- Home

- »

- Biotechnology

- »

-

Epigenetics Diagnostics Market Size & Share Report, 2030GVR Report cover

![Epigenetics Diagnostics Market Size, Share & Trends Report]()

Epigenetics Diagnostics Market Size, Share & Trends Analysis Report By Product (Reagents, Kits, Instruments, Enzymes, Services), By Application (Oncology, Non-oncology), By Technology, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-831-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

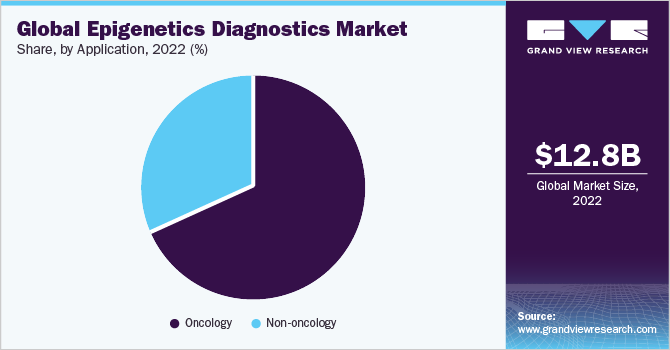

The global epigenetics diagnostics market size was valued at USD 12.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.10% from 2023 to 2030. The high growth is mainly attributed to the increase in investment, funds, and approvals for epigenetics research & development, growing applications of epigenetics in drug discovery & development, and increased affordability of genome sequencing. Epigenetics has exhibited its application potential in non-oncology conditions, thus creating tremendous opportunities for market growth. Epigenetic pathways may be directly or indirectly involved in a variety of cancers, Cardiovascular Disorders (CVDs), reproductive problems, autoimmune diseases, and ailments that affect cognitive function.

The function of these epigenetic pathways can be influenced by external stimuli including the causative agents, such as heavy metals, pesticides, cigarette smoke, hormones, radiation, viruses, environmental factors, and essential nutrients. Increasing awareness regarding epigenetic testing and the increasing demand for such kits and assays is one of the crucial factors in the growth of this market. Increased healthcare R&D spending across the globe is also anticipated to fuel market expansion over the forecast period. For instance, according to the WHO report published in April 2023, the weighted average health GERD as% of GDP increased the most in high-income nations (0.25%) compared to the previous analysis (0.21%).

This can be attributed to the rise of GERD in several of these high-income nations, with the Republic of Korea reporting the biggest rise (from USD 3.8 billion to USD 4.5 billion in 2020), followed by Greece (from USD 513 million to USD 598 million in 2020). Over 15% was reported as an upsurge in both nations. In addition, for instance, in February 2021, the International Cancer Genome Consortium (ICGC) launched the ICGC ARGO Data Platform, a significant step forward after the ICGC 25K Data Portal. ARGO is a global initiative to promote cancer genetics by providing superior-quality clinical, genomic, and molecular data to worldwide researchers.

The spread of the COVID-19 virus created tremendous opportunities for epigenetics researchers. A study conducted by the researchers, wherein they performed DNA methylation on monocytes in the peripheral blood samples obtained from COVID-19 patients, demonstrated the complex relationship between the changes that occurred during myeloid differentiation and DNA methylation changes in COVID-19 patients. Increasing government support and funding for epigenetic research will encourage companies to develop novel epigenetic products and boost market growth in the near future.

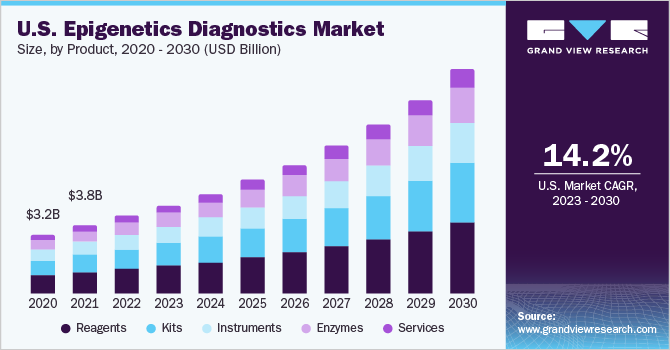

Product Insights

Based on product, the market is segmented into reagents, kits, instruments, enzymes, and services. The reagents segment accounted for the largest revenue share of 31.50% in 2022. The large share of this segment is mainly attributed to the high usage of reagents in epigenetic research studies. The two main categories of reagents used in epigenetics are histone and DNA modifiers. Epigenetics is the study of persistent, maybe reversible changes in gene expression that take place without altering the DNA sequence permanently but that still transfer from one generation to the next generation. Without any changes to the DNA, epigenetically controlled genes can be triggered or suppressed.

DNA methylation, RNA regulation, and histone modification are the three main epigenetic processes that have been the subject of comprehensive research. These mechanisms are crucial for the control of genes. On the other hand, the kits segment is anticipated to record the highest CAGR of over 15.4% during the forecast period. Epigenetic kit demand is fueled by trends, such as a rise in the cases of chronic diseases, a growing aging population, and an increase in the application of epigenetic treatments. In addition, the growing awareness among people along with an increasing number of companies involved in the development of advanced kits will push the segmental growth further.

Technology Insights

Based on the technology, the market is segmented into DNA methylation, histone methylation, histone acetylation, large noncoding RNA, microRNA modification, and chromatin structures. The oncology segment accounted for the largest revenue share of 69.23% in 2022. DNA is treated biochemically and enzymatically by methylation-sensitive enzymes as part of the DNA methylation process, which is used to prepare DNA for methylation analysis. The DNA methylation method holds great promise for unraveling the functional processes behind complicated disorders as well as developing individualized medicines. The rising demand for DNA methylation techniques is responsible for the market growth. Technology advancements are making it possible to evaluate locus-specific DNA methylation on a genome-wide scale more often.

The histone acetylation segment is anticipated to expand at the fastest CAGR of 15.8% from 2023 to 2030 due to its improved efficacy as a result of the development of innovative methods. Numerous studies have suggested that histone acetylation may have therapeutic benefits in conditions, such as solid tumors, inflammation, leukemia, and viral infection. Histone Acetyltransferase 1 (HAT1), General Control Nonrepressible 5 (GNC5), CREB-binding protein (CBP), P300/CBP-binding protein (PCAF), MYST family, P300, TAFII250, and Rtt109 are the HAT subfamilies that have received the most attention to date. It has commonly been claimed that HAT1 contributes to carcinogenesis. With such wide therapeutic potential applications, the market is likely to flourish during the forecast period.

Application Insights

On the basis of applications, the global industry has been further categorized into oncology and non-oncology. The oncology application segment accounted for the largest revenue share of 69.23% in 2022. Currently, cancer is the major area for epigenetics research. With the increasing number of cancer incidences, the market for cancer-related epigenetic diagnosis is likely to grow. As per the American Cancer Society, the estimated number of new cancer cases in the U.S. in 2022 was 1.9 million with around 609,360 deaths caused due to cancer.

On the other hand, the non-oncology application segment is projected to grow at the fastest CAGR of 15.7% during the forecast years. There has been a growing interest in epigenetics studies in the non-oncology disease indication. The non-oncology applications of epigenetics include neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, etc., and developmental disorders, such as ASDs, CVDs, metabolic disorders, and many others. The increasing usage of epigenetics in non-oncology indications will further boost the growth of this segment.

Regional Insights

North America dominated the market with a revenue share of 38.18% in 2022. The large share is mainly attributed to government support and the presence of major companies. High awareness among people, advanced medical infrastructure, and high R&D expenditure are some of the other factors that support the market growth in the region. Moreover, the high prevalence of chronic diseases and increasing investment by market participants for the development of epigenetics will boost regional growth further. For instance, Chroma Medicine, Inc. (Chroma), a brand-new genomic medicine business that pioneered epigenetic editing, started with USD 125 million in investment in November 2021 to treat a variety of disorders and become the most commonly used technology for gene regulation.

The market in the Asia Pacific region is projected to grow at the fastest CAGR of 17.2% from 2023 to 2030. The Asia Pacific market is expected to rise owing to increasing investment in research & development activities by the government and growing incidences of cancer. For instance, in 2022, the WHO South-East Asia Region recorded 1.4 million cancer-related fatalities and approximately 2.2 million new cases, accounting for over one out of every ten deaths in the region. Lung cancer caused 10.6% of cancer-related fatalities, followed by breast cancer (9.4%), cervical cancer (8%), liver cancer (6.6%), and oral cavity cancer at 6.4%. The growing adoption of epigenetics in developing economies will boost regional market growth during the forecast period.

Key Companies & Market Share Insights

Technological advancements are expected to boost market growth over the forecast period. The market is consolidated due to the presence of major market players, such as Roche Diagnostics; Thermo Fisher Scientific, Inc.; Eisai Co. Ltd.; and Novartis AG. These players focus on growth strategies, such as new type launches, collaborations, partnerships, expansions, and mergers & acquisitions. For instance, in January 2023, Agilent Technologies, Inc., announced the acquisition of Avida Biomed, a company that develops target enrichment workflows for clinical researchers utilizing NGS methods to study cancers. Some of the prominent players in the global epigenetics diagnostics market include:

-

Roche Diagnostics

-

Thermo Fisher Scientific, Inc.

-

Eisai Co. Ltd.

-

Novartis AG

-

Element Biosciences, Inc.

-

Dovetail Genomics LLC.

-

Illumina, Inc.

-

ValiRx Plc.

-

Abcam plc.

Epigenetics Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.63 billion

Revenue forecast in 2030

USD 39.15 billion

Growth rate

CAGR of 15.10% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application,technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK, France, Italy, Spain, Denmark, Sweden, Norway; China, Japan, India, Australia, Thailand, South Korea; Brazil, Mexico, Argentina; South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Roche Diagnostics, Thermo Fisher Scientific, Inc., Eisai Co. Ltd., Novartis AG, Element Biosciences, Inc., Dovetail Genomics LLC., Illumina, Inc., ValiRx Plc., Abcam plc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epigenetics Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global epigenetics diagnostics market report on the basis of product, application, technology and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Reagents

-

Kits

-

Chip Sequencing Kit

-

Whole Genomic Amplification Kit

-

Bisulfite Conversion Kit

-

RNA Sequencing Kit

-

Others

-

Instruments

-

Enzymes

-

Services

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Oncology

-

Solid Tumors

-

Others

-

Non - Oncology

-

Inflammatory Diseases

-

Metabolic Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Others

-

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

DNA Methylation

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Histone Methylation

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Histone Acetylation

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Large Non - Coding RNA

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Microrna Modification

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Chromatin Structures

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global epigenetics diagnostics market size was estimated at USD 12.82 billion in 2022 and is expected to reach USD 14.63 billion in 2023.

b. The global epigenetics diagnostics market is expected to grow at a compound annual growth rate of 15.10% from 2023 to 2030 to reach USD 39.15 billion by 2030.

b. Reagents dominated the epigenetics market with a share of 31.5% in 2022. This is attributable to the growing R&D activities with increasing demand for rapid and sensitive diagnostic techniques.

b. Some key players operating in the epigenetics diagnostic market include F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Eisai Co. Ltd.; and Novartis AG.

b. Key factors that are driving the epigenetics diagnostic market include the increasing prevalence of cancer and other chronic diseases along with the rising geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."