- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Dispersing Agents Market Size, Share & Growth Report 2030GVR Report cover

![Dispersing Agents Market Size, Share & Trends Report]()

Dispersing Agents Market Size, Share & Trends Analysis Report By Type, By Structure (Anionic, Non-ionic, Hydrophilic, Amphoteric), By End-Use (Paints, Coatings, & Inks, Construction, Adhesives & Sealants), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-124-4

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

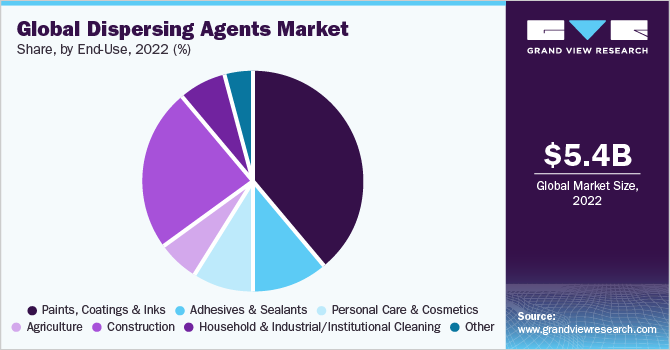

The global dispersing agents market size was valued at USD 5.37 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. This growth is attributed to the rising application of dispersing agents in the paints, coatings, & ink industry coupled with growing construction activities around the globe. Dispersing agents are essential in the paint and coatings industry because they contribute to the enhanced performance and stability of the final product. These agents help to prevent the agglomeration or settling of pigments, ensuring uniform distribution and color consistency.

Moreover, the construction industry is witnessing significant growth owing to increased infrastructure development, urbanization, and renovation projects across the globe. Dispersing agents are essential in construction materials such as paints, coatings, adhesives, and sealants. They improve the dispersion of pigments and solid particles, enhancing the performance, durability, and aesthetic appeal of these materials.

According to the World Paints & Coatings Industry Association, the global construction market witnessed substantial growth from USD 6.4 trillion in 2020 to USD 8.2 trillion in 2022. Technological advancements in construction materials have led to the development of high-performance products that require effective dispersion of additives and fillers thus, driving the demand for product market over the forecast period.

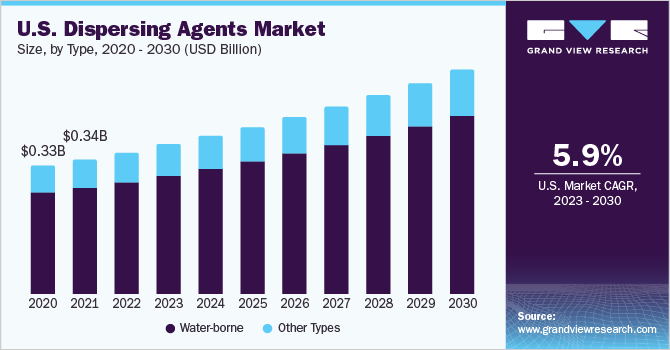

The U.S. is a major consumer of the product in North America with a revenue share of 70.5% in 2022. The growth of the product market during the forecast period can be attributed to the growing demand from current and emerging end-use industries. These industries may include oil and gas, paper, paint, detergents, pharmaceuticals, agriculture, automotive, and others. The increasing use of dispersing agents in these industries indicates a need for improved dispersion and stability of various materials and substances.

According to the International Trade Administration, the U.S. has one of the largest automotive markets worldwide and the second-largest vehicle production and sales. The country’s light vehicle sales accounted for 14.5 million units in 2020. Thus, the advancing demand for automotive will result in an increase in demand for the product as dispersing agents play a crucial role in achieving uniform dispersion of pigments, fillers, and other additives in automotive coatings, ensuring consistent color, improved durability, and enhanced performance.

Type Insights

Water-borne type segment dominated the market with a revenue share of 79.4 % in 2022. This is attributed to the growing demand for sustainable and environmentally friendly products across various industries, including paints, coatings, and inks. Water-borne dispersing agents align with this demand as they contribute to the development of eco-friendly formulations. They are surfactants or polymeric compounds that have hydrophilic properties, enabling them to interact with water molecules. They contain functional groups that can adsorb onto the particle surface, reducing the interfacial tension between the particles and the liquid medium. Hence, the particles are dispersed more easily and prevented from agglomerating or settling.

Other types are also anticipated to witness growth over the forecast period. It includes solvent-borne and oil-borne dispersants. Solvent-borne dispersing agents are formulated to disperse solid particles in solvent-based systems. These dispersants are organic compounds that have good solubility in the solvent used in the formulation and improve overall performance and enhance the durability of the final product. Whereas oil-borne dispersing agents are specifically formulated for use in oil-based systems. They are designed to disperse solid particles or pigments in oil-based formulations such as oil-based paints, varnishes, and coatings.

Structure Insights

Anionic segment dominated the market with a revenue share of 37.8 % in 2022. This is attributed to their wide range of applications, including paints, coatings, inks, adhesives, and ceramics. They offer excellent dispersion stability, preventing the agglomeration or settling of particles in formulations. This leads to improved color development, reduced viscosity, and enhanced overall performance of the end product. Moreover, they are particularly suitable for water-based systems, which are gaining popularity due to environmental regulations and health and safety concerns. These dispersing agents can effectively disperse pigments and additives in water-based coatings, inks, and other formulations, contributing to the growing demand for anionic dispersing agents.

Amphoteric is another segment anticipated to witness growth over the forecast period. They possess both, hydrophilic and hydrophobic properties. Unlike hydrophilic or hydrophobic dispersants, which have a strong affinity for either water or non-polar substances, amphoteric dispersing agents are versatile. As such, they can interact with both types of materials. They contain functional groups that can ionize in both, acidic and alkaline conditions. These functional groups typically include amino acids, such as glycine or betaine, which have both positive and negative charges at different pH levels. This unique characteristic allows the dispersants to interact with a wide range of particles or substances, regardless of their surface charge.

Moreover, amphoteric dispersing agents work through a combination of electrostatic and steric stabilization mechanisms. When added to a system these dispersants can adsorb onto the surface of particles or droplets, forming a protective layer that prevents their agglomeration or coalescence. The charges on the functional groups of dispersants allow them to interact with the surface charges of the particles, providing electrostatic stabilization. Additionally, hydrophilic or hydrophobic portions of dispersants extend into the surrounding liquids, creating repulsive barriers between the dispersed particles. This helps in maintaining their stability.

End-Use Insights

Paints, Coatings & Inks segment dominated the market with a revenue share of 38.7 % in 2022. This is attributed to the fact that they play a crucial role in the formulation and production of paints, coatings, and inks. These agents help improve the dispersion of pigments, fillers, and other solid particles in these systems, ensuring uniform and stable distribution. They help break down pigment agglomerates, enabling better dispersion throughout the paint matrix. This results in improved color uniformity, enhanced hiding power, and reduced settling or flocculation of pigments. These agents also aid in reducing viscosity, promoting easy application, and preventing paint defects like streaking or uneven coverage. They are particularly important in high-solid or solvent-free paint formulations, where particle dispersion is more challenging.

Moreover, dispersing agents are widely utilized in the ink industry to achieve optimal color strength, particle dispersion, and print quality. Inks, which are used for digital printing, flexography, gravure, or other printing methods, rely on the effective dispersion of pigments or dyes. These agents help break down pigment aggregate to ensure their uniform distribution in the ink formulation. This leads to vibrant colors, improved print resolution, and reduced clogging or sedimentation in printing equipment. Based on data from the World Paints & Coatings Industry Association, the worldwide paints and coatings market experienced growth from USD 146.54 billion in 2018 to USD 179.71 billion in 2022. This growth in the market has increased the demand for dispersing agents across the regions.

Construction is another segment anticipated to witness growth over the forecast period. One significant application area of dispersing agents is the production of concrete. These agents enhance the potential of working and pumping of concrete mixes by improving the dispersion and flowability of cement particles. This allows for easier placement and consolidation of concrete, reducing the need for excessive water content, and improving the overall strength and durability of the final structure. Additionally, they help control the hydration process of cement, prevent the formation of undesirable agglomerates, and ensure a uniform and consistent concrete setting. This results in improved compressive strength, reduced shrinkage, and enhanced resistance to cracking.

Regional Insights

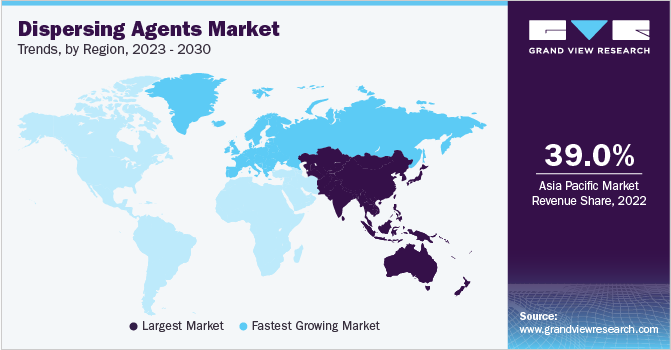

Asia Pacific region dominated the market with a revenue share of 39.0% in 2022. This is attributable to rapid industrialization, particularly in countries like China, India, and Southeast Asian nations. This industrial growth is driving the demand for the product across various industries such as paints and coatings, adhesives, textiles, and pharmaceuticals. Dispersing agents are essential in these industries for achieving optimal dispersion and stability of ingredients, leading to improved product performance.

According to the International Trade Administration, China is the world’s largest construction market and is further anticipated to witness a growth of around 8.6% from 2022 to 2030. Moreover, as per the Ministry of Housing and Urban-Rural Development, the implementation of the 14th Five-Year Plan in China in 2020 aims at developing greener and more efficient cities in the country so as to enhance the quality of China’s urban living conditions. On the other hand, initiatives taken by the government of India to improve the country’s infrastructure are also aiding the growth of the construction industry. Thus, the advancing construction industry is anticipated to drive the demand for products in the region over the forecast period.

North America is another region anticipated to witness growth over the forecast period. The region has witnessed robust growth in the paint & coatings industry, driven by both residential and commercial construction projects. As consumers and industries alike prioritize eco-friendly and high-performance coatings, the demand for dispersing agents has surged. According to the World Paints and Coatings Industry Association, the North American paints and coatings market was valued at USD 33.92 billion in 2022. The market is expected to witness growth in the coming years due to an increase in the number of house renovation activities in countries like Canada, Mexico, and the U.S. This is expected to create opportunities for dispersing agents in the region.

Key Companies & Market Share Insights

The dispersing agents market is characterized by intense competition where companies are engaged in expanding their regional presence via different strategic initiatives. For instance, in August 2023, BASF SE expanded its production in Dilovasi, Turkey. The company plans to double its production capacity for water-soluble dispersants based on acrylic acid. Strategic partnerships, capacity expansions, collaborations, and new product developments are other popular strategies adopted by the manufacturers to maintain and further expand their market share in a global perspective. Some of the prominent players in the global dispersing agents market include:

-

BASF SE

-

Arkema

-

Kemira

-

Solvay S.A.

-

Altana AG

-

Dow

-

Evonik Industries AG

-

Clariant

-

Uniqchem

-

Rudolf GmbH

-

The Lubrizol Corporation

-

Italmatch CSP

-

Nouryon

-

SNF

Dispersing Agents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.67 billion

Revenue forecast in 2030

USD 8.49 billion

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, structure, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Finland; Sweden; Italy; Spain;Benelux; China; India; Japan; South Korea; Brazil; Peru; Chile; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Arkema; Kemira; Solvay S.A.; Altana AG; Dow; Evonik Industries AG; Clariant; Uniqchem; Rudolf GmbH; The Lubrizol Corporation; Italmatch CSP; Nouryon; SNF

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dispersing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dispersing agents market report based on type, structure, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-borne

-

Other Types

-

-

Structure Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anionic

-

Non-ionic

-

Hydrophilic

-

Amphoteric

-

Other Structure

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints, Coatings & Inks

-

Adhesives & Sealants

-

Personal Care & Cosmetics

-

Agriculture

-

Construction

-

Household and Industrial/Institutional Cleaning

-

Other End-Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Finland

-

Sweden

-

Italy

-

Spain

-

Benelux

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Chile

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dispersing agents market size was estimated at USD 5.37 billion in 2022 and is expected to reach USD 5.67 billion in 2023.

b. The global dispersing agents market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 8.49 billion by 2030.

b. Asia Pacific dominated the dispersing agents market with a share of 39.0% in 2022. This is attributable to rapid industrialization, particularly in countries like China, India, and Southeast Asian nations.

b. Some key players operating in the dispersing agents market include TBASF SE, Arkema, Kemira, Solvay S.A., Altana AG, Dow, Evonik Industries AG, Clariant, Uniqchem, Rudolf GmbH, The Lubrizol Corporation, Italmatch CSP, Nouryon, SNF

b. Key factors that are driving the market growth include the rising application of dispersing agents in paints, coatings, & ink industry coupled with growing construction activities around the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."