- Home

- »

- Biotechnology

- »

-

DNA Diagnostics Market Size, Share & Trends Report, 2030GVR Report cover

![DNA Diagnostics Market Size, Share & Trends Report]()

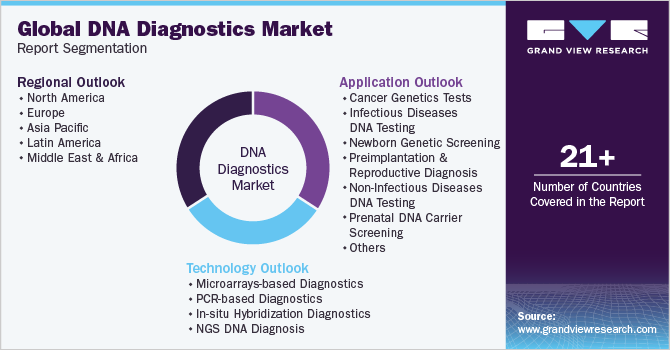

DNA Diagnostics Market Size, Share & Trends Analysis Report By Technology (PCR-based Diagnostics, NGS DNA Diagnosis, In-Situ Hybridization Diagnostics), By Application (Cancer Genetics Tests), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-676-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

DNA Diagnostics Market Size & Trends

The global DNA diagnostics market size was estimated at USD 10.64 billion in 2023 and is projected to grow at a CAGR of 4.51% from 2024 to 2030. Driven by the rising incidence of genetic diseases coupled with the decreasing costs of genetic sequencing technologies and the expanding use of precision medicine diagnostic techniques. For instance, in January 2022 report by Genetics in Medicine shows approximately 2.8 million children aged 0 to 17 in the U.S. have a genetic condition highlighting the expanding need for advanced diagnostic solutions.

The increasing prevalence of genetic, infectious, and chronic diseases is a major factor driving the growth and evolution of the DNA diagnostics market. The demand for advanced DNA diagnostic tools, which enable early detection and personalized treatment planning, has surged due to genetic disorders like cystic fibrosis and various cancers. In April 2023, the Deciphering Developmental Disorders study in the UK, involving over 13,500 families, identified genetic causes in 5,500 individuals with severe developmental disorders. This study highlighted the significant impact of rare genetic diseases, which collectively affect about 1 in 17 people, further fueling the growth of the DNA diagnostics market.

As awareness of the prevalence and impact of genetic disorders increases, so does the demand for precise diagnostic tools. In addition, the growing burden of infectious diseases has led to heightened demand for rapid and specific diagnostic solutions. DNA diagnostics offer unparalleled precision in identifying the exact cause of infections, distinguishing between bacterial and viral strains. A study by the NIH, published in April 2023, reported that infectious diseases remain a leading cause of illness and death worldwide, accounting for over 52 million deaths annually, or 33% of global mortality. This underscores the need for targeted treatment plans that minimize unnecessary antibiotic use and enhance patient recovery. The alarming rise in antibiotic resistance further highlights the importance of alternative diagnostic methods, with DNA-based testing emerging as a powerful solution in the infectious disease segment.

Moreover, recent advancements in Next-generation Sequencing (NGS), including improvements in sequencing speed, accuracy, and data analysis through enhanced bioinformatics tools, have significantly expanded its role in personalized medicine. These developments enable more precise risk assessment, early detection, and tailored treatment strategies. For instance, in May 2024, QIAGEN introduced QCI Secondary Analysis, a Software-as-a-Service (SaaS) solution designed for high-throughput secondary analysis that is compatible with any clinical NGS data. Additionally, the decreasing cost of NGS technology has made it more accessible to healthcare providers and patients, further driving its widespread adoption. Overall, these NGS advancements are accelerating the growth of the DNA diagnostics market by providing more detailed and personalized genetic information.

Innovations in DNA diagnostics also include the development of high-resolution, multiplexed assays that allow for the simultaneous detection of multiple genetic markers from a single sample. These advanced kits leverage cutting-edge technologies, such as CRISPR-based assays, which offer exceptional precision in identifying specific genetic mutations and variations. Improved sample preparation methods, such as automated extraction and purification processes, have streamlined workflows and reduced errors, making testing faster and more reliable. For instance, in November 2023, New England Biolabs launched the NEBNext UltraExpress DNA and RNA Library Prep Kits for NGS on the Illumina platform. These new kits are designed to produce high-quality, high-yield libraries with an expedited and streamlined workflow, enabling RNA library preparation within a single day and DNA library preparation in under two hours. The integration of real-time Polymerase Chain Reaction (PCR) and NGS technologies into DNA kits allows for high-throughput analysis and comprehensive genomic profiling with minimal sample input.

Market Concentration & Characteristics

The DNA diagnostics market is marked by a high degree of innovation, driven by advancements in genomic technologies, such as next-generation sequencing (NGS) and CRISPR-based diagnostics. For instance, in April 2024, Bio-Rad Laboratories introduced digital PCR assay, for breast cancer mutation detection in clinical research.

Regulation significantly impacts the DNA diagnostics market by ensuring the safety, efficacy, and accuracy of diagnostic tests. Stringent regulatory requirements, such as those from the FDA and EMA, guide the development and commercialization of DNA-based tests. For instance, in November 2023, Abbott received FDA approval for its Alinity m HR HPV assay, designed to detect high-risk HPV types that can lead to cancers such as cervical cancer. This test, available on the Alinity m platform, identifies multiple cancer-causing genotypes, highlighting its relevance in molecular diagnostics for infectious diseases. While these regulations help maintain high standards, they can also slow market entry and increase costs, posing challenges for companies in bringing new products to market.

Mergers and acquisitions (M&A) activities in the DNA diagnostics market are at a high level, driven by the industry's rapid growth and technological advancements. Companies are actively pursuing M&A to expand their product portfolios, enhance capabilities, and gain access to new technologies and markets. For instance, in December 2022, Integrated DNA Technologies, Inc. (IDT) acquired NGS research assays from Invitae Corporation, branded as Archer. This acquisition integrates these crucial NGS assays with IDT’s existing portfolio, enhancing their capabilities in researching novel cancer fusions. The expanded offering will provide laboratories with a more comprehensive solution for identifying biomarkers and advancing cancer research. This trend reflects the industry's dynamic nature and the strategic efforts to consolidate resources, innovate, and stay competitive in a rapidly evolving landscape.

Product expansion in the DNA diagnostics market is robust, with companies continually developing new tests and platforms to address a broader range of genetic conditions and diseases. For instance, in April 2023,QIAGEN launched the QIAseq Targeted cfDNA Ultra Panels, designed to facilitate the conversion of cell-free DNA (cfDNA) liquid biopsy samples into libraries suitable for NGS in under 8 hours. This innovation supports researchers in cancer and other disease studies by streamlining the preparation process for genomic analysis, enhancing efficiency, and accelerating research timelines. Innovations in areas like prenatal testing, cancer diagnostics, and personalized medicine are driving this growth. By expanding their product offerings, companies aim to meet the rising demand for comprehensive and precise genetic testing solutions.

Global expansion in the DNA diagnostics market is accelerating as companies seek to tap into emerging markets and increase their international presence. For instance, in October 2021, Thermo Fisher Scientific planned to manufacture nucleic acid isolation kits for the India market. This move aims to enhance the local availability of advanced diagnostic tools, supporting efficient nucleic acid extraction and purification processes essential for various applications in genomics & diagnostics. The initiative underscores Thermo Fisher’s commitment to improving healthcare infrastructure and diagnostic capabilities in India. This expansion is driven by growing demand for advanced genetic testing in regions such as Asia Pacific and Latin America. Companies are investing in local partnerships, regulatory approvals, and tailored products to cater to diverse populations, thereby broadening their global footprint.

Technology Insights

The PCR-based diagnostics segment held the largest share of 50.36% in 2023, the dominance of this segment can be attributed to the widespread market usage and the increase in product availability due to the rising number of key players introducing innovative PCR-based diagnostics. In addition, PCR's high sensitivity and specificity enable it to detect even minimal amounts of DNA in a sample, making it particularly valuable for diagnosing infectious diseases & genetic disorders and detecting genetic variations linked to cancer & other diseases. For instance, in May 2023, Sensible Diagnostics, based in Los Angeles, announced plans to introduce a 10-minute point-of-care PCR system by early next year. These factors are expected to drive the growth of PCR-based diagnostic technology, fueling market expansion.

The NGS DNA diagnosis is projected to grow fastest CAGR of 9.65% over the forecast period owing to advancements in high-throughput sequencing technologies that enable comprehensive genetic analyses. NGS platforms enable whole genome and exome sequencing to support precision medicine by offering detailed genetic insights for personalized treatment & targeted therapies. Furthermore, significant expansion of NGS capabilities by key players, through acquisitions and investments in advanced technologies, is fueling market growth by enhancing sequencing speed, accuracy, and throughput.

Application Insights

The cancer genetics tests segment held the largest share of 29.47% in 2023.DNA sequencing technologies are increasingly utilized to identify and characterize various cancer types and genetic disorders. Tumor DNA sequencing detects unique genetic alterations, which supports the development of targeted cancer therapies. Thus, the growing prevalence of cancer and genetic disorders is expected to boost the demand for genetic testing in both clinical and research environments. Furthermore, real-time PCR methods are favorable options for the analysis of cancer markers. The growing use of high-throughput PCR techniques for cancer detection is anticipated to drive the market.

The newborn genetic screening segment is expected to exhibit substantial growth over the forecast period, due to its ability to detect genetic disorders early. In addition, the introduction of government programs and legislation is anticipated to create a supportive environment for the newborn screening industry to thrive. For instance, in June 2022, the government of Manitoba announced an expansion of its newborn screening program, which aims to add spinal muscular atrophy and other diseases to the screening list. Most countries have established laws governing newborn screening, outlining funding, conditions to be screened, and exemptions.

Regional Insights

North America DNA diagnostics market dominated the overall global market and accounted for the 43.20 %revenue share in 2023.In 2023. The region's dominance is driven by its advanced healthcare infrastructure, robust government support, substantial funding for DNA testing research, and a high incidence of chronic diseases. In addition, North America has seen widespread use of genetic testing for various applications, including disease risk assessment, prenatal screening, pharmacogenomics and ancestry testing. The presence of state-of-the-art laboratory facilities, favorable reimbursement policies, and a large population with access to healthcare services are also key factors supporting the region's leadership in the DNA diagnostics market.

U.S. DNA Diagnostics Market Trends

The U.S. DNA diagnostics market held a significant share of North America market in 2023 due to the high cancer prevalence in the country and consequent rapid adoption of diagnostic tests. Some other factors propelling market growth in the country include the increasing prevalence of genetic disorders and the growing emphasis on personalized medicine. As healthcare shifts toward tailored treatments, genetic testing plays a critical role in identifying the right therapies for patients. In addition, technological advancements, an increasing number of FDA approvals for tests, and competition among biotechnology companies are projected to boost the market over the forecast period.

Europe DNA Diagnostics Market Trends

The Europe DNA diagnostics market is experiencing notable growth driven by the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to significantly boost clinical research prospects in the region. Moreover, the growing incidence of genetic and chronic diseases, such as cancer, cardiovascular diseases, and infectious diseases, is predicted to drive the demand for DNA diagnostics.

The UK DNA diagnostics market is one of the major markets in the region. The presence of advanced healthcare infrastructure, collaborations between key players, and an increasing number of novel product launches are anticipated to contribute to market growth in the UK. Moreover, government support & initiatives are expected to propel the DNA diagnostics market in the coming decade.

The DNA diagnostics market Germany is witnessing notable growth. The increasing rate of tuberculosis is one of the major factors promoting market growth. In Germany, around 4,076 cases of tuberculosis were reported in total in 2022. This is equivalent to 4.9 cases of tuberculosis per 100,000 people annually, according to a Federal Institute article released by the Robert Koch Institute. Following a large increase in the number of cases in 2015 and 2016 to almost 6,000 each, 2017 and 2018 saw a drop to around 5,500 cases.

Asia Pacific DNA Diagnostics Market Trends

The Asia Pacific DNA diagnostics market is experiencing robust growth. The region's growth is driven by factors such as increased R&D incentives granted by governments in developing economies such as China and India, which enable R&D and commercialization of technologically new products. Furthermore, it is expected that the high accessibility of the target group brought about by the prevalence of chronic illnesses will support growth in the upcoming years. Furthermore, the region has seen a great deal of progress in DNA sequencing technologies, including NGS.

The China DNA diagnostics market is expanding notably rapidly due to a shift from infectious diseases to NCDs such as diabetes, cancer, cardiovascular diseases, and chronic respiratory diseases. This growth is driven by increasing healthcare needs, aging populations, and the demand for precision medicine. DNA testing aids in accurate diagnosis and personalized treatment, addressing the rise in genetic and chronic conditions.

DNA diagnostics market Japan is set to grow rapidly, driven by increasing government investment in cancer control and the rising cancer rates linked to an aging population. With Japan having one of the world’s highest median ages, its extensive nationwide cancer screening programs-covering over 94% of the population-boost the demand for advanced DNA diagnostics. This focus on early detection and personalized medicine fuels market expansion.

Latin America DNA Diagnostics Market Trends

The Latin America DNA diagnostics market has witnessed significant growth in the past few years due to the increase in prevalence of various types of cancer in the region. Various government and nonprofit organizations surveys shows that overall cancer mortality in Latin America is almost twice that of high-income countries. Moreover, government and private health initiatives are promoting regular screening, contributing to market expansion.

The Brazil DNA diagnostics market is notably expanding driven by the increasing prevalence of genetic disorders and infectious diseases, coupled with government investments in healthcare infrastructure and genomic research. In addition, growing awareness about personalized medicine and the expansion of private healthcare facilities contribute to market growth.

Middle East & Africa DNA Diagnostics Market Trends

The MEA DNA diagnostics market holds major growth opportunities, as a majority of the market is untapped due to the unavailability of organized chronic disease screening programs in this region, especially in underdeveloped African economies. In the past few years, countries such as Saudi Arabia have launched the Human Genome Program. Programs such as this aim to map the genetic makeup of their populations, leading to advancements in personalized medicine, early disease detection, and targeted therapies.

The Saudi Arabia DNA diagnostics market is expanding rapidly. In Saudi Arabia, the market growth is propelled by substantial government investments in healthcare infrastructure and the Vision 2030 initiative, which emphasizes advanced medical technologies. Furthermore, the rising incidence of genetic disorders and a focus on personalized medicine are also driving the market.

Key DNA Diagnostics Company Insights

The competitive scenario in the DNA diagnostics market is highly competitive, with key players such as F. Hoffmann-La Roche Ltd., Abbott Laboratories, QIAGEN, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Illumina, Inc., Hologic, Inc., Agilent Technologies Inc., Siemens Healthineers AG, and Danaher Corporation (Cepheid, Inc. and F. Beckman Coulter Inc.). holding significant positions. These companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key DNA Diagnostics Companies:

The following are the leading companies in the DNA diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Hologic, Inc.

- Agilent Technologies Inc.

- Siemens Healthineers AG

- Danaher Corporation

Recent Developments

-

In May 2024, QIAGEN partnered with the FBI to develop a new assay aimed at enhancing DNA quantification. This advanced assay is designed to improve the accuracy & reliability of DNA analysis in forensic and human identification applications. The collaboration signifies a significant advancement in forensic science, potentially increasing the effectiveness of DNA-based evidence processing and identification.

-

In April 2024, Bio-Rad Laboratories, Inc. introduced ddPLEX ESR1 Mutation Detection Kit. This new assay extends Bio-Rad’s ddPCR portfolio into the oncology market. The ddPLEX ESR1 kit supports therapy selection, and disease monitoring by providing precise & reliable mutation analysis in cancer studies.

-

In April 2023, Devyser Diagnostics and Thermo Fisher Scientific signed collaboration & distribution agreement. Under the agreement, Devyser would maintain the rights to market these products in the U.S. through its service laboratory and would continue to handle manufacturing responsibilities. This partnership enhances the availability of advanced NGS solutions for post-transplant monitoring and diagnostics.

DNA Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.85 billion

Revenue forecast in 2030

USD 14.14 billion

Growth rate

CAGR of 4.51% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Mexico; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Laboratories; F. Hoffmann-La Roche Ltd.; QIAGEN; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Illumina, Inc.; Hologic, Inc.; Agilent Technologies Inc.; Siemens Healthineers AG; Danaher Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNA Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the DNA diagnostics market report on the basis of technology, application and region.

-

DNA Diagnostics Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

PCR-based Diagnostics

-

NGS DNA Diagnosis

-

In-Situ Hybridization Diagnostics

-

Microarrays-based Diagnostics

-

Other Technologies

-

-

DNA Diagnostics Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer Genetics Tests

-

Infectious Diseases DNA Testing

-

HBV Diagnostic

-

TB Diagnostic

-

CT/NG Diagnostic

-

HPV Diagnostic

-

MRSA Diagnostic

-

Others

-

-

Newborn Genetic Screening

-

Preimplantation & Reproductive Diagnosis

-

Non-Infectious Diseases DNA Testing

-

Cardiovascular Diseases

-

CNS & PNS Related

-

Skeletal, Connective, Ectodermal & Dermal DNA Testing

-

Lung, Kidney, Liver & GT Related

-

Sensory Diseases

-

-

Prenatal DNA Carrier Screening

-

Pharmacogenomics/Drug Metabolism

-

Hematology & Immunology/Identity Diagnostics & Forensics

-

Others

-

-

DNA Diagnostics Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA diagnostics market size was estimated at USD 10.64 billion in 2023 and is expected to reach USD 10.85 billion in 2024.

b. The global DNA diagnostics market is expected to grow at a compound annual growth rate of 4.51% from 2024 to 2030 to reach USD 14.14 billion by 2030.

b. PCR-based diagnostics accounted for the largest share of revenue in 2023 with a market share of 50.36%. The dominance of the segment is attributed to the widespread market usage and high availability of products owing to the presence of a significant number of players offering PCR-based diagnostics in the market.

b. Some key players operating in the DNA diagnostics market include GE Healthcare, Abbott, Beckman Coulter Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Illumina Inc., Cepheid, Hologic, Inc., Siemens Healthcare GmbH, F. Hoffmann-La Roche, QIAGEN, Agilent Technologies Inc.

b. Key factors that are driving the market growth include an increase in the incidence of genetic, infectious, and chronic diseases, the decreasing prices of genetic sequencing technologies, aided with the growing adoption of precision medicine diagnostic techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."