- Home

- »

- Animal Feed and Feed Additives

- »

-

Feed Premixes Market Size, Share & Growth Report, 2030GVR Report cover

![Feed Premixes Market Size, Share & Trends Report]()

Feed Premixes Market Size, Share & Trends Analysis Report By Form (Dry, Wet), By Product (Vitamins, Antibiotics, Amino Acids), By Livestock (Pork/Swine, Poultry, Cattle, Aquaculture, Other Livestock), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-166-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Specialty & Chemicals

Feed Premixes Market Size & Trends

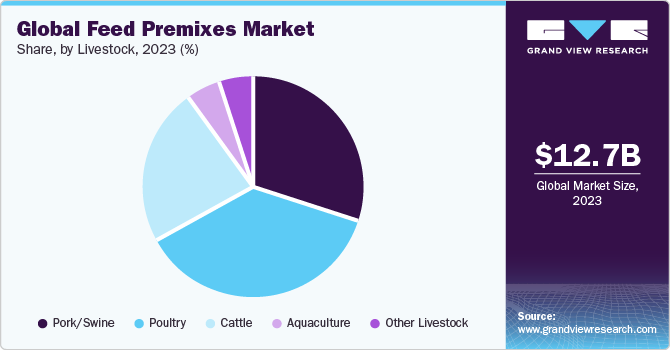

The global feed premixes market size was estimated at USD 12.72 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.6% in terms of revenue from 2024 to 2030. This is attributed to the increasing demand for high-value protein as well as heightened awareness about animal health and nutrition. Further, technological advancements in the field have also led to the introduction of niche and sophisticated feed premix products in the market.

Feed premixes are specialized blends of essential nutrients such as amino acids, vitamins, and other additives designed to enhance the nutritional value of animal food. The premixes play an important role in ensuring that the livestock are provided with a well-balanced diet. They can be formulated in various forms, such as granules, powder or liquids allowing for flexibility in their application.

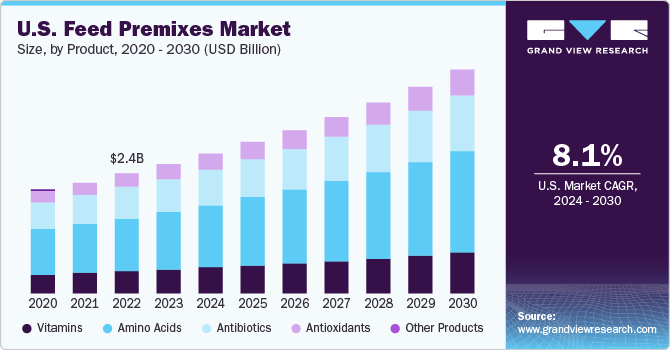

The U.S. has a prominent trend of high level of awareness on pet health issues as well as higher levels of spending on pet food products including premixes. The prevalence of pet food manufacturers such as Diamond Pet Foods, General Mills and General Mills have led to widespread usage of food premixes in the country. Another major driving factor in the country is widespread pet ownership, with 66% of the U.S. households (86.9 million homes) owning a pet, according to Forbes Advisor.

Rising demand from developing nations in South America as well as Asia Pacific region has led to key companies setting up their production plants in those countries. For instance, Brazil with one of the largest cattle numbers in the world, is expected to become a major hub for companies manufacturing feed premixes, catering to the strong demand in the country.

The ban on the inclusion of antibiotics in animal food products in different countries acts as a major restraint for premix producers offering antibiotic-based premixes. For instance, in January 2022, the European Union enacted new laws banning farm livestock from being fed a diet of antibiotics, these laws restrict owners from feeding their livestock antibiotics in any form including feed premixes.

Form Insights

The dry segment accounted for the largest revenue share of around 53.48% in 2023. This is attributed to factors such as convenience in storing, easy handling, lower manufacturing costs as we as widespread applications in the livestock industry. The dry is easier to mix with animal food and provides a much longer shelf life than its liquid counterpart, hence garnering high amounts of acceptability among manufacturers.

The wet form provides a distinct set of advantages for livestock applications. The primary advantage in using wet form is uniform distribution of nutrients within the feed causing enhanced homogeneity. The liquid form of food premixes facilitates precise dosages for animals, hence giving the owners better control over nutrient levels of their livestock. This form is particularly suitable for extruded or pelleted feeds and contributed to its overall feed quality.

Product Insights

The amino acids segment accounted for the largest revenue share of around 42.5% in 2023. This is attributed to their important functions such as building blocks for the development of protein in animals, enhancing the quality and quantity of meat. Commonly used amino acids in feed premixes include lysine and methionine, which are primarily used to rear broiler poultry and pigs.

Antioxidants such as vitamin E, vitamin C, selenium, and others help to improve livestock health by neutralizing free radicals in animal’s body. The antioxidants also help to protect other essential nutrients in the premixes from oxidation process, thereby helping to preserve pet food products for longer period as well as maintain its nutritional value.

Antibiotics play a crucial role in preventing diseases and promoting animal health, thereby improving overall performance of the livestock. They are often included in premixes to address specific health challenges and improve feed efficiency in animals. Penicillins, macrolides and tetracyclines form the most commonly used antibiotics for pet food products.

Livestock Insights

The poultry segment accounted for the largest revenue share of 37.3% in 2023. The poultry industry consists of four major sectors - eggs, broilers, pullets, and breeders are major consumer of feed premixes around the world. The rapid increase in demand for poultry meat, in developing countries has led to an increase in the numbers of poultry livestock. Factors such as low prices and easy availability along with wider acceptability across religious and social norms have led to rise in prominence for poultry meat.

Swine/Pork industry forms another major livestock segment acting as a major consumer of feed premixes. Swine industry employs a heightened focus on disease prevention among animals and antibiotic reduction due to the prevalence of fatal diseases among swine. This has led to incorporation of specialized additives in livestock food products which are administered through the use of these premixes.

Cattle are an important livestock category around the world with countries such as India and Brazil leading the charts in cattle rearing. The feed premixes used in cattle nutrition are employed to serve diverse purposes such as improving milk production, enhancing weight gain as well as increasing meat quality.

Regional Insights

Asia Pacific region accounted for the largest revenue share of around 33.50% in 2023. This is attributed to the presence of a large livestock population in the region in countries such as China, India, Bangladesh, and others. The region also contains some of the leading producers for animal food, with China taking the leading position and others such as Japan, Indonesia, and Thailand containing extensive feed production capabilities. According to Alltech, 16 of the top 20 feed firms in the world are located in the Asia Pacific region, making it a highly competitive market.

North America is a significant region for global market, owing to the large number of pet owners in the region as well as high level of spending on animal nutrition in the region. North America also has the presence of technologically advanced feed production facilities, ensuring precise formulation and strict adherence to quality standards in the making of feed products. The U.S. holds the largest number of cattle in the entire region, holding approximately 90 million of them in 2023, according to the U.S. department of Agriculture, thus forming a major consumer for feed premixes in the region.

South America is another major market due to prevalence of a meat-eating culture encouraging large-scale rearing of livestock such as cows, goats, and pigs. This makes it an important market for the sale of feed premixes with Brazil being one of the largest exporters of beef in the world. The region thus holds potential for cattle-based premix products catering to the large number of livestock in the continent.

Key Companies & Market Share Insights

The development of environmentally sustainable and cost-effective products would offer major growth opportunities for key market players. In addition, the firms are focusing on producing feed premixes through environment-friendly processes. The global feed premixes market is currently dominated by key industry leaders such as Cargill, ADM, and BASF SE.

Major manufacturers operate in the market with diverse strategy initiatives such as expansion, product launches, mergers & acquisitions, and certifications for their products. For instance, in October 2023, Dutch firm De Heus announced the plan to set up a USD 17 million plant in Rajpura City of Punjab to produce high quality animal feed in the region. The plant, expected to be open in first half of 2025, will have a capacity to produce 180 kilo metric tonnes of animal feed annually.

Key Feed Premixes Companies:

- Cargill Inc.

- ADM

- DLG

- ForFramers

- Danish Agro

- BASF SE

- Land O'Lakes Inc.

- Godrej Agrovet Limited

- dsm-firmenich

- InVivo Group

Feed Premixes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.82 billion

Revenue forecast in 2030

USD 24.69 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume, Revenue Forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, product, livestock, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Cargill Inc.; ADM; DLG; ForFramers; Danish Agro; BASF SE; Land O'Lakes Inc.; Godrej Agrovet Limited; dsm-firmenich; InVivo Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Feed Premixes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global feed premixes market report based form, product, livestock, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Amino Acids

-

Antibiotics

-

Antioxidants

-

Other Products

-

-

Livestock Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pork/Swine

-

Poultry

-

Cattle

-

Aquaculture

-

Other Livestock

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global feed premixes market size was estimated at USD 12.72 billion in 2023 and is expected to reach USD 13.82 billion in 2024.

b. The global feed premixes market is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to reach USD 24.69 billion in 2030.

b. Asia Pacific dominated the global feed premixes market with a share of 33.50% in 2023. This is attributed to the presence of an abundant livestock population along with the presence of various agricultural economies.

b. The competition in the global industry is highly dependent on the quality of the product, the number of manufacturers & distributors, and their geographical locations. Several participants and stakeholders are also concentrating on increasing their manufacturing capacities. Major market participants including DSM, BASF, Evonik, and Danisco have been highly active in the M&A activities over the last five years.

b. Increasing consumption of dairy products owing to their associated health benefits, as well as wide applications, is expected to fuel the industry's growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."