Ethyl Levulinate Market Size, Share & Trends Analysis Report By Type (Food Grade, Industrial Grade), By Application (Food Additives, Fragrances), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-757-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

Ethyl Levulinate Market Size & Trends

The global ethyl levulinate market size was estimated at USD 12.5 million in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. With an increasing global focus on sustainability, ethyl levulinate, derived from renewable resources, has gained traction across various industries. This shift toward eco-friendly products is particularly evident in the European Union, which has established ambitious targets for reducing greenhouse gas emissions, aiming for a 55% reduction by 2030 compared to 1990 levels. Consequently, these regulatory measures enhance the attractiveness of bio-based solvents such as ethyl levulinate, motivating manufacturers to integrate them into their product lines.

In addition to regulatory influences, there is a robust demand for ethyl levulinate in the fragrance and food additive sectors. In 2023, approximately 70% of U.S. consumers preferred sustainable products, bolstering the adoption of bio-based solvents in the food and fragrance industries. Ethyl levulinate’s unique properties as a flavoring agent and its ability to enhance fragrance formulations are instrumental in driving its adoption. This growing consumer preference correlates with market growth as companies increasingly prioritize sustainable options to meet evolving consumer demands.

Further supporting market expansion are the rising research and development initiatives to explore new ethyl levulinate applications. Advancements in eco-friendly production processes foster innovation, which is crucial for maintaining competitive advantage. For example, the food processing equipment market in Asia Pacific is expected to grow rapidly over the forecast period, significantly contributing to the rising consumption of ethyl levulinate as a food additive. These R&D efforts enhance product versatility and cater to the burgeoning market interests in sustainability.

Furthermore, the economic growth in emerging markets, particularly in Asia-Pacific countries such as China and India, is a key driver for ethyl levulinate consumption. China’s anticipated substantial market share in bio-based solvents underscores its position as a leader in eco-friendly products. Moreover, Brazil’s bioeconomy, projected to grow by approximately 8% annually, further emphasizes the increasing reliance on bio-based solvents across diverse applications, including agriculture and cosmetics, thereby driving demand for ethyl levulinate globally.

Type Insights

The food grade segment held the largest market share in 2024, driven by its critical function as a food additive that enhances flavor and aroma in various products. With consumers increasingly favoring natural and organic ingredients, food manufacturers are adopting ethyl levulinate to improve taste profiles while complying with health regulations, making it essential for the food industry.

Industrial-grade ethyl levulinate is projected to experience rapid growth over the forecast period due to its diverse applications across multiple industries, such as solvents, fragrances, and chemical intermediates. Valued for its versatility and effectiveness in enhancing product formulations, the rising emphasis on sustainable practices and eco-friendly solutions fuels the demand for bio-based industrial chemicals like ethyl levulinate.

Application Insights

Fragrances dominated the market in 2024, as ethyl levulinate is critical in enhancing the scent of perfumes and personal care products. It imparts a fresh aroma and stabilizes formulations, making it indispensable for cosmetics. The growing emphasis on personal grooming and the popularity of fragrance products, particularly among younger consumers, further amplify this demand.

Applications in food additives are projected to grow lucratively over the forecast period. Ethyl levulinate is esteemed for elevating taste profiles, making it a favored choice among food manufacturers. The increasing consumer preference for natural and bio-based ingredients and the expanding food processing industry greatly contribute to this heightened demand.

Regional Insights

North America ethyl levulinate market is expected to grow significantly in the forecast period due to increased research initiatives aimed at eco-friendly production methods. A robust food and beverage industry and a rising preference for bio-based products fuel demand for ethyl levulinate as a natural flavoring agent and solvent. Supportive regulatory measures further enhance its appeal among manufacturers and consumers.

The ethyl levulinate market in the U.S. dominated the North America ethyl levulinate market in 2024, driven by a strong focus on sustainability and innovation in food and fragrance applications. The expanding food processing sector and heightened demand for natural flavoring agents position ethyl levulinate as a preferred ingredient. Consequently, U.S. consumer demand for eco-friendly products beneficially impacts its market presence.

Asia Pacific Ethyl Levulinate Market Trends

Asia Pacific ethyl levulinate market dominated the global market in 2024 due to rapid industrialization and urbanization in key economies such as India and China. Significant demand from food additive and fragrance industries drives this growth. Moreover, rising disposable incomes and changing consumer preferences toward natural products further strengthen the market, establishing Asia-Pacific as a pivotal region for ethyl levulinate consumption.

The ethyl levulinate market in China held a substantial share in the Asia Pacific ethyl levulinate market in 2024. Rapid economic growth and urbanization have increased the consumption of processed foods and personal care products. Furthermore, government support for sustainable practices encourages the adoption of bio-based ingredients such as ethyl levulinate, fostering its use across various applications nationwide.

Europe Ethyl Levulinate Market Trends

Europe ethyl levulinate market held a substantial market share in 2024. The European Union’s commitment to minimizing environmental impact stimulates the adoption of eco-friendly ingredients across food and fragrance applications. Moreover, consumers’ growing awareness of health and wellness drives demand for natural additives, positioning ethyl levulinate as a key component in various formulations.

The ethyl levulinate market in Germany is expected to grow in the forecast period, owing to its strong industrial base in the food and fragrance sectors. Germany’s commitment to sustainability aligns with the rising demand for bio-based solvents and additives. Moreover, the country’s advanced research initiatives focused on enhancing production processes significantly contribute to market growth, positioning Germany as a leader in innovative ethyl levulinate solutions.

Key Ethyl Levulinate Company Insights

Some key companies operating in the market include Advanced Biotech, Alfa Aesar; Axxence Aromatic GmbH, Bedoukian Research Inc., BEIJING LYS CHEMICALS CO., LTD, Berjé Inc., and CTC Organics, among others. Companies are investing in R&D to create eco-friendly production methods and broaden applications in food additives and fragrances while pursuing mergers and acquisitions to strengthen their market presence.

-

Axxence Aromatic GmbH specializes in producing high-purity natural aroma ingredients, such as ethyl levulinate, for the flavor and fragrance sector. Their commitment to sustainability and innovation positions them as a significant market player across various applications.

-

Oakwood Products, Inc. manufactures and supplies specialty chemicals, including ethyl levulinate, predominantly for the flavors and fragrances industry. Their dedication to delivering high-quality solutions for food, beverage, personal care, and pharmaceuticals establishes Oakwood as a trusted source in the market.

Key Ethyl Levulinate Companies:

The following are the leading companies in the ethyl levulinate market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Biotech

- Alfa Aesar

- Axxence Aromatic GmbH

- Bedoukian Research Inc.

- BEIJING LYS CHEMICALS CO., LTD

- Berjé Inc

- CTC Organics

- Elan Incorporated FZE

- Fleurchem Inc

- Indukern F&F Ingredients Division

- Lluch Essence S.L.U.

- M&U International

- Oakwood Products, Inc.

- Penta Manufacturer

- PerfumersWorld Ltd.

- Merck KGaA (Sigma-Aldrich)

- Tokyo Chemical Industry Co., Ltd

- Ernesto Ventós S.A.

- Vigon International, LLC

Ethyl Levulinate Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.1 million |

|

Revenue forecast in 2030 |

USD 16.4 million |

|

Growth rate |

CAGR of 3.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in tons, revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; UK; Germany; France; China; India; Brazil |

|

Key companies profiled |

Advanced Biotech; Alfa Aesar; Axxence Aromatic GmbH; Bedoukian Research Inc.; BEIJING LYS CHEMICALS CO., LTD; Berjé Inc; CTC Organics; Elan Incorporated FZE; Fleurchem Inc; Indukern F&F Ingredients Division; Lluch Essence S.L.U.; M&U International; Oakwood Products, Inc.; Penta Manufacturer; PerfumersWorld Ltd.; Merck KGaA (Sigma-Aldrich); Tokyo Chemical Industry Co., Ltd; Ernesto Ventós S.A.; Vigon International, LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ethyl Levulinate Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ethyl levulinate market report based on type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Food Grade

-

Industrial Grade

-

-

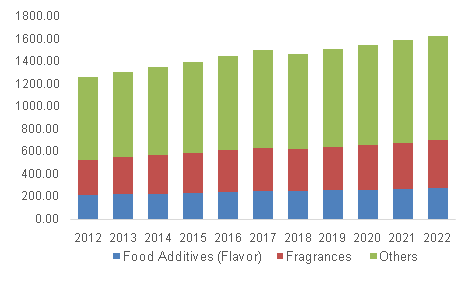

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Food Additives

-

Fragrances

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."