Field Programmable Gate Array (FPGA) Market Size, Share & Trends Analysis Report By Type (Low-End, High-End), By Technology (SRAM, Antifuse, Flash), By Application (Military & Aerospace, Telecom), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-133-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

FPGA Market Size & Trends

The global field programmable gate array (FPGA) market size was valued at USD 10.46 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030.The growing trend for the adoption of field programmable gate array in areas of deep packet inspection, network processing, and security is anticipated to drive their demand over the forecast period. The preference for FPGA architecture is on the rise due to its capabilities, such as low power consumption and high compute density. This trend is driven by the increasing demand for efficient data flow and streaming data processing in various applications. For instance, in February 2022, QuickLogic Corporation launched PolarPro 3 to solve the problem of low power FPGA shortages. The product is developed to consume ultra-low power consumption and is ideal for wearables, handheld, and mobile applications. Such product launches by key players are expected to drive the market growth over the forecast period.

Additionally, the rising implementation of FPGAs as an Infrastructure-as-a-Service (IaaS) resource to cloud customers is driving the market growth. Several cloud service providers are deploying field programming gate arrays to enhance their service-oriented tasks such as high-frequency trading, webpage ranking, memory caching, deep learning, network encryption, and video conversion. For instance, Amazon.com, Inc. uses field programmable gate arrays coprocessor in the EC2 F1 virtual machine for customer hardware accelerations as it helps in solving complex engineering, science, and business problems that requires enhanced networking, high bandwidth, and very high compute capabilities. Such type of initiatives by market players are expected to drive the field programmable gate array market during the forecast period.

Furthermore, companies are entering into collaboration and partnerships to enhance their product offering along with increasing their geographical presence in the market. For instance, in December 2022, Quicklogic Corporation, a fabless semiconductor company entered into a partnership agreement with a Taiwan based Yu-Hsin Layout Technology company for an embedded FPGA IP. The aim of the partnership was to provide the company's customers with several critical post-manufacturing flexibility benefits, including the ability to address competitive threats, adapt to new and emerging standards, pursue market adjacencies, and add new features. Such strategies by key players are expected to fuel the market expansion over the forecast period.

The field programmable gate arrays technology is witnessing a notable trend of continuous evolution, driven by factors such as low turnaround time, cost-effectiveness, and lower power consumption compared to application specific integrated circuits (ASICs). FPGAs are gaining popularity due to their inherent flexibility, allowing for post-implementation reconfiguration of circuits. This trend is expected to have a substantial impact in the coming years, as designers can modify their designs even after the product has been deployed in the field, providing enhanced adaptability and responsiveness. This is likely to remain a substantial driver over the forecast period as well.

Moreover, the automotive industry has emerged as a significant driver for stimulating the market demand. Advanced driver assistance system (ADAS) designers prefer FPGAs for vision processing applications that require high-level processing and fine-grained parallelism. Key manufacturers are continuously upgrading their product portfolio to align with the evolving requirements of the automotive industry. For instance, in May 2023, AMD, Inc. launched XA AU10P and XA AU15P in their automotive-qualified product portfolio. These processors are highly optimized for the use in ADAS sensor applications. These types of developments are expected to drive the demand for the field programmable gate array market over the forecast period.

COVID-19 Impact

The global COVID-19 pandemic led to the subsequent lockdown restrictions and temporarily forced manufacturing units and factories to remain shut, affecting the demand and supply-chain worldwide and hampering numerous industries including semiconductor industry. However, the pandemic caused a significant shift towards remote work, online learning, telemedicine, and increased digital activities. This surge in demand for remote communication and data processing created growth opportunities for FPGA-based solutions.

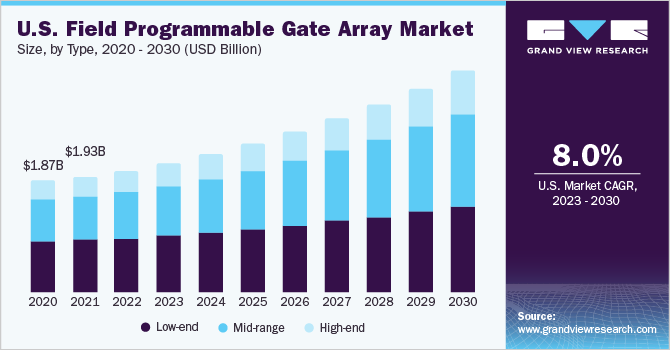

Type Insights

The low-end FPGA segment accounted for the largest market share of over 44% in 2022. This is attributed to their enhanced features, such as high-level security and embedded flash, which are significantly used for system control and management applications in communication, computing, and industrial markets. Furthermore, the low-end FPGAs are capable of enabling more complex board management designs, which is expected to drive the segment growth over the forecast period.

Mid-range FPGAs are expected to register the highest CAGR of 12.5% over the forecast period, owing to the properties offered by the segment such as low power consumption, small form factor, and high performance for FPGA-based devices. In addition, the advantages of the mid-range type segment that are capable of delivering a significant digital signal processing (DSP) along with embedded memory to logic ratio that enhances the intelligence for several applications is anticipated to drive the segment growth.

Application Insights

The telecom sector accounted for the largest revenue share of over 32.0% in 2022 and is expected to continue the same trend over the forecast period. The growing usage of field programmable gate arrays in telecom sector for numerous applications such as optical transport network, data packet processing, and packet switching is augmenting the FPGA market growth. Moreover, FPGAs offer telecom service providers the capability to enhance bandwidth and establish seamless networks that are compatible with a wide range of generations, from 3G to LTE and beyond. These properties are expected to drive the telecom segment growth during the forecast period.

The military and aerospace segment is expected to expand at the fastest CAGR of 12.7% over the forecast period. Emergence of embedded field programmable gate array has particularly favored the aviation and defense industry by offering even better integration, reliability, and low power option over the traditional FPGAs, which is expected to drive the military and aerospace segment growth during the forecast period.

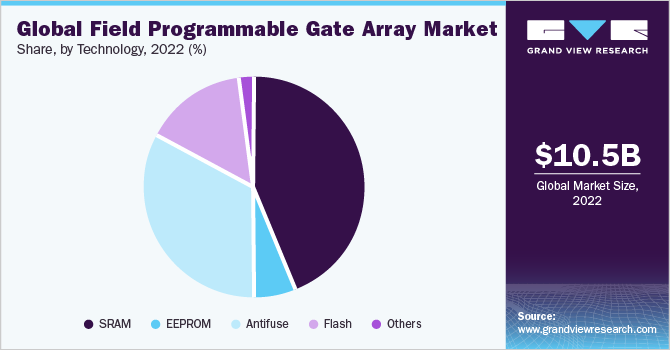

Technology Insights

The Static Random-Access Memory (SRAM) segment accounted for the largest market share of over 44% in 2022. This is attributed to the properties offered by the technology, which include high integration, re-programmability, and better flexibility for various applications. There is a noticeable trend towards the adoption of SRAM-based FPGAs, driven by their ability to deliver high-speed operation. The inherent speed of SRAM cells allows for processing data at high frequencies, enabling real-time processing and high-performance computing. Such beneficial properties are expected to augment the segment growth over the forecast period.

Flash-based FPGAs are expected to register the fastest growth rate of 11.3% over the forecast period. The segment is witnessing high demand as major players upgrade their portfolios of FPGAs to cater to the growing demand from the expanding application base. Additionally, the rising trend favoring flash-based FPGAs over SRAM-based FPGAs due to their lower power consumption is also boosting the segment growth. The utilization of non-volatile flash memory for configuration storage eliminates the need for continuous power, aligning with the industry's emphasis on energy efficiency and power optimization. This power-saving feature is particularly advantageous in battery-powered devices, portable electronics, and energy-constrained applications, which is expected to drive the market growth over the forecast period.

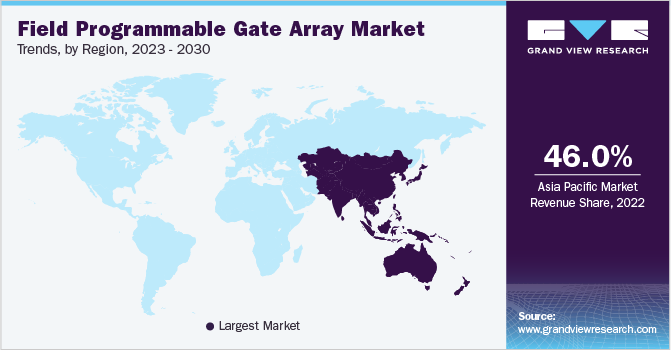

Regional Insights

The Asia Pacific region accounted for the highest revenue share of over 46% in 2022 and is expected to continue its dominance over the forecast period. China accounted for the largest revenue share in the region due to continuous investments and initiatives undertaken by the government to augment the industry growth. For instance, in April 2023, China's southern Guangdong province announced launch of the second phase of semiconductor fund with an investment of over USD 4.3 billion. This investment is expected to help the region to build self-reliance in key technology areas such as semiconductors. Such initiatives are expected to drive the FPGA market in the region.

The North America regional market captured a revenue share of over 23% in 2022. The regional growth of the field programmable gate array market is attributed to the ongoing expansion by key players that are dedicated to the advancement of semiconductor industry. For instance, the U.S. and Canada are planning to create a bilateral semiconductor manufacturing corridor with the help of IBM Company expansion in Canada for the development of semiconductor industry. Such growth initiatives by companies are expected to propel the expansion of the FPGA market across the region.

The South America region is expected to register a significant growth rate of 11.9% over the forecast period. This growth is attributed to the boost in the automobile, industrial, and aerospace sector, where the application of FPGA-based solutions is substantial, especially in Brazil. In addition, the growing demand for connectivity in the region is expected to augment the adoption of advanced telecommunications infrastructure along with the expansion of broadband networks, which is expected to drive the growth of the field programmable gate array market across the region.

Key Companies & Market Share Insights

The market is classified as highly competitive, with the presence of several field programmable gate array market players. The key players operating in the field programmable gate array industry are focusing on strategic alliances, mergers & acquisitions, expansion, and product development to remain competitive in the industry. For instance, in May 2023, Intel Corporation launched their new FPGAs, the Agilex 7 FPGAs with R-Tile. This product from the company is expected to be the first FPGA with CXL and PCIe 5.0 capabilities. Such developments are expected to propel the field programmable gate array market growth over the forecast period. Some of the major players in the global field programmable gate array (FPGA) market:

-

Intel Corporation

-

Xilinx, Inc.

-

Qualcomm Technologies, Inc.

-

NVIDIA Corporation

-

Broadcom

-

AMD, Inc.

-

Quicklogic Corporation

-

Lattice Semiconductor Corporation

-

Achronix Semiconductor Corporation

-

Microchip Technology Inc.

Field Programmable Gate Array (FPGA) Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 11.38 billion |

|

Revenue forecast in 2030 |

USD 23.34 billion |

|

Growth rate |

CAGR of 10.8% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

June 2023 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; South Africa; UAE |

|

Key companies profiled |

Intel Corporation; Xilinx, Inc.; Qualcomm Technologies, Inc.; NVIDIA Corporation; Broadcom; AMD, Inc.; Quicklogic Corporation; Lattice Semiconductor Corporation; Achronix Semiconductor Corporation; Microchip Technology Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Field Programmable Gate Array (FPGA) Market Report Segmentation

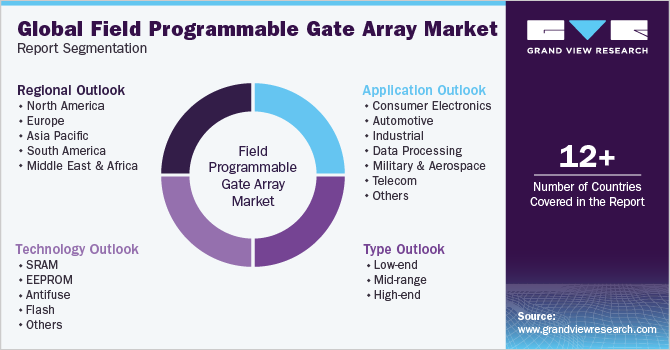

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global field programmable gate array (FPGA) market report on the basis of type, technology, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low-end

-

Mid-range

-

High-end

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

SRAM

-

EEPROM

-

Antifuse

-

Flash

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Data Processing

-

Military & Aerospace

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include efficiency of FPGAs over ASICs, and growing applications in military & aerospace, consumer electronics, and the automotive industry.

b. The global field programmable gate array market size was estimated at USD 10.46 billion in 2022 and is expected to reach USD 11.38 billion in 2023

b. The global field programmable gate array market is expected to grow at a compound annual growth rate of 10.8% from 2023 to 2030 to reach USD 23.34 billion by 2030

b. The SRAM-based segment dominated the industry share of over 44% in 2022 as these are majorly used for programming the routing to interconnect arrays and programming Configurable Logic Blocks (CLBs) used for implementing logic functions.

b. Some key players operating in the field programmable gate array market include Xilinx, Inc., Qualcomm Technologies, Inc., NVIDIA Corporation, Broadcom, and AMD, Inc.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."