- Home

- »

- Medical Devices

- »

-

Europe Ultrasound Devices Market, Industry Report, 2030GVR Report cover

![Europe Ultrasound Devices Market Size, Share & Trends Report]()

Europe Ultrasound Devices Market Size, Share & Trends Analysis Report By Product (Diagnostics Ultrasound Devices, Therapeutics Ultrasound Devices), By Portability, By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-210-5

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Europe Ultrasound Devices Market Trends

The Europe ultrasound devices market size was valued at USD 2.60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.58% from 2024 to 2030. The increasing adoption of diagnostic imaging and the developments in ultrasound imaging technologies in Europe's healthcare sector are significant factors contributing to the market growth. Ultrasound technology is witnessing demand in the healthcare sector owing to its several benefits over other technologies, such as non-invasiveness, cost-effectiveness, and faster outcomes. Moreover, it is safer than other imaging methods since it doesn't use magnetic fields or ionizing radiation.

It witnessed significant developments in recent years owing to growing investments and high GDP share spending. For instance, according to Eurostat, in 2022, 7.7% of Europe’s GDP, 1,334.7 USD billion, was spent on the region’s healthcare sector. This increasing spending is developing the region’s healthcare sector and is anticipated to expand the demand for technologically advanced solutions such as ultrasound devices over the forecast period. Moreover, the developed healthcare infrastructure of the region offers a better opportunity for international companies to launch technologically advanced products in the market.

Ultrasound technology offers a non-invasive solution for diagnosing several health conditions, such as cardiovascular issues, cancer, cysts, etc. This ability of ultrasound devices to diagnose severe health conditions in a non-invasive way is anticipated to fuel the demand for these devices in the region. According to the European Commission, 318,327 new cases and 257,293 deaths were reported due to lung cancer in Europe in 2020. This high burden of diseases is anticipated to increase the demand for non-invasive diagnostics solutions and drive market growth.

The COVID-19 pandemic had a significant impact on the market for ultrasound devices in Europe. The outbreak of the virus led to disruptions in healthcare services, changes in patient behavior, and shifts in healthcare priorities, all of which influenced the demand for medical devices such as ultrasound machines. As healthcare systems focused their resources on managing COVID-19 cases, non-COVID related healthcare services took a back seat. This shift in healthcare priorities deprioritized the investments in new medical equipment, including ultrasound devices.

The companies operating in the global ultrasound device market are focusing on the developments in the technology of the devices. This has increased the availability of advanced devices for the customers. Europe, one of the most developed healthcare sectors, is further attracting technologically advanced device sellers. For instance, in August 2023, GE HealthCare announced the launch of Vscan Air SL at the European Society of Cardiology (ESC) Congress in the Netherlands. This ultrasound device offers a combination of switching between cardiac and vascular assessment at the point of care and propriety image-enhancing technology. Such advancements in ultrasound device technology are further expected to increase their demand and drive market growth.

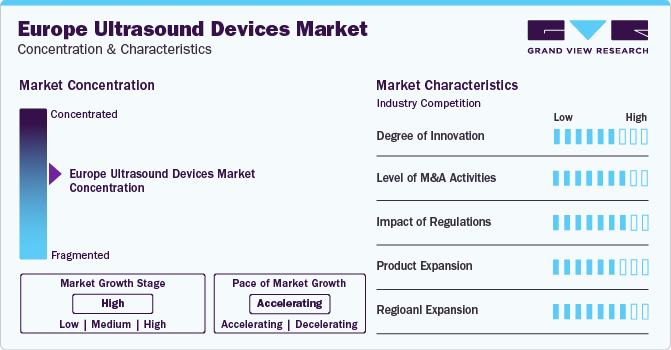

Market Concentration & Characteristics

The degree of innovation in the European ultrasound device market is high, driven by technological advancements, changing healthcare demands, and the need for more efficient and accurate diagnostic tools. The market aims to introduce new features, improve image quality, enhance portability, and increase efficiency. Manufacturers in Europe are investing heavily in innovation to stay competitive and meet the evolving needs of healthcare providers and patients by integrating with other technologies such as robotics, telemedicine platforms, and cloud-based solutions to enhance connectivity, data sharing, and remote monitoring capabilities. Technologies such as automated workflow, 3D and 4D image detailing, enhanced processing speed, and point-of-care solutions are expected to boost the market during the forecast period.

M&A activities in the European ultrasound device market have been notable in recent years. Consolidation through M&A can result in cost partnerships through shared resources, streamlined operations, and reduced overhead expenses. Companies engage in M&A transactions to expand their product portfolios, enter new markets, acquire innovative technologies, achieve economies of scale, and strengthen their market position.

Regulations play a critical role in shaping the European ultrasound device market by ensuring product safety, efficacy, quality standards, and compliance with regulatory requirements. The impact of regulations on this market is substantial, influencing product development, marketing strategies, market access, and overall industry dynamics. For instance, the providers must comply with the essential requirements of the Medical Devices Directive (MDD) or the Medical Devices Regulation (MDR) to obtain CE marking certification for commercialization within the European Economic Area (EEA). In addition, Germany's medical devices are regulated by The Federal Institute for Drugs and Medical Devices; through DIMDI, and manufacturers must meet specific criteria to be approved.

The market is characterized by a moderate level of product substitutes available, such as MRI, CT SCAN, Endoscopy, Nuclear Medical Imaging, etc. While various product substitutes offer alternative imaging modalities with unique advantages compared to traditional ultrasound devices, each modality has strengths and limitations based on clinical indications, patient characteristics, cost considerations, and specific diagnostic requirements.

The ultrasound market in Europe is characterized by medium end-user concentration and varies depending on the type of ultrasound device. Moreover, factors such as patient demographics served by each facility type, availability of specialized expertise, referral patterns from primary care physicians, reimbursement policies, equipment preferences, service offerings, and geographical location affect the end user concentration. Generally, the end users of ultrasound devices in Europe include hospitals, diagnostic centers, ambulatory surgical centers, and research institutions. Hospitals are the primary end users, accounting for a significant portion of the market due to the high demand for ultrasound imaging in various medical specialties such as obstetrics, gynecology, cardiology, and radiology.

Product Insights

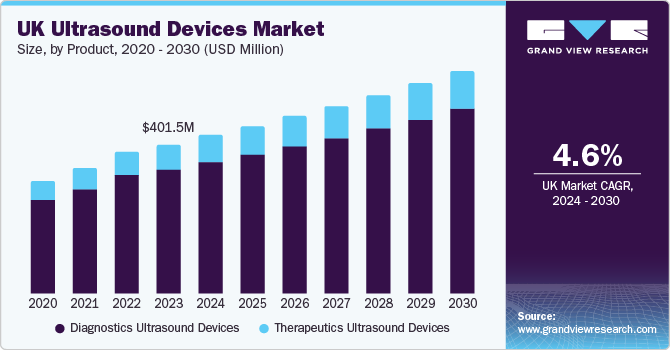

The diagnostics ultrasound devices segment accounted for the largest revenue share of 84.1% in 2023. This is attributed to several factors, such as the non-invasive diagnoses and the aging population of the region. The rising awareness of disease has increased the importance of early diagnosis in Europe. Moreover, the region has one of the fastest-aging populations in the world. For instance, according to Eurostat, the population of people aged 65 years or above is anticipated to increase from 90.5 million in 2019 to 129.8 million in 2050. This burden of the geriatric population increases the demand for non-invasive diagnostics solutions, thereby contributing to the segment growth.

The therapeutics ultrasound devices segment is expected to grow at the fastest CAGR of 5.23% over the forecast period. This can be attributed to the rising focus on the use of ultrasound devices and technology for therapeutic purposes. Moreover, the region is anticipated to witness a rise in the application of processes such as High-Intensity Focused Ultrasound (HIFU) and Extracorporeal Shockwave Lithotripsy (ESWL) owing to the rise in conditions such as cancers, kidney stones, uterine fibroids and others. According to the International Agency for Research on Cancer (GLOBOCAN 2022), there were 57,357 new prostate cancer in France (metropolitan) in 2022. Similarly, according to the same source, there were 55,485 new prostate cancer cases in 2022. This increasing prevalence of diseases that need ultrasound technologies as treatment is anticipated to drive segment growth.

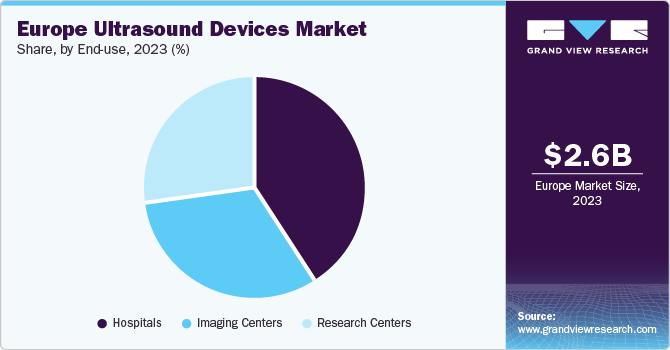

End-use Insights

The hospitals segment accounted for the largest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increased adoption of ultrasound devices in hospitals in Europe and the increasing efforts of market players to get more revenue from hospitals as they have a varied range of medical services and patient populations. Hospitals typically have many patients requiring diagnostic imaging services, including ultrasound scans. This high demand for imaging services drives the need for advanced and efficient ultrasound devices within hospital settings.

Moreover, several market players are adopting strategies such as partnerships and collaborations with hospitals in different countries of Europe to get a larger market share. For instance, in April 2022, Hampshire Hospitals NHS Foundation Trust (HHFT) and GE HealthCare announced a ten year partnership to improve radiology services and patient care in England. GE HealthCare is responsible for the installation and maintenance of radiology equipment, which also includes ultrasound equipment, according to the partnership. Such strategic moves by market players are contributing to the revenue share of hospitals in the market.

Portability Insights

The cart/trolley segment accounted for the largest revenue share in 2023. This growth is attributed to the accessibility and portability of Cart/Trolley-based ultrasound machines without compromising performance, making them a popular choice among healthcare providers. These innovations have attracted healthcare facilities looking to invest in state-of-the-art equipment, thereby driving up the revenue share of this segment. Cart/Trolley-based ultrasound devices are increasingly being used in point-of-care settings such as emergency departments, intensive care units, and outpatient clinics. Their ease of use and mobility make them ideal for quick diagnostic assessments at the patient’s bedside, contributing to their widespread adoption and revenue generation.

The handheld segment is anticipated to grow at the fastest CAGR over the forecast period. Handheld ultrasound devices have gained popularity due to their portability, ease of use, and cost-effectiveness. These devices are useful in point-of-care settings, emergency medicine, and remote healthcare facilities.The rise of telemedicine services has further boosted the demand for hand-held ultrasound devices, as they facilitate remote consultations and diagnostic imaging. For instance, in January 2024, Clarius received FDA clearance for its PAL HD3 wireless ultrasound device in the EU and the UK. This smartphone-sized device offers the low-frequency phased array in a single head suitable for in-depth imaging of the lungs, heart, and abdomen.

Application Insights

The radiology segment accounted for the largest revenue share in 2023. This can be attributed to the increasing application of ultrasound devices in diagnostics and interventional radiology. Moreover, ultrasound technology is used extensively in the field of diagnostics radiology and interventional radiology. The advancements and efforts to implement ultrasound devices in radiology have contributed to the segment's growth. For instance, in October 2023, Curium and PIUR IMAGING announced a strategic partnership to advance thyroid diagnostics in Germany. According to the partnership, PIUR IMAGING is supposed to create hardware and software ultrasound solutions, while Curium is supposed to handle the distribution of those products in nuclear medicine in Germany.

The Obstetrics/gynecology segment is anticipated to grow at the fastest CAGR over the forecast period. The rising awareness about women’s health and the importance of early detection of gynecological conditions have led to a surge in demand for ultrasound devices in obstetrics and gynecology practices. Obstetric ultrasound is a routine part of prenatal care, allowing healthcare providers to monitor fetal development, detect any abnormalities, and ensure the well-being of both the mother and the baby. The high demand for obstetric ultrasound services drives the sales of ultrasound devices in this segment.

Country Insights

Europe Ultrasound Devices Market Trends

Europe held a 26.6% market share in the global ultrasound devices market in 2023. This share is attributable to the region's advanced healthcare infrastructure and technological capabilities. European countries are known for their well-established healthcare systems, which are equipped with state-of-the-art medical facilities and a high level of healthcare expenditure. This facilitated the adoption of cutting-edge medical technologies, including ultrasound devices, across various healthcare settings. Moreover, regulatory support and favorable reimbursement policies in European countries encouraged healthcare providers to invest in advanced medical equipment, including ultrasound devices.

Germany Ultrasound Devices Market Trends

Germany held a significant share of 4.55% in the global ultrasound devices market in 2023. This growth owes to the increasing investments in advanced medical equipment, the rising geriatric population, and growing awareness about the benefits of early diagnosis. Key players in this region are engaging widely to enhance their market positions. For instance, In May 2022, Clarius Mobile Health unveiled high-performance wireless ultrasound scanners in the UK and European Union that can connect to Apple and Android devices and come in pocket-size.

Key Europe Ultrasound Devices Company Insights

Some of the key players operating in the market include Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, etc.

-

GE Healthcare is a subsidiary of General Electric (GE), which focuses on providing medical technologies and services in the healthcare industry. It offers various products, including medical imaging equipment, diagnostic solutions, and healthcare IT. Some of the product lines include Vulson and LOGIQ series ultrasound systems.

-

Siemens Healthineers is a German multinational medical technology company that offers ultrasound solutions under various product lines and serves different medical specialties. ACUSON and SONOLINE are some of their ultrasound systems designed for applications in general imaging, obstetrics and gynecology, cardiovascular imaging, and more.

Key Europe Ultrasound Devices Companies:

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Canon Medical Systems

- Samsung Medison Co., Ltd.

- FUJIFILM SonoSite, Inc.,

- Esaote

Recent Developments

-

In October 2023, Butterfly Network, Inc. and Razom announced the extension of their global health partnership to bring 200 Butterfly iQ+ ultrasound systems for war front liners in Ukraine. This partnership symbolizes the commitment of both companies to bring healthcare quality and accessibility to Ukraine.

-

In December 2022, Siemens Healthineers AG announced the opening of its first ultrasound manufacturing facility in Europe. With 120 system per week capacity, the facility was aimed to be used by the company to manufacture some portions of all general imaging & cardiovascular ultrasound systems.

Europe Ultrasound Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.72 billion

Revenue forecast in 2030

USD 3.56 billion

Growth rate

CAGR of 4.58% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, portability, application, end-use

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Ultrasound Devices Market Report Segmentation

This report forecasts revenue growth at region and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe ultrasound devices market report based on product, portability, application, and end-use:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Diagnostics Ultrasound Devices

-

2D

-

3D/4D

-

Doppler

-

-

Therapeutics Ultrasound Devices

-

HIFU

-

ESWL

-

-

-

Portability Outlook (Revenue in USD Million, 2018 - 2030)

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Cardiology

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Obstetrics/gynecology

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Radiology

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Orthopedic

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Anesthesia

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Emergency Medicine

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Primary Care

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

Critical Care

-

Handheld

-

Compact

-

Cart/trolley

-

Point-of-Care Cart/Trolley-based Ultrasound

-

Higher-end Cart/Trolley-based Ultrasound

-

-

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Research Centers

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe ultrasound devices market size was estimated at USD 2.60 billion in 2023 and is expected to reach USD 2.72 billion in 2024.

b. The Europe ultrasound devices market is expected to grow at a compound annual growth rate of 4.58% from 2024 to 2030 to reach USD 3.56 billion by 2030.

b. Germany dominated the Europe ultrasound devices market with a share of 17.10% in 2023. This is attributable to the rising usage of ultrasound equipment for diagnostic imaging and treatment, along with the increasing prevalence of chronic and lifestyle disorders.

b. Some key players operating in the Europe ultrasound devices market include Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote.

b. Key factors that are driving the market growth include presence of a significant number of competitors in the region and an increasing number of cancer cases are key factors contributing to regional market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."