Flow Chemistry Market Size, Share & Trends Analysis Report By Application (Pharmaceuticals, Chemicals, Academia & Research, Petrochemicals), By Reactor Type (CSTR, Plug Flow Reactor, Microreactor, Packed-Bed Reactor), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-711-7

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Flow Chemistry Market Size & Trends

The global flow chemistry market size was estimated at USD 1.76 billion in 2023 and is expected to grow at a CAGR of 11.6% from 2024 to 2030. Increasing awareness surrounding sustainable development and the growing pharmaceutical and chemical industries are some of the key driving factors for industry growth. The COVID-19 pandemic resulted in an oil price collapse, leading to a narrowing of feedstock cost advantages for chemical companies. This resulted in decreased demand for reactors in the chemical industry, which generates a major part of the industry's revenue. Moreover, these effects were felt by the petrochemical and pharmaceutical industries, thus negatively impacting the market growth.

The pandemic exposed the pharmaceutical supply chain in the U.S., leading to many companies setting up manufacturing facilities. The U.S. Food and Drug Administration (FDA) is advocating the use of flow chemistry for Active Pharmaceutical Ingredients (APIs) production. This is expected to boost the country's industrial growth.

The use of continuous flow methods in this technology for extraction, chromatography, and reactions with supercritical fluids provides several advantages over the batch process. Moreover, the use of green solvents such as methanol and acetone can be safely carried out in a flow reactor under high pressure and elevated temperatures.

Smaller equipment sizes, decreased waste, lower costs, and faster time to market for new medications are expected to fuel the growth. Increased investment in R&D by reactor manufacturers and end-users is projected to drive the market. Several benefits of flow chemical reactors over batch reactors are expected to augment the industry growth.

The market's competitive landscape is driven by technological innovation for the use of flow chemistry. Companies in the industry are extensively spending on R&D and creating products to optimize the manufacturing procedure and increase the yield to be synthesized. Global demand for fine chemicals and specialized chemicals has driven manufacturers to create partnerships with end-users, which is likely to promote growth.

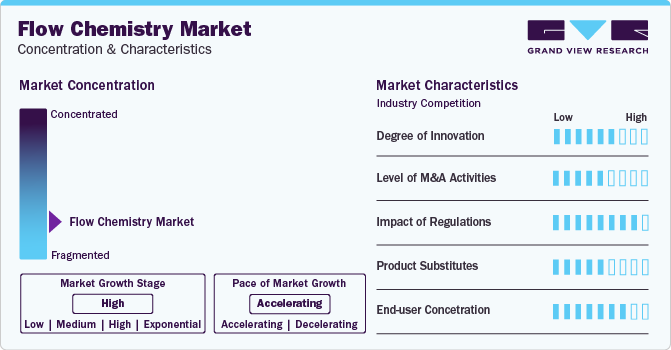

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. The global flow chemistry market is highly competitive owing to the presence of both multinational and local manufacturers. The competitive environment in the market is driven by innovation in technology for the use of flow chemistry. Companies are investing heavily in R&D as well as developing instruments to optimize the production method and improve the yield of the product that is to be synthesized.

Research and new product development are a few of the factors driving the flow chemistry industry’s growth. Companies are tying up with educational institutions along with their in-house R&D facilities to develop processes and technologies that offer a sustainable advantage in the future. New product launches are further creating upswings for the market growth for flow chemistry instruments.

Various rules and regulations govern the manufacturing and distribution of flow chemistry products across the world. Regional and international standards such as ISO and the International Electrotechnical Commission specify the general and safety protocols for the flow chemistry reactors.

The end-user concentration is high in the market for flow chemistry with the presence of industry players from different end-use industries such as chemicals, pharmaceuticals, R&D, and petrochemicals.

The market is characterized by the presence of large multinational companies catering to global demand. Many market players undergo acquisitions to expand their reach in order to increase their market share. For instance, in November 2022, Snapdragon was acquired by Cambrex, which will accelerate the growth of the company in the flow chemistry field.

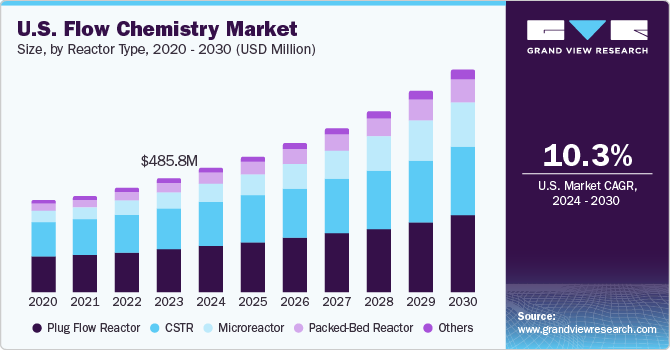

Reactor Type Insights

The continuous stirred tank reactor (CSTR) segment led the market and accounted for over 36.4% share of the global revenue in 2023. Factors responsible for this are high adoption, simple construction, good temperature control, low cost, and adaptability to two-phase runs. Moreover, the increasing use of CSTR in water and wastewater applications is likely to boost industry growth. A plug flow reactor, also known as a tubular reactor, is one of the most commonly used reactors for gas phase reactions. The absence of moving parts, high conversion rate per reactor volume, simple mechanism, and low maintenance lead to a low overall cost of production from these reactors, which is likely to propel their demand.

The microreactor segment is estimated to expand at a lucrative CAGR in terms of revenue over the forecast period. The demand for microreactors in pharmaceutical and fine chemicals due to their low footprint, the requirement of less capital commitment, and the safe processing of highly reactive and hazardous processes is expected to boost industry growth. Microwave-assisted organic synthesis has witnessed significant focus over the past years on account of its fast reaction rate, low byproducts and high yield, high purity of the products, easy scale-up, and ease of use. Microwave-assisted continuous reactors have been utilized mainly for academic and laboratory applications due to size limitations.

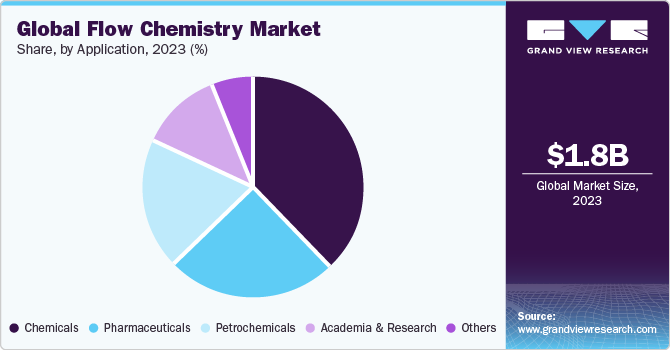

Application Insights

The chemicals segment led the market in terms of revenue share in 2023 on account of the increased use of environmentally friendly technologies such as flow chemistry in order to reduce greenhouse emissions. Moreover, an increase in demand for specialty chemicals from the automotive industry is expected to positively impact the industry's growth. Numerous companies in the pharmaceutical industry have been trying to maintain collaboration between the industry and academic sectors. Academia & research are likely to introduce new methodologies for manufacturing chemicals and APIs, which is expected to augment the demand for reactors in this segment over the forecast period.

The pharmaceuticals application segment is expected to expand at a significant CAGR over the forecast period. Factors such as increasing demand for the optimization of drug development and demand to reduce the time taken for drug launch are expected to boost the demand for this equipment in pharmaceutical applications.

Regional Insights

The strong presence of key players in North America and well-established companies in the end-user landscape is expected to have a positive impact on the growth of the market. The increase in chemical and pharmaceutical production and a rise in investments in research and development in flow chemistry, especially in continuous processes, are some of the key factors fueling the industry growth in the region.

U.S. Flow Chemistry Market Trends

The U.S. flow chemistry market accounts for the largest revenue share of more than 75% in North America in 2023. The U.S. is increasing its domestic production and manufacturing capacities, which is expected to drive the demand for the flow chemistry products over the forecast period.

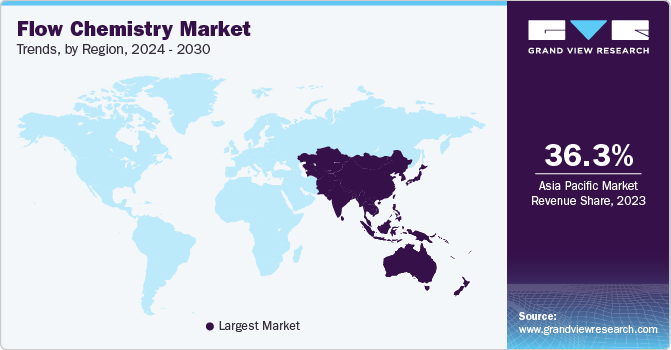

Asia Pacific Flow Chemistry Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of more than 36.3% in 2023, which is significantly attributed to well-established manufacturing sectors such as chemicals, pharmaceuticals, petrochemicals, etc. An increase in government expenditure on pharmaceutical production due to an increase in demand for generic drugs, coupled with the promising outlook for the chemical and petrochemical industries, is likely to augment industry growth in the region.

The China flow chemistry market held the largest share of 48.1% in Asia Pacific in 2023, mainly attributed to well-established chemicals, pharmaceutical production facilities, and research laboratories. China is actively investing in expanding its manufacturing capacities across various verticals to strengthen its position in global trade.

The flow chemistry market in India is poised to witness thefastest growth in the region over the forecast period. This is attributed to various government tax breaks and financial support for small businesses in the manufacturing sector.

Europe Flow Chemistry Market Trends

The flow chemistry market in Europe is anticipated to grow at a lucrative CAGR from 2024 to 2030. The European Commission is introducing various expansion strategies, such as funding support in the chemical industry, which are anticipated to drive market growth. In February 2024, the European Commission introduced guidance on funding for supporting the chemical industry through the Transition Pathway of the Chemical Industry.

The Germany flow chemistry market held the largest share of over 33.3% in Europe in 2023. Germany continues to hold the largest share in industrial manufacturing and research & laboratory activities. In 2022, according to the European Commission, total R&D expenditure by Germany reached USD 130.88 billion, increasing from USD 121.75 billion in 2021.

The flow chemistry market in the UK is expected to grow positively during the forecast period with companies' increasing industrial activities and expansion strategies. For instance, in July 2023, a new project was introduced in the UK by Mitsubishi Chemical Group for the SoarnoL ethylene vinyl alcohol copolymer (EVOH) facility.

Central and South America Flow Chemistry Market Trends

The flow chemistry market in Central and South America is anticipated to witness promising opportunities over the forecast period with the increasing FDIs and government support. The pharmaceutical industry is poised to show lucrative growth prospects with the changing landscape in the regional healthcare industry.

The Brazil flow chemistry market held the largest share of over 40% in 2023 in Central and South America, owing to the flourishing industrial sector and new investments. For instance, in November 2023, Petrobras introduced plans to invest USD 102.0 billion in the country’s fertilizer and renewable energy.

Middle East & Africa Flow Chemistry Market

The flow chemistry market in the Middle East and Africa is expected to register significant growth over the forecast period. The increasing establishment of the diverse industrial and manufacturing sectors in the region is likely to drive the demand for flow chemistry over the forecast period. For instance, in July 2023, Iraq announced plans to launch the Nibras project, consisting of the production of the largest petrochemical plant in the region in a joint venture with Royal Dutch Shell.

The Saudi Arabia flow chemistry market held the largest revenue share of over 34.0% in 2023. The country is planning to invest in non-oil industries in order to diversify its economic landscape. In July 2023, an investment of around USD 8.4 billion was announced in a new green hydrogen plant.

Key Flow Chemistry Company Insights

The global market includes large-scale reactors and microreactor flow chemistry manufacturers. Key players focus on inorganic growth strategies, such as joint ventures and mergers and acquisitions, to sustain the competition and capture a larger market share. Moreover, they maintain their competitive position in this market by offering superior distribution channels and enhanced services.

Key Flow Chemistry Companies:

The following are the leading companies in the flow chemistry market. These companies collectively hold the largest market share and dictate industry trends.

- Am Technology

- Asahi Glassplant Inc.

- METTLER TOLEDO

- Vapourtec Ltd.

- ThalesNano Inc.

- H.E.L. Group

- Uniqsis Ltd.

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

- Parr Instrument Company

- Amar Equipment Pvt. Ltd.

- FABEX ENGINEERING PVT. LTD.

- Dalton Pharma Services

Recent Developments

-

In December 2023, AGI Group acquired Chemtrix B.V. This acquisition of Chemtrix B.V. is anticipated to scale up AGI Group's capabilities in the flow chemistry market for application in the pilot as well as the manufacturing field.

-

In July 2023, H.E.L Group announced a collaboration with IIT Kanpur to leverage sustainable energy driven by the institute. The objective of this initiative was to create new testing labs for conducting research in new chemistry development, battery storage, and thermal characteristics study.

Flow Chemistry Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.94 billion |

|

Revenue forecast in 2030 |

USD 3.75 billion |

|

Growth rate |

CAGR of 11.6% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

April 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Reactor type, application, region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Russia; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE |

|

Key companies profiled |

Am Technology; Asahi Glassplant Inc.; METTLER TOLEDO; Vapourtec Ltd.; ThalesNano Inc.; H.E.L. Group; Uniqsis Ltd.; Ehrfeld Mikrotechnik BTS; Future Chemistry Holding BV; Corning Incorporated; Parr Instrument Company; Amar Equipment Pvt. Ltd.; FABEX ENGINEERING PVT. LTD.; Dalton Pharma Services |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flow Chemistry Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow chemistry market report based on reactor type, application, and region:

-

Reactor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CSTR

-

Plug Flow Reactor

-

Microreactor

-

Packed-Bed Reactor

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Chemicals

-

Academia & Research

-

Petrochemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flow chemistry market size was estimated at USD 1.76 billion in 2023 and is expected to be USD 1.94 billion in 2024.

b. The global flow chemistry market, in terms of revenue, is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 3.75 billion by 2030.

b. Asia Pacific dominated the flow chemistry market with a revenue share of 35.6 in 2023. The rising manufacturing sector & industrialization is facilitating the demand for the flow chemistry in chemical and pharmaceutical industry.

b. Some of the key players operating in the flow chemistry market include Am Technology Asahi Glassplant Inc., METTLER TOLEDO, Vapourtec Ltd., ThalesNano Inc., H.E.L. Group, Uniqsis Ltd., Ehrfeld Mikrotechnik BTS, Future Chemistry Holding BV, Corning Incorporated, Parr Instrument Company, Amar Equipment Pvt. Ltd., FABEX ENGINEERING PVT. LTD., Dalton Pharma Services.

b. The key factors that are driving the flow chemistry market include the rising demand for pharmaceuticals, increasing industrial expansion, and technological advancements in the new instruments.

Table of Contents

Chapter 1. Flow Chemistry Market: Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumption

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Flow Chemistry Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Flow Chemistry Market: Variables, Trends & Scope

3.1. Market Segmentation & Scope

3.2. Penetration & Growth Prospect Mapping

3.3. Value Chain Analysis

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market driver analysis

3.5.2. Market restraints analysis

3.5.3. Industry challenges

3.6. Porter’s Five Forces Model

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Threat of Substitutes

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Environmental Landscape

3.7.3. Social Landscape

3.7.4. Technology Landscape

3.7.5. Economic Landscape

3.7.6. Legal Landscape

3.8. COVID-19: Impact Analysis

Chapter 4. Flow Chemistry Market: Reactor Type Estimates & Trend Analysis

4.1. Reactor Type Movement Analysis & Market Share, 2023 & 2030

4.2. Flow Chemistry Market Estimates & Forecast, By Reactor Type, 2018 to 2030 (USD Million)

4.3. CSTR

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Plug Flow Reactor

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.5. Microreactor

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.6. Packed-Bed Reactor

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Flow Chemistry Market: Application Estimates & Trend Analysis

5.1. Application Movement Analysis & Market Share, 2023 & 2030

5.2. Flow Chemistry Market Estimates & Forecast, By Application, 2018 to 2030 (USD Million)

5.3. Pharmaceuticals

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.4. Chemicals

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.5. Academia & Research

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.6. Petrochemicals

5.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.7. Others

5.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. Flow Chemistry Market: Regional Estimates & Trend Analysis

6.1. Regional Movement Analysis & Market Share, 2023 & 2030

6.2. North America

6.2.1. North America Flow Chemistry Market Estimates & Forecast, 2018 - 2030 (USD Million)

6.2.2. North America Flow Chemistry Market Estimates & Forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.2.3. North America Flow Chemistry Market Estimates & Forecast, By Application, 2018 - 2030 (USD Million)

6.2.4. U.S.

6.2.4.1. Key country dynamics

6.2.4.2. U.S. flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.2.4.3. U.S. flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.2.4.4. U.S. flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.2.5. Canada

6.2.5.1. Key country dynamics

6.2.5.2. Canada flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.2.5.3. Canada flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.2.5.4. Canada flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.2.6. Mexico

6.2.6.1. Key country dynamics

6.2.6.2. Mexico flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.2.6.3. Mexico flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.2.6.4. Mexico flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.3. Europe

6.3.1. Europe Flow Chemistry Market Estimates & Forecast, 2018 - 2030 (USD Million)

6.3.2. Europe Flow Chemistry Market Estimates & Forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.3.3. Europe Flow Chemistry Market Estimates & Forecast, By Application, 2018 - 2030 (USD Million)

6.3.4. UK

6.3.4.1. Key country dynamics

6.3.4.2. UK flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.3.4.3. UK flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.3.4.4. UK flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.3.5. Germany

6.3.5.1. Key country dynamics

6.3.5.2. Germany flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.3.5.3. Germany flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.3.5.4. Germany flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.3.6. France

6.3.6.1. Key country dynamics

6.3.6.2. France flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.3.6.3. France flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.3.6.4. France flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.3.7. Russia

6.3.7.1. Key country dynamics

6.3.7.2. Russia flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.3.7.3. Russia flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.3.7.4. Russia flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.3.8. Italy

6.3.8.1. Key country dynamics

6.3.8.2. Italy flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.3.8.3. Italy flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.3.8.4. Italy flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Flow Chemistry Market Estimates & Forecast, 2018 - 2030 (USD Million)

6.4.2. Asia Pacific Flow Chemistry Market Estimates & Forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.4.3. Asia Pacific Flow Chemistry Market Estimates & Forecast, By Application, 2018 - 2030 (USD Million)

6.4.4. China

6.4.4.1. Key country dynamics

6.4.4.2. China flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.4.4.3. China flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.4.4.4. China flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.4.5. India

6.4.5.1. Key country dynamics

6.4.5.2. India flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.4.5.3. India flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.4.5.4. India flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.4.6. Japan

6.4.6.1. Key country dynamics

6.4.6.2. Japan flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.4.6.3. Japan flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.4.6.4. Japan flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.4.7. South Korea

6.4.7.1. Key country dynamics

6.4.7.2. South Korea flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.4.7.3. South Korea flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.4.7.4. South Korea flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.4.8. Australia

6.4.8.1. Key country dynamics

6.4.8.2. Australia flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.4.8.3. Australia flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.4.8.4. Australia flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.5. Central & South America

6.5.1. Central & South America Flow Chemistry Market Estimates & Forecast, 2018 - 2030 (USD Million)

6.5.2. Central & South America Flow Chemistry Market Estimates & Forecast, By Technology, 2018 - 2030 (USD Million)

6.5.3. Central & South America Flow Chemistry Market Estimates & Forecast, By Application, 2018 - 2030 (USD Million)

6.5.4. Brazil

6.5.4.1. Key country dynamics

6.5.4.2. Brazil flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.5.4.3. Brazil flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.5.4.4. Brazil flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.5.5. Argentina

6.5.5.1. Key country dynamics

6.5.5.2. Argentina flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.5.5.3. Argentina flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.5.5.4. Argentina flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.6. Middle East & Africa

6.6.1. Middle East & Africa Flow Chemistry Market Estimates & Forecast, 2018 - 2030 (USD Million)

6.6.2. Middle East & Africa Flow Chemistry Market Estimates & Forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.6.3. Middle East & Africa Flow Chemistry Market Estimates & Forecast, By Application, 2018 - 2030 (USD Million)

6.6.4. Saudi Arabia

6.6.4.1. Key country dynamics

6.6.4.2. Saudi Arabia flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.6.4.3. Saudi Arabia flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.6.4.4. Saudi Arabia flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

6.6.5. UAE

6.6.5.1. Key country dynamics

6.6.5.2. UAE flow chemistry market estimates & forecast, 2018 - 2030 (USD Million)

6.6.5.3. UAE flow chemistry market estimates & forecast, By Reactor Type, 2018 - 2030 (USD Million)

6.6.5.4. UAE flow chemistry market estimates & forecast, By Application, 2018 - 2030 (USD Million)

Chapter 7. Flow Chemistry Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Vendor Landscape

7.3. Company Categorization

7.4. Company Market Share Analysis, 2023

7.5. Company Market Positioning

7.6. Competitive Dashboard Analysis

7.7. Company Heat Map Analysis, 2023

7.8. Strategy Mapping

7.8.1. Expansion

7.8.2. Mergers & Acquisition

7.8.3. Partnerships & Collaborations

7.8.4. New Product Launches

7.8.5. Research And Development

7.9. Company Profiles

7.9.1. Am Technology

7.9.1.1. Participant’s overview

7.9.1.2. Financial performance

7.9.1.3. Product benchmarking

7.9.1.4. Recent developments

7.9.2. Asahi Glassplant Inc.

7.9.2.1. Participant’s overview

7.9.2.2. Financial performance

7.9.2.3. Product benchmarking

7.9.2.4. Recent developments

7.9.3. METTLER TOLEDO

7.9.3.1. Participant’s overview

7.9.3.2. Financial performance

7.9.3.3. Product benchmarking

7.9.3.4. Recent developments

7.9.4. Vapourtec Ltd.

7.9.4.1. Participant’s overview

7.9.4.2. Financial performance

7.9.4.3. Product benchmarking

7.9.4.4. Recent developments

7.9.5. ThalesNano Inc.

7.9.5.1. Participant’s overview

7.9.5.2. Financial performance

7.9.5.3. Product benchmarking

7.9.5.4. Recent developments

7.9.6. H.E.L. Group

7.9.6.1. Participant’s overview

7.9.6.2. Financial performance

7.9.6.3. Product benchmarking

7.9.6.4. Recent developments

7.9.7. Uniqsis Ltd.

7.9.7.1. Participant’s overview

7.9.7.2. Financial performance

7.9.7.3. Product benchmarking

7.9.7.4. Recent developments

7.9.8. Ehrfeld Mikrotechnik BTS

7.9.8.1. Participant’s overview

7.9.8.2. Financial performance

7.9.8.3. Product benchmarking

7.9.8.4. Recent developments

7.9.9. Future Chemistry Holding BV

7.9.9.1. Participant’s overview

7.9.9.2. Financial performance

7.9.9.3. Product benchmarking

7.9.9.4. Recent developments

7.9.10. Corning Incorporated

7.9.10.1. Participant’s overview

7.9.10.2. Financial performance

7.9.10.3. Product benchmarking

7.9.10.4. Recent developments

7.9.11. Parr Instrument Company

7.9.11.1. Participant’s overview

7.9.11.2. Financial performance

7.9.11.3. Product benchmarking

7.9.11.4. Recent developments

7.9.12. Amar Equipment Pvt. Ltd.

7.9.12.1. Participant’s overview

7.9.12.2. Financial performance

7.9.12.3. Product benchmarking

7.9.12.4. Recent developments

7.9.13. FABEX ENGINEERING PVT. LTD.

7.9.13.1. Participant’s overview

7.9.13.2. Financial performance

7.9.13.3. Product benchmarking

7.9.13.4. Recent developments

7.9.14. Dalton Pharma Services

7.9.14.1. Participant’s overview

7.9.14.2. Financial performance

7.9.14.3. Product benchmarking

7.9.14.4. Recent developments

List of Tables

Table 1 Flow chemistry market 2018 - 2030 (USD Million)

Table 2 Flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 3 CSTR flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 4 Plug flow reactor flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 5 Microreactor flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 6 Packed-bed reactor flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 7 Others flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 8 Flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 9 Pharmaceuticals flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 10 Chemicals flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 11 Academia & research flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 12 Petrochemicals flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 13 Others flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 14 North America flow chemistry market estimates and forecasts, 2018 - 2030, (USD Million)

Table 15 North America flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 16 North America flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 17 U.S. Macroeconomic Outlook

Table 18 U.S. flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 19 U.S. flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 20 U.S. flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 21 Canada Macroeconomic Outlook

Table 22 Canada flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 23 Canada flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 24 Canada flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 25 Mexico Macroeconomic Outlook

Table 26 Mexico flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 27 Mexico flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 28 Mexico flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 29 Europe flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 30 Europe flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 31 Europe flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 32 UK Macroeconomic Outlook

Table 33 UK flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 34 UK flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 35 UK flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 36 Germany Macroeconomic Outlook

Table 37 Germany flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 38 Germany flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 39 Germany flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 40 France Macroeconomic Outlook

Table 41 France flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 42 France flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 43 France flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 44 Russia Macroeconomic Outlook

Table 45 Russia flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 46 Russia flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 47 Russia flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 48 Italy Macroeconomic Outlook

Table 49 Italy flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 50 Italy flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 51 Italy flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 52 Asia Pacific flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 53 Asia Pacific flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 54 Asia Pacific flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 55 China Macroeconomic Outlook

Table 56 China flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 57 China flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 58 China flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 59 India Macroeconomic Outlook

Table 60 India flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 61 India flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 62 India flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 63 Japan Macroeconomic Outlook

Table 64 Japan flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 65 Japan flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 66 Japan flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 67 India Macroeconomic Outlook

Table 68 India flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 69 India flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 70 India flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 71 South Korea flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 72 South Korea flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 73 Australia flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 74 Australia flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 75 Central & South America flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 76 Central & South America flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 77 Central & South America flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 78 Brazil Macroeconomic Outlook

Table 79 Brazil flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 80 Brazil flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 81 Brazil flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 82 Argentina Macroeconomic Outlook

Table 83 Argentina flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 84 Argentina flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 85 Argentina flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 86 Middle East & Africa flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 87 Middle East & Africa flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 88 Middle East & Africa flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 90 Saudi Arabia flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 91 UAE Macroeconomic Outlook

Table 92 UAE flow chemistry market estimates and forecasts, 2018 - 2030 (USD Million)

Table 93 UAE flow chemistry market estimates and forecasts, by reactor type, 2018 - 2030 (USD Million)

Table 94 UAE flow chemistry market estimates and forecasts, by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 QFD modeling for market share assessment

Fig. 6 Information Procurement

Fig. 7 Market Formulation and Validation

Fig. 8 Data Validating & Publishing

Fig. 9 Market Segmentation & Scope

Fig. 10 Flow Chemistry Market Snapshot

Fig. 11 Reactor Type Segment Snapshot

Fig. 12 Application Segment Snapshot

Fig. 13 Competitive Landscape Snapshot

Fig. 14 Flow Chemistry Market Value, 2023 (USD Million)

Fig. 15 Flow Chemistry Market - Value Chain Analysis

Fig. 16 Flow Chemistry Market - Market Dynamics

Fig. 17 Flow Chemistry Market - PORTER’s Analysis

Fig. 18 Flow Chemistry Market - PESTEL Analysis

Fig. 19 Flow Chemistry Market Estimates & Forecasts, By Reactor Type: Key Takeaways

Fig. 20 Flow Chemistry Market Share, By Reactor Type, 2023 & 2030

Fig. 21 CSTR Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 22 Plug Flow Reactor Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 23 Microreactor Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 24 Packed-Bed Reactor Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 25 Other Reactors Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 26 Flow Chemistry Market Estimates & Forecasts, By Application: Key Takeaways

Fig. 27 Flow Chemistry Market Share, By Application, 2023 & 2030

Fig. 28 Flow Chemistry Market Estimates & Forecasts, in Pharmaceuticals, 2018 - 2030 (USD Million)

Fig. 29 Flow Chemistry Market Estimates & Forecasts, in Chemicals, 2018 - 2030 (USD Million)

Fig. 30 Flow Chemistry Market Estimates & Forecasts, in Academia & Research, 2018 - 2030 (USD Million)

Fig. 31 Flow Chemistry Market Estimates & Forecasts, in Petrochemicals, 2018 - 2030 (USD Million)

Fig. 32 Flow Chemistry Market Estimates & Forecasts, in Other Applications, 2018 - 2030 (USD Million)

Fig. 33 North America Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 34 North America Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 35 North America Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 36 U.S. Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 37 U.S. Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 38 U.S. Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 39 Canada Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 40 Canada Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 41 Canada Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 42 Mexico Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 43 Mexico Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 44 Mexico Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 45 Europe Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 46 Europe Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 47 Europe Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 48 UK Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 49 UK Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 50 UK Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 51 Germany Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 52 Germany Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 53 Germany Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 54 France Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 55 France Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 56 France Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 57 Russia Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 58 Russia Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 59 Russia Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 60 Italy Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 61 Italy Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 62 Italy Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 63 Asia Pacific Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 64 Asia Pacific Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 65 Asia Pacific Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 66 China Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 67 China Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 68 China Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 69 India Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 70 India Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 71 India Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 72 Japan Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 73 Japan Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 74 Japan Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 75 South Korea Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 76 South Korea Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 77 South Korea Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 78 Australia Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 79 Australia Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 80 Australia Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 81 Central & South America Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 82 Central & South America Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 83 Central & South America Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 84 Brazil Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 85 Brazil Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 86 Brazil Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 87 Argentina Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 88 Argentina Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 89 Argentina Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 90 Middle East & Africa Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 91 Middle East & Africa Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 92 Middle East & Africa Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 93 Saudi Arabia Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 94 Saudi Arabia Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 95 Saudi Arabia Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 96 UAE Flow Chemistry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 97 UAE Flow Chemistry Market Estimates & Forecasts, By Reactor Type, 2018 - 2030 (USD Million)

Fig. 98 UAE Flow Chemistry Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 99 Key Company Categorization

Fig. 100 Company Market Positioning

Fig. 101 Key Company Market Share Analysis, 2023

Fig. 102 Strategy Mapping

Market Segmentation

- Flow Chemistry Reactor Type Outlook (Revenue, USD Million, 2018 - 2030)

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Flow Chemistry Application Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Flow Chemistry Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- North America Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- U.S.

- U.S. Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- U.S. Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- U.S. Flow Chemistry Market, By Reactor Type

- Canada

- Canada Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Canada Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Canada Flow Chemistry Market, By Reactor Type

- Mexico

- Mexico Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Mexico Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Mexico Flow Chemistry Market, By Reactor Type

- North America Flow Chemistry Market, By Reactor Type

- Europe

- Europe Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Europe Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- UK

- UK Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- UK Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- UK Flow Chemistry Market, By Reactor Type

- Germany

- Germany Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Germany Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Germany Flow Chemistry Market, By Reactor Type

- France

- France Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- France Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- France Flow Chemistry Market, By Reactor Type

- Russia

- Russia Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Russia Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Russia Flow Chemistry Market, By Reactor Type

- Italy

- Italy Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Italy Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Italy Flow Chemistry Market, By Reactor Type

- Europe Flow Chemistry Market, By Reactor Type

- Asia Pacific

- Asia Pacific Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Asia Pacific Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- China

- China Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- China Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- China Flow Chemistry Market, By Reactor Type

- India

- India Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- India Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- India Flow Chemistry Market, By Reactor Type

- Japan

- Japan Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Japan Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Japan Flow Chemistry Market, By Reactor Type

- South Korea

- South Korea Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- South Korea Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- South Korea Flow Chemistry Market, By Reactor Type

- Australia

- Australia Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Australia Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Australia Flow Chemistry Market, By Reactor Type

- Asia Pacific Flow Chemistry Market, By Reactor Type

- Central & South America

- Central & South America Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Central & South America Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Brazil

- Brazil Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Brazil Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Brazil Flow Chemistry Market, By Reactor Type

- Argentina

- Argentina Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Argentina Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Argentina Flow Chemistry Market, By Reactor Type

- Central & South America Flow Chemistry Market, By Reactor Type

- Middle East & Africa

- Middle East & Africa Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Middle East & Africa Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Saudi Arabia

- Saudi Arabia Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- Saudi Arabia Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- Saudi Arabia Flow Chemistry Market, By Reactor Type

- UAE

- UAE Flow Chemistry Market, By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Packed-Bed Reactor

- Other

- UAE Flow Chemistry Market, By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

- UAE Flow Chemistry Market, By Reactor Type

- Middle East & Africa Flow Chemistry Market, By Reactor Type

- North America

Flow Chemistry Market Dynamics

Driver: Rapid Growth In The Pharmaceutical Industry

The pharmaceutical industry is principally driven by the advancement in the field of bioscience and medicine. Growing health awareness among consumers in Asia Pacific, especially in developing countries such as India and China, along with growing disposable income is anticipated the drive market growth. Furthermore, the U.S., U.K., and Europe together dominated the pharmaceutical industry. According to the United Nations, the global population is anticipated to be increasing by 1.24% per year until 2030. Moreover, the proportion of people aged between 65 and 80 will rise to 28%, compared to 22% in 2000. In addition, continuous development of a new continuous flow facility typically require four times less capital expenditure in comparison to that on a batch facility. These factors are anticipated to boost market growth over the forecast period.

Driver: Growing Chemical Industry In Asia Pacific To Drive Market Growth

Major Key players in the chemical industry are endlessly engaged in intensifying production facilities to meet the need for chemicals across various applications. Huge demand for chemicals in among end-use is predicted to drive market growth.The major factors encouraging the growth of the chemical industry in various economies across the globe include supportive government initiatives and investments, stringent environmental regulations, high fragmentation in the industry, and growing importance of specialty chemicals

Restraint: Requirement For High R&D Investment And Capital Cost

The flow chemistry reactors has high efficiency, safety, and ability to scale up the chemical production process, which creates a huge demand among consumers. However, high investment and significant R&D costs is anticipated to hamper market growth. In addition, the high prices of glass and metal micro reactors is projected to restrain growth over the next few years.

What Does This Report Include?

This section will provide insights into the contents included in this flow chemistry market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Flow chemistry market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Flow chemistry market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the flow chemistry market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for flow chemistry market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of flow chemistry market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Flow Chemistry Market Categorization:

The flow chemistry market was categorized into three segments, namely application (Pharmaceuticals, Chemicals, Academia & Research, Petrochemicals), reactor type (CSTR (Continuous stirred-tank reactor), Plug Flow Reactor, Microreactor, Microwave Systems) and region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The flow chemistry market was segmented into application, reactor type and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The flow chemistry market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into seventeen countries, namely, the U.S., Canada, Mexico, Germany, the UK, France, Russia, Italy, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Flow chemistry market companies & financials:

The flow chemistry market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Biotage - Biotage was established in 1989 and is headquartered in Uppsala, Sweden.The company offers flow chemistry products through an organic workflow product line, namely Biotage Initiator+, Biotage Initator+ Microwave System with Robot Eight, and Biotage Initator+ Microwave System with Robot Sixty.It offers various products including, scale-up purification, sample preparation, plasmid purification, protein purification, scavengers & reagents, and organic workflow, peptide workflow accessories & spare parts.

-

Corning Incorporated – Corning Incorporated was established in 1853, and is headquartered in New York, U.S. The company operates in diversified business segments including display technologies, environmental technologies, optical communications, life sciences, and specialty materials.The company has expertise in material science domain; including ceramics science; optical physics; glass science; including engineering capabilities; and deep manufacturing. It serves numerous industries including aerospace & defense, architecture & design, automotive, display technology, mobile consumer electronics, optical communications, life sciences, and optics.

-

Lonza – Lonza operates through two business segments, namely Specialty Ingredients and Pharma & Biotech. The company was incorporated in 1897 and is headquartered in Basel, Switzerland. The company is involved in the manufacturing of diversified product lines including bioresearch, water treatment, consumer health, agro ingredients, pharma & biotech, and coatings & composites. The company has more than 50 manufacturing and R&D facilities and operates through more than 100 sites and offices globally.It also has ventured into custom manufacturing products for numerous applications including development technologies, biological manufacturing, and small molecule technologies.

-

Ehrfeld Mikrotechnik - Ehrfeld Mikrotechnik was incorporated in 2000 and is headquartered in Wendelsheim, Germany. The company is certified with ISO 9001:2008 standard. The company is a leading supplier of products in microreaction technology. Ehrfeld Mikrotechnik serves diversified industries such as pharmaceutical, specialty & fine chemical, petrochemical & polymer chemistry, and food & consumer goods. It operates through various sales partners including HiTec Zang GmbH and Ehrfeld Mikrotechnik GmbH in Germany, IMCD Italia SpA in Italy, Microspin MRT GmbH in Russia, Ehrfeld Chemical Technology Co Ltd. in China, Buchiglas India Pvt. Ltd. in India, and DKSH Japan K.K in Japan. The company has also collaborated with various partners in research and industrial sectors.

-

CEM Corporation - The company has its offices in England, Germany, Japan, France, Italy, Singapore, and Ireland. CEM Corporation was established in 1973 and is headquartered in Charlotte, U.S. CEM serves diversified applications including microwave digestion, solvent extraction, moisture and solids analysis, fat analysis, protein analysis, ash analysis, peptide synthesis, organic synthesis, inorganic synthesis, and microwave synthesis.

-

Syrris Ltd - Syrris Ltd was incorporated in 2001 and is headquartered in Royston, Hertfordshire, UK. Syrris operates through four product types, namely batch reactor systems, scale-up systems, flow reactor systems, and reaction calorimeters. The pharmaceutical company develops innovative and high-quality products for the research and development of chemical engineers and chemists. The company serves various applications, including flow chemistry, flow chemistry reactions, crystallization, sonocrystallization, nanoparticle synthesis, polymerization, drug discovery and development, electrochemistry in flow, synthesis and analysis in flow chemistry, medicinal, reaction calorimetry, carbon capture, and process chemistry.

-

Vapourtec Ltd. - Vapourtec Ltd. was incorporated in 2003 with its headquarters in Bury St Edmunds, UK. The company has its development and manufacturing facilities in the UK and operates through sales and service offices that are based in the UK, the U.S., Canada, and other regions.The company is a technology company that develops and manufactures flow chemistry systems. It offers chemical-based laboratory equipment to pharmaceutical drug discovery industry across regions including Europe, Africa, North America, South America, the Middle East, and Asia Pacific.

-

ThalesNano Inc. – Established in 2002, and is headquartered in Budapest, Hungary. ThalesNano Inc. serves various industries including academia, agrochemical, dyes, flavor and fragrance, materials science, pharmaceutical, and petrochemical. Product lines of the company are utilized across the industries satisfying applications such as automation, heterocyclic synthesis, high energy chemistry, high temperature reactions, substitution reactions, and polymers. The company operates through its direct sales team and distributors in more than 50 countries worldwide.

-

Parr Instrument Company -Parr Instrument Company was established in 1899 and is headquartered in Illinois, U.S. Parr Instrument Company operates through varied product lines including reactor and pressure vessel systems, tubular reactor systems, specialty and custom systems, shakers hydrogenation apparatus, oxygen bomb calorimeters, shaker hydrogenators, and sample preparation. It is a chemical technology company that designs and manufactures laboratory instruments, which can be used for conducting chemical experiments.

-

Milestone Srl - Milestone Srl was incorporated in 1988 and is headquartered in Sorisole (BG), Italy. Milestone ventured into diversified product lines depending upon digestion, extraction, mercury, ashing, synthesis, and clean chemistry. . The company is a specialized laboratory instrument manufacturer and offers a range of products that cater to a host of end-use sectors, which include pharmaceuticals, polymers & specialty chemicals, petrochemical & energy, academia, food, and consumer products.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Flow Chemistry Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Flow Chemistry Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."