers.

Consumers are increasingly focusing on their health and wellness. As they become more health conscious, they prefer healthier snacks over traditional snacks such as candies and chips. Consumers seek nutritious and low-calorie snack options, such as fruit snacks, that are free from artificial additives and contain natural ingredients.

Fruit snacks and fruit juices use real fruits and are a good source of minerals and vitamins, making them a popular choice among health-conscious consumers. Additionally, they are a preferred choice among parents looking for healthier foods for their children to take to school or other activities. Moreover, the packaging of fruit snacks in various formats, such as bites, snack bars, and pouches, makes them portable and convenient. Some of the major players offering fruit snacks in forms such as bites and bars include KIND, Sun-Maid, and That’s it.

According to the 2022 Food and Health Survey report published by the International Food Information Council, 52% of participants followed a specific eating pattern or diet. Among these, the popular choices of eating were calorie-counting (13%), mindful eating (14%), and clean eating (16%).

Product Insights

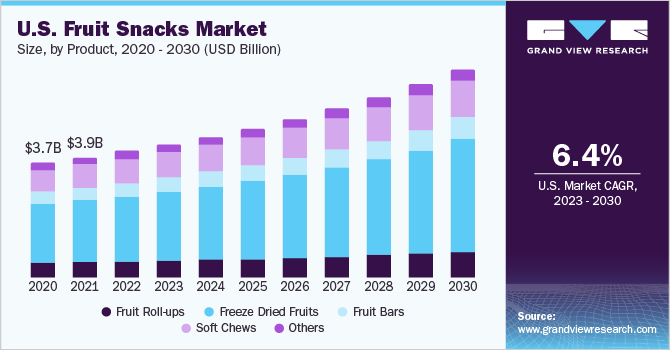

The freeze-dried fruits segment dominated the market and accounted for a revenue share of 52.91% in 2022; additionally, the segment is expected to register the fastest growth rate of 8.0% through the forecast period. Freeze-dried fruit snacks have a higher proportion of fruit exacts compared to roll-ups, bars, and soft chews. Trader Joe’s, Crispy Green, Ocean Spray, Augason Farms, and Mother Earth Products are some of the leading brands in the market.

An article published in MDPI titled ‘Sustainable Approach for Development Dried Snack Based on Actinidia deliciosa Kiwifruit’, published in 2023, compared hot air drying and freeze-drying for improving the shelf life of kiwi fruit. The freeze-dried snack was assessed to be better than its hot-air-dried counterpart. The hot-air-dried snacks were darker in appearance, and better preservation was observed in freeze-dried snacks.

Nature Insights

Conventional fruit snacks accounted for a market share of 87.78% in 2022 and this segment is expected to show a similar trend during the forecast period. Conventional fruit snacks are made with ingredients that may have been treated with synthetic chemicals, pesticides, or fertilizers. They are often more affordable than organic fruit snacks and may be more widely available.

According to research published by the Oral Health Foundation in 2020, the pandemic has changed the eating habits of adults. Staying at home has led to an increase in snacking among 38% of British adults. Additionally, 61% of adults admitted to eating snacks between meals, while 70% of families with kids reported an increase in snacking compared to those without kids.

The organic segment is anticipated to expand at a CAGR of 10.5% during the forecast period. Organic fruit snacks are highly appealing to consumers concerned about the environmental impact of conventional agriculture. The organic fruit snacks market is growing at a faster pace than the conventional market for fruit snacks. Customers are increasingly demanding organic fruit snacks with low to no sugar.

Fruit Type Insights

Berries are expected to be the largest market for fruit snacks by 2030, with the segment holding a market share of 19.6% in 2022. Berries consist of flavors like cranberry, strawberry, blueberry, and mixed berries. Berries often have a sweet or sour taste and are often liked by kids. The demand for apple fruit snacks is projected to grow at a considerable rate of 7.5% during the forecast period. Apple fruit snacks have a longer shelf life than fresh apples.

Dried apple chips have zero water content, which typically lasts up to a year when stored properly in a cool, dry place. Apple fruit snacks are often flavored with cinnamon, honey, or other spices. These are low in calories and fat, an increasingly preferred choice of many consumers. A 1-ounce serving of dried apple fruit snacks contains approximately 100 calories, no fat, and 3 grams of fiber. Many fruit snack brands offer apple-flavored options because of the benefits and delicious taste of the fruit.

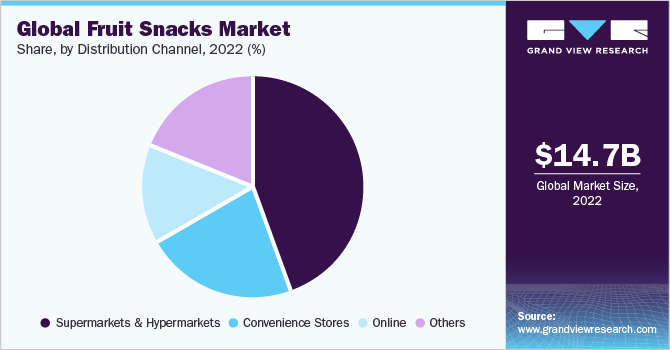

Distribution Channel Insights

The supermarkets & hypermarkets segment held the largest share of 39.23% in 2022. The availability of an in-store associate/expert, assistance on product specifications, and the consumer being able to physically examine the product are some of the factors popularizing the sales of fruit snacks through the retail channel.

Brick-and-mortar stores remain a preferred choice of customers to purchase food and beverage products. Product demand through this distribution channel is expected to remain stable over the forecast period. Research conducted by British Nutrition Foundation reflected that if supermarket trolleys advertise fruits and vegetables, healthy purchases by customers could increase by 12.4%.

The online distribution channel is expected to register the fastest growth rate of 9.3% during the forecast period. The penetration of online distribution channels significantly accelerated after the outbreak of COVID-19. The growth of online channels like Amazon, Target and Costco has significantly improved after the introduction of e-commerce in the market. The availability of a wide variety of options and quick delivery are shaping the online distribution channel.

The growth of the e-commerce industry has contributed to the growth of the fresh fruit market. Online platforms have made it easier for consumers to purchase fresh fruits from different parts of the world and have also enabled farmers to reach a wider customer base. Furthermore, the easy availability of fresh fruits through various chain stores and retail channels such as Walmart, Tesco.com, and others is another factor augmenting market growth.

Regional Insights

The North American region dominated the market for fruit snacks with 35.1% of the revenue share in 2022. Fruit snacks are a popular choice among the younger generation in North America. These snacks are available in various shapes, sizes, and fruit flavors, making them a convenient option for kids. Some fruit snacks are even shaped like popular cartoon characters or animals, which adds to their appeal. These snacks are made with real fruit juices and purees and are often marketed as a healthier alternative to traditional candies.

The UK is the largest market in Europe, holding a revenue share of 17.2% in 2022. The market for fruit snacks in the UK is steadily expanding due to the rising consumer demand for healthier snacking options. The growing consumer interest in health and wellness is one of the main drivers of the UK market for fruit snacks.

For instance, in April 2022, Soul Fruit, a tropical fruit snack brand, launched its new range at Planet Organic, a supermarket chain in the UK. Consumers in France prefer healthy and natural snacking options, which has increased the demand for organic and low-sugar fruit snacks. Germany is expected to expand at a CAGR of 7.7% during the forecast period.

Asia Pacific is projected to expand at a CAGR of 8.3% over the forecast period, owing to the rising regional demand for healthy ingredients in fruit-based products. In China, gummy candy has been considered a snack for children, with Chinese companies focusing on exclusively marketing their fruit-flavored candies and snacks for kids. The country is expected to advance at a CAGR of 9.3% during the forest period.

Moreover, the country has a wide customer base for such products as the demand has risen among the female population. Moreover, Korean fruit-flavored candy has seen an increase in popularity among the Chinese, as consumers are increasingly focusing on the nutritional benefits of the ingredients that are used while processing fruit gummies or freeze-dried fruits. India is another promising economy and held a market share of 18.1% in 2022.

Key Companies & Market Share Insights

The fruit snacks market is characterized by the presence of several well-established players, such as General Mills Inc., Keurig Dr. Pepper Inc., Kellogg Company, Welch's, SunOpta Inc., and Sunkist Growers Inc, USA. These players account for considerable shares in the market for fruit snacks and have a strong presence across the globe. The market for fruit snacks also consists of various small- to mid-sized players who offer a selected range of products and mostly serve regional customers.

Key players operating in the market for fruit snacks are focusing on strategic initiatives such as product launches, acquisitions, sponsorships, collaborations, participation in events, and business expansions to drive revenue growth and reinforce their position in the global market. For example:

-

In February 2023, Fetch, the leading rewards app in the U.S. and a top platform for consumer engagement, partnered with PIM Brands, Inc., producer of Welch’s Fruit Snacks. The partnership will allow PIM Brands to connect with customers of its Welch’s Fruit Snacks, Welch’s Fruit Yogurt Snacks, and Welch’s Juicefuls brands, and gain insights into real-time customer buying behaviors by engaging shoppers through Fetch

-

In October 2022, under its Nutri-Grain brand, the Kellogg Company launched three new flavor mashups, including two new fruit and veggie breakfast bars and bites. The soft-baked breakfast bars are created with flavors of fruits and vegetables and have 8 grams of whole grains. They come in variants like apple & carrot, mixed berry, chocolatey banana, and strawberry & squash

-

In June 2022, General Mills introduced monster-inspired products with unique packaging designed by the American artist KAWS. The company also launched Monsters Mash Halloween Fruit Snacks, with a taste like Monsters cereals. They are made with real apple juice, making them a healthy option for traditional snack foods

-

In April 2022, Sunkist Growers, in partnership with Naturipe Farms and T&G Global's Envy Apples, debuted a ‘Fruitastic’ campaign for the Strawberry Shortcake animated series from WildBrain. Sunkist promoted Blood Oranges with Strawberry Shortcake's friend Orange Blossom

Some of the key players operating in the global fruit snacks market include:

-

General Mills Inc.

-

Mount Franklin Foods

-

Keurig Dr Pepper Inc.

-

Kellogg Company

-

Welch's

-

Seneca Foods Corporation

-

SunOpta Inc.

-

Crispy Green Inc.

-

Sunkist Growers Inc.

-

Chaucer Foods Ltd

Fruit Snacks Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.59 billion

Revenue forecast in 2030

USD 25.67 billion

Growth Rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, fruit type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia & New Zealand; Philippines; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

General Mills Inc.; Mount Franklin Foods; Keurig Dr Pepper Inc.; Kellogg Company; Welch's; Seneca Foods Corporation; SunOpta Inc.; Crispy Green Inc.; Sunkist Growers Inc.; Chaucer Foods Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fruit Snacks Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global fruit snacks market report based on product, nature, fruit type, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fruit Roll-ups

-

Freeze Dried Fruits

-

Fruit Bars

-

Soft Chews

-

Others

-

-

Nature Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional

-

Organic

-

-

Fruit Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Apple

-

Mango

-

Banana

-

Pineapple

-

Berries

-

Mixed

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The growth of the market is primarily driven by the prevalent health and wellness trend, with consumers looking for low-calorie snacks.

b. The global fruit snacks market size was estimated at USD 14.67 billion in 2022 and is expected to reach USD 15.59 billion in 2023.

b. The global fruit snacks market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 25.67 billion by 2030.

b. North America dominated the fruit snacks market with a share of more than 35% in 2022. This is attributable to the rising demand for on-the-go or ready-to-eat foods among the kids segment in the U.S.

b. Some key players operating in the fruit snacks market include General Mills Inc., Mount Franklin Foods, Keurig Dr. Pepper Inc., Kellogg Company, Welch's, Seneca Foods Corporation, SunOpta Inc. and Crispy Green Inc.

b. The Australia & New Zealand fruit snacks market size was estimated at USD 330.4 billion in 2022 and is expected to reach USD 571.6 billion in 2030.

b. China dominated the Asia Pacific fruit snacks market with a share of more than 24% in 2022

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."